10k Gold: When Will the Shiny Yellow Metal Hit 10k? 8 Experts Chime In

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 26th November 2021, 09:24 pm

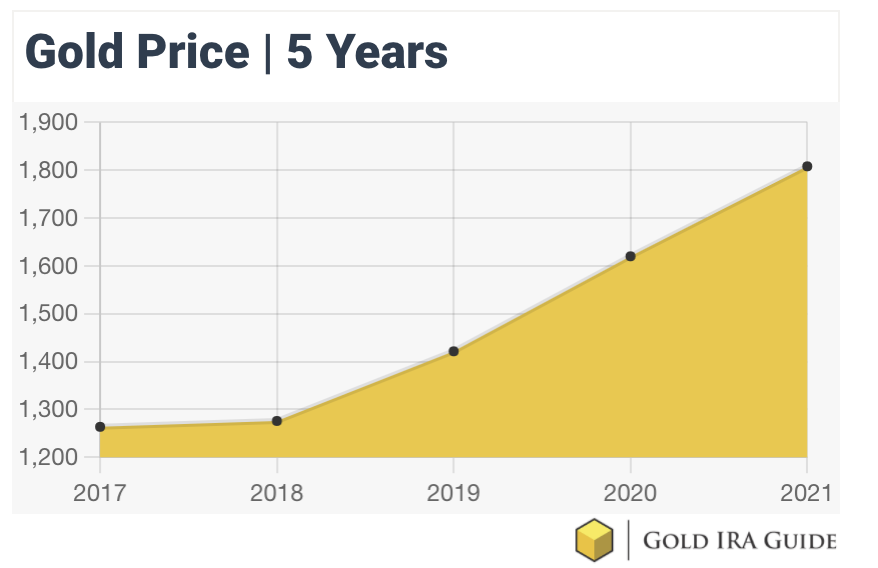

Gold has transfixed humankind for millennia. Casting its beguiling spell upon innumerable generations, the glittering precious metal has influenced and inspired everyone from rulers, to poets, to adventurers seeking their fortunes. This is especially true as of late, with the COVID-19 pandemic ushering in a rapid increase in the price of gold. Increasingly, savvy investors are investing in gold. Yet, the burning question remains – when will the shiny yellow metal reach 10K an ounce? In this article, 8 financial experts chime in.

Table of Contents

- 1) Expect Gold to Hit All-Time Highs Within the Next Few Years

- 2) Between $5,000 and $10,000 in the Next Few Years

- 3) Panic Buying, a Bull Market, and Loss of Confidence in the U.S. Dollar

- 4) Only if the Financial System Fails

- 5) Look More Externally Towards Global Economic Performance

- 6) $10,000 Per Ounce is Not Particularly Imminent for the Gold Price

- 7) Gold Will Push to This Level With the Maturity of its Industrial Uses

- 8) Economic Uncertainty and a Weak US Dollar Will Put Gold in an Uptrend

- 10k Gold Price Will Be a Reality

1) Expect Gold to Hit All-Time Highs Within the Next Few Years

We can expect gold to hit all-time highs within the next few years. We may see gold peak at around $3,000, thanks to inflation and a coming correction in the stock market. Gold is still the go-to hedge against inflation and a decline in the stock market. In just the last few months we're seeing an increase in interest with retail investors.

Will we reach $10,000 gold? It's possible, but understand that gold bulls have been predicting $5,000 to $10,000 gold since the 1970s. It just hasn't happened, and in my opinion, likely won't happen in the short term. The yellow metal's average annual rate of return since 1971 is roughly 10%. While past performance doesn't guarantee future results, we can conservatively predict that gold will not see major swings in either direction. Gold is considered a safe store of value that likely won't soar to $10,000, but also likely will not drop to zero.

It's a great idea to diversify with precious metals if you're worried about inflation or a market decline, but don't bet big on the advice of irrationally exuberant gold bulls and sensational headlines.

Ilir Salihi, Senior Editor, GoldIRASecrets.com

2) Between $5,000 and $10,000 in the Next Few Years

“There will be insufficient gold to meet demand. As a result, my business anticipates that the gold price will continue its relentless increase throughout the remainder of 2021, with very few significant corrections but with high volatility. $100 transactions in a single day are quite possible. As a result, gold is projected to reach a peak between $5,000 and $10,000 in the next few years.”

Shad Elia, Founder, and CEO, New England Home Buyers

3) Panic Buying, a Bull Market, and Loss of Confidence in the U.S. Dollar

“Massive global debt, money printing, and record inflation are what's keeping the price of gold suppressed. Gold can be pushed easily beyond $2,000 to up to $10,000. The three main drivers that we're going to see that are going to put the pressure on this are:

- A loss of confidence in the U.S. dollar.

- A simple continuation of this bull market in the stock market resulting in continued economic expansion.

- Panic buying in response to a new disaster where people are looking for a stable, proven asset as a safe haven.”

Terry Sacka, AAMS, Chief Financial Analyst, Cornerstone Asset Metals

4) Only if the Financial System Fails

“I only see gold at $10k per ounce if the financial system fails. I, therefore, view it as an insurance product rather than an investment.

Although I do expect the value of gold to rise as the level of debt increases, I think it’s unlikely to reach this level unless the financial system essentially collapses.

I like to have some in my portfolio – just in case. But I have other assets as well.”

Simon Popple, Brookville Capital

5) Look More Externally Towards Global Economic Performance

“Gold has long been identified as a safe haven asset that investors use to protect their wealth from times of economic hardship both domestically and worldwide.

Although $10,000 per ounce seems like a figure that would require a significant price rally in the short term, we’re historically used to seeing the value of gold soar following a financial crisis. With this in mind, working out when gold may hit $10k could require looking more externally towards global economic performance.

In the wake of the 2008 crash gold more than doubled in value per ounce over a three-year run. Today, with record-breaking levels of inflation felt across the world and the ever-present threat of Evergrande defaulting on its financial commitments, we’re likely to see more investors turn to gold as a protective measure in an increasingly volatile market.

Whether the ongoing economic hardships are significant enough to inspire a rally towards $10k for an ounce of goal, however, remains to be seen.”

Maxim Manturov, Head of Investment Research, Freedom Finance Europe

6) $10,000 Per Ounce is Not Particularly Imminent for the Gold Price

“I don't think $10,000 per ounce is particularly imminent for the gold price. That level is likely at least 5 years away, perhaps 10 years out or more. But I have to qualify that forecast a bit. When gold has entered a big cyclical price rally in the past (e.g. following the last financial crisis, and during the late 1970s), it tends to do so over the course of about two years. Although those episodes have only come around about once per generation, it wouldn't be totally outside the realm of precedent for gold to rise 5x in price by 2023 or 2024 given those past experiences.

So the caveat here, is that the process of the wheels falling off the world economy (or the global financial system) would have to start fairly soon for gold to reach $10k within the next few years. Make no mistake, if and when gold reaches that price, it will almost certainly be amid some kind of crisis or panic. In my view, the onset of that kind of a calamitous economic downturn will probably be forestalled for a few years; so in that scenario, either gold won't begin its ascent to such high prices until the middle of this decade, or it will be a much more gradual process that plays out over the next 5–10 years.”

Everett Millman, Precious Metals Specialist, Gainesville Coins

7) Gold Will Push to This Level With the Maturity of its Industrial Uses

“It’s unlikely gold will reach $10k in the next several months. It will get to $3k in 18 months and that's with major resistance before it hikes up to $5k. That could take more than a year and then eventually $10k. It’s a well-known safe haven investment prone to acting positively in times of uncertainty and market volatility like we’re seeing now. It is viewed as an asset that holds no liability, adding to its ability to mitigate risk.

One of the major shifts that will push gold to this level is the maturity of its industrial uses. Gold has been known for having only two major utilities: as an investment and pieces of jewelry, but we’re starting to see gold being used in electronics, phones, cellphones, data centers, and healthcare. As the world shifts to remote working and lifestyle changes, people will be counting more on electronic devices and computers to keep them connected. All these devices need gold.”

Collin Plume, CEO, Noble Gold Investments

8) Economic Uncertainty and a Weak US Dollar Will Put Gold in an Uptrend

“Gold will definitely reach 10k an ounce for a number of reasons, but primarily for these two:

Inflation is at its highest in years, and the threat of inflation will boost gold's appeal as a hedge. Because of scarcity, gold’s value will rise with continued inflation. A weak US Dollar will put gold in an uptrend.

Historically, gold has increased its value during periods of market and economic uncertainty and downturns. Looking at macro-environmental trends, a market or economic downtown is very probable, which will boost gold’s value. Additionally, there are currently a few geopolitical risks, and political uncertainty may send more inflows into gold, increasing its value.

Andrew Lokenauth, Fluent In Finance

10k Gold Price Will Be a Reality

Including gold in one’s portfolio is an excellent means of diversification. One of the easiest ways to invest in gold is via a retirement account like a Gold IRA. These types of accounts enable the average investor to hold physical gold and other precious metals as protection against inflation, coupled with efficient tax treatment on the assets. Learn more about your options within this space by having a look at our reviews for the Top Gold IRA companies.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,355.86

Gold: $3,355.86

Silver: $38.41

Silver: $38.41

Platinum: $1,468.02

Platinum: $1,468.02

Palladium: $1,286.05

Palladium: $1,286.05

Bitcoin: $117,749.21

Bitcoin: $117,749.21

Ethereum: $2,952.91

Ethereum: $2,952.91