Credit Suisse Gold Bars: Full Review & Comparison (2026 Update)

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

The Credit Suisse Gold Bar has long been one of the most popular and recognizable gold bars in the world.

Even though Credit Suisse no longer exists as a standalone bank after its 2023 acquisition by UBS,

Credit Suisse-branded bars still trade globally because their value comes from the gold content

and the refinery authentication, not the health of the former bank.

Get a free Gold IRA kit + current pricing

If you’re comparing dealers or exploring a rollover, start by requesting the GoldenCrest Metals kit.

It’s a simple way to benchmark fees, promotions, and coin/bar pricing before you buy.

Disclosure: We may earn a commission at no extra cost to you.

Table of Contents

- Review Highlights (Quick Facts)

- Who Actually Makes Credit Suisse Gold Bars?

- Development, History, and Introduction

- Credit Suisse Gold Bars Physical Characteristics

- Pricing, Premiums, and What You’re Really Paying For

- Liquidity and Resale: Dealer Buybacks vs. Private Sales

- Credit Suisse vs. Other Popular Gold Bars

- Where to Buy Credit Suisse Gold Bars (Top Dealers We Recommend)

- Investing in Credit Suisse Gold Bars Through an IRA

- 401(k) Considerations (Quick Reality Check)

- Who Are Credit Suisse Gold Bars Best For?

- Frequently Asked Questions

Review Highlights (Quick Facts)

- Manufacturer: Valcambi SA (LBMA-accredited Swiss refinery)

- Purity: Typically .9999 fine gold (24k)

- Weights: 1g to 1kg, plus select troy-ounce formats

- Authentication: Unique serial number + assay card/certificate (often sealed)

- Liquidity: Strong global recognition, especially when assay packaging is intact

- Premiums: Often slightly higher than generic bars due to brand recognition (especially small sizes)

- Branding note: UBS ownership means future Credit Suisse branding is not guaranteed

Who Actually Makes Credit Suisse Gold Bars?

This is the #1 thing people misunderstand: Credit Suisse did not manufacture gold bars. Authentic Credit Suisse-branded bars are produced by Valcambi SA, an LBMA-accredited Swiss refinery. Credit Suisse historically served as a major financial brand and distribution channel, while the refinery handled the metallurgy, assaying, serializing, and certification.

Since UBS acquired Credit Suisse in 2023, the bank is no longer a standalone institution. That said, existing Credit Suisse bars remain investment-grade bullion and continue to be bought and sold worldwide. If UBS eventually sunsets the branding, it may affect “new production” availability, but it does not erase the bullion value of existing bars.

For official background on the 2023 acquisition, you can read UBS’s announcement here: UBS press release on the Credit Suisse acquisition.

Development, History, and Introduction

Credit Suisse was initially established to aid in the construction of Switzerland’s railway system as a public works project. Through the first several decades of its existence, the “Swiss Credit Institution” (as it was then called) evolved and became an integral part of Switzerland’s development.

The company is credited with aiding in the creation of the Swiss currency (the Swiss Franc), funding Swiss entrepreneurs, and helping develop the reputation of Swiss banking. The first Credit Suisse Gold Bars were made available to world markets in 1979. Credit Suisse Gold Bars have been produced since 1979 by Valcambi, one of Switzerland's most respected refiners. Since 2003, Valcambi SA has been the sole manufacturing partner for authentic Credit Suisse bars.

In the early 2020s, Credit Suisse faced escalating financial and reputational challenges, culminating in a 2023 rescue acquisition by UBS. The key investor takeaway is simple: the bullion value of a Credit Suisse bar is not tied to the bank’s survival. It is tied to the gold content, the assay, and the global gold market.

Credit Suisse Gold Bars Physical Characteristics

Gold Bar Design

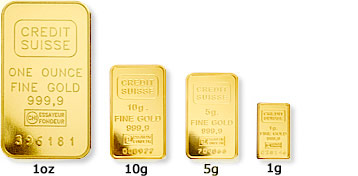

The design of the Credit Suisse Gold Bar is distinct and instantly recognizable. The bars are thin rectangles with smoothed edges and minimal “flash.” The front is stamped with key information including weight, fineness, and a unique serial number. On a 1-gram bar, you’ll commonly see text like 1 g., FINE GOLD, 999.9.

Under the main markings, you may see the French words ESSAYEUR FONDEUR, referring to the assayer-refiner stamp. The reverse side often features a repeating pattern of the Credit Suisse logo.

Practical tip: resale value is typically strongest when the bar remains sealed in its original assay packaging, with the serial number visible and matching the certificate/card.

Gold Bar Specifications

Credit Suisse Gold Bars are typically .9999 fine gold (99.99%), qualifying as 24-karat. Bars are commonly found in metric denominations, though some are in troy ounces.

Common sizes include 1g, 2.5g, 5g, 10g, 20g, 50g, 100g, 250g, 500g, and 1kg. Some lines also exist in 1 oz, 10 oz, and other specialty formats like tolas.

Pricing, Premiums, and What You’re Really Paying For

Gold bars are not legal tender, but they have a major advantage for investors: they usually carry lower premiums than bullion coins, especially in larger sizes. In general, the market price of a bar is influenced by the spot price of gold, production costs, shipping/insurance, and dealer markup.

That said, brand recognition can add a modest premium. Credit Suisse bars often command slightly higher premiums than generic bars of the same weight, particularly for smaller sizes (like 1g, 5g, 10g) where fabrication and packaging costs make up a bigger percentage of the purchase.

To track spot price and context, see our live gold price page.

Liquidity and Resale: Dealer Buybacks vs. Private Sales

Credit Suisse bars are often described as “highly liquid,” and that’s generally true. But liquidity can mean different things depending on how you sell:

- Selling to a major dealer: typically fast and straightforward, but you’ll receive a bid price below spot (the spread covers dealer risk and overhead).

- Selling privately: you may get closer to spot, but it’s slower and requires more caution around authenticity, payment method, and safety.

- Assay packaging matters: sealed bars with intact assay cards usually sell faster and for better pricing than loose bars.

If you want a deeper walkthrough of liquidation options, see our guide: how to sell gold and silver.

Credit Suisse vs. Other Popular Gold Bars

If you’re comparing options, here’s the quick “real world” difference between a few common choices:

- Credit Suisse (Valcambi-manufactured): excellent recognition, typically modest premiums, strong resale when assay is intact.

- PAMP Suisse: extremely popular, often higher premiums due to brand and packaging presentation, strong collector appeal in some lines.

- Perth Mint bars: widely recognized, premiums vary by region, sometimes easier to resell in certain markets.

- Generic LBMA bars: often the lowest premiums, great for investors focused purely on ounces, but branding may not carry the same consumer recognition.

For a broader list of investor-friendly bar brands, see: top gold bars for investors.

Where to Buy Credit Suisse Gold Bars (Top Dealers We Recommend)

If you’re buying a Credit Suisse gold bar, the main goal is simple: avoid counterfeits and buy from a dealer with a real track record. Below are 10 reputable dealers we’ve reviewed on Gold IRA Guide. If you’re also considering a gold IRA company, these are a good starting point for requesting pricing, comparing fees, and getting a free information kit.

Want a free Gold IRA kit and pricing info?

Our #1 ranked partner for 2026 is GoldenCrest Metals. If you’re comparing dealers or exploring a rollover, start by requesting their free kit.

Disclosure: This link is an affiliate link (we may earn a commission at no extra cost to you).

| Rank | Company | Best For | Quick Action |

|---|---|---|---|

| #1 | GoldenCrest Metals | Best overall (kits + strong promos) | Get Free Kit |

| #2 | Noble Gold | Best rated overall | Visit / Get Kit |

| #3 | Augusta Precious Metals | High net worth investors | Visit / Get Kit |

| #4 | Birch Gold | Best for gold bars | Visit / Get Kit |

| #5 | Silver Gold Bull | Great pricing on bars | Visit / Get Kit |

| #6 | Advantage Gold | Education + strong reviews | Visit / Get Kit |

| #7 | Gold Alliance | Good custodian/depository options | Visit / Get Kit |

| #8 | American Bullion | Longevity + IRA setup support | Visit / Get Kit |

| #9 | Goldco | Flat-fee style (varies by promo) | Visit / Get Kit |

| #10 | Rosland Capital | Selection + customer service | Visit / Get Kit |

Tip: If you’re buying a bar for personal storage, prioritize dealers that offer assay-sealed bars and clear buyback policies. If you’re buying inside an IRA, confirm the dealer works smoothly with your custodian and an IRS-approved depository (learn more about IRA-approved metals and the rollover process).

Considering a Gold IRA instead of storing bullion at home?

GoldenCrest’s kit includes a plain-English checklist for rollovers, the most common fees to watch for, and the questions smart investors ask before choosing metals.

Disclosure: We may earn a commission if you use this link.

Investing in Credit Suisse Gold Bars Through an IRA

The IRS allows certain self-directed IRAs to hold specific precious metals bullion that meets purity rules. Credit Suisse-branded bars (manufactured by Valcambi) generally meet the purity threshold commonly referenced for gold bullion.

Important clarification: You may see minimum purchase amounts mentioned online (like $5,000 initial or $1,000 subsequent). Those are typically dealer or custodian policies, not an IRS requirement. The IRS rules focus on eligibility, custody, and storage requirements rather than forcing a specific minimum dollar purchase.

If you’re new to the concept, start here: complete Gold IRA guide.

For IRA-held metals, storage generally must be handled through an approved custodian and depository setup. Here are two helpful internal resources:

For an official IRS resource on rollovers and retirement distributions, you can also review IRS guidance here: IRS rollover guidance.

401(k) Considerations (Quick Reality Check)

Most employer-sponsored 401(k) plans do not allow you to hold physical bullion directly inside the plan. In practice, investors who want physical metals typically use a compliant rollover path to a self-directed IRA, then purchase eligible bullion through that IRA structure.

If you’re shopping providers, our rankings page can help you compare options quickly: best gold IRA companies.

Who Are Credit Suisse Gold Bars Best For?

- Long-term holders who want a widely recognized bar brand that is easy to resell later.

- Investors who value assay packaging and want simple authenticity signals (serial + certificate).

- People building a Gold IRA allocation who want eligible, investment-grade bullion and prefer bars over coins.

- Buyers who like brand recognition but don’t want to pay “collector premiums” associated with some premium product lines.

Not ideal for: investors who want the absolute lowest premium per ounce (a large generic bar may be cheaper), or buyers who tend to mishandle bullion (pure gold shows wear more easily, especially outside sealed packaging).

Before you buy any premium coins or “exclusive” products, read this first.

GoldenCrest’s kit helps you understand which products are commonly favored for long-term retirement holdings and how to avoid overpriced markups.

Disclosure: We may earn a commission if you request the kit through this link.

Frequently Asked Questions

Are Credit Suisse gold bars still being produced?

Credit Suisse is no longer a standalone bank, but Credit Suisse-branded bars have historically been manufactured by Valcambi. Branding decisions can change under UBS ownership, so future “new production” under the Credit Suisse name is not guaranteed. Existing bars remain widely tradable investment-grade bullion.

Are Credit Suisse gold bars backed by the Swiss government?

No. They are not government-issued legal tender. Authenticity is established through the refinery’s assaying and certification (often via sealed assay packaging and serial numbers).

Do Credit Suisse bars hold value if Credit Suisse is gone?

Yes. Bullion value is based primarily on gold content and the global gold price. Brand recognition can influence premiums, but the core value comes from the metal itself.

Do Credit Suisse gold bars carry higher premiums than generic bars?

Often, yes, especially for smaller sizes. The tradeoff is brand recognition and easier resale. For the lowest premium per ounce, larger generic LBMA bars may sometimes be cheaper.

Is it better to buy sealed assay bars?

Generally, yes. Sealed assay packaging helps maintain liquidity and can improve resale pricing. A loose bar can still be authentic, but buyers may demand additional verification.

How can I verify authenticity?

Look for a matching serial number on the bar and assay card, buy from reputable dealers, and consider professional testing (like XRF) if you’re buying second-hand.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $4,816.13

Gold: $4,816.13

Silver: $94.16

Silver: $94.16

Platinum: $2,470.84

Platinum: $2,470.84

Palladium: $1,884.89

Palladium: $1,884.89

Bitcoin: $88,327.52

Bitcoin: $88,327.52

Ethereum: $2,933.86

Ethereum: $2,933.86

Hi where to sell my credit Suisse gold bar in Jakarta soon hard to find right place?

Hello, I just purchased a bar that says quarter ounce I cannot find any bars with the word quarter rounds on them can you give me some information thank you. The serial number is 065346

Hello, I just purchased a bar that says quarter ounce I cannot find any bars with the word quarter ounce on them can you give me some information thank you. The serial number is 065346

Ah, found your bar! It is actually made of aluminum and plated in 18k gold. Hope you didn’t pay full price for it.

Where can we research the serial numbers of bars?

Where can we look up serial numbers. I have a one ounce gold bullion. Serial number 346467

Do the gold bars come with certificate of authenticity

Hi Collin, yes usually do. Speak to your gold dealer.

Stay far away from Suisse gold as possible, a simple $6000 investment turned into a scam where they decided not to send me my bullion order. Get your money back if you’re also a victim of similar scams by reaching Alex through his email, he’s the fund recovery agent who helped get back everything I lost

AGcollections84{at}gmail,com

Hello I was offered a gold bar with a serial number: 375821 could you give me its value? Anita

Hi Anita, you should take your gold bar to a local gold dealer for an appraisal. Its value will largely depend on its purity (gold content). weight, its type and brand. If it’s a Credit Suisse certified gold bar, it’s better than if it’s an unbranded one.

I have a credit suisse 50gram gold bar. What is the value in US $ now (real time today)?

I have a credit suisse 50gram gold bar. What is the value in US $ now (real time today)?

Hi Virgilio, please use our gold calculators here to find the value of your gold bar: https://goldiraguide.org/gold-calculators/

Do the serial numbers on a Suisse Credit 1 oz .9999 bar indicate when they were purchased?

Hi Myron,

No unfortunately they don’t. 🙁

Best regards

I have a credit suisse 1 g gold pendant surrounded by 24 diamonds serial number 24184 where can I find approximate value?

I have a Credit Suisse Bar Stated on bar 50g, Fine Gold 999.9, serial number 87926. where can I find the value of it?

i have a 1oz CREDIT SUISSE gold bar with serial number A232258. is this a real thing?

I got duped I have a credit Swiss 1 oz of fine gold which is a counterfeit and I don’t know how to get my money back I purchased it from credits list but it might possibly be a website that was not Credit Suisse or essayed fonder keep an eye out for our websites that are like the real one second time it’s happened to me first time I got caught off guard was with what I thought was Amazon but it wasn’t so I was duped on that one as well so it sucks cuz that when you buy two of them thinking that you have gold and it’s not gold and you’re out $3,000 when you only make $500 a month total to live on people should be ashamed of themselves for being like that it’s just unreal and if it wasn’t for a family member I would be homeless cuz you can’t pay rent with 500 bucks in survive food and everything yeah I don’t work so I’m screwed which is really upsetting

Hi Kendra, sorry to hear about your loss. Hopefully, you have reported the website and the authorities can catch the fraudsters! You should take your gold to a pawn shop or gold shop and get an appraisal to see if you can get anything from it. People have to be very careful about fake websites claiming to be “official”. Always look at the address bar on top of your browser, and ensure the connection is secure (padlock icon). Also, check the URL (web address) to make sure it’s the official domain name of the company. When in doubt, go on Google and type the company’s name. The official website should appear at the top of search results. You can also look up the website’s reviews online and call the company to verify authenticity. Hope this helps.

Have Credit Suisse Quarter Ounce Gold Bar with serial number 026489 please tell me if this is legitimate.

Hi Miriam, you will need to take it to your local gold dealer and get it appraised. Get 2-3 appraisals from different dealers to make sure you are getting the right price.

I possess a Credit Suisse pendant in a 10g bezel made of 999.9 fine gold, marked “Chi Essayeur Fondeur CHI” since 1986, accompanied by a chain. Could you please provide an estimate of its current value?

I have a 50gram Suisse gold bar. Where can I sell it after getting appraisals and its offenticated?

Hi Jakkie, you can go to your local gold dealers and compare their offers for your Credit Suisse gold bar. You can also try posting it online on a site like eBay or your local classifieds.

tengo un lingote de Credit Suisse 1oz… donde puedo ver su valor? el numero de serie es 246347… hay forma de ver en alguna pagina su autenticidad?

I have onde ingold Credit Suisse 1 g fine gold 999,9 2076 Could you please provide an estimate of its current value? Thanks

Would like to no the value of the credit Sussex gold gold anits a beautiful coind where can I trade it.

I have credit suisse one ounce fine gold 999,9

(Chi)Essayeur founder

358184 please guide me this value?

Whatsapp: +923402315998

how do I verify gold bars:

A244304

A244302

Hi John, take them to a few local gold bullion dealers and compare estimates.