Desperate to Save Reeling U.S. Economy, Fed Pumping In Another $2.3 Trillion

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

This past week saw the U.S. economy continue to crater as lockdowns and shutdowns around the nation continued to boost unemployment claims yet again to another scary all-time high. Another 6.6 million Americans joined the unenviable ranks of the newly jobless this past week, bringing the three week total to a staggering and unprecedented 16 million unemployment claims.

The Federal Reserve reacted to the damaging economic release in their typical newfound panic mode, unveiling yet another stimulus package in a desperate attempt to save the reeling American economy from lasting ruin (this one aimed primarily at local and state governments and cash-strapped mid-sized firms). The Fed announced that it will flush another $2.3 trillion around the economy (using expanded and new programs) on Thursday. This is on top of the recently passed $2.2 trillion economic relief package and the earlier stimulus package from only several weeks prior.

Treasury Department Funds Enable Fed to Buy Municipal and Corporate Bonds Now

The stimulus package of the week comes courtesy of new powers granted to the Federal Reserve by the Treasury Department and congressional authorization. Congress has enabled the Federal Reserve board to purchase municipal bonds and to increase its corporate bond purchasing programs to cover riskier, lower-rated debt now. The Fed also revealed its much-anticipated lending program to businesses that is aimed at helping mid-range companies, especially those who are not allowed to apply for aid using the Small Business Administration loan scheme.

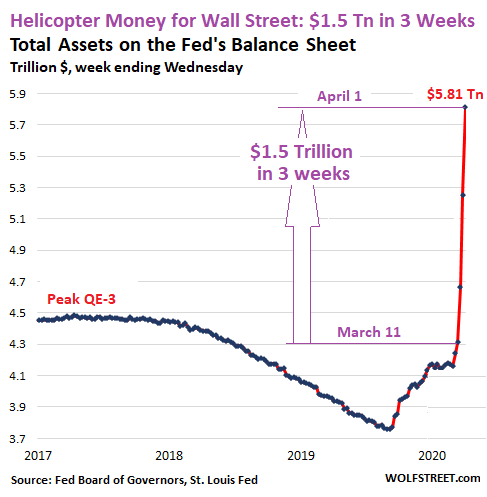

The latest announced measures mean that the Federal Reserve is now way beyond its Herculean efforts of the 2008 Global Financial Crisis. It has so far made huge endeavours to prop up the failing economy and to keep stock markets on life support. It has meant that interventions in money markets and limitless bond purchasing campaigns, once unthinkable, are now an almost everyday occurrence. It is expected that the programs of the Fed's will now over quadruple in size versus their prior package of roughly $500 billion in emergency lending efforts, as this chart below demonstrates:

An Unprecedented Level of Fed Intervention in Markets

Fed Chairman Jerome Powell explained the Federal Reserve's desperate seeming actions with:

“We are deploying these lending powers to an unprecedented extent, enabled in large part by the financial backing from Congress and the Treasury.” We will keep using these powers “forcefully, proactively, and aggressively until we are confident that we are solidly on the road to recovery.”

Congress is busily flushing money through the system wherever it possibly can. It just handed Treasury an astonishing $454 billion cash in order to backstop these Fed emergency loan facilities. The Fed utilizes these to maintain the flow of stalling credit through the flat lining economy in such unprecedented circumstances. These facilities must be insured in case of losses as they enable higher credit risk. The additional backstop makes it possible for the American central bank to boost its programs.

Yet these Federal Reserve actions are clearly well past extraordinary; they are completely unprecedented and could not have even been foreseen only a month ago. To all intents and purposes, the central bank' s lending powers are now almost unlimited. Yet the Fed had carefully steered clear of purchasing municipal debt and low-rated corporate debt deliberately in the past. They were worried about the higher credit risk and did not want to be seen as selecting losers and winners in the crisis. Yet pressure on the Fed to act became too great to resist any longer as the market continued to tank.

The Fed was also revealing more of its plans to deliver major relief to the larger American employers who count up to 10,000 employees on their payrolls. The central bank will purchase as much as $600 billion worth of loans via its Main Street Lending Program. Treasury has already earmarked $75 billion as a backstop to the new program.

Firms that have as many as 10,000 workers, or with under $2.5 billion in annual revenues, can now gain access to these four year duration loans via the program. Banks will handle the loan origination and keep a five percent stake, selling the balance 95 percent back to the Fed. The program documentation stated that:

“Firms seeking Main Street loans must commit to make reasonable efforts to maintain payroll and retain workers.”

They are also restricted in their ability to buy their own shares back, issue dividends, and generously compensate their directors and management as part of the funding access deal. Both principal and interest on such loans may be deferred for as long as a year. The loan is not forgivable though as with the congressionally authorized and funded small business loans from the prior week's rescue package.

Congress Pushing for Municipal Liquidity Facility

The markets are hungrily awaiting the new Municipal Liquidity Facility since Congress did not give more substantial relief to the cities and states in its recent relief package legislation. Local governments utilize these markets to issue their bonds and finance themselves, but these markets are now in chaos. It has made it nigh on impossible for officials to pay for government expenses even as their sales taxes dissipated while critical needs for cash soared.

This brand new program makes it possible for the Fed to purchase as much as $500 billion in short term notes directly off of the states and counties that count minimally two million inhabitants, as well as cities whose populations are minimally a million people, per the Fed's release. The Fed explained that:

“Eligible state level issuers may use the proceeds to support additional counties and cities. We will evaluate whether additional measures are needed to support the flow of credit and liquidity to state and local governments.”

Corporate Bond Buying Programs Also Ramping Up Now

Treasury has similarly unveiled its new TALF Term Asset-Backed Securities Loan Facility. They will be insuring the Federal Reserve's two programs for buying corporate bonds as well. The programs will get backing to the tune of $85 billion from Treasury as they grow. This is desperately needed as they are now including riskier debt for the first time. Those firms who suffered downgrades to under investment grade level (after March 22nd) can now apply for help from the Fed.

The new and improved TALF program will now take debt bundles constructed from leveraged loans and commercial mortgages as acceptable collateral. The asset-backed securities still have to be highly rated. Founder Julia Coronado of MacroPolicy Perspetives cautioned that:

“It's not like the door is open to every piece of junk in the world — far from it. It looks shocking, but I think there's definitely still credit checking, and quality standards.”

Central Bank Leaves Doors Wide Open for Still More Program Expansion In Near Future

Still more shocking is that the American central bank has not closed the door to still more future expansion of the programs and acceptable collateral from struggling cash-strapped companies. The Fed's term sheet explained that:

“The feasibility of adding other asset classes to the facility or expanding the scope of existing asset classes will be considered in the future.”

Jerome Powell reiterated that the Fed is not authorized to hand out money, only to enable the lending, with:

“These are lending powers, not spending powers. The Fed is not authorized to grant money to particular beneficiaries.”

This week's news about the continuing falling apart of employment levels in the United States and the Fed's dramatic latest response to the economic carnage is troubling at best. If you needed a reminder of why gold makes sense in an IRA, you have it. IRA-approved precious metals can be a diversifying lifeline for your investment and retirement portfolios. While the stock markets have fallen as much as a third in the past two months, gold prices have set new multi-year highs as people flock to traditional safe haven assets like the yellow metal to safeguard their own portfolios. You should further review the Gold IRA Storage Options as well as the Top Gold IRA Companies before taking any action.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,727.53

Gold: $2,727.53

Silver: $33.49

Silver: $33.49

Platinum: $1,014.28

Platinum: $1,014.28

Palladium: $1,136.33

Palladium: $1,136.33

Bitcoin: $67,743.12

Bitcoin: $67,743.12

Ethereum: $2,495.34

Ethereum: $2,495.34