Ban On Evictions Set to Expire End of March

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 20th April 2021, 10:22 pm

This past week saw warnings sounded regarding a wave of evictions set to begin starting the first week of April. The eviction ban is set to expire at the end of March if President Joe Biden does not extend it. Rental assistance help is on the way to those who are in danger of being forced out, but it will not arrive in time to keep landlords from putting their tenants out on the street. With a crisis moment fast approaching some states are taking matters into their own hands and establishing protocols for how the situation should be handled.

Massive Wave of Evictions Only Days Away

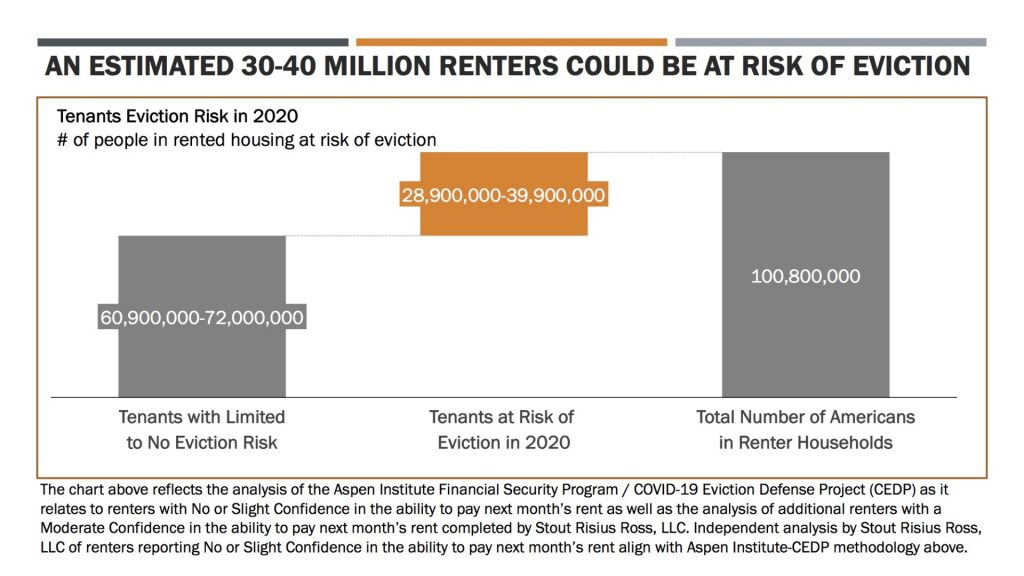

In September of 2020 the CDC Centers for Disease Control and Prevention established the ban that prevented renters in arrears from being evicted while the pandemic is raging. This protection is set to run out at the end of March. The Trump administration enacted this policy that the Biden team now has to consider. The chart below shows that tens of millions of Americans are at risk of eviction:

A number of key organizations have warned in a letter on March 15th that a major surge of evictions will take place if the protection lapses at the end of this month. These groups include the AARP, American Civil Liberties Union, and the NAACP. To back up their point, they referred to research that revealed past evictions have caused up to another 400,000 cases of the coronavirus. CEO and President Diane Yentel of the National Low Income Housing Coalition warned that:

“Increased evictions lead to increased spread of, and potentially deaths from, COVID-19.”

Many organizations have expressed their concern at the upcoming watershed event. Over 2,200 of them wrote President Biden a letter in which they urged that he extend the nationwide eviction ban.

Landlords Struggling with Providing De Facto Free Housing

The other side of the complicated issue surrounds the property owners. Landlords attacking the eviction ban argue that they can not keep giving their tenants free housing. National Apartment Association President Bob Pinnegar expounded on the problem with:

“Short-term policies like eviction moratoria leave renters accruing insurmountable debt and jeopardize the ability for rental housing providers to provide safe, affordable housing.”

Congress recently earmarked over $45 billion in financial assistance for renters. Unfortunately it will require several months before this money reaches those in need. Housing experts have warned that permitting the ban on evictions to expire ahead of the rental assistance reaching renters is unsound policy. Law Professor Emily Benfer at Wake Forest University cautioned that:

“Eroding eviction protections before rental assistance reaches those most at risk and just as we are approaching a turning point in the pandemic only undermines mitigation strategies and escalates the crisis, making recovery that much more untenable. “

These combined organizations in their letter asked the CDC, the Biden administration, and the Department of Housing and Urban Development to extend the timeframe on the eviction moratorium and to strengthen its provisions.

Despite Moratorium, Landlords Still Proceeding with Evictions

Even though a moratorium remains in place for now, a number of landlords have managed to proceed with evicting their tenants who are in arrears on rent. Their cause has been strengthened by the two federal judges who raised questions regarding the power of the CDC to ban evictions. Princeton University's Eviction Lab has found that over 180,000 different evictions in only the 19 cities and five states that it is tracking have taken place since the CDC's national ban took effect in September. The organizations wrote that:

“Under the CDC moratorium, renters are only protected if they know about it and take affirmative steps to be protected. As a result, corporate and other landlords continue to evict renters before renters know about the moratorium protections or by finding reasons for eviction other than nonpayment of rent.”

The analysis of the Center on Budget Policies and Priorities revealed that approximately one out of five renters stated they are behind on their rent as of January. The numbers are worse for minorities. Around 36 percent of Black renters claimed to be behind. The Biden administration has not revealed whether or not it will extend the eviction ban as of yet. As things stand now, a federal court has ruled the pandemic eviction ban unconstitutional.

$45 Billion in Rental Assistance Pledged But Arrears Are Significantly Higher

Other help is coming for Americans who have fallen into arrears on rent and utilities during the coronavirus pandemic. Rental assistance has been made available to aid those who are struggling in the latest stimulus packages Congress passed in December and in March through the American Rescue Plan. This offers over $45 billion in help for renters. The problem is one of time. While the federal government still has to deliver these funds to the individual states, every state has to establish a new program to which individuals can apply.

Another problem is that the amount of aid allocated to help delinquent renters will not be enough. Housing advocates estimate that renters are behind around $70 billion currently. Yet the money the government has to disburse may be enough to assist millions of Americans in keeping their homes.

Rent Assistance Funds Not Yet Available With End of March Deadline Fast Approaching

A number of states have not managed to establish their rental assistance programs to date. President and CEO Diane Yentel from the National Low Income Housing Coalition advised that:

“If individuals are in a state where the program has not opened, they should check to see if their locality is offering a rental assistance program.”

According to Yentel, a number of the programs do not have caps on the dollar amount that individuals can get. The limitations will instead be on the number of months in rent that people can receive. While some of the programs will grant 12 months in housing payment help, other ones could provide up to 18 months in rent. The money goes directly to a renter's landlord. In cases where the landlord will not accept them, renters may be able to receive the payments themselves.

Some States Establishing Their Own Protection Programs for Renters

Some of the states are not relying on the protections afforded by the CDC. They are instead announcing their own protections against evictions. This includes states Minnesota, Washington, Connecticut, and Hawaii. Minnesota and Connecticut in particular are maintaining their own eviction moratorium measures until they declare the end of their statewide health emergencies. These policies are designed to ensure that the help provided to their citizens carries them through the specific conditions of the statewide crisis.

For landlords who ignore the rules, renters are able to engage lawyers to defend themselves. Free to inexpensive legal help with sate evictions is available through Lawhelp.org. A study in New Orleans revealed that over 65 percent of renters who did not have legal representation suffered eviction. For those who had a lawyer to defend their case in court the rate was less than 15 percent successfully evicted.

The complex issue of struggling renters versus landlords is not an easy one to solve with coronavirus still disrupting everyday life and many types of employment in the United States. It reminds you why gold makes sense in an IRA. There are a number of different Gold IRA allocation strategies available.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,336.55

Gold: $3,336.55

Silver: $37.80

Silver: $37.80

Platinum: $1,337.40

Platinum: $1,337.40

Palladium: $1,124.21

Palladium: $1,124.21

Bitcoin: $117,645.06

Bitcoin: $117,645.06

Ethereum: $4,436.18

Ethereum: $4,436.18