Fundrise Review

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 24th March 2023, 11:33 pm

- Phone : 1-(202) 584-0550

- URL :

- Global Rating

- Very Good

User Rating

- 1 Reviews

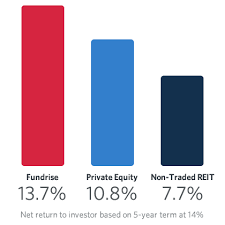

As the original founder of the real estate crowdfunding space, Fundrise delivers everything they promise in terms of transparency and affordable access to well-diversified real estate investing. Customer service is a little weak and you must be an accredited investor to participate, but if you can get past these problems, this is a fantastic way to earn a return greater than 12% on a proven investment product in commercial real estate.

Pros:

- IRA investing in the platform deals is permitted.

- Platform handles all legwork and due diligence.

- Fundrise takes care of all reporting and distributions.

- A true one-stop shop for real estate crowdfunding investing.

Cons:

- Must be an accredited investor to participate.

- While you can invest via your IRA, it is subject to a minimum investment amount that may be higher than the standard $100 minimum to $5,000 average investment.

- Customer service is weak compared to Fundrise rivals.

Real Estate forms of Peer to Peer crowdfunding lending have been popping up everywhere over the last few years. The first one opened its doors in 2010, and today there are over 50 of them in the U.S. You should expect to see even more of them in the future, as a number of larger national outfits alongside the typical local startups have announced that they will be launching platforms in the near future. Developers' constant need for money to fund their various real estate projects has given you the investor these opportunities to gain superior returns with investments where you can understand how they work. These crowd funding real estate investment platforms are so convenient to work with and easy to utilize that you can not avoid giving them serious consideration for your investment dollars.

Fundrise Intro & Background

The very first outfit to pioneer the way with online commercial real estate investments in the hands of the investing public was Fundrise. Back in 2010, they paved the way for the now dozens of real estate peer to peer platforms in existence. Providing you with the chance to obtain real equity ownership in properties in your region and around the U.S. is their stated goal and mission: They believe that “everyone should be able to invest in real estate.” They do this well, though it is not strictly speaking completely true when they say everyone. Only accredited investors, those who are able to prove over $1 million in net worth and at least $200,000 in individual or $300,000 in joint income, may participate. This remains a severe weakness with the crowdfunding-cherished principles of everyone being able to invest, regardless of how much they have to put into the investments in question.

Still, Fundrise does give at least accredited investors a previously unknown access to real estate investment opportunities brought out by the best and most successful types of real estate firms nationwide. They do this with their single, easy to utilize, and very transparent platform. Working with Fundrise, you are truly able to share and build up wealth together with other people in your local or regional communities by investing in local area real estate projects that matter to you personally. Both public and local investment offerings are found on this platform and investing website.

To say that Fundrise has demonstrated that this model of real estate funding can work is no overstatement. They have put together more than 30 major transactions in ten different major markets throughout the nation. While Washington, D.C. and New York City (with eight transactions in NYC alone) are their largest two single markets representing half of Fundrise's business, they have funded deals so far in another eight markets throughout the U.S.

Fundrise Founder and Management Team

Founder and President of Fundrise Daniel Miller grew up with his brother Benjamin in a family real estate development business that built over 20 million square feet of space. Daniel heads up the New York office and leads the real estate division, taking care of sourcing the real estate deals, underwriting, and securing new transactions. Daniel manages all of the creative and new development side of the business, while Ben oversees the remaining operations from their other office in Washington, D.C.

Co-founder and Chief Executive Officer Ben Miller runs the Washington, D.C. office and takes care of the daily management side of the existing operations. He is the hands-on administrator of Fundrise. As a Partner at WestMill Capital and President of Western Development Corporation, Ben has co-owned more than $800 million worth of real estate. His over 17 years of experience in the real estate business makes him ideally suited for this role as lead daily operations chief.

The third co-founder and current Chief Technology Officer of FundRise, Kenny Shin, leads the development of software for the platform and website and handles the asset management and investor internal applications. Before he started with Fundrise, Kenny served as consultant to a number of important clients such as Lockheed Martin, Oracle, Fannie Mae, and Computer Sciences Corporation.

Independent Board Advisor Tal Kerret is the Silverstein Properties Inc. President. His company developed the One World Trade Center and has over $10 billion of real estate deals presently under development.

Fundrise Loans

Fundrise is almost exclusively in the business of commercial real estate funding and loans. The average capital they raise for a typical project is approximately $1 million. In 2015 they will close on their biggest transaction so far, found in New York City and valued at $10.5 million. Besides this, they have several transactions in the pipeline for from $5 million to $10 million. In 2014, they closed over 20 funding deals, raising an impressive $25 million for real estate development projects. By the end of 2015, the platform is on track to close over $100 million in funding on deals located in 25-30 cities around the U.S.

The other real estate peer to peer outfits have so far been mostly U.S. focused. As the first in the space, it should not come as a terrible surprise that Fundrise is also looking to expand its operations of funding into Europe, beginning in London, the financial center of both Great Britain and the continent.

How Fundrise Works

To get started as an investor with Fundrise, you simply follow five easy steps. These are:

- Open Your Account – set up your completely free account in a matter of seconds, choosing to invest either as part of an entity or an individual investor. Here you ceate your individual preferences for types of product, your geographical areas of interest, and your personal risk profile.

- Browse the Opportunities

- Invest and Build Up Your Portfolio

- Track Your Investments and Earn Returns

- Reinvest

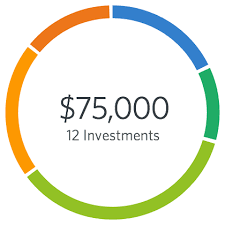

The minimum sized investment is currently $100 with the maximum typically topping out at $1 million (though they have allowed institutional investors to invest in excess of a million dollars). Average sized investments in any project are around $5,000. The majority of returns on these investments are in the range of from 10% to 16%. Returns are typically paid out quarterly, though with interest payments they can be monthly.

Fundrise Services

Fundrise handles all parts of the real estate learning, funding, and project oversight operations on your behalf. This includes:

∙ Elimination of Middlemen – Fundrise eliminates the quantities of typical middlemen in a real estate transaction, which reduces the total numbers of fees. Cost savings like these go to you the investor, permitting you to realize a healthier return on the same investments in real estate.

∙ Direct Access to Real Estate Investments – Gives you the opportunity to become involved with major U.S. market real estate transactions directly, though still passively. This makes it as easy as possible to build up a diversified portfolio of real estate holdings.

∙ Real Estate Investing Education – Fundrise takes pride in offering investors a variety of real estate education in the education part of the site under the heading “Learn.” There is an investing glossary of terms and concepts, a healthy Frequently Asked Questions section, and numerous articles posted that you can read on such topics as the “Top 10 Tools for Real Estate Developers.”

∙ Transact entirely online – Everything is handled over the Internet, without having to rely on old-fashioned mail or courier service. This covers digital legal documents, transfer of funds, and recording of ownership.

∙ Manage and track investments online – Their platform permits you to follow up your portfolio online, to receive distributions and interest payments automatically to your attached bank account, and to obtain financing reports on a regular basis.

∙ Due Diligence – The platform carefully runs every investment opportunity through their process of due diligence via their team of experienced underwriters. Less than 1% of the hundreds of projects the company considers every month are approved. Fundrise puts their money where their mouth is by pre-funding all of their investments upfront using their own assets, resources, and balance sheet in advance of bringing the deal to their investors. You can feel calm knowing that they are not recommending any investment to you that they have not put their own money into first.

∙ Initial screening – Weeds out 50% of applicants.

∙ Thorough Review of Project – Next the underwriters closely scrutinize the project itself, including its legal, financial, management, and market components, reducing the remaining 25% of applications still standing to under 1% which are approved.

∙ Fundrise purchases the entire investment – fronts the investment itself to improve speed of funding execution, then places it to you their investors using the crowd funding, peer to peer lending apparatus of their platform.

∙ Ongoing Reporting – The platform and company ensures that regular reports are delivered to you the investor and sets up the regular distributions to your bank account.

∙ Rolling Maturities – They give you better liquidity with offers of from 1 to 3 years maturity dates on average. This means that your portfolio in fixed real estate investments can be set up to pay out every year, or every several years. By buying into a number of deals this way, you will have principle being returned on a constant and rolling basis over time. This eliminates the problem of seemingly indefinite periods of holding unmarketable and illiquid investments.

Fundrise Locations

Fundrise is unusual for the peer to peer lending and crowdfunding space in that it operates more than one office. Their headquarters are located in Washington, D.C. at 1519 Connecticut Ave NW, Ste 200, Washington, DC 20036 where CEO Ben Miller is based. The President and Head of Real Estate Daniel Miller operates out of the firm's New York City office at 175 Greenwich Street, NEW YORK, NY 10001.

Fundrise Interface Screenshots

Fundrise Safety

The safety of Fundrise's investments are not yet evaluated in terms of an independently verified investment grade. The company maintains that it has not suffered from any failures or defaults so far. Skeptical investors would ask, “how do you measure the quality of these real estate deals or of the underwriting?” The answer is that more time will tell, though five years with no defaults or failures is a pretty impressive track record so far.

All personal data that you submit to the company is protected via standard 128 bit SSL encryption.

Fundrise Complaints and Ratings

The Better Business Bureau rating of A+ on Fundrise is consistent with all of the other data and information on the company. The BBB does admit that one complaint with the BBB over the past three years and zero filed with them in the last twelve months is an exceptionally low volume of complaints for a business of this size. Still, those of you who respect the BBB ratings system will have some concerns about the unusually low rating they give Fundrise.

Fundrise Customer Support

Fundrise provides primarily email customer support on their website. While they do not give out telephone numbers as general information, investors will have them provided once they sign up for the service and deposit money to fund deals. No live chat is available with the platform. This all means that the customer service department is the weakest link of the otherwise mostly impressive Fundrise chain and overall operation.

Fundrise Costs & Fees

We were pleasantly surprised to see that the fees which Fundrise gets from its investors are exceptionally low for the Peer to Peer investing sector. Investors pay between .3% and .5% of their money invested each year to manage and service their investments. Historically, Fundrise has never taken any spread on the difference between the assets' income and the rates they pay out on the Project Dependent Notes, though this could always change in the future.

Real Estate companies whose deals are funded on their platform pay an origination fee of between 1% and 2% as a one time fee. There is also a $5,000 closing cost and due diligence cost, which again is not high considering that their typically funded deals run over a million dollars. We love the transparency that Fundrise does more than just pay lip service to with their revealing of investor fees via a detailed breakdown on the individual web pages for every investment opportunity.

Final Words on Fundrise

It is hard to argue with the pioneer in the real estate peer to peer lending market and their over 69,550 members. Just like they promise, they do make investing in real estate both simple and profitable. They have delivered exceptionally low fees and incredible transparency to their investors. It is a real testament to the success and viability of Fundrise that a great number of professional and experienced experts, as well as new young professionals, are utilizing the platform to build up a well-rounded and -diversified portfolio of real estate investments. The New York Times says it all with their summary endorsement that “Fundrise has cracked the code on how to do crowdfunding well.” Now if only they could remove that annoying restriction on non-accredited investors, then the platform would be pretty close to perfect.

- Phone : 1-(202) 584-0550

- URL :

- Global Rating

- Very Good

User Rating

- 1 Reviews

As the original founder of the real estate crowdfunding space, Fundrise delivers everything they promise in terms of transparency and affordable access to well-diversified real estate investing. Customer service is a little weak and you must be an accredited investor to participate, but if you can get past these problems, this is a fantastic way to earn a return greater than 12% on a proven investment product in commercial real estate.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $5,154.83

Gold: $5,154.83

Silver: $82.49

Silver: $82.49

Platinum: $2,087.33

Platinum: $2,087.33

Palladium: $1,672.09

Palladium: $1,672.09

Bitcoin: $67,027.70

Bitcoin: $67,027.70

Ethereum: $1,963.32

Ethereum: $1,963.32