Crypto Roth IRA vs. Traditional Roth IRA (2021 Guide)

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 16th September 2021, 06:10 pm

Crypto Roth IRAs and traditional Roth IRAs are both types of Individual Retirement Accounts. As with anything, there are pros and cons to each account type. Depending on your specific situation, temperament, and objectives, one will most likely be better positioned to meet your investing goals than the other.

It all comes down to providing the best investment class for you. We’ll review the two types of Roth IRA and break down their characteristics, and the difference between them. At Gold IRA Guide, we’re here to help you decide which is right for you and we’ve provided the low-down to do so.

Table of Contents

Differences Between Crypto Roth IRA and Traditional Roth IRA

Traditional Roth IRA

Introduced in 1997, the Roth IRA is the opposite of the traditional IRA. A Roth IRA is a special individual retirement account in which the money going into the account is taxed and the future withdrawals are all tax-free. As such, it is an account that holds the chosen investments with after tax money.

(Note: A regular, traditional IRA functions in the opposite way of a Roth IRA. It taxes the money once you pull it from your account upon retirement – not when you place the money originally.)

You have a variety of typical investment options within a Roth IRA or a traditional IRA. The most common include stocks, bonds, mutual funds, annuities, unit invest trust (UITs), exchange traded funds (ETFS).

Crypto Roth IRA

On the other hand, a crypto Roth IRA or bitcoin IRA refers to a self-directed individual retirement account that invests in only cryptocurrencies or a combination of cryptocurrencies and traditional assets.

Most common crypto IRAs include investments into alternative asset classes that are not included in traditional or Roth IRAS. This includes real estate, precious metals and, of course, cryptocurrency. For top bitcoin IRA companies to invest in, here is a list of some of the top bitcoin ethereum IRA companies.

It’s a well-known fact that cryptocurrency can be volatile. Nonetheless, they present considerable upside potential for generating long-term returns. The good news is that investors can avoid capital gains taxes on these returns when they buy bitcoin with the help of a self-directed IRA. Let’s talk taxes!

Tax Benefits of Crypto Roth IRA vs. Traditional IRA

Since the IRS allows tax deferments on IRAs, investors can use a crypto Roth IRA to their advantage. Any crypto asset that savers don’t sell until retirement, carries the benefit that it may incur zero capital gains tax. Even contributions of crypto to a traditional IRA are tax-deductible for savers who fall below the given income threshold established by the IRS.

Therefore, investors who wait until retirement age will be able to cash out the IRA, by paying the regular income taxes on only the withdrawals. The best part is that in a crypto Roth IRA, investors do not have to pay capital gains taxes even on the increase in the value of the crypto, which may be substantial over a long period. But the difference is that in a crypto Roth IRA, one may not be able to deduct the deposit from the income for tax purposes.

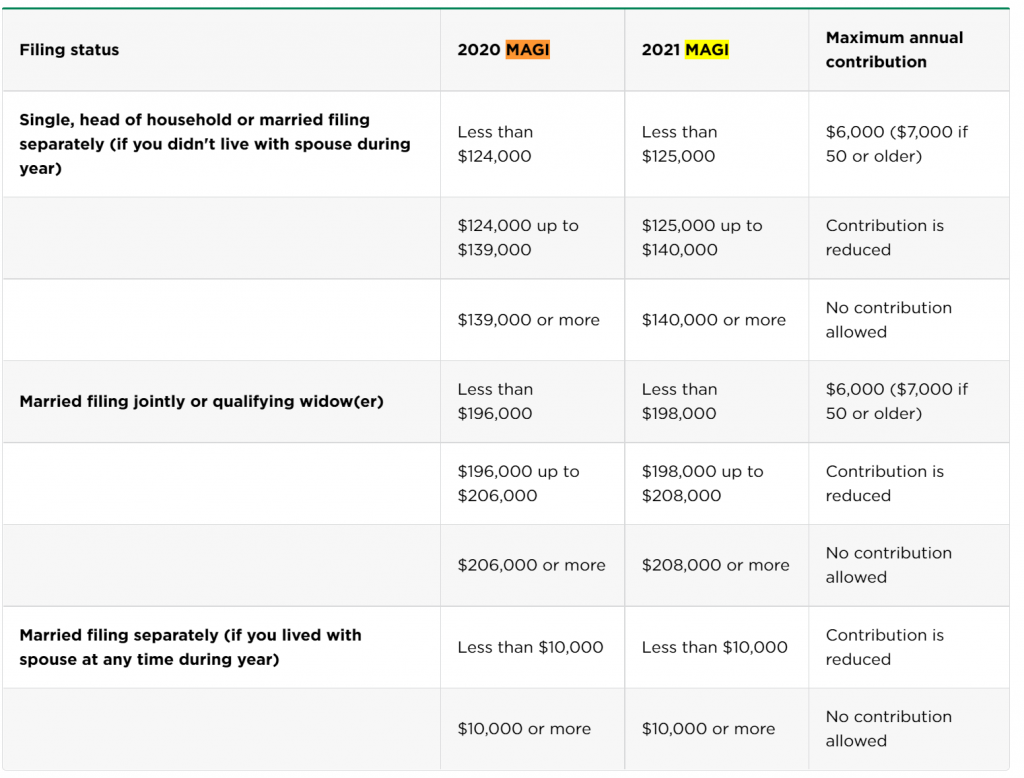

For Roth IRAs, the withdrawals made after retirement will incur no taxes. It’s no wonder then that Roth IRAs are a popular investment option. However, there are Roth IRA contribution limits as well as eligibility requirements. For instance, savers whose income is above a certain threshold cannot contribute to a Roth IRA.

In fact, in 2021, the rule for married couples who file their taxes jointly, and make more than $198,000, is that the amount that can be contributed to a Roth IRA is lower than that for the average individual. And those couples whose income amounts to equal to or greater than $208,000 cannot even contribute to a Roth IRA.

Refer to the chart below (Fig. 1) for a full list of the most recent IRS cryptocurrency IRA contribution limits by modified adjusted gross income (MAGI).

Figure 2. Source: NerdWallet

Roth IRAs do not offer investors any upfront tax deduction. A tax break is given later, at the time of withdrawal. Moreover, a Roth IRA is not subject to the rule of minimum distributions during the lifetime of an investor. It means that if the investors do not need the money in the Roth over the course of their life, they can leave it to their heirs or whoever they intend to bequeath it to.

Who Should Opt for Crypto Roth vs. Roth IRA?

Individuals with a higher risk tolerance may consider the crypto Roth IRA investment option more seriously. If the ebb and flow of your Cardano Crypto keeps you up at night then a more traditional IRA might be for you. You should think about answering these questions before you opt to invest in Bitcoin or any cryptocurrency.

Of course holding onto the investment for the long term is a good idea to gain good returns in both cases. HODL – which means Hold On for Dear Life, or simply “hold” in the long-term – is a wise attitude to have for cryptocurrencies. Those who sell on an impulse, when the cryptocurrency falls or rises in great proportions may be unable to benefit from its long term benefits or returns.

Custodian for Crypto vs. Traditional IRA

A custodian is needed for an IRA. In case of brokerage IRAs or IRAs with traditional assets, the custodian can be a large financial institution or a bank. On the other hand, for a crypto Roth IRA, investors need to find a self-directed IRA provider who can provide this service. As can be seen, the method of investing in a traditional vs. crypto Roth IRA is different too.

With any Roth IRAs – both crypto and traditional – withdrawals made after retirement will incur no taxes. All in all the key differences between a crypto Roth IRA and a traditional Roth IRA described above make one a better fit for you.

Be sure to consider the distinctions and diversification above before you make an investment. It may even help to consult your accountant or financial advisor to decide which is the best fit for you.

Regardless of which investment class you choose to invest in, a Roth IRA a great option for individuals who expect to be in a higher income bracket when they retire than the one they are in now.

Above all, start investing today – the sooner the better!

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,652.87

Gold: $3,652.87

Silver: $41.70

Silver: $41.70

Platinum: $1,386.02

Platinum: $1,386.02

Palladium: $1,166.10

Palladium: $1,166.10

Bitcoin: $117,117.70

Bitcoin: $117,117.70

Ethereum: $4,574.22

Ethereum: $4,574.22