Unfolding Banking Crises in Italy and China Pose Great Risks

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 30th December 2019, 12:44 pm

In the past few weeks, the extent of the unfolding banking crises in both Italy and China has become more apparent. In mid-December, the Italian government found itself forced to save the struggling southern lender Banca Popolare di Bari. The bank is receiving a substantial 1.5 billion euros in aid from two major sources. Meanwhile, China also had to participate in its largest regional banking bailout recently. Signs of severe banking strain in two of the largest economies in the world are cause for concern about the global economy.

Italian Public Institutions to Save Banca Popolare di Bari in Italy's Largest State Bailout So Far

Italy's government is using several of the country's public institutions to save the failing Banca Popolare di Bari. These include a state-operated and -owned bank MCC Banca del Mezzogiorno-Mediocredito Centrale and the Italian deposit guarantee fund FITD the Fondo Interbancario di Tutela dei Depositi. The MCC will deliver 900 million euros in capital to the Bari bank with most of the rest expected to come form the FITD. Together they will recapitalize the ailing lender with approximately 1.5 billion euros.

Italy's Largest Bank Bailout Reveals Extent of Problems

Popolare di Bari has several features that made it critical to save. The bank is the largest lender in Southern Italy. Its operations are critical for helping development in the disadvantaged southern part of the country to continue. This explains why Rome was desperate to pass the emergency measures that allowed them to inject 900 million euros (or $992 million) of government money directly into the institution.

This capital injection is moving through the state intermediary regional development Banca del Mezzogiorno-Mediocredito Centrale on its way to save Popolare di Bari. Mediocredito is deploying 500 million worth of the euros now to purchase shares in a capital raising at Popolare. The remaining 400 million euros is being put to the side for additional needs in the future, according to an Italian government source.

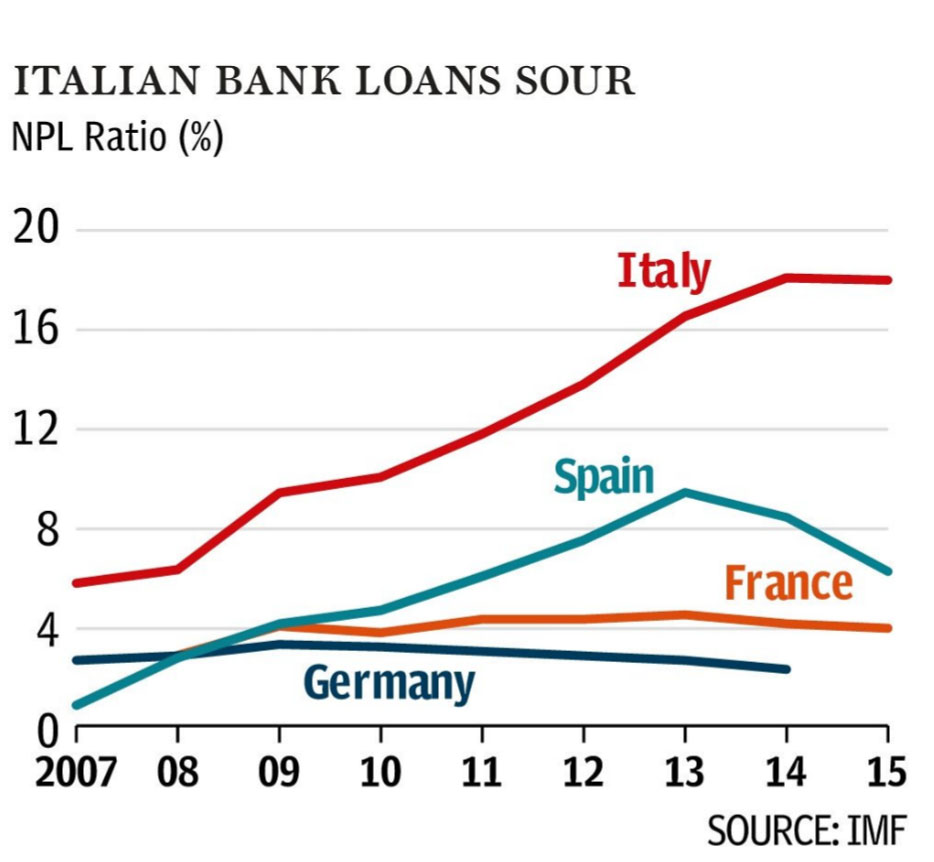

The additional 600 million euros is ultimately coming from the rest of Italy's banks in the form of the national deposit guarantee fund the FITD. The fund has been busy lately, having just financed Carige of Genoa's rescue package. This chart below shows the percentage of Italian non-performing loans versus other major European countries:

EU rules make it difficult for Italy to intervene in its troubled banks with public finances, but Popolare di Bari's problems could not be ignored. Their troubled debts had risen from 13 percent of all lending back in year 2011 to 23 percent of lending totals for this year. The Bank of Italy argued that with a 10 percent market share in southern Italian regions Apulia, Abruzzo, and Basilicata and clientele that included fully 100,000 local firms, the region could not bear its failure. The Bank of Italy warned that this crisis has the potential to sap confidence in other regional Italian banks, with:

“The impact would be significant… and the weak local economy would also struggle to cope with any job losses.”

Italy Not the Only Major European Country Bailing Out Banks

The Italians had to rely on partial rescue funds from the FITD contributions in order to meet the tough newer EU state aid regulations, according to Regional Affairs Minister Francesco Boccia:

“The measures chosen… allow us to meet all EU rules.”

Italy is not the only major EU country that has just rescued one of its banks either. Germany saved its bank NordLB in December as well. Brussels approving this NordLB bailout gave Italian officials the confidence that Italy will gain still more flexibility with the state aid rules in helping its many troubled banks.

Italy has struggled to work with these new “bail-in” regulations in addressing a number of bank crises over the last year. The rules state that investors in the banks have to suffer losses before state money can be deployed. This has caused Italy enormous difficulties as thousands of smaller savers had invested their funds into shares and bonds of the local banks, many of which are in trouble.

The government in Rome has poured around 20 billion euros into its ailing banks since year 2015. Italy has managed to somewhat limit its smaller retail investors' losses in the institutions by receiving EU approval to use compensation plans or by winding up many smaller lending institutions using Italian liquidation rules.

Some of the struggling Italian banks' problems come from their participation in saving still other struggling banks over the past years since the Global Financial Crisis. Popolare di Bari and its clients had paid for most of the rival bank Tercas rescue back in 2014-2015. Popolare financed the majority of the 550 million euros in capital Tercas received, according to the Bank of Italy. Many regional banks like Popolare di Bari never were able to recover from the most serious post-Second World War recession that hit the country. Thousands of businesses went bankrupt, leaving banks with enormous piles of loans that were never repaid.

Chinese Banks Are Also In Trouble Now

The world's second largest economy China is also showing signs of severe stress with its banking system. Per the PBOC Peoples' Bank of China “2019 China Financial Stability Report,” an incredible 586 of the total 4,379 Chinese lending institutions are officially considered to be “high risk.” It is worth noting that China's government is rarely transparent. When the nation's regulators actually publish problems on their own banking system, it means they are severe indeed.

How Serious Is the Problem With Chinese Banks?

This figure may not even expose the full extent of the country's banking problems today. This 2019 China Financial Stability Report argues that more than a third of all its rural lenders are in the “high risk” category. The dearth in confidence is starting to contribute to bank runs around China now.

It was only in November that both Yichuan Rural Commercial Bank of Henan Province and Yingkou Bank of Liaoning Province suffered bank runs. Back in May, Beijing assumed control over Baoshang Bank of Inner Mongolia. This represented the first time that the government had nationalized a privately run financial institution in over 20 years.

The country also organized a three state-owned bank bailout of the Bank of Jinzhou back in July. Now the Middle Kingdom has assembled another consortium to save Hengfeng Bank of Shandong Province. This cost $14 billion to save a tiny Chinese regional lender.

Chinese Banking Insolvency Could Run in the Trillions

With an additional 585 financial institutions besides Hengfeng Bank that are classified as “high risk” by the national banking regulator, the Chinese problem could amount to trillions of dollars. Today's China banking system is massively greater than all other banking systems on the planet, even than the one in the U.S.

Consider that the banking system of China is today about $40 trillion. This is over two times bigger than the American banking system, per data obtained from the Federal Reserve Bank of St. Louis. More ominously still, China's enormous banking system is over three times as large as the entire national economy. This means that a tiny percentage of banks in China needing a bailout would create a cascade of economic impacts. Only five percent of the Chinese banks needing to be bailed out would equal 20 percent of the country's entire GDP. Not even China can bail out this enormous percentage of GDP.

With China as a critical planetary growth engine, major economic and banking disruptions would likely cause the rest of the world to fall into recession. Unfortunately the news this month from Italy and China shows why gold makes sense in an IRA. One way to diversify your retirement assets away from investments sensitive to banking problems is by purchasing IRA-approved precious metals. You can read all about Gold IRA allocation strategies and Top Gold IRA companies to learn more.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,623.09

Gold: $2,623.09

Silver: $29.51

Silver: $29.51

Platinum: $929.27

Platinum: $929.27

Palladium: $917.22

Palladium: $917.22

Bitcoin: $98,210.06

Bitcoin: $98,210.06

Ethereum: $3,442.95

Ethereum: $3,442.95