Business Activity Rapidly Collapsing in Europe and China

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

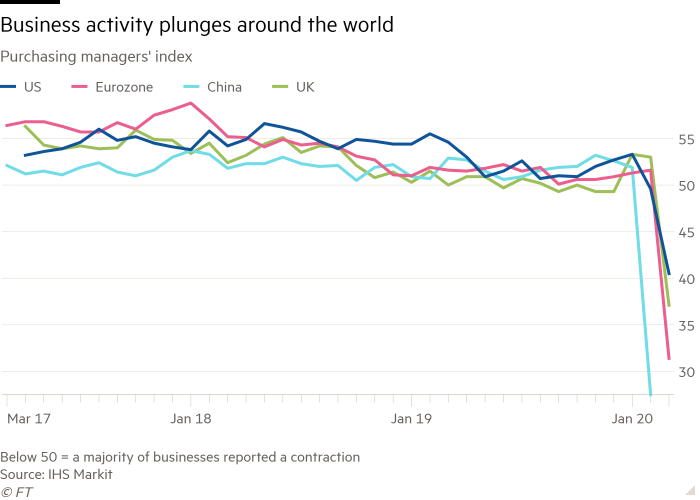

Data this week revealed that business activity for March in the euro zone economy experienced an “unprecedented collapse” with the intensification of the coronavirus. The abysmal PMI provisional Purchasing Manager's Index survey data was released by IHS Markit on Tuesday. It revealed that the euro zone composite PMI crashed from February's 51.6 level to 31.4 for March. This survey accounts for both the crucial manufacturing and services sectors of business activity in all 19 member states of the euro zone.

Eurozone Suffers Largest Fall in Business Activity Ever Recorded

What made the data all the more discouraging was that it represented the biggest ever monthly decline in business activity dating back to the beginning of the data collection of July in 1998. Previously, the index low of 36.2 had been recorded back in February of 2009 during the Global Financial Crisis. Tuesday's dismal reading came in significantly lower than all of the forecasts from the Reuters poll that had anticipated a median level of 38.8. Under 50 in this index represents contraction for the overall economy.

IHS Markit noted that the euro zone's area growth had modestly improved during January and February of the year. Yet March witnessed the massive and extensive business disruptions because of the stringent policies to try to contain the coronavirus outbreak from spreading further. Continuously stricter measures throughout the continent meant that cafes, restaurants, and hotels were all closed as the travel and tourism sector suffered especially badly.

The service sector activity in the survey dropped more than 24 points from February's 52.6 down to 28.4 for March, as the chart below shows:

This beat the prior lowest level of 39.2 seen back in February of 2009. Chief Business Economist Chris Williamson of IHS Markit stated in this most recent report that:

“Business activity across the euro zone collapsed in March to an extent far exceeding that seen even at the height of the Global Financial Crisis. Steep downturns were seen in France, Germany, and across the rest of the euro area as governments took increasingly tough measures to contain the spread of the coronavirus. Clearly there's scope for the downturn to intensify further.”

Williamson added that this PMI result for March is expressive of the GDP gross domestic product for the euro zone declining over the quarter at approximately two percent. According to other analysts, the data does not provide much encouragement for the coming months. Senior Europe Economist Jack Allen-Reynolds of Capital Economics noted Tuesday that:

“March's slump in the euro zone Composite PMI is so sharp that at any other time it would look like a spreadsheet error. But now it is all too believable, and April's data could be even worse.”

The reason is that the responses from the survey were obtained from March 12th through 23rd. Many of the lockdown policies had not yet been implemented at that point. Reynolds noted this would likely make the April data substantially worse.

German Business Sentiment Plunges Most Since the Great Recession

Indeed even more recent data from Germany confirmed fears of the data continuing to worsen. The business sentiment (morale) for Germany registered its most precipitous decline since the country was reunified back in 1990. This data came from the closely followed IFO Institute for Economic Research on Wednesday. The institute warned that the German Ifo business climate index plunged from February's 96 down to 86.1 for March. Expectations had been for a slightly better 87.7. This level had not been seen since July of 2009. The IFO institute tweeted that:

“The German economy is in shock.”

Tuesday night the finance ministers from the euro zone met over a video conference. They were urgently talking over potential coordinated fiscal policy responses to the expanding economic crisis. Allen-Reynolds explained that:

“They might not agree to anything concrete today, but any progress would be helpful. Even if they do reach an agreement, it will do nothing to shore up aggregate demand while much of the economy is on lockdown. But it could help the economy to recover once those restrictions are eventually relaxed.”

Markets across Europe are all significantly in bear market territory as they had feared a dramatic slowdown in business output and activity.

Survey Shows Chinese Economy Could Drop 10 Percent in Q1

Another worrying development came from China this week. The first examination of Chinese business conditions for March did not reveal a hoped for economic recovery in the Asian economy, per the China Beige Book. This company runs an independent survey of over 3,300 Chinese companies each quarter. Their first results for Q1 have dropped to the lowest amount in 10 years of tracking data on the economy of China, per the early brief that came out Tuesday. The report stated that:

“Crucially the results continued to deteriorate into mid March when most firms were re-opening and supposedly back to work. Nationally, our revenue index plunged to -26 this quarter while profits dove in tandem, to -22.”

The government's official statistics from the past two weeks show that the biggest firms and important businesses started work again at rates ranging from 80 percent to 90 percent. Yet small to medium sized firms are only working again at a rate over 60 percent. These smaller companies deliver most of the jobs and growth in the economy. Managing Director Shehzad Qazi of the China Beige Book stated that:

“Output contracted (in March) even more than it had in February, employee work weeks shrank further, and hiring continued to decline despite labor supply shortages worsening. The larger takeaway is clearly that return to work has not meant return to growth for China (at least not as yet).”

Analysts and economists had anticipated that growth would return to China for March in the wake of easing restrictions on the locked down areas of the country.

Weakness of Chinese First Quarter May Continue

More sobering news from the China Beige Book was their assessment that it is “not unreasonable” for GDP gross domestic product to plunge in this first quarter of 2020 by from 10 percent to 11 percent. This is despite a minor improvement over the past several weeks of March. Just last week, the National Bureau of Statistics unveiled data for the first two months revealing severe drops of a few important indicators like retail sales and fixed asset investment.

Meanwhile the cities unemployment rate (doubted by a number of analysts) showed an increase for February to 6.2 percent. This was higher than the range it had maintained for at least two decades. Other workers could not return to their jobs (either because they were unwilling or not able). The survey demonstrated that unskilled and skilled laborer availability for the first quarter plunged.

It is not a surprise that a number of economists slashed their growth forecasts for China for 2020 after the past week's announced weak growth. The most recent firm to do so Monday was CICC China International Capital Corporation of Beijing. They cut their real GDP growth prognosis from the prior 6.1 percent down to 2.6 percent. According to the China Beige Book:

“The China recovery story is no longer just about domestic resilience, but also factors beyond Beijing's control. Admitting unprecedented Q1 figures is more sensitive because China may also have to admit to poor Q2 numbers on global weakness. Investors may therefore be severely overestimating the extent of China's recovery and hence the extent to which China can cushion a global downturn.”

Unfortunately the news from Europe and China regarding plunging economic and business output is far from good. This is the latest reason for why gold makes sense in an IRA. You can diversify your retirement portfolio away from volatile stocks by acquiring IRA-approved precious metals. It is a good idea to read more about Gold IRA allocation strategies and the top Gold IRA companies.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,727.53

Gold: $2,727.53

Silver: $33.49

Silver: $33.49

Platinum: $1,014.28

Platinum: $1,014.28

Palladium: $1,136.33

Palladium: $1,136.33

Bitcoin: $67,743.12

Bitcoin: $67,743.12

Ethereum: $2,495.34

Ethereum: $2,495.34