Despite EU Recovery Package Deal, ECB Warns of Threat to European Banks

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

It was only last week that the European Union passed its long-awaited, block-wide relief package. The final amount of money that they agreed on for stimulating their stricken economies turned out to be somewhat underwhelming. Early this week, the European Central Bank released updated stress tests showing that European banks could suffer significant difficulties if the ongoing coronavirus-induced economic crisis deepens. With the global banks all exposed to one another, it means that American banking giants are also conceivably at greater risk than the Fed might admit.

European Union Leaders Agree on a $2 Trillion Economic Rescue and Recovery Package

On July 20th word emerged that the 27 governments comprising the European Union had at last achieved a breakthrough arrangement on an updated fiscal stimulus package. It took a record setting four days over exhausting talks in Brussels for them to reach agreement on the amount.

In the end, the European Commission took the responsibility for tapping the global financial markets in order to raise the 750 billion in euros (about $860 billion). These funds will be disbursed to the various sectors and nations of the EU that have suffered the most loss from the results of the lockdowns and shutdowns of the coronavirus pandemic. They will be made available as both grants and loans.

President Charles Michel of the European Council declared victory early the next day with his statement on what he saw as a “pivotal moment” for the continent. Meanwhile President Ursula von der Leyen of the European Commission stated that:

“Europe, as a whole, has now a big chance to come out stronger from the crisis.”

What fewer people were talking about was the fact that the money they have agreed on amounts to one percent of the GDP of the concerned countries' economies. It is a trivial amount compared to the stimulus that other major economic powers such as Japan, the United Kingdom, and the U.S. have pledged to support their struggling economies.

The S&P warned that nations needed to spend more to support their struggling economies recently. Now the EU has done so at last after disagreeing and putting off an agreement and coming to terms with their next budget. An ideological rift between the Frugal Four (Austria, the Netherlands, Denmark, and Sweden) and the rest of the block ensured that the final package would be divided between grants and loans that must be repaid. They also finally concurred on how the investment would be overseen and linked to democratic values in the EU at the summit that became the second longest running one in EU history.

The final results amounted to a plan to distribute a total of 390 billion euros of the 750 billion fund as grants versus the original proposal from Germany and France to supply 500 billion worth of euros in grants. The EU attempted to be fiscally responsible by pledging a time limit to the total debt issuance by the year 2026. They pledged to pay back the sum total of this debt within 38 years from now by 2058.

Meanwhile, the various member states must create plans detailing the ways that they will invest the new money. These have been labeled Reform and Recovery plans. Each recipient country's proposal must be signed off on by the other nations of the EU through a qualified majority instead of the usual unanimous arrangements that govern major EU decisions and which the Netherlands was insisting on early in the summit.

EU Leaders Agree on Next EU Budget

The other major announcement from the summit was that the upcoming EU budget will amount to 1.074 trillion euros (approximately $1.25 trillion). The two together will increase the expected investments to a total of 1.824 trillion euros (approximately $2.1 trillion). This second tranche of money does not pay out in a single year though, but over multiple years. President Emmanuel Macron of France declared that:

“This recovery fund will help us to almost double the European budget for the years to come.”

The European Union successfully put a positive spin on the final result which did achieve a key unprecedented outcome. For the first time ever, the block has jointly issued debt. Should one of the fiscally weaker nations in the group (such as Italy, Spain, or Portugal) default on their repayment of the loans, then the stronger fiscal nations (like Germany, the Netherlands, Austria, and Sweden) will be liable for the shortfalls.

European Central Bank Will Buy Government Bonds and Taxes Are Going Up

Besides this stimulus, the European Central Bank is now purchasing government bonds under their Pandemic Emergency Purchase Program that amounts to 1.35 trillion euros (approximately $1.55 trillion). The European governments have agreed to come up with new means of financing the payment of the accumulated additional debt that they are jointly issuing. New taxes are included as part of the additional financial resources that they must raise.

Deal Marks the First Joint Debt At A European Level

Analysts have noted how significant it is that the EU block countries will now issue debt jointly. Berenberg Bank analysts wrote in a note that:

“With the biggest-ever effort of cross-border solidarity, the EU is sending a strong signal of internal cohesion. Near-term, the confidence effect can matter even more than the money itself.”

Many economists have criticized the EU for its glaring lack of a so-called common fiscal policy as the United States has. Another issue threatening the block surrounds the rise in anger at the EU that has become more commonplace in a few of the countries making up the union. Policy makers have voiced their concerns that this will lead to a possible breaking up of the union. Berenberg analysts addressed these issues with:

“The EU and the euro zone are not en route towards fiscal union. But they are taking a significant step towards stronger fiscal co-ordination when it matters. The deal sets a precedent. The EU issues debt in a crisis. Expect some common fiscal response to play a greater role in future crises as well.”

EU Bank Stress Tests Show That European Banks Might Be In Trouble As Crisis Deepens

Economists expressed concern yesterday at the release of the ECB's recent Covid Vulnerability Analysis stress tests. The central bank reviewed 86 continental banks throughout the euro zone. While the main headline was that the banks can currently handle the challenges that the global pandemic provides, the underlying headline was more troublesome. The banks of the single currency zone may soon encounter difficulties should the present crisis deepen further so that their present capital positions become eroded.

The European Central Bank Supervisory Board Chair Andrea Enria revealed in an interview that:

“The banking sector (in the euro area) is in a very strong position to withstand an unprecedented shock,” but should the crisis deepen then a few banks “would face difficulties in maintaining their compliance with the minimum (capital) requirements.”

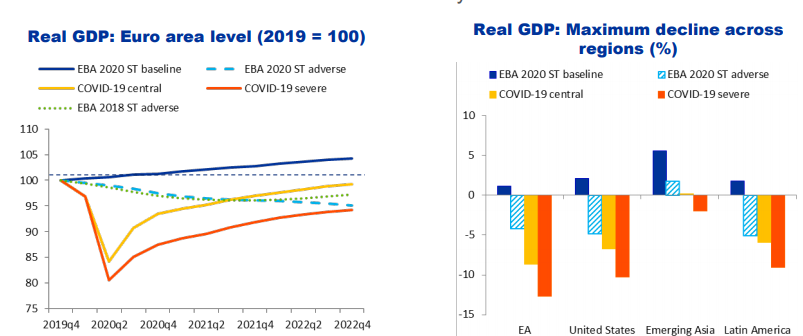

In the ECB's second case scenario, they allowed for a potential decline (of euro zone block economic activity) of 12.6 percent in 2020. This would cause their version of the “Tier 1” capital (CET ratio) to decline by 5.7 percentage points. The chart below shows the ECB's central and worst case scenario projections for not only the Euro area, but also the U.S. and other regions of the world:

The European Central Bank explained about their severe case scenario that:

“In this scenario, several banks would need to take action to maintain compliance with their minimum capital requirements, but the overall shortfall would remain contained.”

Meanwhile the ECB instructed its European lenders not to repurchase stock shares or pay out dividends through January of 2021.

Unfortunately for the European economies and banks, this week's news of substantial debts being jointly issued as some of the euro zone's banks are potentially headed for trouble (primarily Italian and Spanish banks) is not good. The banks around the world are all exposed to one another's debts, creating global systemic risk. It is why gold makes sense in an IRA.

One way to reduce your investment and retirement portfolio exposure to banks and fluctuations in the stock market is through IRA-approved precious metals like gold. You can learn more by reading about topics like Gold IRA Pros and Cons as well as Top Gold IRA Companies.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,631.42

Gold: $2,631.42

Silver: $29.86

Silver: $29.86

Platinum: $938.75

Platinum: $938.75

Palladium: $921.81

Palladium: $921.81

Bitcoin: $95,667.01

Bitcoin: $95,667.01

Ethereum: $3,322.64

Ethereum: $3,322.64