Fuel Shortage: Are Gas Prices Being Inflated Through Supply?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

These days, a lot of people are asking if there is a fuel shortage. The main reason is the spiking gas prices that we have never before seen in the US. Gas prices have reached an average across the nation of $5 per gallon.

However, some states are seeing average prices of over $6.50 per gallon, for example, California. While single instances of $8 per gallon and higher have been reported in some counties in the country.

We are going to have a look at what is happening to fuel supply and the consequences a fuel shortage could have on the economy. Then we will discuss what action you can take and how you can protect your investment portfolio.

Table of Contents

Is the Global Gas Supply Constrained?

This is the crucial question. If there is a fuel shortage it can come from excess demand, decreased supply, or a mixture of both. However, we often wonder if supply is capable of fulfilling demand, then what is causing the shortage?

What is very clear is that the global pandemic of 2020 caused by COVID-19, caused an economic slump. The decline in demand for energy products that resulted would have forced producers of gasoline to cut back on production.

Cutbacks in production usually occur in an industry when they believe the situation will be prolonged. However, the lockdowns and the restrictive legislation ended relatively quickly. The return to some normality created a surge in demand, and supply has not been able to catch up.

Refinery Count

One factor we can look at to determine if supply is keeping up with demand is refinery counts. The number of refineries operating in the US is kept by the EIA. From their website, we can see that the number of operating petroleum refineries fell to 135 in 2018 from 137 in 2017. That number decreased further to 132 in 2019, and then to 131 in 2020.

In the aftermath of the pandemic, by 2021 the number of operating refineries fell to 124. However, now that we are clear of restrictions and the demand has reached pre-pandemic levels the operating refineries are back up to 125 only.

So, we are still short of six refineries to get production capacity back to levels that were available before the pandemic hit demand for energy products. But there might be another factor that is stopping refiners from opening new plants, and that is crude oil supply.

Crude Oil Supply

Clearly, if refiners do not have enough raw materials, increasing the number of operating refineries would make no sense. I'm sure it takes time to start a refinery, but refiners have seen the rising demand. They also have 5 refineries that are operable but that are not actually operating, as per the EIA.

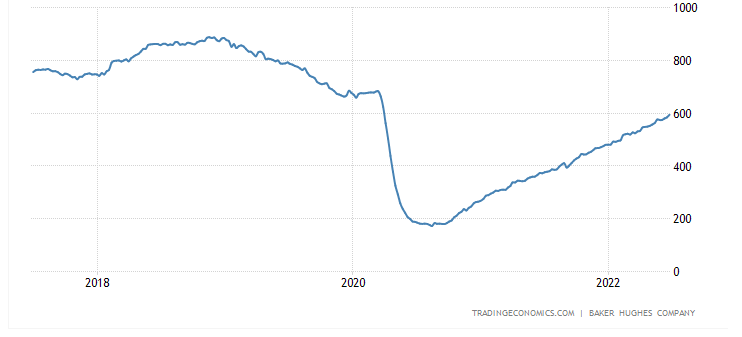

So, could it be a matter of a lack of crude oil supply? Well, from the chart below we can see that the crude oil rig count in the US is still way below the number of rigs before the pandemic kicked off. Again, it may take some time for companies to get rigs up and running, in any case, the supply from extraction is lower than the level in early 2020.

Source: TradingEconomics

Source: TradingEconomics

Keystone Pipeline

This matter has seen a lot of controversies as politicians are divided along party lines with both sides apparently having good reason to impose their ideas. The fact of the matter is that the Keystone pipeline, independently of ecological issues, as I don’t have the data, was about bringing highly needed crude oil from Canada.

The previous years already showed the US that they could not rely on crude oil supplies from Mexico and Venezuela. The Keystone pipeline was set to transport up to 900,000 crude oil barrels a day as reported by Forbes.

On a side note, crude oil transportation is ramping up via truck and rail. Which is more polluting and far more dangerous than a pipeline. Had President Biden not canceled the Keystone pipeline, that infrastructure may well have started running already. That amount of supply, according to Forbes, would have offset the deficiencies from Mexico and Venezuela.

War on Ukraine

The Russian invasion of Ukraine has contributed to further curtailing supplies of energy products. EU and NATO countries have heavily sanctioned Russia. The consequences of these sanctions meant there was less Russian oil on the market.

While the US started selling crude oil to its allies as they were particularly affected by not being able to buy Russian oil, demand at home also increased. This created a scissor effect which has probably brought the demand for US crude oil to levels that are even higher than those before the pandemic.

How Likely Is a Fuel Shortage?

According to Paul Sankey, lead analyst at Sankey Research, in an interview with CNBC said he saw a high risk of a fuel shortage going into the summer. The main reasons he mentioned are:

- Russian sanctions have reduced Russian crude oil exports by 1.5 million barrels daily.

- Historically low inventories

- Refinery outage from hurricane or accident is a big threat

The US is now subsidizing the Russian exports which our allies relied heavily upon. This creates a greater shortage of domestic demand. Historically low inventories mean that any kind of disruption to supply will be met with a sharp price increase, but also a physical shortage of fuel.

Last but not to be underestimated, we already have a low refinery count. So, a fire or other incident that could cause an outage would be catastrophic for supply. Add to all that, the summer season often creates a spike in demand for gasoline for recreational purposes and we could have a perfect storm scenario.

We also know that hurricane season is a great threat to the refineries and rigs in some parts of the country. These weather events can paralyze production and refining for days and sometimes weeks. So, on top of short levels of inventories, there is a real possibility we could see fuel shortage problems.

Consequences of a Sustained Fuel Shortage

I would say it is fairly obvious that the first impact of a fuel shortage is higher prices. Initially, gasoline and diesel prices will continue to rise. However, a lot of transportation runs on diesel and gasoline across the nation. Merchants will inevitably pass on transportation costs over to the consumer.

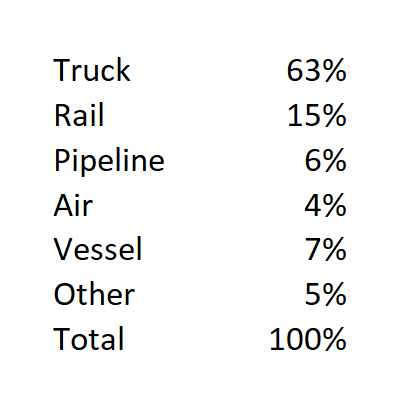

Just to understand how importantly higher fuel prices can impact inflation let's take a look at the most common methods of transportation. As we mentioned most of transportation is by truck and rail.

However, the Bureau of Transportation Statistics shows that in 2017, 63% of freight transports were carried by truck, and 15% by rail. That included an increase from 2016 of 3% for trucks and 5.2% for rail. So, we can see truck transportation is a big part of our economy, and so is the fuel it runs on.

Freight Transportation by Mode

Source: BTS.gov

Source: BTS.gov

Clearly, a fuel shortage that puts pressure on gas prices will also put pressure on the prices of goods in general. This factor is enhanced by the fact that so much of transportation runs on gasoline or diesel. So, the aftershock of a fuel shortage will be higher inflation.

However, things could get even worse. I would say this extreme event is more unlikely to occur. But if the fuel shortage is dire enough then we will also see trucks and trains without fuel to make deliveries.

Of course, that goes along with a fuel shortage at the gas pump, or perhaps rationing a specific number of gallons per car. Needless to say, you might not feel that as much as you would seeing your local food store with half-empty shelves.

How to Protect Your Portfolio from Fuel Shortage

Ok, so, apart from stocking up for the summer on just about everything there's not much we can do to fend ourselves from a fuel shortage. However, there are steps we can take to protect our investment portfolio.

If inflation continues to spiral out of control, and it looks like that is what is happening, there will be a hard landing as recognized by various analysts. This is due to the Federal Reserve which will be obligated in raising interest rates much faster than it is currently.

Creating an economic slowdown that seems inevitable as corporations see the free money supply end. With a shrinking economy comes lower prices for stocks on Wall Street. And with rising interest rates lower prices for bonds.

So, traditional assets will be hit the worst as they are the most exposed to the macroeconomic factors that are turning against them. In my opinion, now is definitely a good time to look at alternative assets. If you don’t own any alternative assets this could be a good opportunity to switch a part of your portfolio to real assets like gold and silver.

If you already have a small percentage of your portfolio in alternative investments, then this could be a great moment to add some more protection.

Precious Metals

Precious metals have proven their characteristic of protection from inflation. Over the decades, since Nixon ended the gold conversion of the dollar, the price of gold has floated freely. With free-market forces in play, the true value of gold has come to shine.

Gold and other precious metals are used in a variety of products, from industrial production and electronics to jewelry. Gold is perhaps the king of all precious metals due to its rarity, its indestructibility, and the fact that it has been used as a store of value and wealth for millennia.

Real Estate

Real estate has also shown a capacity to weather out rising inflation. Especially property with rental contracts. As most rental contracts are linked to inflation, when prices rise over time the rental contracts are adjusted upwards to compensate for the rising inflation.

Also, real estate returns are known for not having a high correlation to stock and bond returns. This feature helps diversify a portfolio as more assets included with low correlation help lower the overall risk. Be aware that REITs may at times of a crisis perform similarly to stocks, as they did in the 2008 crisis and the mini-crash in 2020.

Cryptocurrencies

Cryptocurrencies have taken a beating since the beginning of the year and some digital assets have lost over 90% of their value. The number one digital coin by market capitalization, Bitcoin, is down over 55% against the US dollar YTD at the time of writing.

But the ever-increasing involvement of financial institutions brings new money to the game. And more and more companies allowing their customers to pay with cryptocurrencies show that cryptocurrencies are here to stay.

What seems apparent since the beginning of the year, is that investors are in a risk-off mood. So, in general, risky assets such as stocks and crypto are sold off to reduce risk rather than simply a lack of belief or trust.

Decision time

What is surprising, is that in a recent survey we conducted we found that 79.1% of investors surveyed had not taken any action yet to reduce the negative effects of inflation on their portfolio. While 9.4% have added precious metals, 5.3% have added real estate and 4.9% have cryptocurrencies.

As the months progress and inflation keeps biting into investors' pockets, we believe this picture may change. Especially as expectations for inflation continuing into 2023 and 2024 are continuously increasing.

Bottom line

Assets like crypto are known for their extreme volatility. We always recommend caution when allocating a portion of your investment portfolio to risky assets and even more so with cryptocurrencies. We also recommend you seek the advice of your financial advisor to best determine how to allocate assets among your investments.

Gold, silver, and precious metals, however, have a much lower level of volatility and therefore risk. Of course, you need to establish what percentage may suit your needs and your financial advisor can help there too. You may want to invest in precious metals through a tax-enhanced retirement account. You can check out our top gold IRA companies review here.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,688.06

Gold: $3,688.06

Silver: $42.69

Silver: $42.69

Platinum: $1,409.17

Platinum: $1,409.17

Palladium: $1,206.01

Palladium: $1,206.01

Bitcoin: $115,366.67

Bitcoin: $115,366.67

Ethereum: $4,501.36

Ethereum: $4,501.36