10.8% Of Americans Own Gold, While 11.6% Own Silver, According To A New Survey

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 19th May 2023, 10:04 pm

For the past two years, we've set out to answer the question: how much gold does the average American own?

In 2019, we conducted a survey on gold and silver ownership asking 1,500 American respondents if they owned any gold or silver coins or bars. Now, a year later with a decidedly different world, we conducted a similar survey asking 1,500 US respondents if they owned any of the precious metals, with some compelling results.

Based on the results from the 2020 survey, the overall percentage of gold and silver ownership has dropped somewhat amongst the American population. Yet, given the onset of the global COVID-19 pandemic, it could be an indication that the average American may be refraining from investing amid unparalleled economic uncertainties.

However, compared to the results from our 2019 survey, younger Americans now seem more inclined to embrace gold and silver ownership. Millennials comprised the largest demographic of respondents who indicated that they owned gold or silver, or both in 2020. Curiously in the 2019 survey, older Americans were most inclined to invest in the two precious metals, evidence of a shift in sentiment amongst the demographics.

For the summer 2020 survey, we used Google Surveys and targeted 1,500 males and females between the ages of 18 to 65+ from coast to coast. We asked the following question with several possible responses:

Do you own any gold or silver (coins/bars)?

- I don't own either.

- I own both gold and silver.

- I own some silver. No gold though.

- I own some gold. No silver though.

(Note that, as of 2023, gold demand is currently at multi-year highs—especially among institutional investors and central banks. Given the strength of gold, it's likely that gold ownership is even higher in 2023.)

Table of Contents

- The Average American Does Not Own Any Gold or Silver, Especially Middle-Aged Women Between 45 And 54 Years Old

- Millennial Investors Own Both Gold And Silver, Especially Males between 25 and 34

- Males Between 18 And 24 Years Old Are Most Inclined to Own Silver

- Females Between 25 and 34 Years Old Are Most Inclined to Own Gold

- Conclusion

- Details About The Study And RMS Score

The Average American Does Not Own Any Gold or Silver, Especially Middle-Aged Women Between 45 And 54 Years Old

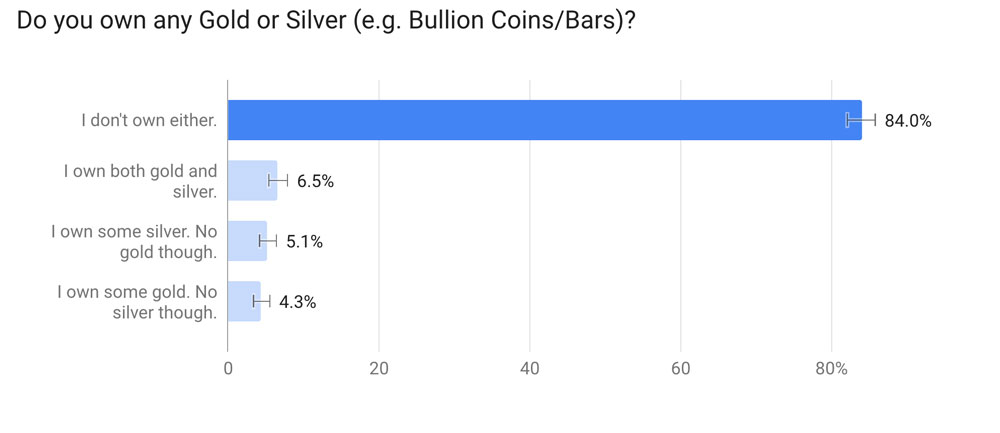

The overwhelming response from participants, at 84%, was that they owned neither gold of silver.

However, compelling insight was revealed when demographic filters were applied to the results targeting gender. When females were specifically factored, the percentage increased to 88.1%. It rose to 89% with middle-aged women between 45 and 54 years old. Thus, this cohort represented the largest percentage of participants who indicated that they owned neither of the precious metals.

Conversely, when demographic filters were applied factoring specifically males, the percentage dropped to 79.7%. In addition, when the focus was placed solely on male Millenials between 18 and 34 years-of-age, the percentage decreased further to 74.5%. Therefore, this demographic had the lowest percentage of respondents who indicated that they did not own either of the precious metals.

Suffice it to say, the global COVID-19 pandemic has ushered the world into wholly unprecedented times. The economic repercussions of the pandemic, alone, have been felt across the US and around the world. Thus, the unparalleled uncertainties we are collectively experiencing appear to have made American investors even more risk-averse than presumed – even for an asset like gold which, historically, has been regarded as a hedge against economic turmoil.

Millennial Investors Own Both Gold And Silver, Especially Males between 25 and 34

The next most popular response, garnering 6.5%, were those who owned both gold and silver bullion bars or coins.

Yet, curious insight was revealed when demographic filters were applied to the results, targeting solely Millenial participants. 7.5% of the survey respondents between 25 and 34 years old indicated that they owned both gold and silver. When males from this age bracket were specifically targeted, the percentage soared further to 10.9%. Based on the results, Millennial investors specifically appear to be turning to alternative assets like precious metals as a hedge against these present economic uncertainties.

For investors who are inclined, precious metals such as gold and silver can make a good addition to a diversified portfolio.

Males Between 18 And 24 Years Old Are Most Inclined to Own Silver

Of the respondents, 5.1% stated that they owned some silver, but no gold.

However, when demographic filters were applied to the survey results factoring only males, the percentage increased to 7.4% – making this the second most popular response amongst all male survey participants. Interestingly, when demographic filters were applied factoring specifically males between 18 and 24 years old, 10.7% gave this cohort gave this response. It would appear that young male Millenials are most inclined to invest their money in silver as a hedge against these tumultuous times.

Curiously, when females from the 18 to 24 cohort were specifically targeted, only 2.2% of those participants said they owned silver, but no gold. This was the least popular survey response for this demographic.

Females Between 25 and 34 Years Old Are Most Inclined to Own Gold

The final group of survey participants, 4.3%, stated that they owned gold, but no silver.

Yet, compelling insight was gained when demographic filters were applied targeting females between 25 and 34 years old – 5.8% of respondents within this cohort indicated that they owned only gold. Not only was this the demographic with the highest percentage that indicated that they invested only in gold, but it was the second most popular survey response amongst them as well.

Conclusion

Amid economic uncertainties, precious metals such as gold and silver can prove to be a good hedge for a diversified portfolio. Yet, it is imperative to do your due diligence prior to investing in either of these precious metals. Moreover, it is highly advisable to only allot a small percentage of a portfolio to precious metals.

Based upon the results from this 2020 survey, the combined total of American investors who own gold and silver is 10.8%, and 11.6%, respectively. Specifically, Millennials now comprise the largest demographic who seem most inclined to invest their money in the two precious metals. At present, young males between 18 and 24 years old are most inclined to own silver. Conversely, older Millenial females between 25 and 34 are most likely to invest in gold.

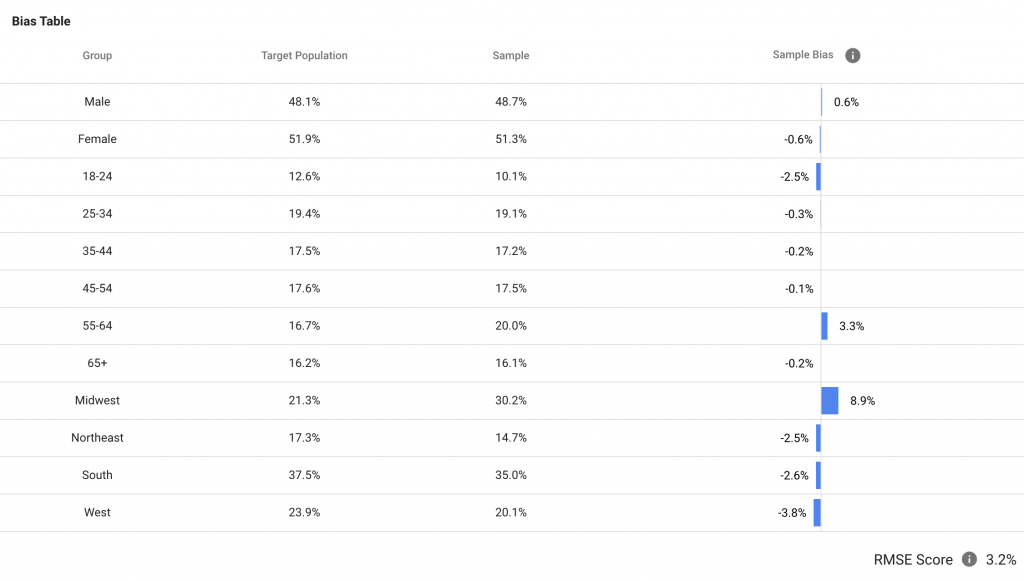

Details About The Study And RMS Score

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $5,142.84

Gold: $5,142.84

Silver: $87.50

Silver: $87.50

Platinum: $2,149.20

Platinum: $2,149.20

Palladium: $1,735.87

Palladium: $1,735.87

Bitcoin: $63,192.02

Bitcoin: $63,192.02

Ethereum: $1,823.89

Ethereum: $1,823.89

Hi Sarah,

I was reading your article above I tried everyone in that field to ask them if this is the case above for the USA, what would it be for the UK and all around the world the reason I Am asking you is apparently- i am in the 1% on gold in the world and 15% on silver if I am trying work out my next move myself, I assume its the same for the UK those statistics, I am looking to go for some Crypto’s as well I really hip you can give me some insight on the above thanks..

Kind regards,

Mark

Hi Mark, we haven’t done a study for the UK but one can assume that the numbers would be similar, given the cultural/political similarities between both the U.S. and UK. For crypto companies, please look at the top crypto IRA page here: https://goldiraguide.org/top-bitcoin-ethereum-ira-companies/

Thank you for your comment.

What are these people saying now???? The times are achanging!!

Hi Ralph, that number is much higher in 2026. See this more recent study.

Thanks