Gold Reserves by Country (2025): Current Rankings.

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 18th November 2025, 06:44 pm

We’ve accessed various accredited, verified, and recent data sources in order to provide the most accurate rankings possible of countries in order of gold held by the central government.

Fair warning, however, that many reputable sources do not coincide with each other. For instance, Chinese sources conflict heavily with Western-origin sources. This creates a dilemma, which sources have the right numbers? And to what extent can the numbers reported by central authorities be relied upon?

We have examined three central resources and realized that creating a conclusive ranking based on the information found was not entirely possible. Nonetheless we’ve put together an exclusive ranking to the best of our ability based on the information available.

However, we did proceed with information from highly reputed global institutions that access their information regularly. These data providers are well regarded by economists, investment professionals, and industry experts alike.

Table of Contents

Rankings & Sources

To compose our rankings, we’ve put together a composite of three trusted data sources held by three globally recognized institutions:

The list includes G7 countries, plus Russia and China. Canada is missing from the list as it has no formal gold reserves. China and Russia have been included for the size of their economies, their geopolitical importance, and the value of their gold reserves.

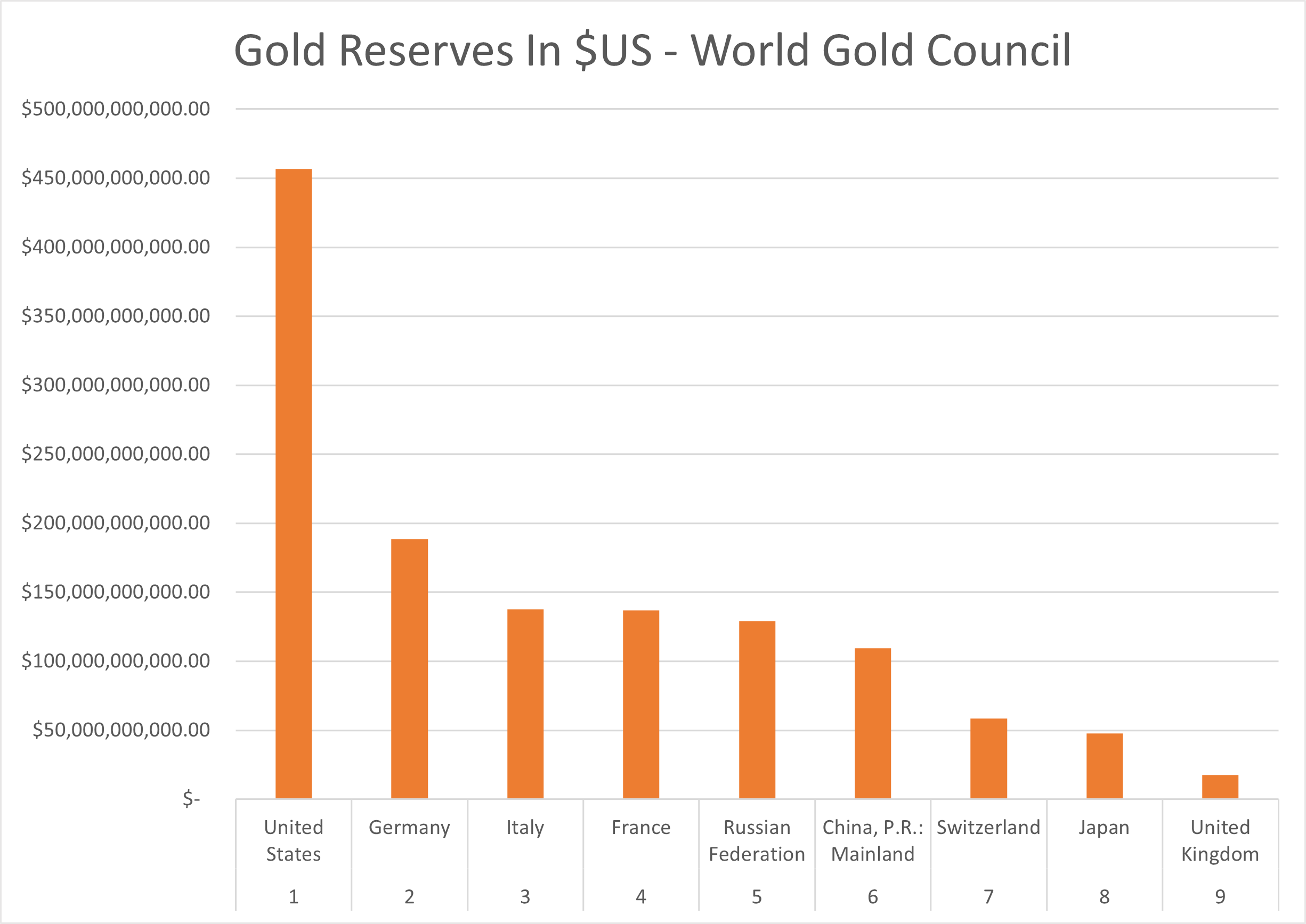

Ranking According to The World Gold Council

World Gold Council ranks by tonnes of gold, to make a more easily comparable ranking criterion, we calculated the equivalent troy ounces and multiplied that number by the current spot price. We now have a ranking from The World Gold Council based on the US dollar worth of reserves.

Source: World Gold Council

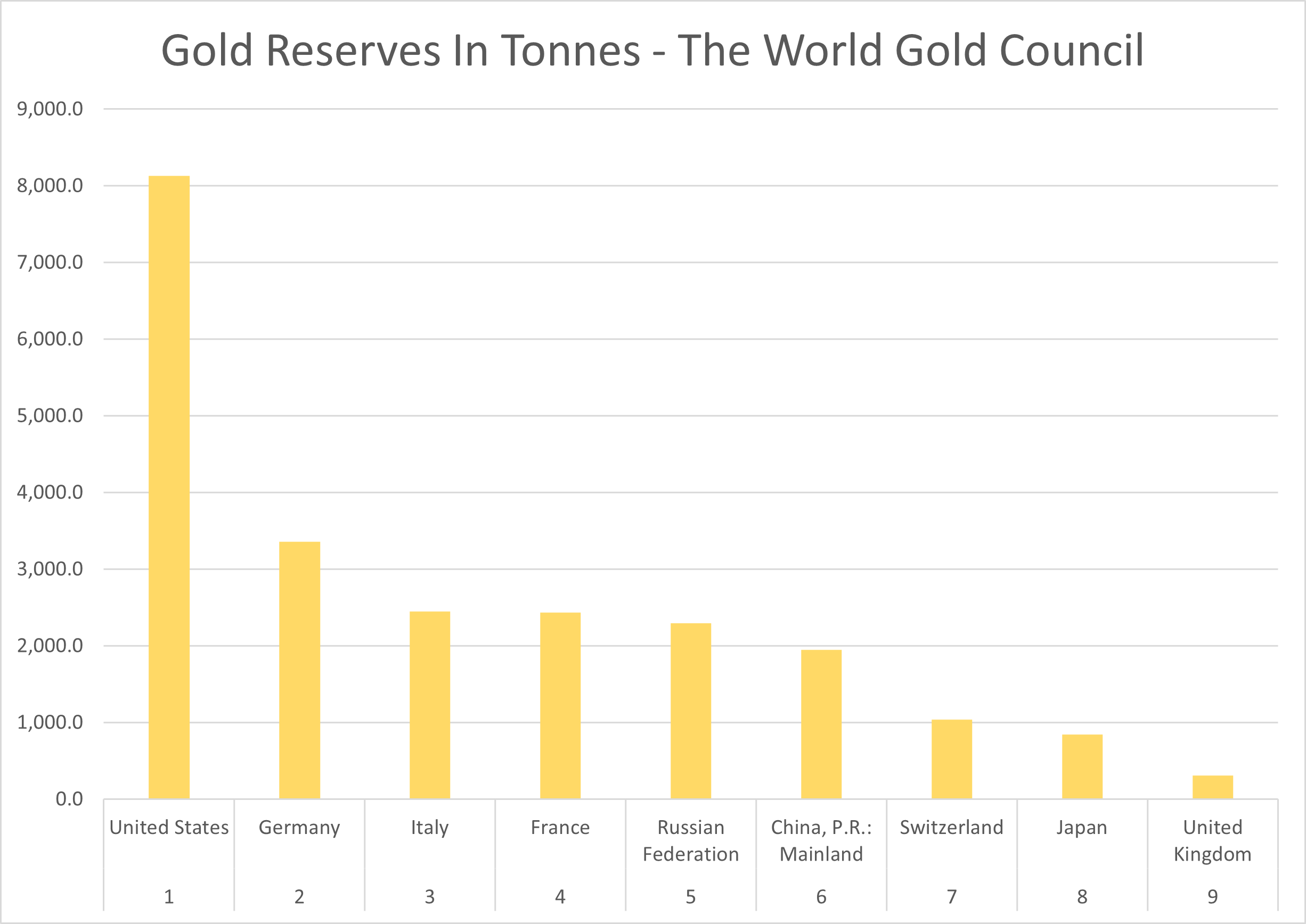

The chart above shows country gold reserves ranked in US dollars. While the chart below shows country gold reserves ranked by tonnes. Both sets of data are from The World Gold Council.

Source: World Gold Council

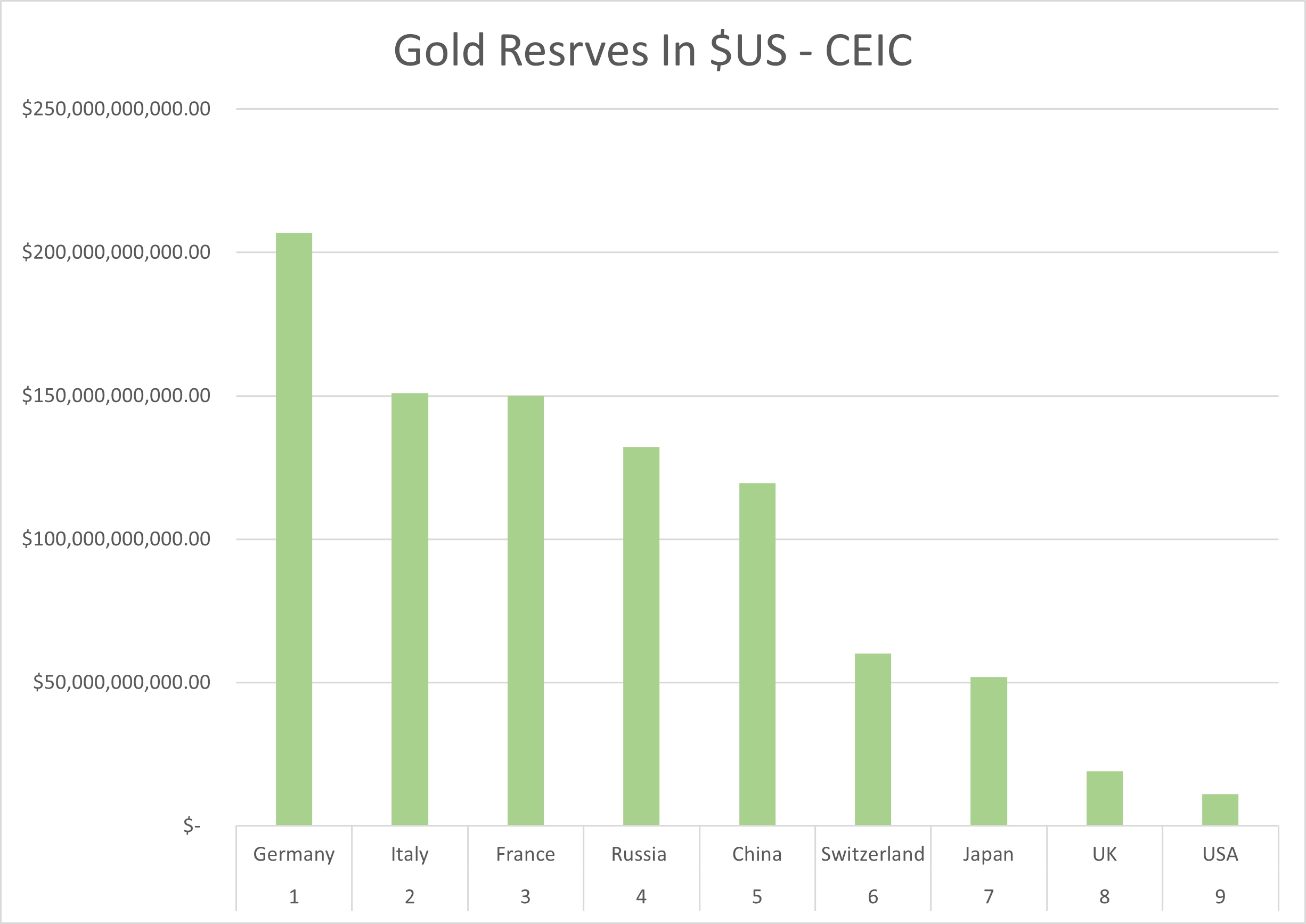

Ranking according to CEIC

CEIC was founded in 1992 by an expert team of analysts and economists to provide accurate and expansive data services. Among their clients you will find universities, corporations, and investors, among others.

They are a recognized data provider with staff operating in many different countries. In the case of gold reserves, CEIC generally republishes official figures and sometimes expresses them at book value rather than at current market prices. For example, the United States still carries its gold on the books at an old statutory price of 42.22 dollars per ounce, which produces a total of only a little over 11 billion dollars on paper even though the same metal would be worth over one trillion dollars at current spot prices.

Because of this accounting quirk, we did not rely on CEIC’s dollar figure for U.S. gold reserves. However, we do find their data useful for cross-checking relative positions and for countries where their methodology aligns more closely with current market values. According to CEIC’s estimates expressed in market terms, China’s official gold reserves place it behind the United States and the largest European holders, but still among the world’s leading gold-holding nations.

Source: CEIC

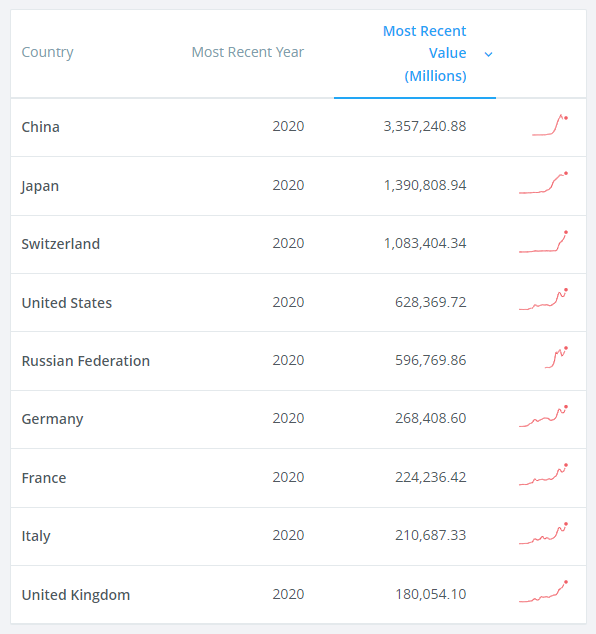

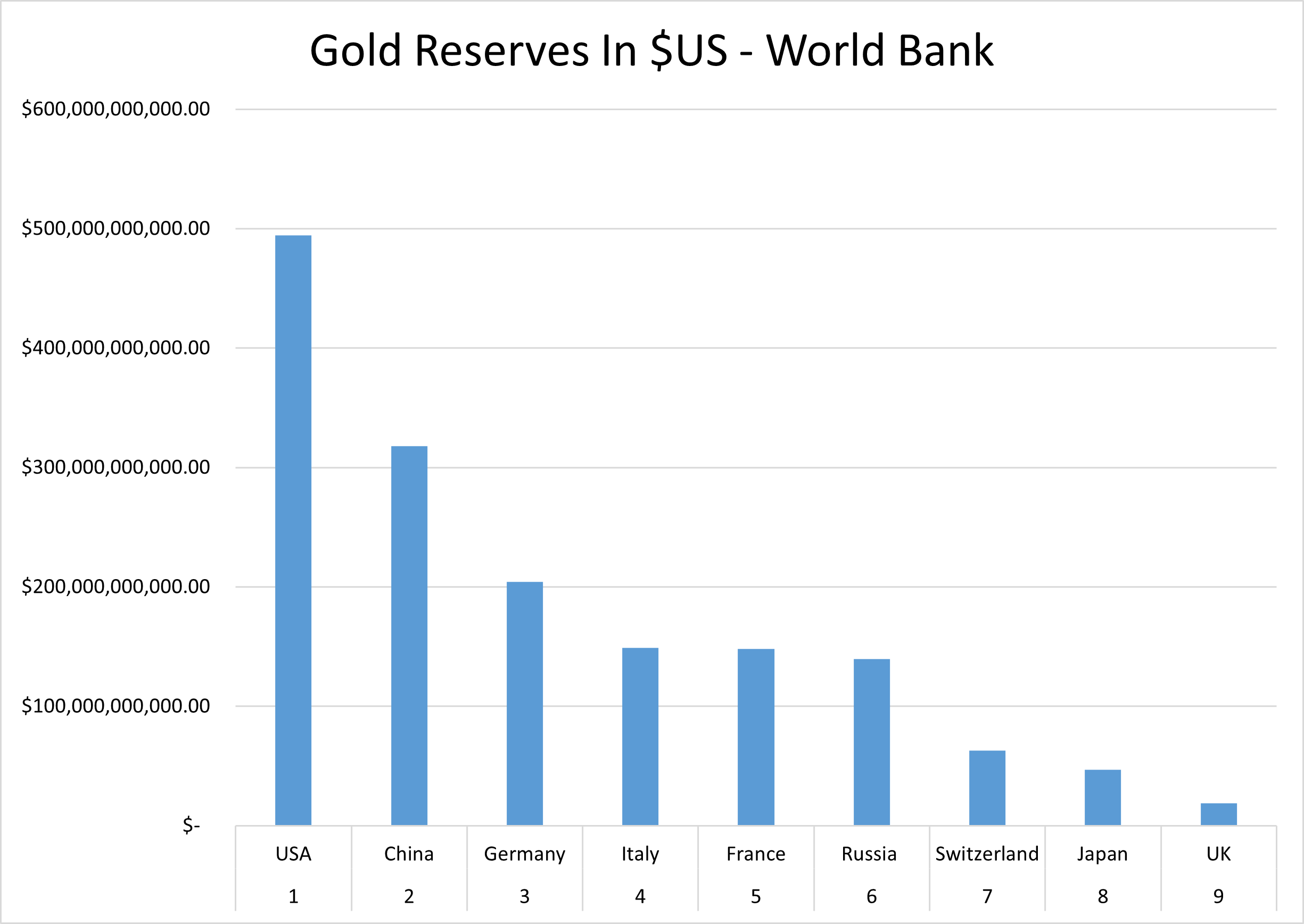

Ranking According to The World Bank

The data from The World Bank ranks country reserves including gold and excluding gold. We then subtracted the data for reserves excluding gold from the data for reserves including gold. The subtraction gives us the value of gold holdings in US dollars per country.

Reserves Including Gold per Country

Source: World Bank

Reserves Excluding Gold Per Country

Source: World Bank

The chart below shows the ranking for gold reserves per country from the World Bank using the method mentioned above. The World Bank ranks the USA first with just short of $500 billion in gold, and China second with $318 billion in gold reserves.

Source: World Bank

Data Comparison

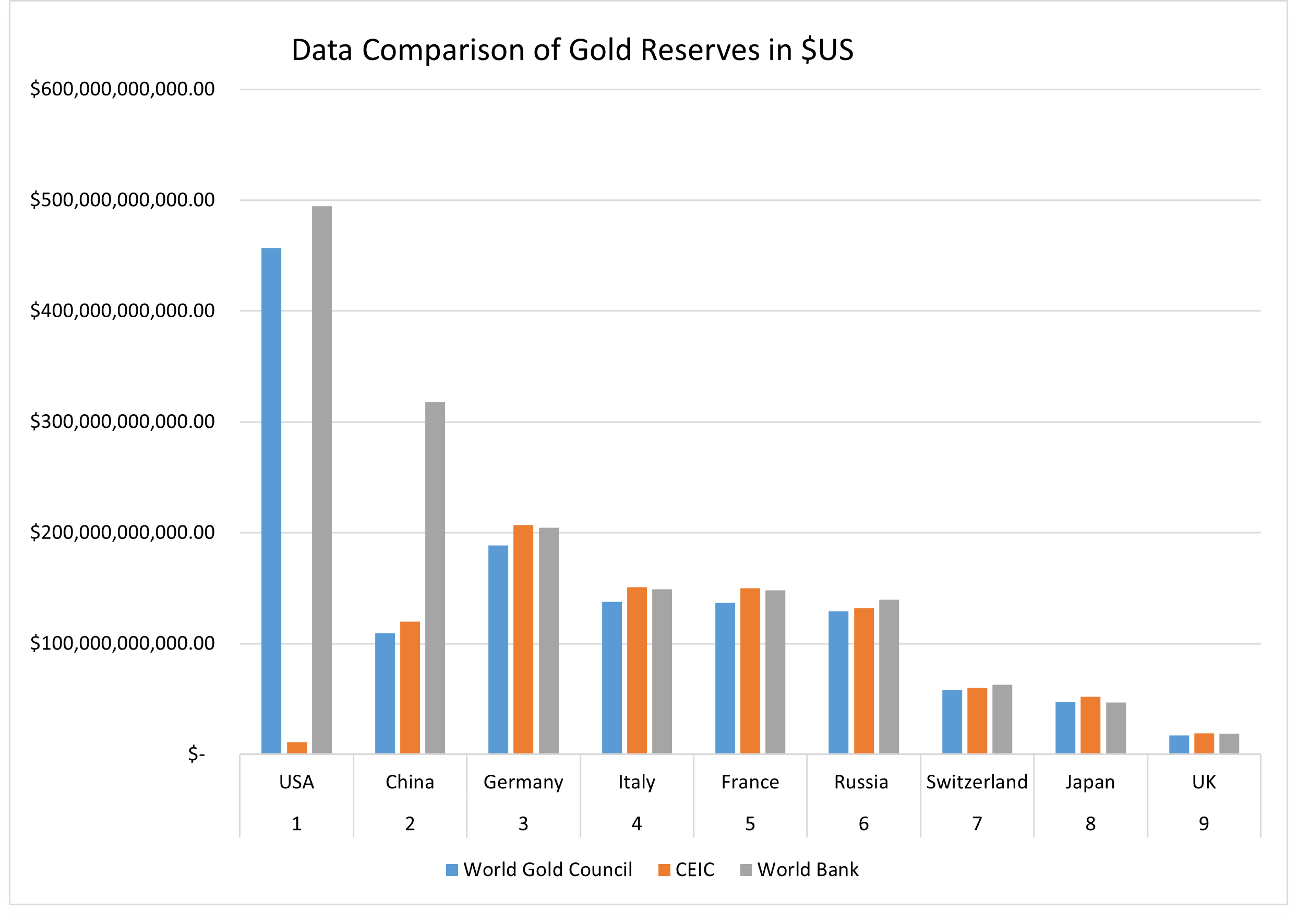

We have found that all three sources rank our list of countries for gold reserves in more or less the same way, excluding CEIC with the United States. The chart below shows a graphical comparison of the countries ranked and the list produced by each of the three data sources.

As we can see from the chart above, China ranks 6th with the World Gold Council but higher in some other datasets. Estimates published by the China Gold Association (CGA) suggest that China as a whole may hold over 14,700 tonnes of gold. It is important to note that this figure refers to the broader national gold stock (including central bank reserves, commercial holdings, investment bars, and jewelry) rather than purely to the officially reported central bank reserves. For that reason, it cannot be directly compared, on a like-for-like basis, with World Gold Council figures that focus on declared central bank holdings.

That number far exceeds the official central bank reserve estimates reported via the World Gold Council, CEIC, or the World Bank. It reflects a different concept of “reserves,” closer to all gold within the country’s borders than to gold officially declared by the central bank. Given the difficulty of obtaining fully transparent information from China, and the different ways these sources define “reserves,” it is not possible to make a conclusive, universally accepted estimate of China’s official gold holdings

However, we know from various reports from Chinese media that the government has increased the reserve holding of gold for at least a decade, and continues to do so as of 2025. This fact should put China closer to the top of the list and could possibly be the reason for which reports from the CGA are likely to be more in line with real figures.

What the Experts Say

Some experts are particularly interested in gold being amassed by the People’s Republic of China. Keith Weiner, a PhD, economist, and CEO of Monetary Metals, has the following to say:

“Foreign central banks hold dollars as assets on their balance sheet, and their local currencies are the liabilities. They are dismayed, when the dollar drops, because it means capital losses to them. Gold is a counterbalance, it may go up in local currency terms when the dollar is going down.

Also, Putin expected economic sanctions when he planned [the invasion of] Ukraine. So he accumulated gold. Xi may be thinking of a similar move. Gold is not subject to the same kind of control as US dollars are. Though as Putin is discovering, it can be hard to sell gold, too, when under sanctions.”

Likewise, some analysts, such as Alasdair Macleod, the Executive Chairman of Macdoch Group, a London-based private investment firm, believe that China is hoarding far more gold than conventional Western sources let on. Alasdair says the following in reference to China.

“They’ve got a lot of hidden reserves…They aren’t in the central bank’s account, but the Communist Party’s accounts, the army accounts, and the Young Communist Party’s accounts—it’s kind of spread around…I suspect Russia is in a similar situation.”

In an effort to de-dollarize, China is alleged to have purchased large amounts of gold that do not appear on official ledgers such as those of the IMF or World Bank. Rather, they are alleged to keep the gold off the books because to reveal the extent of their holdings would destabilize the value of the U.S. dollar, a currency China holds in reserve to the tune of $3.2 trillion.

Our Conclusion

Needless to say, it’s impossible to know with any degree of certainty how much gold is held by every country in the world. However, there are credible accounts that indicate that either the United States or China holds, by large margins, the most in the world.

According to expert testimony and recent large-scale gold reserve acquisitions by China, there are essentially two ways to look at the global gold reserve picture:

View 1: Officially reported central bank reserves (IMF / World Gold Council)

On the basis of official disclosures, the ranking of the largest central bank gold holders is approximately:

-

United States (about 8,100 metric tons)

-

Germany (about 3,350 metric tons)

-

Italy (about 2,450 metric tons)

-

France (about 2,440 metric tons)

-

China (a little over 2,000 metric tons)

View 2: Broader, high-end estimates of China’s national gold stock

Some Chinese and independent sources argue that, once you include undeclared and non-central-bank gold held by state entities and within China’s borders, the country’s total gold stock could be in the 14,000–30,000 metric ton range. If those high-end estimates were accurate, China could in theory possess more gold within its borders than any other sovereign country. However, these figures are not verifiable and are not accepted by mainstream official data providers, so they should be treated as a scenario rather than as a statement of fact.

To the best or our ability, we conclude that China likely currently possesses more gold in reserve than any other sovereign country, with roughly 14,000 metric tons on the books. The United States possesses the second-largest with over 8,000 metric tons of gold held by the Federal Reserve.

Note that our rankings and scenarios are a composite of various intelligence sources, both Western and Chinese in origin. Our findings are based on the best approximation of the truth that we can currently surmise and should not be taken as an absolute statement of fact. We encourage you to read further on the subject and to decide for yourself how you believe gold resources are distributed globally.

There is no doubt, however, that gold is an asset in high demand on a global scale. The yellow metal will certainly play a critical role in the global economy of tomorrow, and savvy investors would do well to get their share of the physical metal while they still can. To invest in gold within a tax-advantaged account, consider opening a gold IRA today with a trusted service provider.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $4,953.73

Gold: $4,953.73

Silver: $78.34

Silver: $78.34

Platinum: $2,097.90

Platinum: $2,097.90

Palladium: $1,701.59

Palladium: $1,701.59

Bitcoin: $70,536.48

Bitcoin: $70,536.48

Ethereum: $2,059.80

Ethereum: $2,059.80