Pacific Premier Trust Company Review: Is This Custodian Still Worth Your Trust?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

- Phone : 855-453-4960

- URL :

- Global Rating

- Very Good

User Rating

- 1 Reviews

Pacific Premier Trust started in December 1989 as PENSCO Trust, in 2020 the custodian joined Pacific Premier Bank and took the bank’s name. The company is headquartered in Irvine, California and has three physical locations for clients. Irvine and San Francisco California and Denver Colorado. The company currently has $17.6 billion in assets under custody and 43,903 client accounts. The trust has higher than average minimum fees, although it can cater for probably the widest variety of assets. Pacific Premier Trust states it has 40,345 unique assets in custody.

Pros:

- Over three decades of experience.

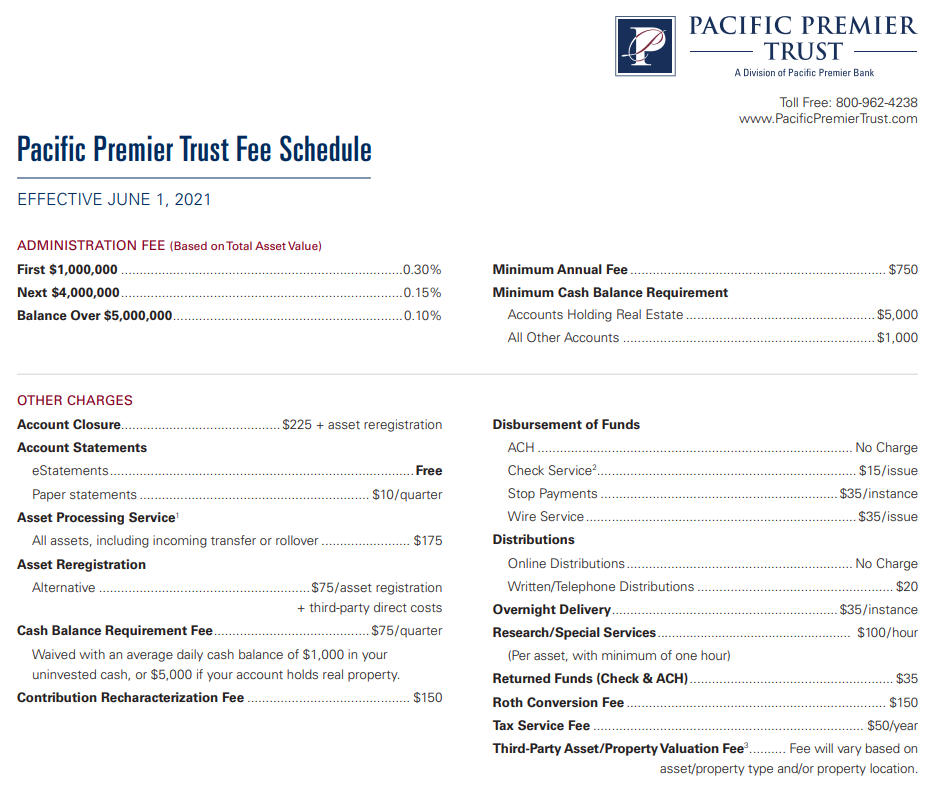

- Low fees for the largest account sizes. 0.10% on the balance of over $5,000.

- Capable of handling all types of alternative assets.

- Partners with a top-tier depository.

Cons:

- High minimum yearly fees at $750.

- Aimed mainly at institutional and high net worth investors.

Pacific Premier Trust Company started in December 1989 as PENSCO Trust. In 2020, the custodian joined Pacific Premier Bank and took the bank’s name. The company is headquartered in Irvine, California, and has three physical locations for clients located in Irvine and San Francisco, California, as well as in Denver, Colorado.

The company currently has $17.6 billion in assets under custody and 43,903 client accounts. The trust has higher than average minimum fees, although it offers perhaps the widest variety of assets in the U.S. alternative investing field. Pacific Premier Trust states it has 40,345 unique assets in custody.

Wondering whether Pacific Premier Trust Company is the right option for your retirement savings? In this Pacific Premier Trust review, we'll touch on all the key aspects of this company you need to know about before getting started.

Table of Contents

About the Management

Unfortunately, there isn't a lot of publicly available information on the top management team at Pacific Premier Trust. However, we managed to find information on the two figures mentioned on their website: COO Tamara Wendoll and Head of Sales William Eustis.

Tamara Wendoll, EVP & COO

Tamara Wendoll brings almost 25 years of experience in the investment industry. She joined Pacific Premier Trust in November 2021, after spending 9 years at Durham Trust Company as their COO.

William Eustis, Head of Sales & SVP

William Eustis joined Pacific Premier Trust in October 2020 and has over 15 years of experience in the investment industry. He was Executive Vice President at Cannon Financial Institute for 8 years, and previously at Bank of America for 6 years.

Pacific Premier's Crunchbase account lists the company as having between 51 and 100 employees and lists Tom Anderson as the company's founder. The company's LinkedIn profile notes that 113 employees have profiles associated with the company.

Pacific Premier Trust Company Prices & Products

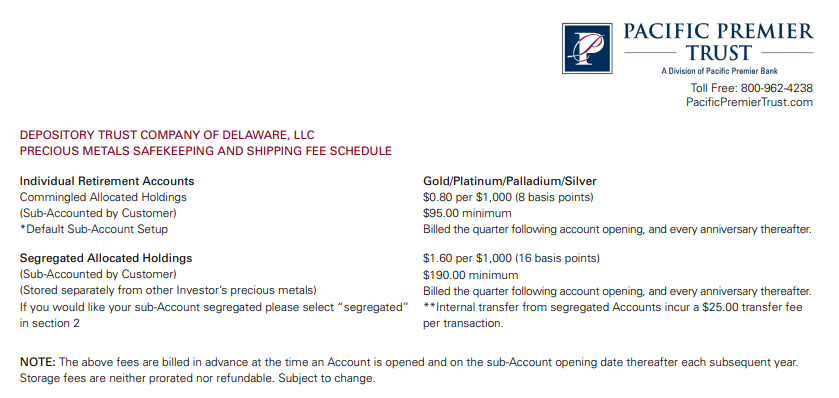

Pacific Premier Trust boasts the capability of taking hold of one of the widest varieties of assets classes available among custodians. The shortened list includes real estate, promissory notes, marketable securities, wind farms, and of course precious metals. The trust uses the services of a top-tier depository such as the Depository Trust Company of Delaware, LLC.

Storage fees are relatively low if you have large amounts of precious metals. Their quarterly fee is $0.80 per $1,000 in value of gold, silver, platinum, or palladium. They charge a minimum of $95 per quarter, which adds up to $380 per year, slightly higher than the average flat storage fee.

You also have the possibility of segregating your precious metals holding for an extra fee. In this case, your quarterly storage costs rise to $1,60 per $1,000 in value. While the minimum quarterly fee is $190. Segregation of your holdings guarantees that you will receive the exact items you purchased when you take delivery.

Commingled holdings are cheaper as the storage facility can bundle items in one place. Bullion gold bars from a specific refiner will have the same characteristics, same for mint coin items. However, some investors prefer to keep their bullion in separate specified storage areas.

Yet not all custodians offer segregation among their storage services. So, it’s a detail in their services that adds some points for Pacific Premier Trust.

Pacific Premier Trust Ratings & Complaints

- Better Business Bureau: ⭐, B- (Details)

- BBB: Customer Rating ⭐ Out of 35 Reviews

- BBB: Complaints Closed 17

- Business Consumer Alliance: N/A

- Yelp: Rating ⭐ Out of 23 Reviews

According to Forbes, Pacific Premier is one of America's top banks. In our books, this is a major boost of confidence that that the company's BBB scores leave much to be desired.

There is some positive news coming out for Pacific Premier, including new additions to the company's Board of Directors as of August 2022, including Stephanie Hsieh, a former Harlan Fiske Stone Scholar from Columbia University School of Law. The company's Q4 2022 earnings call also produced largely positive results, a sign that the company is headed in the right direction.

Pacific Premier Trust Company Contact Details

- Address: 17901 Von Karman Avenue, Suite 1200, Irvine, CA 92614

- Toll-Free Phone: 855-453-4960

- Website: https://www.pacificpremiertrust.com/

Always Review the Competition Before You Buy

The general consensus is that investors should be looking to allocate about 5%-20% of their overall retirement portfolio towards precious metals. This portion of your portfolio is intended to fulfill two primary purposes. It acts as a rather predictable and effective hedge against inflation. When the inflated dollar's value decreases, the value of gold typically rises. And it provides the opportunity to boost the value of your retirement savings multiple times over in the event of another recession or depression (which could dramatically increase the demand for and price of gold).

What does all this ultimately mean? It means you should be extra careful about how you invest that seemingly small portion of your portfolio. As it could wind up becoming the most important investment you can make for your retirement in the long-term.

Fortunately, we've made it easy for anyone to conduct their own research and compare the leading gold IRA companies and top IRA custodians. Our guides and comparison charts provide convenient resources from which to research how gold IRAs work. As well as which companies are the most trusted and cost-effective service providers and bullion dealers.

How We Rank IRA Custodians

While building this year's list of the top 10 IRA custodians, we considered numerous different companies before narrowing down the candidates presented in the finalized custodian comparison table. We've made it easy for anyone to conduct their own research regarding the history, features, reputations, and fees of the leading precious metals IRA custodians. Each company has been thoroughly researched and ranked based on the following factors:

- preferred/partnered depositories and storage options

- whether storage fees are included in the annual charge – some companies require you to pay storage fees in addition to annual administration/renewal fees

- setup charges and account startup cost

- fee structure – sliding scale annual fees vs. flat-rate annual fees

- company reputation and industry presence

Why Broad Financial Is Ranked #1 IRA Custodian of 2024

In addition to excelling in the above aspects, Broad Financial also ranked as the #1 custodian this year because of their partnership with Augusta Precious Metals, the #3 company on our list. You can check out our 2024 list of the top gold IRA companies here.

Broad Financial partners with bullion dealers, brokers, and investment firms to bring retirement investors cost-effective, streamlined access to precious metals IRAs. While you can setup an account with Equity Institutional directly as an individual, there are numerous unique benefits associated with opening your account through Augusta.

Information Kit

If you'd like to learn more about the advantages of opening a Broad Financial precious metals IRA through Augusta, see the full review of Augusta Precious Metals. Likewise, you can also access Augusta's highly informative investor's education kit.

You may have found Pacific Premier Trust a perfect match or you may still want to compare other companies before making a final decision. You can check out the reviews of other top trusts on our list of the top IRA custodians here.

- Phone : 855-453-4960

- URL :

- Global Rating

- Very Good

User Rating

- 1 Reviews

Pacific Premier Trust started in December 1989 as PENSCO Trust, in 2020 the custodian joined Pacific Premier Bank and took the bank’s name. The company is headquartered in Irvine, California and has three physical locations for clients. Irvine and San Francisco California and Denver Colorado. The company currently has $17.6 billion in assets under custody and 43,903 client accounts. The trust has higher than average minimum fees, although it can cater for probably the widest variety of assets. Pacific Premier Trust states it has 40,345 unique assets in custody.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24