Wealthfront Review

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 25th March 2023, 12:32 am

- Phone : (650) 249-4258

- URL :

- Global Rating

- Good

User Rating

- 0 No reviews yet!

Wealthfront offers a smart and diversified assets under management program, but it is far from perfect. They have a limited algorithm-based set of ETF's that they will put your money in, and you can not change their mix of choices. Their fees are among the lowest in the business if you can be content with letting their computer handle your investment selection.

Pros:

- Easy way to manage personal investments.

- Risk tolerance level gauge that give you a risk scale tolerance of from 1 to 10.

- Allows you to change your survey answers to see how this would alter your recommendations.

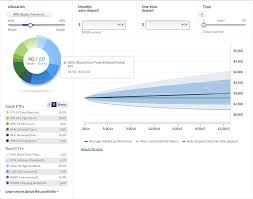

- Provides you with a graph showing their recommended mix of assets' performances versus the underlying asset classes.

- Estimate your chances of gains versus losses, using the historic volatility of the underlying components of your personally recommended portfolio during up to 10 years.

- Supports traditional IRAs, SEPs, Roth IRAs, and SEP IRA accounts.

Cons:

- Other accounts are not supported by Wealthfront – the algorithms of Wealthfront are good, but they are unable to take accounts at other brokers into consideration when they come up with your personal portfolio. Wealthfront is not the only personal financial app and automated money manager that has these problems.

- Inability to customize – Wealthfront’s algorithms will choose a mix from the same 5-6 ETF’s as they do for all of their clients. It is irrelevant to them if you do not want any real estate holdings within your IRA account. Their recommendations are good, but you can not adjust an algorithm or its authoritarian asset allocation programming.

- You can not hold cash in your accounts – the algorithm will place all of your money into its proprietary mix of ETF’s for stocks and bonds. You can not be conservative and go to cash like the big money managers do in unsafe points in the markets. This makes Wealthfront a poor choice for you if you are retired and may need all or part of your money soon or you are seriously risk averse.

Among the growing number of robo advisors in the personal financial apps space today, Wealthfront proves to be one of the biggest and most successful. They measure their success in more than $2.7 billion of customer assets under management. The company has achieved this level of success by merging the best features of their strenuous investment research with the latest in modern technology in order to create tax efficient, reasonably priced, and well-diversified index ETF portfolios. In other simpler words, Wealthfront now ensures that it is so much simpler for individuals of any income and asset level to gain access to a diversified, sophisticated, and longer time frame type of investments portfolio so that they do not have to pay the old school wealth managers' astronomic fees and meet their steep account minimums.

Wealthfront accomplishes all of this without charging commissions for trading. More impressively, their service is totally free of charge for any account that comes in at less than $15,000. Accounts that are bigger than the $15,000 threshold pay a low flat management fee of .25% per annum.

Wealthfront Intro and Background

Although Wealthfront only hails from December 2011, it achieved the significant milestone of $1 billion of customer assets under management in only 2 and 1/2 years. This is because of their highly trained, skilled, and experienced management team. The CEO is Adam Nash, a leader from Greylock Partners, eBay, and LinkedIn fame. The Executive Chairman is Andy Rachleff, faculty member of the Stanford Graduate Business School and a cofounder of investment company Benchmark Capital. Among the qualifications of the investment advisors team are more than 7 Ph.D.'s and a raft of impressive credentials.

Wealthfront Tools and Features

Wealthfront prides itself on its one of a kind tools and features that target better after tax returns for its investors. Among these tools are:

Different Types of Taxable Asset Mixes – Wealthfront understands and pursues a different strategy of assets for retirement accounts than it does for taxable ones. They would place municipal bonds in taxable accounts, but corporate bonds in retirement accounts.

Variety of Index ETF's – Because ETF's turn out to be far more tax efficient investments than do mutual funds, Wealthfront pursues Index ETF's. These carry significantly lower ratios of expenses and create very little tax liability since they feature limited turnovers. Through a careful and strategic combination of different types of ETF asset classes and holdings, investors with Wealthfront are capable of possessing parts of literally thousands of securities that span the world economy for an extremely minor cost.

Automatic Rebalancing Services – Wealthfront's system and platform makes it a point to maintain your asset allocation. We love this feature of the service as it ensures that you do not become skewed in your exposure to stocks, bonds, real estate, metals, or other asset classes as investment values and reinvestment causes your allocation mix to change over time. The company is careful to rebalance as tax efficiently as possible. They do this through the twin strategy of:

- Smart Dividend Reinvestment– A main feature of their rebalancing program is to reinvest all of the paid out dividends directly into the underperforming asset classes. This efficiently keeps the asset allocation level.

- Cash Flow Reinvestment– When you deposit additional funds to your Wealthfront account, it permits them to invest these new funds into the underperforming assets in order to readjust the asset class mix without having to resort to tax inefficient selling of outperforming assets.

Wealthfront Interface Screenshots

Wealthfront Tax Loss Harvesting Strategies

You could say that Tax Loss Harvesting is something of a special interest pursued by Wealthfront. They have even penned several white papers on the subject. Their ultimate conclusion, supported by the research and evidence, was that using Wealthfront's Tax Optimizing Direct Indexing feature and their service for Daily Tax Loss Harvesting can increase your annual returns on investment by as much as 2.03%. On a more significant sized account, we would hardly call over 2% chump change.

Direct Indexing for Tax Optimization – For any clients who maintain over $100,000 in balance under management, Wealthfront promises to set up your own portfolio of indexes that delivers improved tax loss harvesting. They do this by purchasing as many as 1,000 different individual S&P 1500 stocks.

Daily Basis Tax Loss Harvesting – There is no minimum balance on your account to avail yourself of this free feature. In this helpful service, Wealthfront uses tax loss rules to sell investments that have declined in value so that you are able to take write offs on the losses against your taxable income. This reduces your overall tax amount due. Wealthfront will then simply reinvest the money in another investment option that is greatly correlated so that your asset mix remains the same.

Wealthfront Fees

The advisory service at Wealthfront costs around .25% per annum, but this fee only applies to assets under management that are in excess of $15,000. We love that your first $15k is management fee free. This is a feature that you do not find just anywhere.

There are no other commission fees or service fees charged by Wealthfront besides the .25% management fee. You will never pay custodian fees, trade commissions, or account closing fees. The ETF's do charge something for owning them, however. THe cost for these holdings is typically between .10% and .15% per year, on top of Wealthfront's .25% management fees. You are still looking at between .35% and .40% total management and trading costs, which is astonishingly good for proven and professional money management services.

Wealthfront Safety and Security

We have examined a number of security apparatuses over the years and not seen many that are as thorough as Wealthfront's safety and security procedures. They keep your money and personal information both safe by providing:

SIPC Insurance – Your account is covered by government insurance for as much as $500,000 of securities for every kind of account you have at Wealthfront. SIPC further protects as much as $250,000 of cash. An IRA account is considered a different type of account from a regular taxable one. Beyond this amount, Apex clearing has purchased an additional $150 million of insurance coverage for its clients assets.

Independent Custodian – Apex Clearing, a third party independent custodian with no ties to Wealthfront, holds all of your assets in its vaults. The company is unable to reach or use your money, and can only give trading directions for your account. Only you can withdraw funds from or deposit funds to your personal account.

Zero Rehypothecation – No margin accounts are held by Wealthfront or its clients. There is zero possibility of your securities or cash being borrowed by or loaned out by either Apex or Wealthfront.

Zero Proprietary Trading – Apex Clearing, Wealthfront's brokerage partner, does not engage in any proprietary trading for itself.

Final Words on Wealthfront

In the end, Wealthfront comes up with your recommended portfolio mix as a result of answers you give to their risk tolerance queries. They then recommend an asset allocation mix according to their six preferred classes of assets:

- American Stocks

- Developed Market Stocks

- Developing Market Stocks

- Natural Resources

- Real estate/REITs

- Bonds

Wealthfront tends to prefer ETF's from the Vanguard family. In natural resources, they instead utilize iPath's DJP ETN. If you can live with their limited and static categories of ETF's, then you will be fine with the experienced professionals at Wealthfront asset management.

- Phone : (650) 249-4258

- URL :

- Global Rating

- Good

User Rating

- 0 No reviews yet!

Wealthfront offers a smart and diversified assets under management program, but it is far from perfect. They have a limited algorithm-based set of ETF's that they will put your money in, and you can not change their mix of choices. Their fees are among the lowest in the business if you can be content with letting their computer handle your investment selection.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,334.85

Gold: $3,334.85

Silver: $37.99

Silver: $37.99

Platinum: $1,342.28

Platinum: $1,342.28

Palladium: $1,133.37

Palladium: $1,133.37

Bitcoin: $116,746.81

Bitcoin: $116,746.81

Ethereum: $4,799.84

Ethereum: $4,799.84