Top 7 Best Gold Coins to Buy for Investors

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 2nd September 2024, 01:43 pm

In an earlier post, we covered the Top 7 Gold Bars for Investors. In a similar vein, today we are going to identify 7 of the best gold bullion coins in which to invest. And, since this is a Gold IRA website, we are going to limit ourselves only to those coins which are eligible for IRA investing. Beware of coins that are mostly meant for collectors and not for investors. They will cost you a fortune in premiums! IRA-approved bullion must meet the minimum purity requirements as set forth by the Internal Revenue Service.

These purity standards mean that acceptable bullion coinage and bars must be at least .995 fine or 99.5 percent pure gold. Besides this, the gold must be produced by and at an IRS approved foreign government mint. Finally, the gold must be true bullion, which means that it is not collectible, rare, and does not feature an excessively high premium over world spot gold prices.

A quick primer: there are two ways to add physical gold bullion to your IRA – gold coins or gold bars. While there are some real differences between choosing to purchase a bullion coin vs. a bullion bar, you are ultimately making a decision to trust in gold over paper currencies. This is true regardless of the form of bullion you select.

Here is our list of the top 5 gold coins (in no particular order):

Table of Contents

Austrian Philharmonic Gold Coins

- Purity: 99.99% (24 karat)

- Weight: 1 oz (also available in smaller sizes)

- Mint: Austrian Mint

The Austrian Philharmonic is the king of gold coins in Europe, and this fantastic gold bullion coin has a long and fascinating history. Its beautiful design showing musical instruments, the name recognition and the quality are the reasons it sits comfortably on this list.

While these particular bullion coins have only been minted since 1989, the legendary Austrian Mint has been producing leading gold and silver coins for over 800 years., and their current iteration is 99.99% gold pure.

These coins have been awarded the enviable title of best selling gold bullion coins on earth on three separate occasions back in 1992, 1995, and 1996. They are routinely listed as the most heavily demanded continental European coin. These coins were originally issued with Austrian shilling face value. In 2002 with the creation and implementation of the euro, these coins were switched over to 100 euros face value. At the time, this made them the highest face value pieces issued by any significant minting country in any major world currency.

American Eagle Gold Coins

- Purity: 91.67% (22 karat)

- Weight: 1 oz (also available in 1/2 oz, 1/4 oz, and 1/10 oz)

- Mint: United States Mint

The official gold bullion coin of the United States, the American Gold Eagle Coin does not have the standard 24K purity of IRA-approved gold bullion. Rather, Gold Eagles are made of a 22K gold alloy, providing a tougher metal that shows less wear and abuse. In addition to providing IRA investors with a tougher metal, the United States is a renowned producer and holder of gold, and US citizens are among the biggest demanders of gold in the world. You can find American Eagles being sold at most reputable gold dealers across the U.S. and worldwide.

These coins have proven to be among the most popular gold bullion coins in the world where Precious Metals IRA holdings are concerned. This is despite the fact that technically the coin does not measure up to the 99.5 percent gold purity level which the IRS enforces rigorously on every other gold bullion coin besides this one.

The reason the coin gets a pass from the Internal Revenue Service (besides it being the official gold bullion coin currently produced by the United States) has to do with the mass of these golden pieces. While the American Gold Eagles are only 91.67 percent pure, because the coin weighs in at 1.0909 troy ounces, the coin still manages to pack in a full troy ounce of gold even with its higher content of alloy metals.

The United States Congress both authorized and introduced these American Gold Eagle coins. The U.S. Mint strikes them not only in gold, but also in platinum and silver today.

Canadian Maple Leaf Gold Coins

- Purity: 99.99% (some can be 99.99999 pure. That's right, five zeroes after the decimal!)

- Weight: 1 oz (also available in smaller denominations)

- Mint: Royal Canadian Mint

The first nationally produced, 24K gold bullion coins, Canadian Maple Leaf Gold coins are some of the most recognizable and important gold coins of the modern world. On top of that, these are also the most “liquid” gold coins, with over 40 million Gold Maple Leafs in circulation today. In many ways, these are the “gold standard” among gold coins. For investors looking for a truly incredible quality coin, the Royal Canadian Mint has produced 99.999% 1 oz Gold Maple Leafs.

The Canadian Maple leaf proves to be the purest of the major gold bullion coins in the globe. As per Wikipedia, these coins are so pure in their .99999 fine versions that there are practically no base metal alloys involved in the gem's production. These gold must all come from Canadian mines, according to the legislative requirements of Canada.

Canada's Royal Canadian Mint was the first government mint on earth to strike the .9999 gold coins for transactional use. The Mint made another first back in 2007 when the government of Canada announced it would release a $1 million face valued Gold Maple Leaf coin. Despite the fact that this coin had the world's first $1 million legal tender, its gold content was greater still, worth over twice as much as the million. Stanley Witten designed these unique Gold Maple Leaf coins to be struck with .99999 fineness.

Australian Kangaroo Gold Coins

- Purity: 99.99% (24 karat)

- Weight: 1 oz (also available in various sizes)

- Mint: Perth Mint

Originally called the “Gold Nuggets” because their initial designs contained the images of gold ore, Australian Gold Kangaroos now feature a different kangaroo on the reverse side for each year of mintage since 1990 (1 oz coins only). This makes the Australian Kangaroo a perfect coin for investors who are also collectors. To add to their numismatic value, the Perth Mint also releases “Lunar Series” Gold Kangaroo coins, alternating Zodiac symbols yearly. All Australian Kangaroo Gold coins are 99.99% gold.

These gold Kangaroos/Nuggets turn out to be the official bullion coin of Australia. They are struck at the world renowned Perth Mint. As such, they remain among the highest quality and purest of all gold coins produced on earth. The pieces were first struck by the Gold Corporation subsidiary company (which the Western Australian government owns) back in 1986. This company maintains a unique arrangement with the Australian Department of the Treasury which permits it to not only mint, but also to market, gold, platinum, and silver coins which are fully legal tender to both investors and collectors.

The first day of sales sold the original Australian Gold Nugget coin sell more than 155,000 ounces worth of gold at a grand total value of in excess of $103 million. Demand for these gold bullion coins has not waned since those early days. The original mintage specifications for the series of coins started at only single troy ounce sized coins. Since 1991, denominations have expanded to include 2 ounces, 10 ounces, and 1 kilogram sized coins. This makes them among the biggest gold bullion coins ever struck.

Today's Gold Kangaroo/Nuggets and the series now boast sizes which range from a tiny one-sixtieth ounce of gold up to the impressively large single kilogram size. The Australians set another world record for producing the single biggest gold coin ever struck at 1,000 kilograms in size.

American Buffalo Gold Coins

The “Gold Buffalo” coin is the only 24K gold bullion series ever released by the United States. Introduced as a American option for investors and collectors who wanted a gold purity higher than the Gold Eagles, the release has been a huge success. In fact, the United States Mint had to temporarily halt the sale of American Buffalo Gold coins when inventories were depleted as a result of high demand.

This coin only appeared back in 2005 with the Presidential $1 Coin Act of 2005 which the American Congress authorized. The legislation took a page from the Canadian playbook by insisting that all American Buffalos had to be produced with newly mined gold sourced from U.S. based mines. Every American Bullion coin is produced in the West Point Mint found in New York. The coins themselves actually started shipping in 2006.

It was the proof version of the American Buffalo gold bullion coins which was released first. Later on, the U.S. Mint released an uncirculated variant of the American Buffalo coins and began selling them to the public. Though the two coins are quite similar in final appearance, their minting process is different. Uncirculated means that such coins do not carry legal tender face value. They may not be used in everyday ordinary purchases.

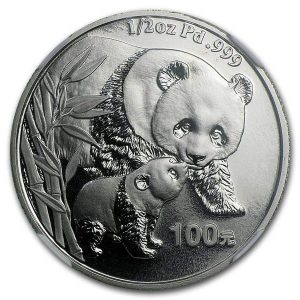

The Chinese Gold Panda

- Purity: 99.9% (24 karat)

- Weight: 30 grams (just under 1 oz; previously 1 oz)

- Mint: People’s Republic of China

The Chinese Gold Panda is a 99.9% pure gold coin minted by the People's Republic of China, and is by far the most popular gold coins in the PRC. It known for its annual design changes that usually feature the beloved panda bear. Weighing 30 grams (slightly under 1 ounce), the coin is not only valued for its gold content but also cherished by collectors for its aesthetic appeal and limited-edition nature, making it a sought-after piece for those who appreciate both investment and artistry.

The British Gold Britannia

- Purity: 99.99% (24 karat)

- Weight: 1 oz (also available in smaller sizes)

- Mint: The Royal Mint (UK)

Why Invest in Gold Coins?

So why would you choose to own gold coins instead of gold bars? Aside from the fact that the coins are far more interesting (and make better conversation pieces) than mere bars and ingots are, there are a couple of primary reasons why you might opt for coins:

- Bullion coins are almost always given legal tender status in their country of origin. This means that they hold an actual transactional value. This not only helps distinguish gold coins from each other, but also makes them a more attractive alternative in the case of financial crisis. In practice though, no one would spend the coins for face value alone, which is usually vastly lower than the market prices of the coins' intrinsic gold.

- Bullion coins are more popular and more commonly produced than bullion bars, making them more convenient to own and trade. They are almost always a more “liquid” asset.

- Bullion coins are far more collectible than bullion bars, making their numismatic value significantly higher in most cases. They are often more carefully refined and feature more intricate, attractive designs.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,643.19

Gold: $3,643.19

Silver: $42.19

Silver: $42.19

Platinum: $1,399.65

Platinum: $1,399.65

Palladium: $1,215.36

Palladium: $1,215.36

Bitcoin: $116,175.09

Bitcoin: $116,175.09

Ethereum: $4,709.86

Ethereum: $4,709.86