The Key Differences Between Investment, Speculation and Wealth Protection/Preservation

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

There are three terms that are unfortunately often used interchangeably in the investing world. These are investment, speculation, and wealth preservation. While they have some basic elements in common, they are vastly different concepts in general and should not be confused. In this article we will look at the definitions of and differences between these three ideas to compare and contrast them.

The Definition of Investment

Investment equates to acquiring an asset that you believe will generate an income. More broadly, investment refers to taking present money and assets to sacrifice them with an expectation of future benefits like income. Investments involve two primary elements. These are risk and time.

There are countless varieties of investment choices offered on the market today. You can purchase property, deposit money in bank accounts and CD's, buy stock shares of a corporation or in a mutual fund, or put your money safely to work in government bonds.

There are two broad categories into which experts divide investments these days. These are variable income investments and fixed income investments. With the variable income ones, investment returns will not be set like with real estate or stock shares. Fixed income investments involve a pre-determined return rate, common in preferred stock shares, bonds, fixed deposits, money market funds, and provident funds.

The Definition of Speculation

Speculation is more of a loaded term. This trading type of activity centers on participating in transactions that are financially risky with a hope of realizing huge profits from massive changes in the financial assets' underlying market values. Speculation involves a substantial risk of your initial capital losing most or even all of its value if the activity does not work out as expected. This very real danger is offset by the odds of gaining a significant profit.

Scientifically done, speculation involves careful calculation and analysis in terms of a risk versus reward scenario. Speculators are more commonly involved in highly fluctuating markets. Securities' prices can move massively with these penny stocks, currencies, derivatives, and commodities futures.

The Differences Between Speculation and Investment

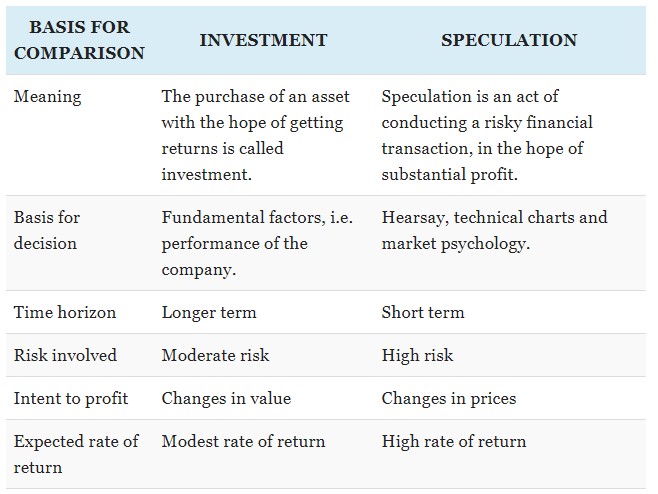

Unfortunately, the two terms of investment and speculation are often utilized in an incorrectly but overlapping fashion. There are many differences between the two, as shows in this chart below:

Legendary American investor and economist Benjamin Graham defined investing as an activity that involves a thorough analysis to make sure that the investment is both principal safe and delivers an adequate return. Speculation would not meet these standards.

Investing involves careful fundamental analysis on a company and its performance. Speculation is instead based on market psychology and technical charts. The holding time frame between the two is different as well. Investors tend to hold investments for minimally a year or longer. Speculators keep their positions for shorter term times of typically weeks or months (and sometimes even days).

Risk and expectations are vastly different as well. Investment risk tends to be moderate, while speculation risk is usually high. Investors hope to realize profits from asset value changes, while speculators anticipate recognizing profit from dramatic price changes from the interaction of the forces of supply and demand.

Investment refers to the purchase of an asset with the hope of getting returns. The term speculation denotes an act of conducting a risky financial transaction, in the hope of gaining a substantial profit. At the same time, investors anticipate obtaining an investment return that is more modest. Speculators expect to attain higher profits with their speculation in a trade off for the high degree or risk which they bear. They are potentially better rewarded for taking on a situation without stable income that is a hallmark of investments.

Finally, there is a vast difference in attitudes between investors and speculators. Investors will tend to be careful and conservative types of people. Speculators are more reckless and risk taking in their personalities and actions.

Definition of Wealth Preservation

Wealth preservation is entirely different from investing and speculating. With wealth preservation, your goal is to carefully manage your assets so that you maintain the value of these assets and do not suffer loss. The objectives of wealth preservation are to maintain the value of existing wealth rather than to make a greater amount of (additional) money.

There are many different elements involved with wealth preservation. These include retirement planning, life insurance, inflation, correct asset allocation, diversification, long term care, and effective protection against risk to capital markets. This preservation also focuses heavily on estate planning strategies to reduce the impacts of succession and exit strategies from businesses, impacts of taxes, and investments that are tax advantaged which can optimize income while minimizing the associated tax burdens.

Wealth Preservation vs Investing

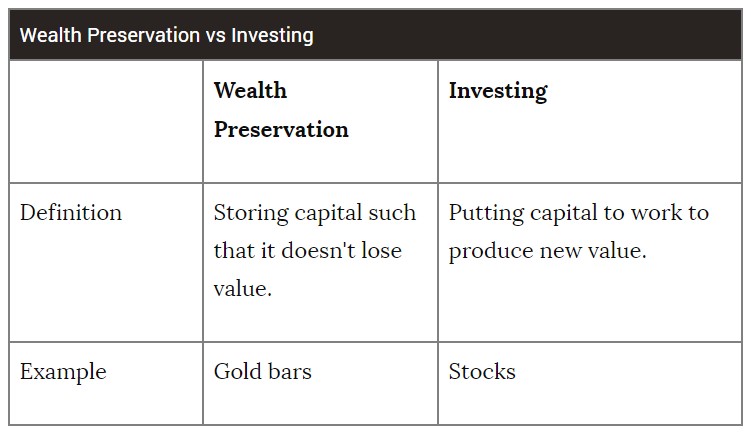

While wealth preservation is storing your capital in such a manner that it does not lose value, investing focuses on putting your capital to work in order to create additional value. This graphic below shows some of the key differences between the two concepts:

Investing is a kind of wealth growing activity that puts your capital into productive use in exchange for returns on the investment. This could be through leasing out real estate holdings or lending money to a business as two examples.

Wealth preservation does not necessarily require investing, though it could. Purchasing gold bullion is a way to preserve wealth, yet it does not create any additional income or new value. At best gold can increase in value, helping the investor to keep pace with inflation or to gain in price appreciation by a greater amount. Holding gold ties down financial resources and produces nothing in exchange for feelings of physical security and peace of mind. This is why physical gold bullion is not necessarily generally to be an investment (unless of course the holder of the gold loans it out to other institutions for a fee).

It would also be wealth preservation to buy real estate and do nothing but hold it. As it is not yielding income or creating additional value, it does not qualify for the strict definition of investment. If the owner leases it out for rents though, this becomes an investment (and it could also be considered wealth preservation as well).

In Conclusion

It is important to recognize the differences between these three various categories of financial activities. Investors and speculators are two different kinds of people. Those who are interested in growing their wealth through productive use are also not engaging in the same practice as those interested in and practicing maintaining the value of assets. Buying old bullion is an effective and time-tested means of wealth preservation that could also qualify as a speculation. In the majority of cases it does not amount to an investment, as it produces no income.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $4,206.41

Gold: $4,206.41

Silver: $52.92

Silver: $52.92

Platinum: $1,677.69

Platinum: $1,677.69

Palladium: $1,573.41

Palladium: $1,573.41

Bitcoin: $111,079.75

Bitcoin: $111,079.75

Ethereum: $3,983.54

Ethereum: $3,983.54

Investing in shares of gold mining companies has an advantage over other ways of investing in gold. Possessing shares of companies, the investor can expect to receive profit regardless of the price of raw materials. Business is focused on profit in any market situation.