Honest FedSpeak Dents Market Hope and Optimism

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 5th July 2021, 10:48 pm

This past week saw an update from the Federal Reserve at its regularly scheduled meeting. The U.S. central bank gave a policy announcement that surprised many observers by bringing forward its interest rate hike timeline. They also issued a forecast for higher inflation of 3.4 percent for this year. It was a full percentage point higher than they had predicted at their March meeting and forecast. Between this elevated expectation of inflation and the now predicted two interest rate increases in year 2023 the markets sold off. Earlier warnings that the American Rescue Plan threatened inflation may be coming to pass.

“Dr. Copper” Predicts Losses for the Economy

The price movement of copper has long been an accurate predictor of economic activity, earning it the nickname of “Dr. Copper.” Last week saw copper futures drop five percent with oil prices down 1.5 percent as well. IRA-approved precious metals platinum and palladium also dropped by over seven percent and 11 percent, respectively. The Fed not mentioning tapering its stimulus was at least partly to blame for the broad based sell off. Chief Investment Strategist Jim Paulsen of Leuthold Group shared that:

“Commodities have been a popular investment in the last year as investors have been adding some portfolio protection against inflation. So many investors were probably overexposed going into the Fed meeting and the U.S. dollar's response is forcing some reconsideration.”

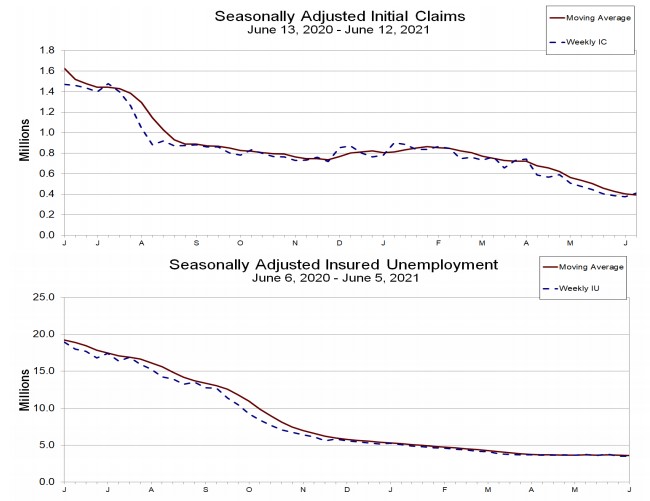

Bearish sentiment got another boost with Thursday's initial jobless claims report. The U.S. Labor Department announced that the claims increased from the prior week's 375,000 to 412,000. Dow Jones polled economists had anticipated a figure of only 360,000. The charts below show these figures as compared to earlier ones:

Mortgage Rates Make Decisive Move Higher

Last Thursday the Mortgage News Daily reported that the 30 year fixed mortgage average rate had moved significantly higher. Although the Fed held rates study, the rate touched 3.25 percent, the highest level going back to the middle of April. The unexpected move higher came in response to Federal Reserve Chair Jerome Powell's comments on Wednesday after the central bank met. Fed officials hinted that the rate hikes could begin next year in 2023. At the same time, they did not discuss at what point they would begin to scale back on their huge bond buying program. Powell shared that:

“You can think of this meeting that we had as the ‘talking about talking about' meeting.”

This recalled a statement he gave back in year 2020 when he said that the central bank was not “thinking about thinking about raising rates.”

The rates had moved still higher Tuesday anticipating the upcoming Federal Reserve meeting, yet the federal funds rate was not changed. This did not stop the mortgage rates from their typical tracking of the 10 Year Treasury that climbed higher. Another reason for the move stemmed from anticipation that the Fed purchases of the mortgage backed bonds will not taper off as soon as previously conjectured. Some observers were surprised by this position, according to Chief Operating Officer Matthew Graham of Mortgage News Daily. He observed that:

“Markets were somewhat surprised by the Fed's rate hike outlook. Granted, the Fed Funds Rate doesn't control mortgage rates, but the outlook speaks to how quickly the Fed would need to dial back its bond buying programs (also known as ‘tapering'). Those programs definitely keep rates low.”

Taper Tantrum Fears Resurface

The earlier the Fed begins its tapering, the sooner these mortgage rates will be going up. This occurred during the previous taper tantrum of June 2013. Mortgage rates have risen around a quarter of one percentage point versus the last Friday as well as where they were about one year earlier. This amount is substantial for people who might be considering refinancing their home in order to save costs on monthly payments.

When the rates dropped significantly over the past fall, the average rate for the 30 Year fixed mortgage stood at 2.75 percent, leading to a refinancing boom in the U.S. These days the applications for refinancing home loans have dropped 22 percent compared to a year ago, per the Mortgage Bankers Association. It means that many fewer borrowers will see any advantage to undertaking a refinance.

Loans Harder to Qualify for As A Result

The end result is that loans are much more difficult to qualify for now. Thanks to the significantly higher home values and prices, not only will approvals for loans be more difficult but monthly payments will be sometimes significantly higher. The Chief Economist Danielle Hale of Realtor.com shared her belief that:

“For home buyers, this means it's a good idea to take a fresh look at your home shopping budget. Run the numbers and know what it means for your search price if rates tick up a quarter point, but keep these worries in context. Even if mortgage rates rise, they are not the biggest challenge for today's buyers, who are still contending with relatively few fast-selling home choices and record high asking prices.”

JP Morgan Hoarding Cash Against Inflation

Others are convinced that the revised Fed guidance is going to lead to potentially higher inflation. CEO Jamie Dimon of JPMorgan Chase is convinced that cash is the place to be for now. Instead of purchasing Treasuries and other investments, he has engaged in “effectively stockpiling” cash. Dimon is concerned that increasing inflation will force the hand of the Fed into increasing interest rates he shared in a Monday press conference. As a result, the long time CEO and head of the largest American bank (according to assets) has put the organization in a position to gain from increasing interest rates. This will let them purchase assets that are higher yielding.

Dimon spoke out on the continuing debate concerning higher inflation and whether or not it will be longer lasting or merely a by product of reopening the economy (as a result of issues in the supply chain or shortages of raw materials). He revealed that:

“We have a lot of cash and capability and we're going to be very patient, because I think you have a very good chance inflation will be more than transitory. If you look at our balance sheet, we have $500 billion in cash, we've actually been effectively stockpiling more and more cash waiting for opportunities to invest at higher rates. I do expect to see higher interest rates and more inflation, and we're prepared for that.”

Meanwhile Federal officials continue to label the present day jump in inflation as transitory, or short lived and temporary. Yet a number of other voices are warning of the eventual consequences of the Federal Reserve ignoring inflation. These include economists at Deutsche Bank warning of a global time bomb from global inflation as well as hedge fund billionaires like Paul Tudor Jones who recommends betting heavily on every inflation trade. Lead Deutsche Bank economist David Folkerts-Laundau warned that the return of early 80's styled inflation is possible, with:

“It may take a year longer until 2023 but inflation will re-emerge. And while it is admirable that this patience is due to the fact that the Fed's priorities are shifting towards social goals, neglecting inflation leaves global economies sitting on a time bomb. The effects could be devastating, particularly for the most vulnerable in society.”

Inflation could be back in a big way soon. One way to hedge against rising prices is with IRA-approved gold. Today there are many Gold-IRA storage options available.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,638.85

Gold: $3,638.85

Silver: $41.61

Silver: $41.61

Platinum: $1,385.15

Platinum: $1,385.15

Palladium: $1,162.78

Palladium: $1,162.78

Bitcoin: $117,117.70

Bitcoin: $117,117.70

Ethereum: $4,574.22

Ethereum: $4,574.22