Johnson Matthey Gold Bar

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

The Johnson Matthey gold bar is one of the most recognizable gold bullion bars in the world. These bars are produced by the British conglomerate Johnson Matthey. Named after Percival Norton Johnson and George Matthey, the organization was founded in 1817 as a gold assaying company in London. Unlike many precious metals bullion producers, Johnson Matthey is an incredibly diverse organization which has operations in such fields as automotives, medicine and pharmaceuticals, among others. The nearly 200-year old company employs some 10,000 people worldwide and their gold and silver bullion are highly valued in nearly every market.

Development, History and Introduction

Johnson Matthey exploded onto the precious metals scene in 1946 after being approached by the British government to become the sole producers of all silver coins in the UK. Ever since, Johnson Matthey bullion has come to be world-renowned for their quality and variety.

Since, the Johnson Matthey Gold Bar has become one of the world’s favorite gold bullion products. The production of their gold bar products has been diverse, including all manner of weight denominations in refineries located all over the world.

At one point or another, Johnson Matthey gold was produced at various refineries in Australia, Belguim, Hong Kong, the United Kingdom, Canada and the United States. However, only the refineries located in Brampton, Canada and Salt Lake City, Utah currently mint gold bullion bars.

Johnson Matthey Gold Bar Physical Characteristics

Bar Design

Variety is the name of the game with Johnson Matthey bars – in both size and look. Most are fairly plainly designed, though some very unique and attractive designs exist for all kinds of special occasions.

In contrast to the intricate, multiple-pressed and often expensive minting process used for other forms of gold bullion, Johnson Matthey gold bars often have a very simplistic design. However, the design of the bars is not completely uniform, and more intricate designs can be found if investors value a more polished look and feel.

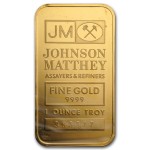

Perhaps the recognizable Johnson Matthey Gold Bar is the flat 1 oz.

bar. Minted in a rectangular shape, the front (“obverse”) side of the bar carries the initials “JM” next to the Johnson Massey logo containing two crossed hammers. The full name “JOHNSON MATTHEY ASSAYERS & REFINERS” reads underneath the logo, followed by the fineness “FINE GOLD 9999” to indicate the quality of the bullion. After the weight (“1 OUNCE TROY”), some Johnson Matthey bars carry a unique serial number, though not all do.

It should be noted that Johnson Matthey no longer mints gold bars, but rather “casts” gold ingots. Cast gold bars are produced by pouring molten, liquid gold into an ingot-shaped mold. Minted bars are often more flat, made from “blank” presses that have been cut to specific dimensions and are cut from solid sheets of gold.

Specifications

Johnson Matthey Gold Bars have been offered in a very large number of different weight denominations over time. Most bullion bars are currently produced in their Canadian refinery, which has offered 15 different sizes.

- TROY OUNCE SIZES: 1/10th, 1/4th, 1/2, 1, 2, 5 and 10

- GRAM SIZES: 1, 2.5, 5, 10, 20, 100 and 500

The two most commonly founds sizes of Johnson Matthey Gold Bars are the 1 oz. and 10 oz. varieties, though much larger sizes are available. All approved Johnson Matthey Gold Bars carry a fineness of .9999 (99.99% gold).

Johnson Matthey Gold Bar Pricing

Unlike bullion coins, gold bars are not used as legal tender, and therefore carry no transactional value. Still, gold bars carry certain advantages over gold coins as an option for investing in physical gold.

The mintage cost of gold bars, such as the Johnson Matthey Gold Bar, can be much lower than the minting cost of gold coins. This means that their market price (value of the bar comprised of the value of its gold content plus shipping and production costs) tends to be very close to the spot price (trading value) of gold. Gold bars are a very cost effective way to own gold.

The market price is used to determine value inside of an investment portfolio. Since gold prices fluctuate daily, the value of Johnson Matthey Gold Bars will also fluctuate daily. Most major newspapers report the daily price of gold, making the value easy to track.

Owing to their low production costs and years of experience, Johnson Matthey Gold Bars carry some of the lowest premiums over spot price in the bullion world.

Investing in Johnson Matthey Gold Bars Through an IRA

The IRS allows Individual Retirement Accounts (IRAs) that meet specific requirements to carry precious metal bullion as an investment in a portfolio. These are often referred to as a “precious metals IRA.” Precious metals IRAs are self-directed and the only bullion allowed inside must be IRS-approved. Qualifying precious metals include certain gold, silver, platinum and palladium bars and coins.

Johnson Matthey Gold Bars are one of the authorized forms of bullion for IRA investing. By placing real, physical gold inside of an IRA, these gold bars offer diversification in your portfolio that is independent of fluctuations in stocks or bonds.

All Johnson Matthey Gold Bars meet the minimum purity requirements established in Internal Revenue Code section 408(b). For IRA investing, the owner of the account must make an initial purchase of at least $5,000 of qualifying bullion to establish a precious metals IRA. All subsequent purchases must be at least $1,000 each.

When an investor makes a purchase of Johnson Matthey Gold Bars (or any precious metals IRA bullion), the IRS further requires that all coins and/or bars be held in a qualifying “depository.” The depository is responsible for the security and maintenance of the bullion.

Those with an existing IRA have the option of transferring or rolling over funds into a precious metals IRA.

Johnson Matthey Gold Bars are a very liquid bullion asset, able to be purchased and sold through dealers across the world and are registered with international exchanges including the LBMA, COMEX and APMEX. To avoid purchasing counterfeit gold bars, it is recommended to purchase directly from highly reputable gold bullion dealers or from the Johnson Matthey website.

Sign up to learn more. It's free!

If you're worried about the economy and want to learn tips on how to protect your retirement savings in case of another systemic collapse, sign up to our monthly newsletter now for free! We cover topics such as: precious metals investing, inflation, currency devaluation, national debt, the Fed's financial policies, world politics, and much more. Join now and we'll send you a free PDF report entitled “5 scams to avoid when investing in bullion gold & silver”

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $4,929.70

Gold: $4,929.70

Silver: $75.87

Silver: $75.87

Platinum: $2,052.43

Platinum: $2,052.43

Palladium: $1,725.14

Palladium: $1,725.14

Bitcoin: $67,487.61

Bitcoin: $67,487.61

Ethereum: $1,987.07

Ethereum: $1,987.07

I have one of your 1 ounce bars,I would like to sell it,but up here in Whistler,I have been striking out.Where would you recommend,I trade it in,I’m thinking somewhere in Vancouver,can you guide me in the right direction?

Very valuable