Factory Closures In China Now Having Significant Impact on Global Economy

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

The Coronavirus has caused a scare around the world as an unfolding global health pandemic, but not as much attention has been paid to the effects it is having on the Chinese and now global economies. Uncertainty surrounding the resumption of work at factories in China has begun to take its toll. Now cities and provinces there are announcing varying dates for how long their extended shutdowns will be with the virus continuing to spread. Initially the authorities had stated that operations would start again today on Monday, but the delays have already been pushed forward in many regions across China.

Apple's biggest manufacturer of iPhones Foxconn is one of the companies impacted. Even if businesses started operations running again now, there would still be an additional two week delay for workers to complete their quarantine requirements. The added delays have caused analysts to warn that there will be a significant hit not only on the Chinese economy but around the world as well.

Factory Shutdowns Extended Again

Just last week, over 20 provinces and regions informed businesses that they could not start working again until at least February 10th at the soonest. It is important to note that these regions of the country contributed to over 80 percent of the Chinese GDP and amounted to over 90 percent of Chinese exports, per CNBC calculations.

Restarting operations today (with workers returning in two weeks) would be bad enough, but now a number of districts and provinces have directed firms not to begun work again until the 1st of March, per officials. Morgan Stanley has analyzed this and issued a report. They have determined that business in some of the provinces will be able to partly restart today. Meanwhile workers coming back in other provinces still have to obey quarantine restrictions. There are particular sectors like construction that will still have to delay restarting work too. Morgan Stanley stated in its report:

“It is uncertain whether factories could resume production this week amid local quarantine efforts and traffic controls. Indeed many authorities and enterprises at local levels are targeting Feb. 17th or later to restart business, and the resumption is likely to be a phased approach… There are still uncertainties as to how quickly the coronavirus situation will be brought under control and when production and goods transportation services will be ramped up to normal levels.”

Markets hate the resulting uncertainty. Morgan Stanley is not alone in sounding the alarm on how this will impact China and the rest of the world economies. The Chief Economist for Asia Pacific Alicia Garcia Herrero of Natixis declared that:

“That… is a major blast to the global value chain, not only for China, but the world. That is already, basically a month and a half without factories working. So indeed, it is a big blow to the Chinese economy, and the world.”

American and other international companies are being increasingly affected by the delays.

Apple's Largest Supplier Foxconn Among the Affected Companies

One of the important companies severely affected by the factory closures is Hon Hai Precision Industry listed in Taiwan. Americans know it as Foxconn, the company that is the biggest assembler of iPhones in the world. Reuters reported today that Foxconn has obtained permission to restart production at its Zhengzhou facility. They are doing this with only 10 percent of their workers. Yet the company is still having to “try very hard” to obtain approval in order to resume production at its other plants in different places throughout China, per Reuters. Foxconn issued the following statement about its production plans:

“The operation schedules for our facilities in China follow the recommendations of the local governments, and we have not received any requests from our customers on the need to resume production earlier.”

Foxconn did not say directly when it will resume its other operations.

Apple and Carmakers Could Be Severely Impacted

Yet analysts have pointed out that these delays have the potential to hurt Apple. On Sunday, Wedbush Securities issued a note on the effects that this development could cause. They stated that the development could cause:

“A shock to the system and disrupt the supply chain further for Apple” both for iPhones as well as AirPods.

These components are already suffering from a shortage as things stand. Apple is not the only company feeling the pinch of the factory closures either. The auto industry has taken significant hits. Both Japan's Toyota and Germany's BMW have announced that they will have to extend their plants' shutdowns (located in China) until the next week. Other carmakers have similarly stated that they will be forced to delay their factory production restarts.

Chinese tech companies are also impacted. Tencent (listed in Hong Kong) requested that its own employees keep working out of their houses another week. They have now pushed forward the return to offices date from February 14th to February 21st.

Economist Mohamed El-Erian Warning Investors

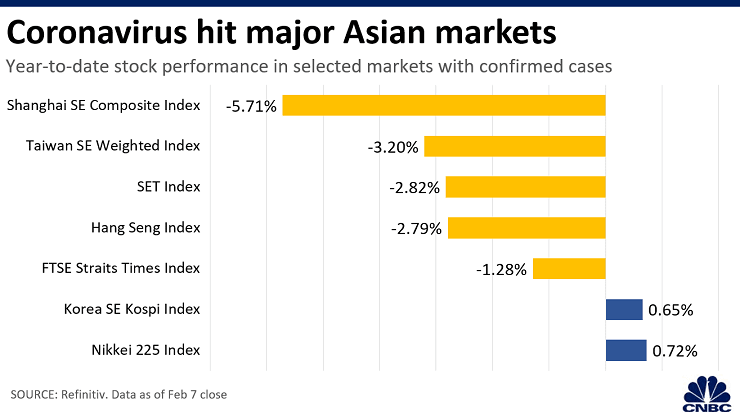

Some investors have been tempted to buy into stock market declines that have resulted from the coronavirus shutdowns. This chart below demonstrates how steep the losses have been, particularly in Asian markets so far this year:

At least one well-known and -respected economist Mohamed El-Erian has cautioned investors against using pullbacks in the markets as an opportunity to buy the dips. The long-time Pimco CEO and current Allianz chief economic advisor warned on CNBC that this viral outbreak is going to cause a major impact on China's economy while harming growth around the globe, with:

“For a long time I thought the market sentiment was so strong that we could overcome a mounting list of economic uncertainty, but the coronavirus is different. It is big. It is going to paralyze China. It is going to cascade throughout the global economy. Importantly, it cannot be countered by central bank policy. We should pay more attention to this. And we should try and resist our inclination to buy the dip.”

Investors have been warned. The ripple effects from the coronavirus related shutdowns will likely continue for some time to come.

The Dr. Copper Indicator Showing Hit to Chinese GDP Will Be Substantial

Copper is a multi-decade long followed indicator on the health of the global economy. In recent years, it has also become a barometer for China's economic growth. Over the last few weeks, “Dr. Copper” prices have plunged by 12 percent. They could go even lower going forward. With production plants throughout China halted, rumors have emerged of a number of Chinese manufacturers declaring a state of force majeure to cancel commodity supplier contracts, particularly in copper. It is confirmed by the over 10 percent drop in copper prices.

This has caused one Chinese government economist to forecast that the quarterly growth rate could decline from the anticipated six percent to five percent or perhaps even lower. The slowing growth in China will continue to cause substantial impacts on worldwide copper demand. Copper demand and prices in turn predict the future direction of growth for the world as a whole.

Unfortunately the news this week surrounding the impacts of the coronavirus continues to be negative. It is now having a significant impact on the economies of China and the world. This reminds you why gold makes sense in an IRA. Diversification into IRA-approved gold is one way to hedge against the risks threatening your retirement and investment portfolios. You can read about what is involved with a Gold IRA rollover versus transfer and the top Gold IRA companies to learn more.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,336.55

Gold: $3,336.55

Silver: $37.80

Silver: $37.80

Platinum: $1,337.40

Platinum: $1,337.40

Palladium: $1,124.21

Palladium: $1,124.21

Bitcoin: $117,645.06

Bitcoin: $117,645.06

Ethereum: $4,436.18

Ethereum: $4,436.18