Millennium Trust Company Review: An IRA Provider On The Rise?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

- Phone : 1 800-258-7878

- URL :

- Global Rating

- Very Good

User Rating

- 1 Reviews

Millennium Trust Company is a massive IRA account administrator and record-keeper with over 305,000 accounts and around $11 billion under management. They deliver a range of alternative and traditional asset investments to their varied client base of individuals, financial advisors, and institutions. The company charges a bit higher fees for this wide array of offerings at $200 for administration and storage fees. There are no sliding scale fees unless a client opts for segregated storage of their precious metals, which costs another $75.

Pros:

- They provide services to individual investors, financial advisors, and institutions alike

- With over 305,000 accounts and approximately $11 billion under management, they are large, well-established, and impressive in scope

- They offer traditional and alternative asset class investment solutions

Cons:

- Fees for both administration and metals storage are a little high at $200 for co-mingled storage and $275 for segregated storage

- Sliding scale fees apply for segregated storage accounts

Millennium Trust Company is ranked #7 on our list of the top gold IRA custodians. In the following review, we’ll discuss this custodian’s history, management, reputation, products/services, and fees.

Millennium Trust Company (www.mtrustcompany.com) is an industry-leading financial firm that specializes in providing a broad range of custodial and administrative services to individuals, institutions, and advisors. The company was established in 2000 and has since amassed a client base consisting of more than 305,000 accounts, with more than $11 billion in total assets under custody.

Table of Contents

- Millennium Trust Company Management

- Millennium Trust Company Fees & Products

- Millennium Trust Company Ratings & Complaints

- Millennium Trust Company Contact Details

- Is Millennium Trust Company Worth Your Money?

- Contact Us if You Own or Represent Millennium Trust Company

- Why Broad Financial is Ranked #1 IRA Custodian of 2024

Millennium Trust Company Management

Gary Anetsberger – CEO

Millennium Trust Company consists of more than 200 experienced professionals. The company’s chief executive officer is Gary Anetsberger. Anetsberger initially joined Millenium as the firm’s COO in 2002. He has over four decades of experience in the financial services industry. Anetsberger acquired an accounting degree from Illinois State University and financial planning certificate from DePaul University.

Millennium Trust Company Fees & Products

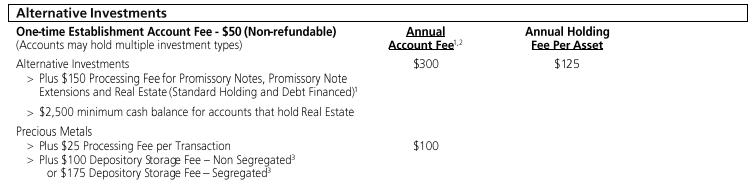

Millennium Trust Company provides clients with the opportunity to invest in a traditional and alternative investments within a variety of account types. They offer self-directed IRAs and Solo 401(k)s to individual investors, while services offered to institutions and advisors include alternative asset custody solutions, private fund custody services, automatic rollover programs, and registered investment advisor services. To gold IRA investors, their most important service is of course the self-directed IRA, which allows you to invest in precious metals within your retirement account. The screenshot below displays the section of Millennium Trust Company's fee schedule dedicated to precious metals fees:

You can see by the fee schedule above that the annual maintenance fee for holding a precious metals IRA with Millennium Trust Company is set at a flat-rate charge of $100, with a flat-rate depository storage fee of only $100 as well. Thus, the total annual cost of having a Gold IRA with MTC is $200. That fee does not change or increase with the value of your account in the way that some custodians charge sliding scale fees, unless you want segregated storage, in which case it would cost $75 more. If you'd like to see the rest of Millennium Trust Company's fee schedule, click here.

Millennium Trust Company Ratings & Complaints

- Better Business Bureau: ⭐, 1.1/5 Stars, A+ (Details)

- BBB Complaints: 137 complaints closed in the last three years (Details)

- Business Consumer Alliance: Rating “C” (Details)

- Yelp: ⭐⭐, 1.6/5 Stars (Details)

- Trustpilot: ⭐⭐⭐⭐, 4.1/5 Stars based on 23,838 user reviews (Details)

Millennium Trust Company Contact Details

- Address: 2001 Spring Road, Suite 700, Oak Brook, IL 60523

- Phone: 800-258-7878

- Email: info@mtrustcompany.com

- Website: www.mtrustcompany.com

Is Millennium Trust Company Worth Your Money?

The short answer is that, yes, they could be. While they are a reputable, longstanding company, it also has its fair share of customer complaints posted online, especially via the Better Business Bureau and Business Consume Alliance.

Choosing a custodian to administer your precious IRA is not a decision that should be overlooked or underestimated in importance. Although many financial advisors only recommend allocating between 5 to 15% of one's retirement portfolio towards precious metals, this seemingly small portion of your portfolio could wind up being the most pivotal investment you could make.

With inflation an ever-present concern, there's a good chance that gold and other precious metals will continue to increase in demand and in price. As other forms of currency are gradually devalued, prudent investors are becoming increasingly interested in protecting their wealth with gold, driving the demand up, and therefore the price as well.

This essentially means that the longer you wait to invest in gold, the more likely it is that you'll have to pay a higher price per ounce. It also means that converting some of your cash holdings to gold is the best way to protect against inflation and the possibility of currency debasement.

With this investment being of such critical importance, we strongly suggest that you consider all options before making a commitment. You might want to start by comparing the top Gold IRA companies, and learning more about the top precious metals IRA custodians.

Contact Us if You Own or Represent Millennium Trust Company

If you're an owner, representative, or associate of Millennium Trust Company and you've noticed any information within this review that us outdated or inaccurate, please do bring your concerns to our attention. We will gladly revise or remove any content that is not in line with our goal of providing the most accurate and useful company reviews.

Why Broad Financial is Ranked #1 IRA Custodian of 2024

While building this year's list of the top 10 IRA custodians, we considered numerous different companies before narrowing down the candidates presented in the finalized custodian comparison table. We've made it easy for anyone to conduct their own research regarding the history, features, reputations, and fees of the leading precious metals IRA custodians. Each company has been thoroughly researched and ranked based on the following factors:

- preferred/partnered depositories and storage options

- whether storage fees are included in the annual charge – some companies require you to pay storage fees in addition to annual administration/renewal fees

- setup charges and account startup cost

- fee structure – sliding scale annual feesvs. flat-rate annual fees

- company reputation and industry presence

In addition to excelling in the above aspects, Broad Financial also ranked as the #1 custodian this year because their accounts are compatible with Augusta Precious Metals, one of the top-ranked companies on 2024's list of the top Gold IRA companies. Broad Financial partners with bullion dealers, brokers, and investment firms to bring retirement investors cost-effective, streamlined access to precious metals IRAs. While it is possible to set up an account with Broad Financial directly as an individual, numerous benefits are unique to opening your account through Augusta.

If you'd like to learn more about the advantages of opening a Broad Financial precious metals IRA through Augusta, see the full review of Augusta Precious Metals. You can also access Augusta's highly informative investor's education kit that teaches you everything you need to know about investing in a gold IRA by filling out the simple form below. Even if you don't plan on investing any funds right now, we strongly recommend you consider the content presented in their FREE information kit before making an investment decision in the precious metals industry.

- Phone : 1 800-258-7878

- URL :

- Global Rating

- Very Good

User Rating

- 1 Reviews

Millennium Trust Company is a massive IRA account administrator and record-keeper with over 305,000 accounts and around $11 billion under management. They deliver a range of alternative and traditional asset investments to their varied client base of individuals, financial advisors, and institutions. The company charges a bit higher fees for this wide array of offerings at $200 for administration and storage fees. There are no sliding scale fees unless a client opts for segregated storage of their precious metals, which costs another $75.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $5,130.29

Gold: $5,130.29

Silver: $85.89

Silver: $85.89

Platinum: $2,186.37

Platinum: $2,186.37

Palladium: $1,684.78

Palladium: $1,684.78

Bitcoin: $68,492.98

Bitcoin: $68,492.98

Ethereum: $1,992.75

Ethereum: $1,992.75