7 Tips for Cryptocurrency Investing (2021 UPDATE)

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 16th September 2021, 06:12 pm

Cryptocurrencies hold the potential to revolutionize how we make payments and do business. As a decentralized, peer-to-peer payment network, blockchain technology is secure, irreversible, anonymous, and free from government or corporate interference. In other words, cryptocurrencies could be the monetary system of tomorrow.

Every day, we’re inching closer to that potential future. There are currently 210 million cryptocurrency users worldwide, and this number is rising dramatically every month. Currently, the global crypto market is worth over $2 trillion in market capitalization. If you don’t want to miss the boat, now would be a good time to get in on the action and invest in crypto.

Don’t know where to start? Before you start cryptocurrency investing, check out our list of the seven must-know tips and pieces of advice to help you avoid costly mistakes. This way, you can diversify your portfolio with confidence knowing that you stayed clear of the many scams and frauds that can, unfortunately, be found in this investment space.

Our Top Tips for Safer, Better Cryptocurrency Investing

Below, we’ve listed our top seven pieces of advice to help you invest in cryptocurrencies such as Bitcoin, Litecoin, and Ethereum with confidence. Keep in mind that these are listed in no particular order, so make sure you take each of them to heart without giving preference to any.

1. Diversify, Don’t Concentrate

You’re going to want to concentrate on this tip: never concentrate when investing in cryptocurrencies. Instead, diversify! Like any investment asset, cryptocurrencies are volatile and frequently undergo large price swings. The asset class has also lost considerable value in the past—notably, during the market resets in 2013 and early 2018.

That’s not to say that cryptocurrencies are unsafe. That’s not the case at all. Rather, they carry risk. As an investor, it’s your job to manage risk by allocating only a small portion of your wealth to cryptocurrencies, or any alternative assets for that matter.

Many of the world’s top investors only dedicate about 5% of their wealth to “higher-risk” assets like cryptocurrencies. For example, Kevin O’Leary from ABC’s Shark Tank currently holds about 7% of his investment portfolio in digital currencies.

Portfolio diversification is one of your best defense strategies against natural market volatility, recessions, or financial crises. If you hold too much of any one asset—whether it’s stocks, bonds, or crypto—you might suffer big losses if the market dips. Spreading your wealth across multiple non-correlated assets can help cushion the blow in a down market.

2. Don’t Expect Short-Term Gains

Cryptocurrencies aren’t a get-rich-quick scheme. Remember that prices can fluctuate dramatically in the cryptocurrency market. As recently as May 2021, the price of Bitcoin fell by 30% over the course of a single day. However, it would go on to recover its losses over the following months.

The point is, cryptocurrency is for both the patient and the brave of heart. You have to be willing to weather the storm when the market inevitably turns south, and to have the patience to allow the market to rebound in due time. To borrow a cliche, cryptocurrency investing is a marathon, not a sprint.

3. Assess Your Risk Tolerance

As a rule, you should never invest more than you can afford to lose when investing in cryptocurrency. However, it’s not always clear how much one’s willing to lose in order to realize a potential gain. That’s why any cryptocurrency investment strategy must first involve an honest discussion about how much one can afford to “gamble” on a risky investment.

If you’re hesitant about losing money, consider sticking to the tried-and-true digital currencies that have deep market penetration and have proven longevity. The largest cryptocurrencies by market cap are the first that come to mind—Bitcoin ($850B), Ethereum ($338B), and Cardano ($77B). Ultimately, the best cryptocurrency to buy right now is the token that best suits your risk tolerance.

Those willing to take on a little extra risk might want to think about diversifying with altcoins. Technically, any non-Bitcoin cryptocurrency classifies as an altcoin, but this term is used widely to refer to smaller and newer tokens such as Chainlink, Dogecoin, and Ripple (XRP). Since these coins have much smaller market capitalizations, they hold the largest upside potential, although at a higher degree of risk.

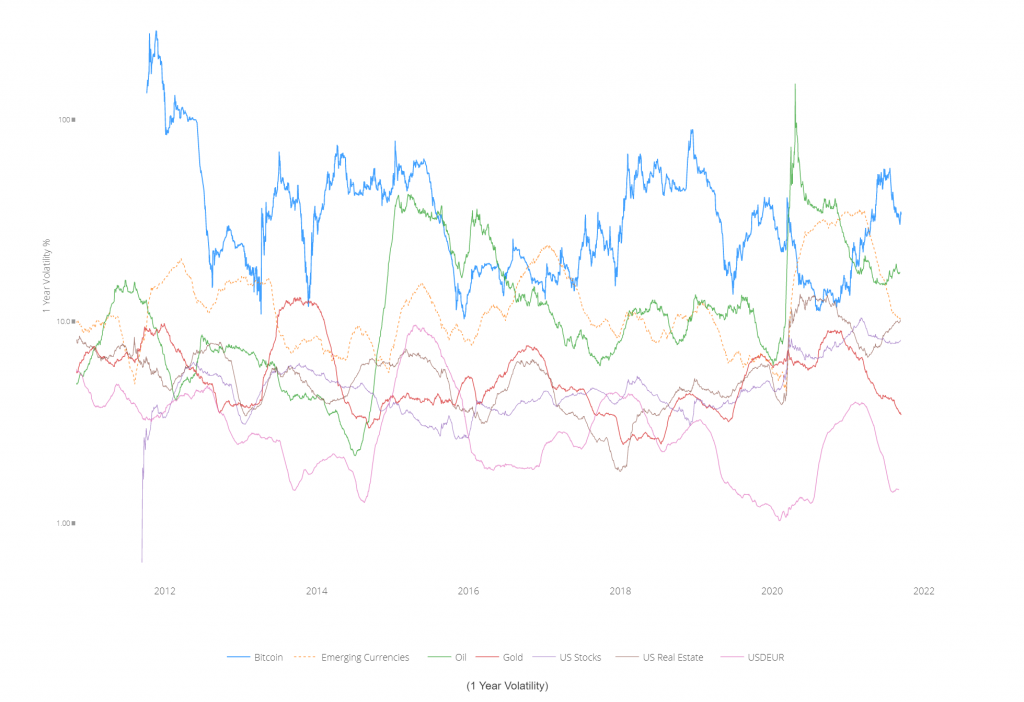

As depicted by the chart below (Fig. 1), the volatility of Bitcoin over the past decade is still quite pronounced compared to other major asset classes. However, the good news is that it appears to have stabilized significantly compared to its early days. It's also quite promising that Bitcoin's volatility doesn't appear to mirror any other asset type, which makes it an excellent portfolio diversifier. For example, if the oil future market or the S&P 500 wavers, it's likely that Bitcoin will either retain its value or increase in value. Historical precedent indicates that Bitcoin does not follow the same pricing patterns as any other asset.

Figure 1. Source: WooBull.com

4. Stick to Trusted Exchanges and Companies

Sadly, there’s no shortage of scammers in the cryptocurrency industry hoping to prey on unsuspecting new investors. Like any nascent asset class, Bitcoin investing is especially susceptible to fraudsters.

Fortunately, you can protect yourself fairly easily by sticking to the most trusted exchange platforms and investment companies. If you decide to invest on your own, you’re going to want to make use of the longest-running exchanges on the market to convert your U.S. dollars into cryptocurrencies.

The largest and most trusted exchanges are listed below, ordered by average 24-hour trading volume:

- Binance ($25.5B)

- Tokocrypto ($18B)

- Upbit ($8B)

- OKEx ($6.2B)

- Bitcoin.com Exchange ($4.8B)

- Coinbase Exchange ($3.6B)

New investors should note that taking a DIY approach to cryptocurrency investing isn’t always in your best interest. Doing so entails more risk, and makes it more likely that you’ll owe Uncle Sam more money on your tax return. To minimize your exposure to risk, consider using a trusted crypto IRA company to invest safely within a tax-advantaged account.

5. Automate Your Investments

It’s generally not a good call to actively manage your cryptocurrency portfolio. Since the market is so difficult to forecast, any attempt to predict future price movements is all but futile. That’s why timing the market probably isn’t a great idea. Fortunately, you can set up automated payments so that your dollars are gradually converted to crypto over time.

The practice of investing predetermined amounts of money at regular installments (e.g., $250 on the 1st of the month) is called dollar-cost averaging, and it’s often found to be more beneficial than making one lump sum investment. This is especially true for assets like Bitcoin whose price patterns are notoriously difficult to predict.

If you work with a Bitcoin IRA company, the account custodian can help you set up recurring purchases. This way, you can “set it and forget it” without having to worry about when to log on for your next scheduled deposit. In short, investing through a Bitcoin IRA simplifies the investment process and makes it easier to make better, lower-risk investment decisions.

6. Don’t Buy Simply Because the Price is Low

As we saw during the 2018 initial coin offering (ICO) frenzy, there are a lot of blockchain projects that aren’t supported by sound business fundamentals. In some cases, founders create cryptocurrencies in order to quickly cash out and abandon the project shortly thereafter.

In fact, an October 2018 EY report found that 86% of the ICOs listed on public exchanges in 2017 had depreciated compared to their original listing value by mid-2018. An entire portfolio constructed with these ICOs was down 66% by this point in time.

The EY study is a grim reminder that many blockchain projects are not destined for success. If you had invested in these cryptocurrencies when they launched because you were attracted to their token price, you would have lost money. Thankfully, you can easily avoid this common mistake by sticking to one of the cardinal cryptocurrency investing tips: stick to established, high market cap tokens like Bitcoin and Ethereum.

7. Take Your Security Seriously

Decentralization is a double-edged sword. Sure, it’s a trustless system with fewer points of weakness, both of which benefit the average investor, but this also means that you’re on your own if you lose your wallet or exchange password.

In many cases, there’s no recourse available if you can no longer access your cryptocurrency wallet. That’s why it’s crucial that you write down your security passphrase by hand and keep it somewhere secure. If you store your tokens off-exchange, it’s also a good idea to store them in a cold storage wallet or a piece of hardware (i.e., USB stick or hard drive).

If the security protocols involved in maintaining a crypto investment account sound too complex, don’t worry. Your other option is to simply invest through a third-party custodian. Opening a Bitcoin IRA account can provide access to the cryptocurrency market while also adding a key layer of protection if you lose your access credentials. Essentially, it’s the perfect option for new or novice investors who might be too intimidated to invest otherwise.

Get Started With Crypto Today

Take your retirement savings to new heights. Start investing today in diversified assets, including cryptocurrencies and other investments that aren’t correlated to the stock market. This way, when the economy enters into the next recession—or, worse, a full-blown market crash like in 2008 or 2020—you can walk away with more of your money retained.

To get started, check out our comprehensive list of the best Bitcoin IRA companies. With a Bitcoin retirement investment account, you can let your digital currencies appreciate on a tax-free or tax-deferred basis—saving you potentially thousands on capital gains taxes.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,336.55

Gold: $3,336.55

Silver: $37.80

Silver: $37.80

Platinum: $1,337.40

Platinum: $1,337.40

Palladium: $1,124.21

Palladium: $1,124.21

Bitcoin: $117,645.06

Bitcoin: $117,645.06

Ethereum: $4,436.18

Ethereum: $4,436.18