Recession News: Experts Weigh in on 2022 Recession Chances & Strategies

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Recession news has been one of the main headlines that investors are worried about since the beginning of the year. Inflation has continued to rise, the Fed implementing tightening monetary policy, and the war in Ukraine all adding fuel to the fire.

Let’s take a look at what experts are saying about recession news, the chances of full-blown negative growth, and the strategies we can follow to lessen the pain. Here is what some of the main pundits are saying about the possibility of a recession in the US. We looked at some of the major Wall Street players and the collective view of CEOs.

Opinions were pretty much aligned across the board. The main differences came from when and how deep a recession might be. However, the consensus of a high risk of recession seemed aligned among all parties.

Table of Contents

Former Treasury Secretary Larry Summers

Let’s start with the opinion of former treasury secretary Larry Summers, who sees a “Very high likelihood” of a recession. His remarks came just before the release of GDP Growth data for Q2 2022.

Despite the Whitehouse’s attempt to redefine a recession, two consecutive quarters of negative growth is technically considered a recession. Summers’ comments came in an interview with CNN’s Fareed Zakaria. Where Summers also stated that he saw it very unlikely that the Fed would be able to engineer a soft landing.

Meaning a moderate decline in economic activity as the central bank continues to raise interest rates. However, the Fed has as its principal mandate price stability. With the last data for inflation coming in at 9.1%, the Fed has a tall task to bring it back down to the 2% target.

Summers did not specify when he expected the recession to begin, although we could already be in one. He also argued that typically recessions arrive when inflation is high and unemployment low. And that “Soft landings represent a triumph of hope over experience”. However, he also said, “We are very unlikely to see one”.

CEOs

In June, The Conference Board Published a survey of CEOs' views on recession news. The survey was conducted in May, before the Fed interest rate hike in June. Of all respondents, 60% of CEOs believed their geographic region would experience a recession within the next 12 to 18 months.

Furthermore, the survey found that 22% of CEOs saw a risk of recession, and 15% of them reported their region was already in a recession. The CEOs pointed to inflation, high energy prices, and geopolitical conflict as the main economic threats along with the recession.

Survey authors also wrote that the CEOs and other C-suite executives believed that higher energy prices and costs of scarce resources would squeeze profit margins. These factors are coupled with Russia’s ongoing invasion of Ukraine creating risks to global fuel supply and supply chains.

The situation would further escalate with China coming out of COVID-19 lockdowns, which would create even more demand for fuel and commodities.

Bank of America

Previously Bank of America had been one of the more optimistic voices about the possibilities of recession. That changed in mid-June, when newly appointed Head of US Economics, Michael Gapen, wrote: “We now forecast a mild recession”.

Gapen’s team stated that they saw heavy headwinds from higher continued inflation, fading fiscal revenue, and an aggressive monetary tightening policy. As a consequence of the convergence of these factors the team sees shrinking GDP growth throughout the second half of 2022

On another note, Bank of America’s monthly survey of fund managers showed that 58% of managers were underexposed to risk. A level that surpassed the level seen during the global financial crisis of 2008.

The survey included 259 participants with an AUM of $722 billion for the week of July 15, 2022. The authors of the survey reported that managers saw high inflation as the biggest tail-risk. Which is followed by a global recession, hawkish central banks, and systemic credit events.

Deutsche Bank

Deutsche Bank was the first major global bank to forecast a recession back in April 2022. By the end of April, the bank had increased the severity of its initial prediction. At the beginning of April, Deutsche Bank had predicted a mild recession for the US economy. By April 27, that forecast was elevated to a major recession.

The bank stated that higher inflation was the greatest risk. And to minimize the negative impact of high inflation the Fed would have no choice but raise interest rates quickly. However, the effect of raising interest rates too quickly can have a dramatic effect on the performance of the economy.

Deutsche Bank’s report also stated that the Fed in the past had never been able to correct the course of inflation, even when its employment and inflation goals were missed by smaller margins. And that the Fed often finds itself “behind the curve” when it comes to dealing with the problem.

Goldman Sachs

In June 2022, Goldman Sachs analysts issued a note that the risk of recession in the US had increased. The team at Goldman now sees the probability of recession over the next year at 30%. That equals a double increase in probability from their previous call of 15%. They also saw a 25% probability of recession for the second year if a recession doesn't hit the economy this year.

Overall, those percentages equate to a 48% probability of recession over the next two years. Previously that probability had been at 35%. “We now see the risk as higher and more front-loaded, “ wrote the team of economists led by Jan Hatzius.

The team stated that the Fed will feel compelled to respond to high headline inflation and consumer inflation expectations. Even if accelerating its monetary tightening policy will cause an economic slowdown.

Strategies Against Recession

Recessions and the inevitable sell-off in the stock market are concerns for every investor, retail or institutional. And the fact that it looks like we are headed for one driven by high inflation, supply constraints, and geopolitical turmoil will make many feel uneasy about their investment portfolios.

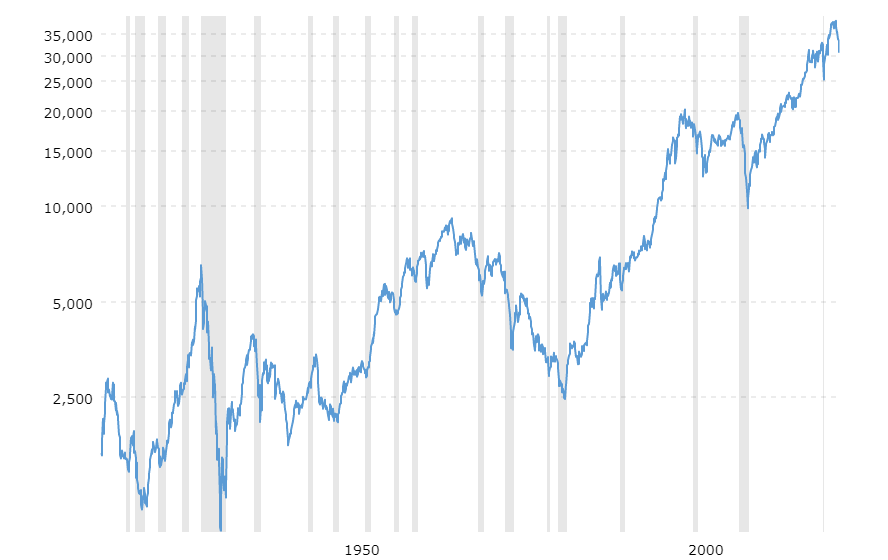

However, we have seen time and again how the stock market always recovers from its all-time low during a recession and achieves new highs. The chart below shows the historical performance of the Dow Jones Industrial Average Index, going back 100 years.

Source: Macrotrends

Source: Macrotrends

As we can see, with enough time, all dips in the chart are retraced to new highs. Of course, looking at the stock market crash of the great depression we can see it took almost 30 years for the stock market to recover to its previous peak in August 1929.

But we can also see as we enter more modern times, dips are shorter and rebounds take less time than they previously did. This feature may be due to the number of investors now able to add buying liquidity to the market.

Not only are more and more people investing their money in stocks nationally, they are also investing from all corners of the world. The money mass has also increased, and funds and managers are managing sums of money never seen before. For example, BlackRock now has $10 trillion of assets under management.

Portfolio Balancing

Armed with this knowledge, that stock markets have a strong tendency to bounce back and reach new peaks, let’s have a look at one way to navigate stormy waters. A well-known portfolio management strategy called portfolio balancing may be of some help in this situation.

As the name suggests, this strategy consists of maintaining a balanced investment portfolio as time passes. What happens is that as the price of one asset outperforms the other of your portfolio you end up with a skew in risk to one asset over the other.

Let’s consider a two-asset portfolio of stocks and bonds, where you initially invest 80% in stocks and 20% in bonds. However, after one year your stock investment has risen by 25% and your bond investment by 2%. To simplify, your initial investment was $100, and now you have $100 in stocks and $20.4 in bonds.

Clearly, your portfolio is now overweight in stocks, with stocks now accounting for 83% of the portfolio. While your bond holdings of $20.4 now account for 17% of the portfolio. The strategy would consist of selling your stock holdings to bring the portfolio back in line with your initial ratio of 80/20.

Recession Balancing Act

How does this strategy help in a recession? Well, the whole theory of the strategy means that when one asset goes down in price greatly, usually stocks, you need to buy them. You would buy them to bring your portfolio back into balance. However, when an asset in your portfolio rises sharply you would then need to sell to rebalance the portfolio.

As you can see you will tend to buy as the market goes lower and sell when it goes higher. You can choose how often you want to rebalance your portfolio, monthly, quarterly, or yearly. However, in a stock market sell-off, it can be very difficult to time the bottom.

For sure if we could time the bottom of a stock market rout, that would be when you want to rebalance your portfolio. However, timing the market is extremely complicated even for the best professionals.

So, in my opinion, monthly rebalancing allows investors to add some new stocks at cheaper prices as the market goes down. I know, the market can go down a lot, the 2008 crisis took almost 50% off the Dow Jones Industrial Index. But it takes staying power, it also helps if each month you are adding new funds to your portfolio.

Another example that is easier to apply when you hold your investments through managed funds is the dollar-cost share average. This strategy is applied when you make monthly allocations to your investment portfolio.

Typically, the cheapest way to invest in the broader stock market is through ETFs. So, as you continue funding your investment account you also continue to add shares in these ETFs. However, if the market has fallen you will add them at a cheaper price.

Let’s say you bought 10 shares in XYZ ETF in January at 20$ a share. The stock market then dipped and in February you bought 10 shares again at $18. You now have 20 shares at an average price of $19 a share. If the market continues falling you can still continue to add shares and further reduce your dollar-cost average.

In the long run, when the stock market goes back up you will benefit sooner and see a positive yield on your portfolio as you bought shares at continuously lower prices.

Bottom Line

It certainly looks like there will be a bumpy ride ahead of us from the stock market. Inflation is still entrenched, and supply chain woes are not helping the strain on prices. The S&P 500 already touched recession territory when at one point it was down nearly 20%.

So, we need to buckle up and hold on tight. Ultimately, I believe the one asset that can protect you the most from adverse economic conditions is Gold. Other precious metals are also known to protect wealth in troubling times as well as good times.

The IRS considers precious metals as real assets so you can also take advantage of a tax-enhanced environment by investing in gold, silver, and platinum through self-directed IRAs, where you can choose between traditional or Roth accounts.

When it comes to setting a precious metals IRA there are several top-rated companies with expertise in the field. Be aware of scammers and companies that have a low rating and trustworthiness. We have filtered out some of the best, you can read our reviews on the top-rated precious metals IRA companies here.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $5,278.67

Gold: $5,278.67

Silver: $93.76

Silver: $93.76

Platinum: $2,367.84

Platinum: $2,367.84

Palladium: $1,786.66

Palladium: $1,786.66

Bitcoin: $64,040.30

Bitcoin: $64,040.30

Ethereum: $1,870.73

Ethereum: $1,870.73