Cheap Oil Stocks Under $5: Best Oil Stocks to Buy 2022

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 27th August 2024, 09:34 pm

Oil and gas companies have had a high-performing run over the past year as crude oil and gas prices have risen sharply. But which are the cheap oil stocks under $5 that may have the potential to continue their rally?

Adding oil stocks to an equity portfolio can be an effective way of diversifying among the typical sectors such as technology, retail, and finance. Other sectors investors are beginning to look at closely include:

- Lithium stocks: Thanks to the wide use in renewable energy production

- Silver stocks: This safe haven asset is attracting attention for its industrial use

- Nickel stocks: Again, this metal is being used more and more from electricals to renewable energy

We’ll have a look at the best cheap oil stocks under $5 to buy in 2022 and 2023. In the process, we’ll consider each company’s stock profile, technical view, and fundamental analysis. In the conclusion, we'll evaluate the forward view of the energy industry as a whole.

The oil industry has long been a lucrative investment opportunity, but in recent years the market has become increasingly volatile. While some oil stocks have soared to incredible heights, others have fallen to rock-bottom prices. In this article, we will be focusing on the latter group and highlighting five top oil stocks that are currently trading for under $5 per share.

- Crescent Point Energy Corp.

- W&T Offshore Inc.

- Vaalco Energy Inc.

- PHX minerals Inc.

- Southwestern Energy Company

All five of these companies are major players in the oil industry, with a strong track record of success and a proven ability to weather market downturns. While they may be trading at a lower price point currently, these stocks have the potential to deliver impressive returns for investors who are willing to take a chance on them.

As with any investment, it is important to thoroughly research and carefully consider the risks before making any decisions. However, for those who are looking for an opportunity to invest in the oil industry at a discounted price, these five stocks are worth taking a closer look at.

Table of Contents

Cheap Oil Stocks Under $5

Let’s take a closer look at the companies we mentioned above and get to know them a bit better, as well as evaluate their most recent performance.

1. Crescent Point Energy (NYSE: CPG)

- Market Capitalization: $3.8 billion

- Average Volume: 11.6 million shares

- Forward Annual Dividend Yield: 4.48%

- Profit Trend: 2 years of increasing gross profit

Crescent Point Energy was founded in 1994 and is a Canadian crude oil and natural gas exploration and production company. CPG has operations in Saskatchewan, Alberta, British Columbia, Manitoba in Canada, and North Dakota and Montana in the United States.

The company has a diverse portfolio of high-quality assets, including a significant position in the Bakken and Three Forks formations in the Williston Basin. Crescent Point is committed to maximizing value for shareholders through a disciplined approach to capital allocation and a focus on operational excellence.

Crescent Point Energy Technical View

CPG stock price has had a bumpy ride this year, where it rallied for the first six months from $5.67 to a year high of $10.73 which is equal to an 89 percent increase. However, it fell just as quickly and struggled to gain traction again.

At the time of writing CPG was trading at $6.84 and was below both the 50-day and 200-day moving averages. Some signs a bullish momentum may be picking up again can only be seen if the price manages to trade above its 200-day moving average again. YTD this stock is up 21.28 percent.

2. W&T Offshore (NYSE: WTI)

- Market Capitalization: $ 837 million

- Average Volume: 3.4 million shares

- Forward Annual Dividend Yield: Not Available

- Profit Trend: 3 years of increasing gross profit

W&T Offshore started operations in 1983 and is a Houston-based independent oil and natural gas company with operations in the Gulf of Mexico. The company has a diverse portfolio of assets, including production, development, and exploration properties, as well as offshore facilities.

W&T Offshore is focused on maximizing value through a combination of organic growth and strategic acquisitions. The company currently has a large acreage of oil fields on and off land, which include 606,000 acres of fields under lease.

W&T Offshore Technical View

WTI reached a YTD high in November 2022 at $8.99 from which it retraced to current levels of $5.85. However, the stock is still up 61.16 percent YTD and the 50-day moving average is well above the 200-day moving average.

Price action dipped below the 200-day moving average on two occasions over the course of 2022. However, it looks like this third dip below that indicator may have terminated already. A clear break above the 200-day moving average should indicate renewed bullish momentum.

3. Vaalco Energy (NYSE: EGY)

- Market Capitalization: $ 462 million

- Average Volume: 2.4 million shares

- Forward Annual Dividend Yield: 2.99%

- Profit Trend: 3 years of increasing gross profit

Vaalco Energy is an independent energy company engaged in the exploration, development, and production of oil and natural gas. The company's operations are focused on West Africa and the United States, with a particular emphasis on the offshore areas of Gabon.

Vaalco is committed to maximizing value for shareholders through a focus on operational excellence and disciplined capital allocation. The company is based in Houston, Texas, and was incorporated in 1985.

Vaalco Energy Technical View

EGY stock looks like it is in a bear trend at the moment, although the stock is still up 28.7 percent YTD. From its high of $8.60, the stock plunged to a recent low of $3.93, for a drop of 54.3 percent. More worrying is that the current share price is well below its major moving averages.

EGY's share price attempted to break above the 200-day moving average in October 2022 and failed. It then continued to fall and is now also below the 50-day moving average. Overall, this stock doesn’t look very attractive from a technical viewpoint.

4. PHX Minerals (NYSE: PHX)

- Market Capitalization: $ 131 million

- Average Volume: 182 thousand shares

- Forward Annual Dividend Yield: 2.28%

- Profit Trend: years of increasing gross profit

PHX Minerals is a Houston-based exploration and production company focused on acquiring and developing oil and gas properties in the United States. The company's strategy is to build a portfolio of high-quality, low-risk assets through a combination of acquisitions and drilling programs.

PHX Minerals is committed to creating value for shareholders by leveraging its technical expertise and industry relationships. Its main properties are located in Texas, North Dakota, Louisiana, and Oklahoma. The company was founded in 1926 as Panhandle Oil and Gas and changed its name in 2020 to PHX Minerals.

4. PHX Minerals Technical View

PHX stock price has experienced bullish momentum since the start of 2022. The stock is up 59 percent YTD and reached a recent high in June of $4.73. The stock then lost a lot of ground reaching a temporary low of $2.67.

However, PHX stock managed to recover from that dip below the 200-day moving average. It then dipped again below the 200-day moving average and continued to climb. While it seems to have thwarted the third attempt to break below the 200-day moving. If the price remains above it then we would expect further gains.

5. Southwestern Energy Company (NYSE: SWN)

- Market Capitalization: $ 6.86 billion

- Average Volume: 28.5 million shares

- Forward Annual Dividend Yield: Not Available

- Profit Trend: 3 years of increasing gross profit

Southwestern Energy Company is a leading independent exploration and production company with operations in the United States. The company is focused on creating value through its exploration and development of unconventional natural gas and oil resources, as well as through its acquisition and exploitation of existing producing properties.

The company has proved natural gas, oil, and NGL reserves of 21,148 billion cubic feet of natural gas equivalent. Southwestern Energy is committed to maximizing value for shareholders through a focus on operational excellence and a disciplined approach to capital allocation. SWN was incorporated in 1929 and is headquartered in Spring, Texas.

Southwestern Energy Company Technical View

Year to date this stock is still up by 32.2 percent despite its recent fall over the past month where it has lost 12.2 percent. The stock hit a recent high in June 2022 of $9.64 but has continued to fall since.

At the time of writing the stock was quoting at $6.20 and was below the 50-day and 200-day moving averages. SWN price has also broken and drifted well below the support line created by two previous dips. For this stock to show a reversal of the current bear trend you would need to see a break above that line and above the 200-day moving average.

Oil Industry Sector Evaluation

The first to assess when evaluating a sector for a specific product is understanding the demand. Despite all the ESG and renewable energy propaganda, fossil fuel consumption has been on the rise. Not just in the United States but also throughout the world.

While it may be necessary to protect the planet from increasing Co2 emissions it doesn’t seem in my opinion that renewable energy is reliable enough to take care of our society and its needs. That might explain why fossil fuel demand continues to rise.

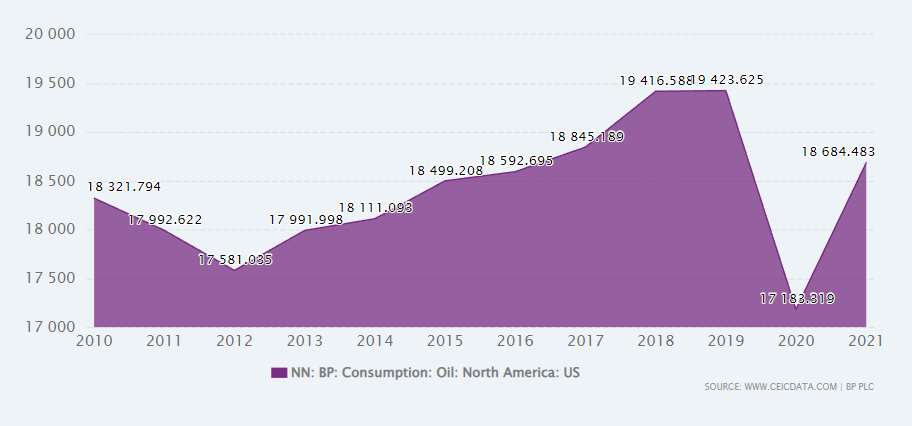

The chart below shows the steady progression upwards of crude oil consumption in North America from 1965. And apart from a large dip thanks only to the draconian mandates enforced all over the western world, we have a steady rising trend.

It would seem that for the time being, our reliance on fossil fuels is here to stay. And on a global basis with the continued economic expansion of China and India, you might imagine that demand will increase.

In my opinion, the future of fossil fuels is practically guaranteed, and with companies like Exxon (XOM) achieving high ESG rankings they won’t be short of investors either. So, the matter remains more in corporate affairs, and how a company can turn its business into a profitable one for its shareholders.

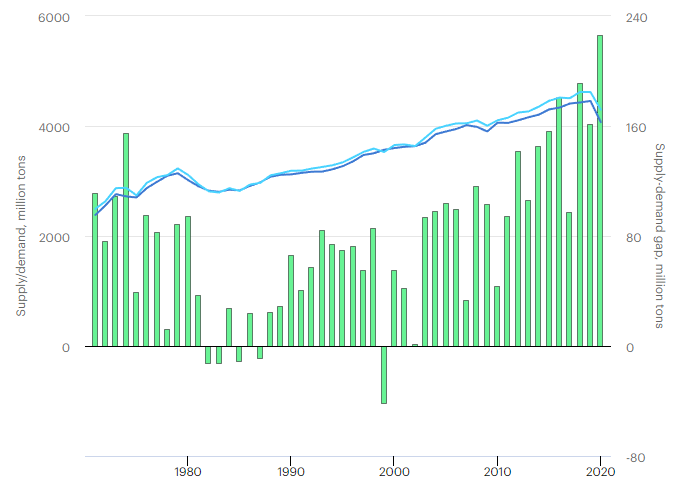

While on the supply side as in most self-regulated markets, supply usually marginally exceeds supply. It’s true that OPEC+ meet regularly to determine their unified output, but in the end, they are motivated to maximize their profits and maintain supply at steady rates.

The chart below from the IEA shows how world demand and supply for crude oil have been growing steadily since 1971. We can also see in the histogram the net difference in supply less demand throughout those years.

Bottom Line

If you are looking at oil stocks as a way to diversify your stock holdings you may want to consider other assets to diversify your portfolio as a whole. Precious metals are effective in protecting your portfolio from the adverse effects of inflation and market crises among other qualities. You can read all about precious metals investing in our comprehensive guide here.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $4,088.87

Gold: $4,088.87

Silver: $48.43

Silver: $48.43

Platinum: $1,576.08

Platinum: $1,576.08

Palladium: $1,487.67

Palladium: $1,487.67

Bitcoin: $108,889.33

Bitcoin: $108,889.33

Ethereum: $3,843.63

Ethereum: $3,843.63