Fed Predicts Over 50% Drop in Q2 GDP While Stock Market Rallies

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 9th June 2020, 09:56 am

This past week, it has really felt like the stock market was proverbially fiddling in the flames of the burning United States' streets and economy. Even as a new crisis in the form of out of control violent and destructive protestors ravaged major U.S. metropolitan areas, the coronavirus continued to claim the lives of its citizens. The Atlanta Fed predicted this past week that the second quarter GDP for America will drop by at least 51 percent in the upcoming important data release.

Yet despite the horrific economic and social unrest reality rocking the nation, the stock market is once again within striking distance of making a new all-time high. You should beware of the radical disconnect between the markets and the reality on the streets.

Atlanta Federal Reserve Forecasts Stunning 51 Percent Drop in National GDP for Q2

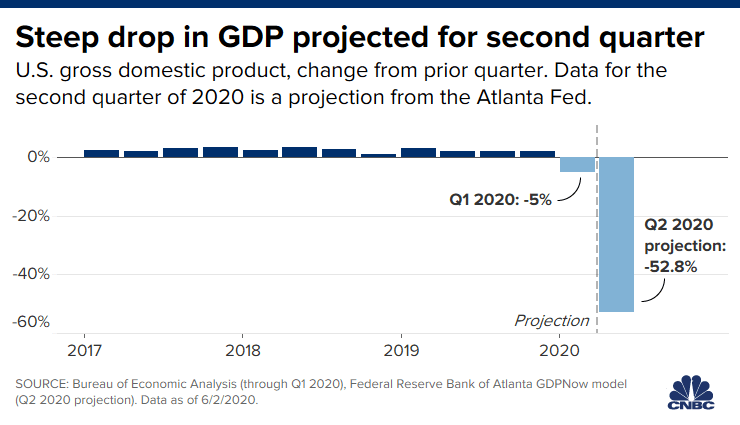

The Atlanta Federal Reserve's grim chart on projected national GDP outlet explains it all:

This is also not the only discouraging economic metric out of the U.S. data this week either. The full accounting of total United States' economic output known as Gross Domestic Product declined by a sobering five percent already for the 2020 Q1 time period. Yet it is nothing compared to what the Atlanta Fed is predicting for Q2. They expect the national economy to realize a full 51 percent cratering of the world's largest economy.

Given the devastating news of the American economy burning down at an unprecedented pace, you would expect stock markets to be hovering at levels in the ash can. Yet as of this past week, the S&P 500 broadest measure of major American companies is only down a stunning 4.6 percent from the first of the year 2020. As one financial analyst Silverblatt cleverly put his response:

“You've got to be kidding me, four percent? You mean 40 percent.”

Yet irrational exuberance has returned in full strength apparently. Some analysts argue that the sentiment of investors has been improved dramatically by the sight of gradual state reopenings that started in earnest throughout the United States these past two weeks. They are also encouraged by the apparent progress being made to develop a coronavirus vaccine that would finally normalize things for the national and world economies, putting an end to the devastating measures of social distancing.

Investors have become fixated on the hope for a critical consumer spending rebound to push the U.S. economy out of its slump and dramatically improve flagging retail sales. Even the widespread countrywide “Black Lives Matter” protests that have seized the attention of the mainstream news media are not impacting the stock market levels and investor sentiment.

They have chosen to ignore the serious problems of growing economic inequality and social unrest in the U.S. (and around the developed world) as they do not foresee much chance of it causing any real lasting economic damage, per economists. The Senior Equity Analyst Preston Caldwell of Morningstar ratings stated that the 34 percent decline previously seen in March in the S&P 500 index did not reflect the most likely scenario for the U.S. economy over the longer term:

“I would say the economic data is old news for the market's purposes. Right now, most market participants are looking beyond the [second quarter] to try to understand the second half of 2020 and beyond.”

A jointly published Financial Planning Association, Journal of Financial Planning, and Janus Henderson Investors sponsored survey revealed that most financial advisors are accepting a rosier picture that they hold on to for the longer-term economic picture. A full quarter of these advisors anticipate boosting their stock portfolio recommendations to their own clients in the coming year, per this widely followed jointly published financial survey.

Some experts argue that the stimulus measures pushed aggressively by the federal government have reduced many fears of investors from March and April months. The Congress managed to pass its CARES Act in a $2.2 trillion relief package for the coronavirus victims across America. This delivered single time stimulus payments to nearly every American household, provided forgivable loans to small businesses, and expanded and extended unemployment benefits through the end of July.

Besides this, the nation's central bank the Federal Reserve embarked on a vast money printing operation in order to ensure that municipalities and businesses alike were able to get readily available cash for their operating needs. Markets have also been buoyed by powerful performances from the biggest market cap companies in the U.S. called the FAANG stocks. These include the likes of Facebook, Apple, Amazon, Netflix, and Google-Alphabet. Their skyrocketing runs have ensured that other sector weaknesses were largely offset (as with energy sector declines), per Jenkins.

Retesting of March Lows Still in the Cards Per Analysts

Yet not all respected and widely followed analysts have bought into this unprecedented comeback in stocks out of a severe bear market already. A respected Wells Fargo Strategist Darrell Cronk, who is the President of the Wells Fargo Investment Institute, warned investors via Yahoo Finance that:

“It would be unusual and unprecedented for a bear market or recession to only last 30 or 45 days. It just doesn't happen. Don't be too optimistic of the most recent stock market rally.”

Instead Cronk has warned that the markets have not yet properly and fully digested the severe GDP contractions, high and still-rising unemployment figures, and poor first quarter earnings that have not been appropriately marked down so far. Cronk continued:

“The consensus still has earnings declining above seven, eight, or nine percent, and second quarter is about 15, 16 percent right now. That's way too low for what we're going to have in GDP contraction. I think you've got some markdowns still ahead on earnings that the market hasn't been as realistic about as they should be.”

Besides this, Cronk anticipates an “unprecedented amount” in dividend and shares buyback suspensions for this earnings season. He warned that “I think the amount of it will probably surprise to the downside.”

Optimistic Jobs Report from this Week Was Likely A Data “Head Fake” Per Revered Allianz Economist El-Erian

According to the revered economist Mohamed El-Erian who is the Allianz Chief Economic Advisor, there is a huge risk in the most recent surprising American jobs report. He fears that it will be seen in retrospect as a “head fake.”

“That's the nightmare scenario. .The big risk… is that this is a head fake, a major head fake that we are picking up the impact of both data distortions and policy distortions.”

For sure the unemployment report for May confused economists who had been glumly anticipating a loss of 7.5 million jobs for the month. Rather than this, the report claimed that over two million jobs had been added and that the unemployment rate had dropped to 13.3 percent. El-Erian explained that:

“No one was looking for an uptake in jobs. It may be that the economy has picked up in a major way. That's the hope. And that's certainly what the market has embraced. Or it may be two other things: that government policies were very effective in reducing those who were officially unemployed. Or it may be that the data is very, very noisy.”

We will all know in a few more short weeks as additional data clarifies the surprise jobs report.

Several Major Risks to the Markets Persist Despite Irrational Exuberance in Markets Now

There are very real major risks to the markets' irrational exuberance right now. The likelihood of a second coronavirus wave breaking out either over the summer or in the fall is high. This would require at the very least more severe social distancing protocols that would reduce still-recovering consumer spending. The federal government failing to continue to legislate additional stimulus measures could cause investor sentiment to fall as this would translate to less free flowing cash for jobless consumers to pump back into the American economy, per experts.

The economic data continues to be poor even as markets are irrationally rallying on these distant future potential hopes. Now it is clear why gold makes sense in an IRA. You ought to at least consider acquiring some IRA-approved gold now. This is the time to read more about Gold IRA allocation strategies and the Top Gold IRA companies in the industry.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,727.53

Gold: $2,727.53

Silver: $33.49

Silver: $33.49

Platinum: $1,014.28

Platinum: $1,014.28

Palladium: $1,136.33

Palladium: $1,136.33

Bitcoin: $67,743.12

Bitcoin: $67,743.12

Ethereum: $2,495.34

Ethereum: $2,495.34