Strata Trust Review: A Worthwhile IRA Company in 2024?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

- Phone : 866-928-9394

- URL :

- Global Rating

- Very Good

User Rating

- 0 No reviews yet!

Self-Directed IRA Services (Horizon Bank) is one of the industry-leading custodians and account administrators for both small businesses and individual investors. Better known Horizon Bank (since 1905 in Austin, Texas) established this firm back in 2008 as their wholly-owned subsidiary. This group prides itself on its wide variety of both alternative and traditional asset class investment choices which include the full range of precious metals. They partner with a large number of the top-rated 2024 bullion dealers and gold IRA firms.

Pros:

- They are one of the few IRA custodians to charge yearly flat rate fees for both storage and account administration

- They offer choice of co-mingled storage for only $100 per year with either Brinks Global or Delaware Depository

- The firm provides clients with choice of segregated storage on a sliding scale fee

- Many of the top-rated for 2024 gold IRA firms and bullion dealers partner with them

Cons:

- The company itself is newer as it was only established in 2008, though its parent company is over 100 years old

Self Directed IRA Services (Horizon Bank) is ranked #12 on our list of the top 10 IRA custodians of 2024. In the following review, we’ll discuss this custodian’s business background, management, reputation, products/services, and their fees for a precious metals IRA.

Self Directed IRA Services (www.sdiraservices.com) is an industry-leader in custodial and administrative account services for individual investors and small businesses. The company was founded in 2008 as a wholly-owned subsidiary of the more established Horizon Bank, which was founded in 1905 and is based in Austin, Texas. As a large provider of individual retirement accounts (IRAs), they specialize in letting clients invest in a broad range of traditional and alternative investments within IRAs, including precious metals. This custodian is partnered with many of the top bullion dealers and Gold IRA companies of 2024.

Table of Contents

- About the Management

- Self Directed IRA Services Prices and Products

- Self Directed IRA Services Contact Details

- Key Pages From Self Directed IRA Services' Website

- Always Review the Competition Before You Buy

- Contact Us if You Own or Represent Self Directed IRA Services

- Why Broad Financial is Ranked #1 IRA Custodian of 2024

About the Management

Self Directed IRA Services has a management staff of more than 15 professionals in business development, client services, operations, and accounting. Their Client Relations Manager is Margaret McVan, while the company's leading precious metals IRA specialist is Susan Swanson. Not much else is listed about the management staff on their official website.

Self Directed IRA Services Prices and Products

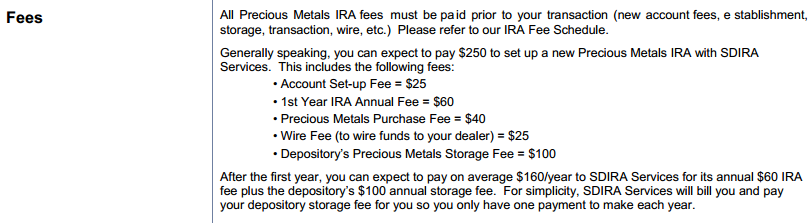

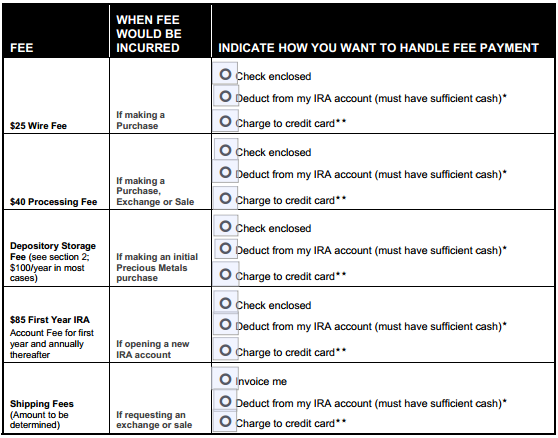

Self Directed IRA Services is one of the few IRA custodians that charges a flat-rate annual fee for both account administration and storage. Clients can sign up for commingled storage at Delaware Depository or Brinks Global for the flat-rate fee of $100 per year. However, there's also an option for segregated storage at the sliding scale rate of $1.60 per $1,000 worth of gold held in the account (so a segregated storage account with $100,000 worth of gold in it would cost $160 per year, plus the annual administration fee). See the following screenshots from their official fee schedule to learn more about their account pricing:

To learn more about Self Directed IRA Services' fees for a precious metals IRA, see their complete fee schedule.

Self Directed IRA Services Contact Details

- Address: Self Directed IRA Services, Inc., 215 Mary Avenue, Suite 311, Waco, Texas 76701

- Toll-Free Phone: 866-928-9394

- Local Phone: 512-637-5739

- Fax: 512-495-9554

- Email: info@sdiraservices.com

- Website: www.sdiraservices.com

Key Pages From Self Directed IRA Services' Website

- Gold IRA & Precious Metals Investing – Includes a guide to setting up a Gold IRA and the benefits of using Self Directed IRA Services to do so.

- IRA Resource Center – A detailed knowledgebase covering the types of IRAs, investment options, frequently asked questions and a variety of other topics related to self-directed IRAs.

- Getting Started – A quick disclaimer shown to clients before they open an account.

Always Review the Competition Before You Buy

The general consensus is that investors should be looking to allocate about 5%-20% of their overall retirement portfolio towards precious metals. This portion of your portfolio is intended to fulfill two primary purposes – its acts as a rather predicable and effective hedge against inflation (when the inflated dollar's value decreases, the value of gold typically rises,) and it provides the opportunity to boost the value of your retirement savings multiple times over in the event of another recession or depression (which could dramatically increase the demand for and price of gold).

What does all this ultimately mean? It means you should be extra careful about how you invest that seemingly small portion of your portfolio, as it could wind up becoming the most important investment you can make for your retirement in the long-term.

Fortunately, we've made it easy for anyone to conduct their own research and compare the leading Gold IRA companies and top IRA custodians. Our guides and comparison charts provide convenient resources from which to research how Gold IRAs work and which companies are the most trusted and cost-effective service providers and bullion dealers.

Contact Us if You Own or Represent Self Directed IRA Services

If you're an owner, representative, or associate of Self Directed IRA Services and you've found any of the details in this review to be erroneous, misleading, or outdated, please do contact us with your concerns. With the intent of providing the most accurate reviews on an ongoing basis, we will gladly revise or remove any content that is outdated or incorrect.

Why Broad Financial is Ranked #1 IRA Custodian of 2024

While building this year's list of the top 10 IRA custodians, we considered a total of 37 different companies before narrowing down the candidates presented in the finalized custodian comparison table. We've made it easy for anyone to conduct their own research regarding the history, features, reputations, and fees of the leading precious metals IRA custodians. Each company has been thoroughly researched and ranked based on the following factors:

- preferred/partnered depositories and storage options

- whether storage fees are included in the annual charge – some companies require you to pay storage fees in addition to annual administration/renewal fees

- setup charges and account startup cost

- fee structure – sliding scale annual feesvs. flat-rate annual fees

- company reputation and industry presence

- Phone : 866-928-9394

- URL :

- Global Rating

- Very Good

User Rating

- 0 No reviews yet!

Self-Directed IRA Services (Horizon Bank) is one of the industry-leading custodians and account administrators for both small businesses and individual investors. Better known Horizon Bank (since 1905 in Austin, Texas) established this firm back in 2008 as their wholly-owned subsidiary. This group prides itself on its wide variety of both alternative and traditional asset class investment choices which include the full range of precious metals. They partner with a large number of the top-rated 2024 bullion dealers and gold IRA firms.

Let Us Match You

Unsure about which Gold IRA company to choose? Let us match you based on your situation and objectives by taking this 1 minute quiz:

[os-widget path=”/iron-monk-solutions/find-the-right-gold-ira-for-you3″]

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,357.71

Gold: $3,357.71

Silver: $38.80

Silver: $38.80

Platinum: $1,399.81

Platinum: $1,399.81

Palladium: $1,248.19

Palladium: $1,248.19

Bitcoin: $119,780.03

Bitcoin: $119,780.03

Ethereum: $3,007.65

Ethereum: $3,007.65