Kingdom Trust Company Review: Your Next IRA Custodian?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

- Phone : 1 270-226-1000

- URL :

- Global Rating

- Very Good

User Rating

- 2 Reviews

Kingdom Trust Company offers its clientele a wide range of alternative asset investments in such options as precious metals, private companies, real estate, promissory notes, and other kinds through their MyRA Accounts. The company was founded in 2008, making it a relative newcomer to the self-directed IRA management field. It must be noted that this company currently has a B rating on BBB - typically, most IRA custodians reviewed have at least an "A" rating with Better Business Bureau.

Pros:

- Their MyRA account was groundbreaking when they started offering it in 2009

- In 2017, Kingdom Trust was the first company to offer custody of Bitcoin

- The firm offers a huge selection of alternative asset investments such as precious metals, private companies, real estate, and promissory notes, among other options

- The annual administration fee of $75 per year is relatively low for the industry

Cons:

- They charge a $40 per transaction fee

- Sliding scale fees apply for precious metals storage and start at $100 annually

Editor's Note: Kingdom Trust Company is ranked #8 on our list of the top gold IRA custodians for 2024.

Kingdom Trust Company, recently rebranded as “Choice by Kingdom Trust” (www.kingdomtrustco.com), is a leading IRA custodian that specializes in helping clients invest in precious metals, real estate, private companies, promissory notes, and other types of alternative assets within Individual Retirement Accounts. The company was originally founded in 2008, has had an open file with the BBB since 2012, and is based in Murray, Kentucky.

In 2017, Kingdom Trust Company became the first custodian to offer Bitcoin as an alternative asset for custody in a self-directed IRA. In 2020, the company launched Choice, a rebranded version of itself. Presently, under the Choice umbrella, Kingdom Trust Company has 20,000 assets under custody, 125,000 accounts, and $18 billion in assets under custody.

Table of Contents

- Kingdom Trust Company Management

- Kingdom Trust Company Prices and Products

- Kingdom Trust Company Ratings & Complaints

- Kingdom Trust Company Contact Details

- Always Review the Competition Before You Buy

- Contact Us if You Own or Represent Kingdom Trust Company

- Why Broad Financial is Ranked #1 IRA Custodian of 2024

Kingdom Trust Company Management

Kingdom Trust Company was founded by Matt Jennings in 2009. Jennings currently serves as the Executive Chairman and co-founder of Choice by KT. Kingdom Trust provides custodial services for cryptocurrencies in retirement accounts via the Choice app. He has an extensive background in the buying and selling of real estate investments, in addition to being a serial entrepreneur.

Kingdom Trust Company Prices and Products

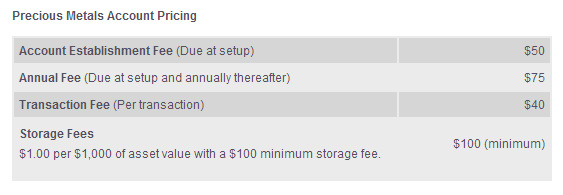

Kingdom Trust Company specializes in providing self-directed IRA services and institutional custody services to individual investors and advisors. In addition to letting clients invest in precious metals within retirement accounts, Kingdom Trust Company's MyRA account (which they've been offering since 2009) also gives investors the opportunity to invest in a diverse range of other alternative investments. Below is a screenshot of the section of Kingdom Trust Company's fee schedule dedicated to precious metals:

Kingdom Trust Company Ratings & Complaints

Let's take a look at what some of the top consumer ratings agencies have to say about Kingdom Trust.

- Better Business Bureau: ⭐⭐, B (Details)

- BBB: 61 complaints closed in last 3 years (Details)

- Business Consumer Alliance: Rating D (Details)

- Facebook: 1,380+ Likes

Kingdom Trust Company Contact Details

- Address: 1105 State Route 121 Bypass North Suite B, Murray, KY42071

- Phone: (270) 226-1000

- Fax: (270) 226-1001

- Email: help@kingdomtrustco.com

- Website: www.kingdomtrustco.com

Always Review the Competition Before You Buy

Any investment that could influence your wealth during retirement should be carefully researched and considered before any commitments are made, This is especially true in the case of opening a precious metals IRA, as this particular investment could wind up playing the most crucial role in protecting the value of your savings and investments in the time leading up to and during your retirement.

Most financial experts advise their clients to allocate at least 5% – 20% of their retirement portfolio to precious metals investments, in order to protect against the effects of inflation and the dangers of currency debasement. Even if you were to take an optimistic stance and assume that the dollar is not going to crash, inflation alone will at the very least decrease the dollar's value.

So at best, even if there is no economic collapse or crisis, there's a high probability that, at the time of your retirement, the dollars in your 401k will be worth less than they are now. By rolling over a portion of your retirement savings into physical precious metals, you can effectively hedge against the devaluing effects of inflation; precious metals appreciate in value as inflation worsens.

Now that we've explained exactly why a precious metal IRA is such a critical component in a well-diversified retirement portfolio, it's easier to see why advisors strongly urge clients to do their research before opening or funding an account. Fortunately, we've made it easy for anyone to quickly research and compare the top Gold IRA companies and the top precious metals IRA custodians.

Contact Us if You Own or Represent Kingdom Trust Company

If you're an owner, associate, or representative of Kingdom Trust Company and you've found any of the information within this review to be false, outdated, or misleading, please do bring your concerns to our attention. We strive to provide the most accurate and helpful reviews and guides on an ongoing basis, and will therefore revise or remove any content that is found to be nonfactual.

Why Broad Financial is Ranked #1 IRA Custodian of 2024

While building this year's list of the top 10 IRA custodians, we considered numerous different companies before narrowing down the candidates presented in the finalized custodian comparison table. We've made it easy for anyone to conduct their own research regarding the history, features, reputations, and fees of the leading precious metals IRA custodians. Each company has been thoroughly researched and ranked based on the following factors:

- preferred/partnered depositories and storage options

- whether storage fees are included in the annual charge – some companies require you to pay storage fees in addition to annual administration/renewal fees

- setup charges and account startup cost

- fee structure – sliding scale annual feesvs. flat-rate annual fees

- company reputation and industry presence

In addition to excelling in the above aspects, Broad Financial also ranked as the #1 custodian this year because of their compatibility with Augusta Precious Metals, one of our top-ranked companies on 2024's list of the top Gold IRA companies. Broad Financial partners with bullion dealers, brokers, and investment firms, like Augusta Precious Metals, to bring retirement investors cost-effective, streamlined access to precious metals IRAs. Check out our exclusive Augusta Review to get a free IRA sign-up kit and info package.

- Phone : 1 270-226-1000

- URL :

- Global Rating

- Very Good

User Rating

- 2 Reviews

Kingdom Trust Company offers its clientele a wide range of alternative asset investments in such options as precious metals, private companies, real estate, promissory notes, and other kinds through their MyRA Accounts. The company was founded in 2008, making it a relative newcomer to the self-directed IRA management field. It must be noted that this company currently has a B rating on BBB - typically, most IRA custodians reviewed have at least an "A" rating with Better Business Bureau.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,347.59

Gold: $3,347.59

Silver: $38.15

Silver: $38.15

Platinum: $1,411.19

Platinum: $1,411.19

Palladium: $1,235.08

Palladium: $1,235.08

Bitcoin: $119,780.03

Bitcoin: $119,780.03

Ethereum: $3,007.65

Ethereum: $3,007.65