China Gold Reserves: 2,000 Tonnes? 15,000 Tonnes? 30,000+ Tonnes?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 25th March 2022, 10:05 pm

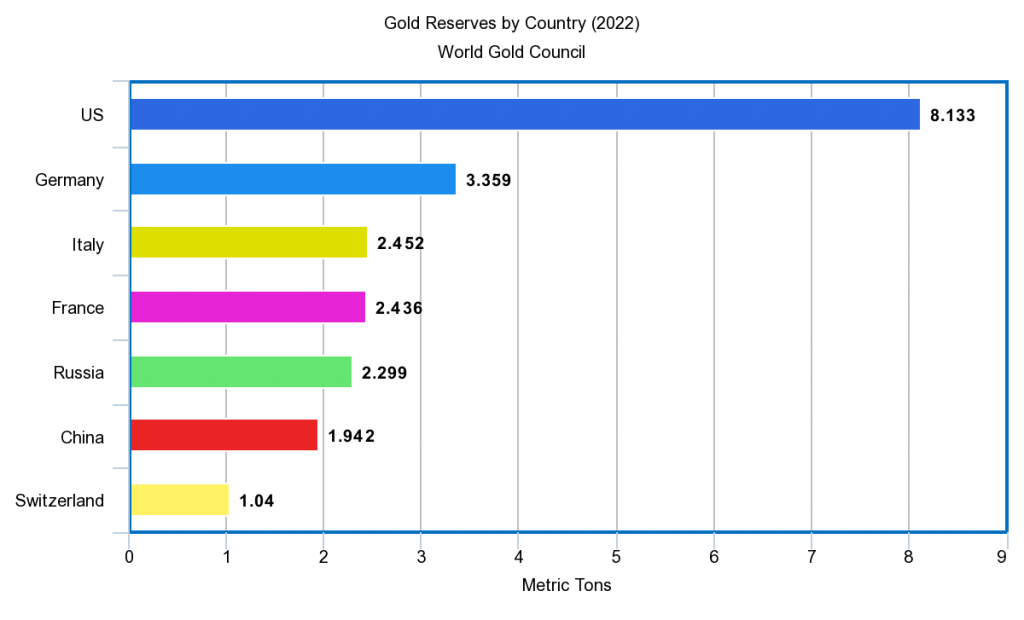

Nations and central banks have been stockpiling gold for decades as a way to diversify their sovereign wealth holdings, and the World Gold Council has been reporting on every country's reserves on an annual basis. The U.S. has been leading the race by far, at least since the WGC started reporting and ranking countries by gold reserves.

However, the question is: how accurate are these rankings? In the case of China, it seems a bit odd that they would rank 6th and hold only 1,949 tons of gold, especially given their economic stature and geopolitical influence. Is the WGC reporting the correct figure, or should we look elsewhere to get the true story when it comes to how much gold China is really holding?

Table of Contents

How Much Gold Does China Really Have?

Currently, the PRC is ranked sixth in global central bank gold holdings, with a reported 1,949 metric tons of gold according to the International Monetary Fund. The United States, who officially holds the top-ranking position in global gold reserve rankings, reports having 8,134 tonnes of the yellow metal in reserve.

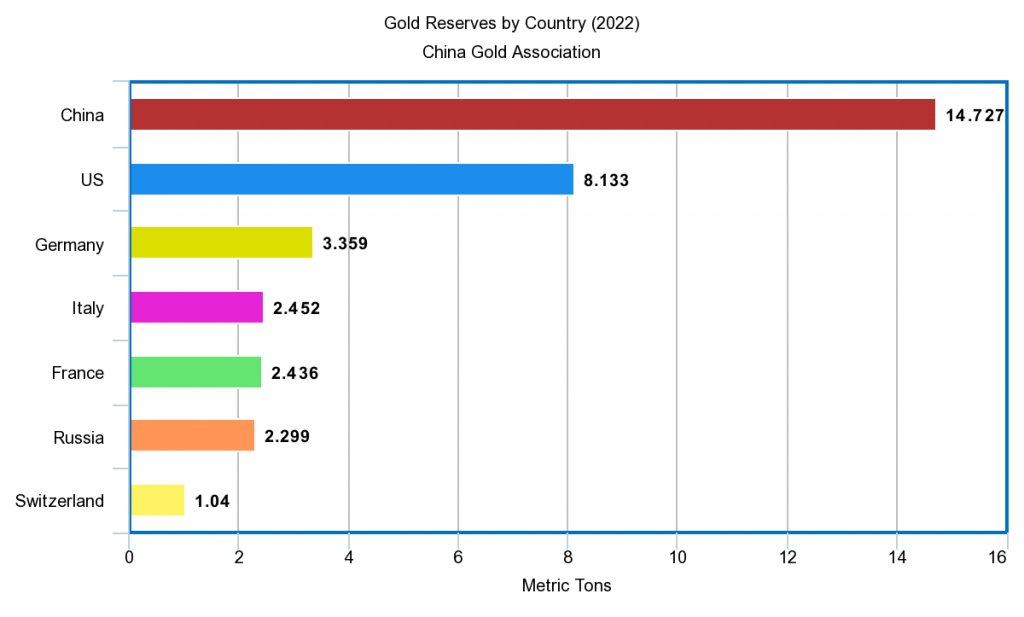

This would be uncontroversial if not for Chinese state media (Xinhua) reporting, in 2020, that China's gold reserves have grown for 15 consecutive years—reaching a sum of 14,727 tonnes. Xinhua News is the PRC’s largest newspaper by circulation. This figure nearly doubles the U.S.’ self-reported holdings.

Western economic agencies, however, still list China's official gold reserves as amounting to far less than their self-reported figure. Per the World Gold Council (WGC), as well as most other Western sources, China currently holds 1,948 tonnes, as of Q2 2022—a far cry from their self-reported 14,000+ metric tons. This is corroborated by TradingEconomics, which cites an identical figure as the WGC.

Global gold reserves by country according to Western reports

China's Massive Gold Buildup

Reuters has reported that China added 150 additional tonnes in April 2021, up from roughly 10 tonnes per month beginning in February 2020. Therefore, even China's most recent self-declared figure of 14.7K tonnes is already out of date and is likely beyond the 17K mark if Beijing's estimates are to be believed.

However, the ruling Chinese Communist Party (CCP) has gone even further to shore up its gold position off the books. For instance, China spent the 2010s on a decade-long buying spree of global gold mining companies, including Australia's Phoenix Gold (ASX:PXG), Norton Gold Fields (ASX:NGF), and the Porgera gold mine in Papua New Guinea.

Through Zijin Mining Group, a Chinese mining multinational headquartered in Fujian province, Chinese state actors wield control over 49.5% of all gold operations in the Democratic Republic of the Congo, over 20% of Canada's Pinnacle Mines, and extensive mining operations in the Central Asia region, including Tajikistan and Kyrgyzstan. This, in addition to the 400+ tonnes of gold that China mines domestically every year.

Beginning in 2008, authorities in Beijing have actively encouraged Chinese citizens to buy gold jewelry, and have promoted investments in gold funds and products. It should go without saying that it’s highly unusual for sovereign governments to take an active role in private citizens’ investment decisions.

At the same time, China started importing gold bullion at an unprecedented rate. Not only is China the world's premier bullion miner, but it is now the world's top buyer of overseas gold bars. Since 2019, the People's Bank of China (PBOC), the country's central bank, introduced sky-high gold import quotas of about $3.5 billion per month when, previously, there had been no quotas at all. In 2021, monthly gold imports were 48% higher than they were the year prior.

In a country where all branches of the government are under strict, unified control, it stands to reason that there are likely strong political incentives behind China’s aggressive gold-buying mandates. Although the Chinese domestic market for jewelry rose 63% Y-O-Y in 2021, it's unlikely that this tells the full story behind China's spike in gold buying.

Global gold reserves by country according to Chinese sources

Who’s Telling the Truth: China, or the West?

So, who is to be believed, and why are Western media sources reluctant to accept Xinhua's reporting?

We’re more inclined toward trusting Chinese sources because Chinese state actors have no reason to overreport their gold reserves; in fact, they are disincentivized from doing so. If China were to reveal that they hold greater gold reserves than previously thought (i.e., 30,000+ tonnes), this would ruin the Yuan's exchange rate and send gold prices skyrocketing—both of which are antithetical to Chinese state interests.

It's not only Chinese media sources that have reported on China's gold accumulation. Pravda, a Russian state media source, also has made mention of “unconfirmed reports” of up to 30,000 metric tons of gold held in China. Similarly, a Bangkok-based daily newspaper speculates that China is “preparing to adopt a pending gold standard” based on their recent gold accumulation campaign.

It's a matter of fact that both China and the U.S. have an incentive to inaccurately report their true gold holdings. However, in the context of China's gold accumulation, China has a compelling reason to understate its holdings, whereas the U.S. is naturally inclined to downplay or doubt the veracity of China's gold reserves. On both sides, official gold reserve numbers have been obfuscated and are largely opaque to foreign observers, as even the U.S. Federal Reserve has refused auditing for decades.

Therefore, the real number could be even higher than what Xinhua is reporting. This would align with certain experts' analyses, such as Dominic Frisby and Alastair McLeod.

Expert Perspectives

Dominic Frisby claims that China likely holds upwards of 31,000 metric tons of gold between official reserves, jewelry, and unreported holdings. London Stock Exchange member Alasdair McLeod agrees, claiming that China's true reserves are not merely what is reported in their Central Bank's coffers, but also the gold held by the People's Liberation Army, Young Communist faction, and the CCP itself.

On the other hand, some outside observers speculate that China's reporting is, in fact, inflated. They opine that China is counting “underground” reserves that have yet to be mined. However, the extent of China's “unmined” reserves is estimated to amount to no more than 2,000 tonnes.

In Conclusion

For reasons unknown, Western media sources are largely silent on the subject of China's major expansion of its gold reserves. It may well be that Western financial institutions don't find China’s self-reporting credible; however, China’s central bank has a greater incentive to underreport than not.

The president of the Shanghai Gold Exchange, who operates at arm's length of China’s ruling party, has previously called for China to have more gold in reserve than the U.S. He may have finally gotten his wish in 2020, when China first publicly announced that its holdings far surpass all other sovereign nations’.

From sanctions to trade threats, dependency on the U.S. dollar makes states vulnerable. This is something that Beijing and Moscow understand well, and is now seemingly making moves to undo with the emergence of a gold and Yuan-backed financial order.

Based on all of the available evidence, it's more likely that China is understating their gold reserves than overstating them. It's time that Western states and economic agencies take this seriously. This should give cause for concern to any investor with a stake in the strength of the U.S. dollar—or, in other words, all of us.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24