US Dollar Confidence Survey: More Than 68% of Consumers Age 55+ Have Lost Confidence in the Dollar

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 11th April 2023, 04:40 pm

Table of Contents

- “Given the current state of the economy, national debt and Fed's policies, how confident are you in the future of the dollar?”

- Retirees and High Income Earners Are the Least Confident in the Dollar

- Dollar Confidence Higher in Urban Areas – Cities Creating Economic Optimism

- Regional Differences in Dollar Confidence

- Political Orientation and Dollar Confidence – Living Up to the Stereotypes

- Gender-Based Differences

- Other Key Insights

- Important Stats About Our Survey

- General Consensus – The Dollar is Risky

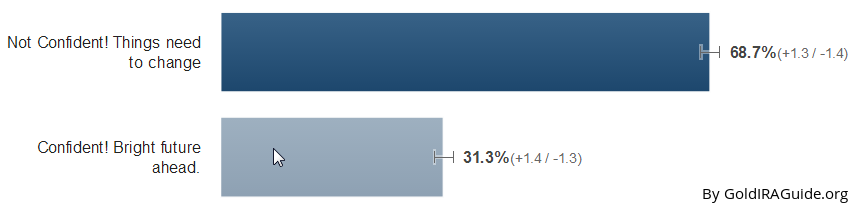

“Given the current state of the economy, national debt and Fed's policies, how confident are you in the future of the dollar?”

Methodology: Conducted by Google Consumer Surveys for GoldIRAGuide.org, September 02, 2014 – September 15, 2014 and based on 4,639 online responses. Sample: General U.S. Population filtered to 55+ year-olds.

Methodology: Conducted by Google Consumer Surveys for GoldIRAGuide.org, September 02, 2014 – September 15, 2014 and based on 4,639 online responses. Sample: General U.S. Population filtered to 55+ year-olds.

As you can see, more than two thirds of the 55+ demographic are pessimistic about the future of the dollar. In the paragraphs below we'll take a closer look at some of the more detailed insights provided by the survey.

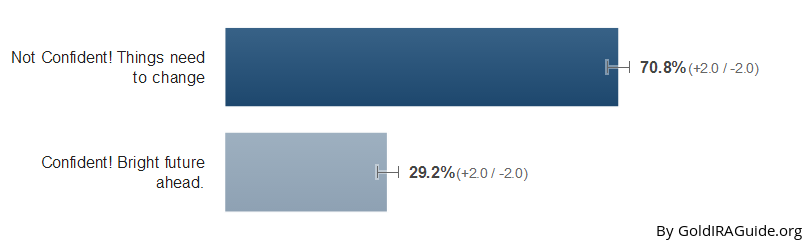

Retirees and High Income Earners Are the Least Confident in the Dollar

Retirees and high-income earners seem to be the least optimistic about the dollar's future. More than 70% of the 1,971 poll participants in the 65+ age group (mostly retirees) chose the “Not Confident” answer:

Poll Results for 65+ Demographic

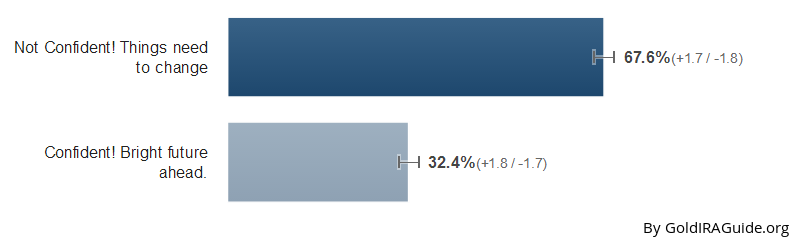

Now let's compare those stats to the age 55-64 demographic results (more than half of the survey participants fall within this age group):

Poll Results for 55-64 Demographic

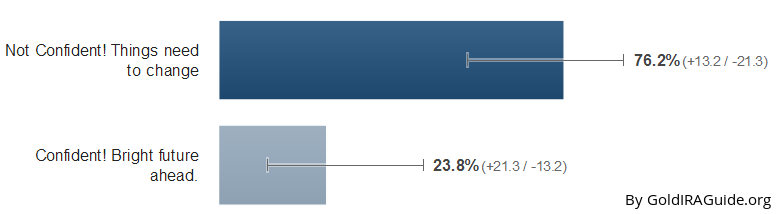

High-income earners are even less confident in the dollar:

Poll Results for High-Income Earners ($150k+ Per Year)

What we can gather from the above data is that individuals who have amassed more wealth and financial experience tend to lean towards the opinion that the dollar is headed downhill.

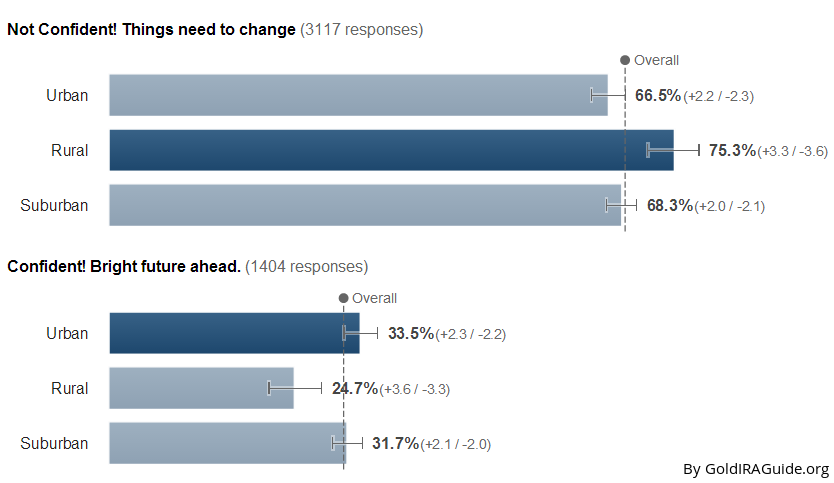

Dollar Confidence Higher in Urban Areas – Cities Creating Economic Optimism

The survey indicates that individuals in dense urban areas tend to be more confident in the dollar than people in suburban and rural areas:

There are a number of sociological and psychological factors that most likely influence these distinct viewpoints within each type of societal environment. First, people in urban areas tend to witness, and partake in, a higher volume of financial transactions. Frequent purchases are easily observable in urban shopping malls and plazas.

Furthermore, other aesthetic and architectural features like office buildings, department stores, and newer vehicles tend to give the impression of a thriving economy within bustling cities, thereby instilling an inflated sense of economic optimism in people who live and work in densely populated urban areas. While consumer spending is alive and well in the city, in rural areas the scene is much less glamorous, with small shops and local businesses comprising most of the economic landscape.

In addition to living in a slower financial environment, most investors in rural areas also tend to carry a different political and social perspective, with conservatism being a more popular theme, and self-sufficiency related hobbies like hunting and fishing being common activities. All of these factors likely influence the rural investor's mindset and willingness to depend on the dollar.

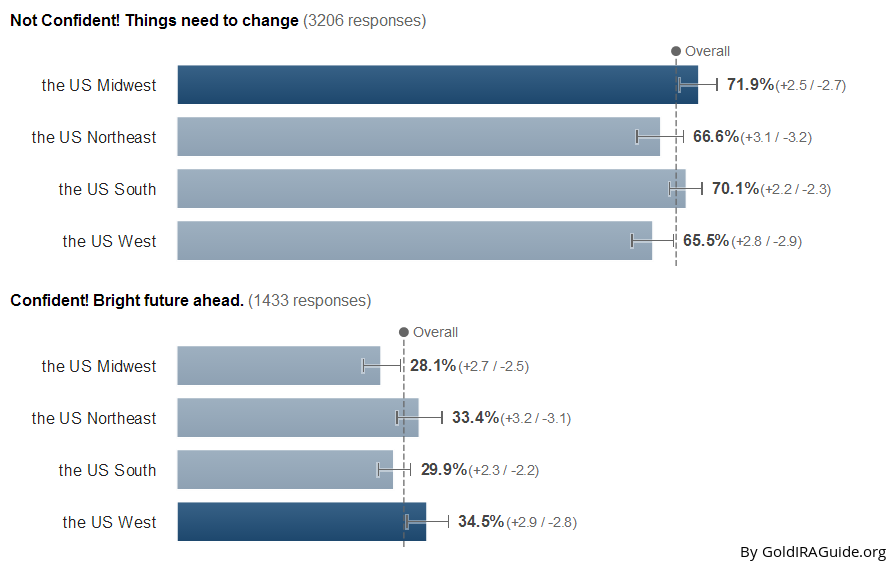

Regional Differences in Dollar Confidence

The survey shows that people in the Midwestern US are least confident in the dollar, while people in the Western US have the highest dollar confidence:

Political Orientation and Dollar Confidence – Living Up to the Stereotypes

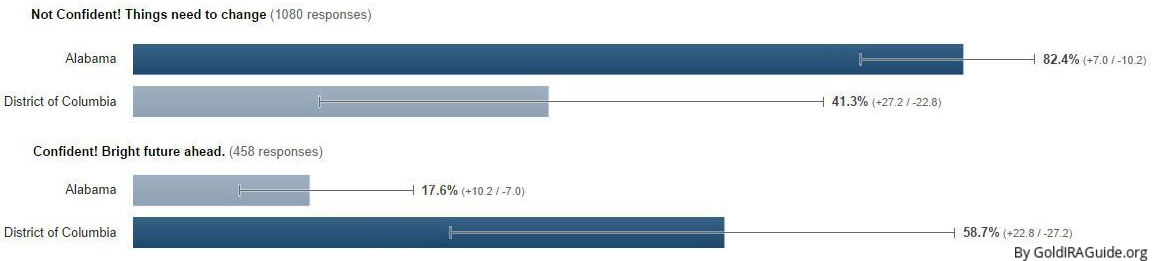

Respondents in the politically-charged, primarily Democratic state of Washington D.C. showed the most faith in the dollar at 58.7% confidence, making it the only state in which a majority of the respondents expressed dollar confidence. Meanwhile, the highly rural and historically conservative state of Alabama showed the least faith at only 17.6% confidence.

The District of Columbia is predominantly a blue state, with 75% of the voters there affiliating themselves with the Democratic Party. Alabama has been mostly Republican for a long time, and is the most populous Republican state in the country. McCain won the vote there in 2008 and Mitt Romney took the majority vote there in 2012.

In our survey both of the aforementioned states lived up to their stereotypes, with Republicans in Alabama reluctant to trust the current Obama-led administration and its direction of the economy, and the Democrats in D.C. holding the opposite standpoint. This comparison is probably the clearest indicator that urban density and political orientation are the two biggest factors that influence dollar confidence:

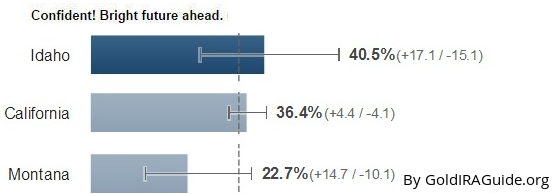

But rural setting does not always equate to lower dollar confidence, as many sparsely populated states have comparable or even higher dollar confidence than their more rural counterparts. For example, in the Western US the highly rural state of Idaho has higher dollar confidence than the much more populated state of California, while Montana lives up to the rural stereotype with a very low dollar confidence:

Based on the above comparisons, we can conclude that political orientation is the most important influence on a region or state's overall confidence in the dollar and the financial system as a whole, even more than rural or urban setting. It appears that the correlation between rural setting and low dollar confidence has more to do with the fact that rural areas tend to be predominantly conservative and Republican.

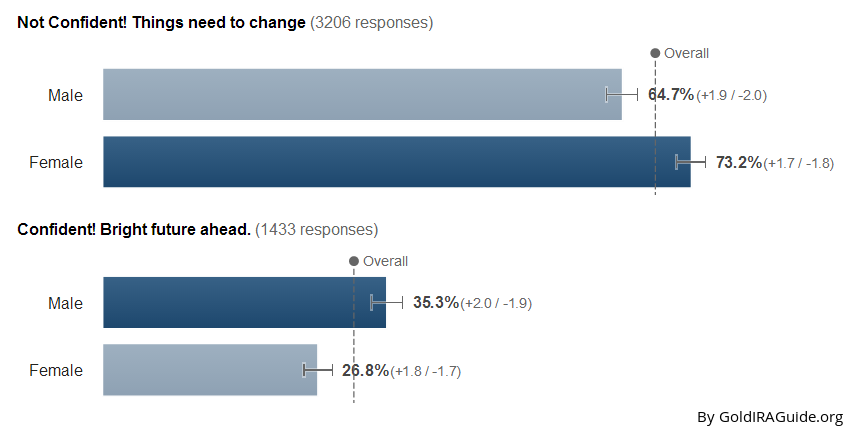

Gender-Based Differences

The survey also showed that females have significantly less trust in the dollar than males do:

Several studies have shown that women tend to be more cautious with their finances than men. The fact that females typically take a more conservative approach to investing is not surprising, as characteristically women are naturally inclined to be more protective than aggressive, in contrast to the stereotypical risk-taking male figure. A stubborn skeptic could argue that this conclusion is nothing more than a sexist opinion, but it is impossible to deny that most females have protective maternal instincts, and these personality traits may play a role in financial decision-making as well. An alternative explanation for the cautiousness of female investors is that women on average have less money to invest than men, and are therefore more likely to be careful and selective with every investment.

Other Key Insights

In addition to the revelations above, the survey also provided the following key insights:

- Urban density had the biggest impact on dollar confidence in the Southern US, with 34% of Southern urban respondents expressing dollar confidence and only 21% of Southern rural respondents expressing confidence.

- Rural respondents in the Southern US earning between $25-49k per year showed the lowest confidence in the dollar, with 21% of 930 respondents choosing the “Confident- Bright Future Ahead” option.

- While females are less confident in the dollar than males, the least confident females are those in the 65+ age bracket earning between $50k-74k, with 76% of them answering “Not Confident – Things need to change.”

- Suburban correspondents in the Midwestern US were much more confident (at 31.7% confident) than rural correspondents in the same region (only 20.9% confident).

- Alabama, South Carolina and Nebraska are the least confident states (82.4%, 82.2% and 81% having respectively answered “Not Confident!Things need to change!”), while DC expressed the most confidence out of all 50 states. (58% having answered “Confident! Bright future ahead”)

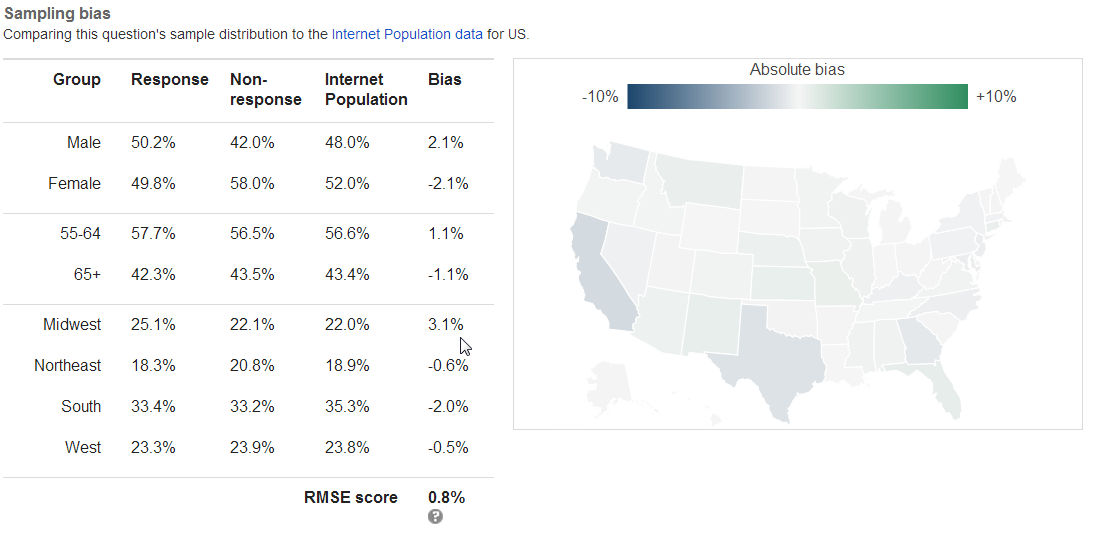

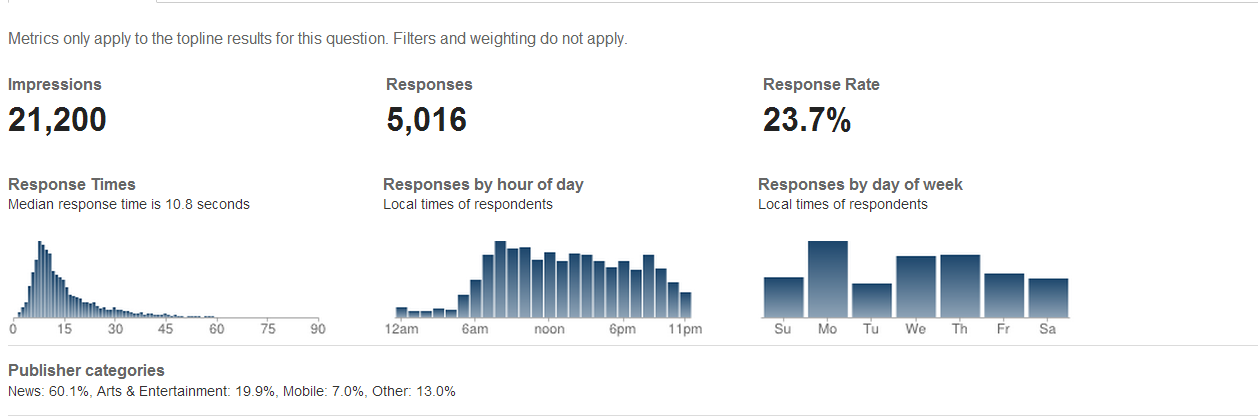

Important Stats About Our Survey

For the advanced stat crunchers out there, here's some more information about the statistical significance of our “US Dollar Confidence” study:

Sampling Bias:

Response Metrics:

Note: although we got a total of 5,016 responses, only 4,639 were analyzed for this survey, as results were weighted by inferred gender, age and geography to make the sample as representative as possible of the U.S. population.

General Consensus – The Dollar is Risky

The primary takeaway from this survey is that the most mature (65+), wealthy ($150k+ earners), and cautious (female) groups have the lowest overall confidence in the future value and stability of the US dollar. The poll results simply confirm what many of us already know to be true:

Most investors feel that the US dollar is declining, and unless significant changes are made, it is likely that it will either completely collapse or experience a major devaluation within the next decade.

So what's the best course of action for people who have stored most of their retirement savings in dollar form? Financial experts and advisers recommend converting at least 5%-20% of your overall assets into precious metals, which retain (and typically gain) value, especially in times of economic turmoil.

When fiat currencies like the dollar start to show signs of devaluation or collapse, the first thing most investors will do is convert a large portion of their cash assets into precious metals and other commodities. When this happens the demand for such metals will increase exponentially, causing prices to skyrocket. A historical example of this can be seen in the global financial crisis of 2008 and the recession that followed. In just three years the price of gold more than doubled, from about $800 per ounce in August, 2008 to about $1900 per ounce in August, 2011.

In other words, when the dollar declines in value, precious metals increase in value. If you're saving for retirement in a 401k or other account that stores your assets in dollar form, your best bet would be to take some advice from the other retirees that participated in this US Dollar Confidence survey – stop trusting the stability of the dollar and start looking for ways to protect your assets.

The best way to convert your retirement savings into precious metals is to rollover your existing retirement account into a self-directed precious metals IRA (individual retirement account). To learn more about precious metals IRAs, see the following resources:

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,408.31

Gold: $3,408.31

Silver: $38.91

Silver: $38.91

Platinum: $1,356.66

Platinum: $1,356.66

Palladium: $1,114.94

Palladium: $1,114.94

Bitcoin: $112,480.93

Bitcoin: $112,480.93

Ethereum: $4,502.64

Ethereum: $4,502.64