Pros and Cons of Investing in a Bitcoin IRA

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 11th January 2022, 05:35 pm

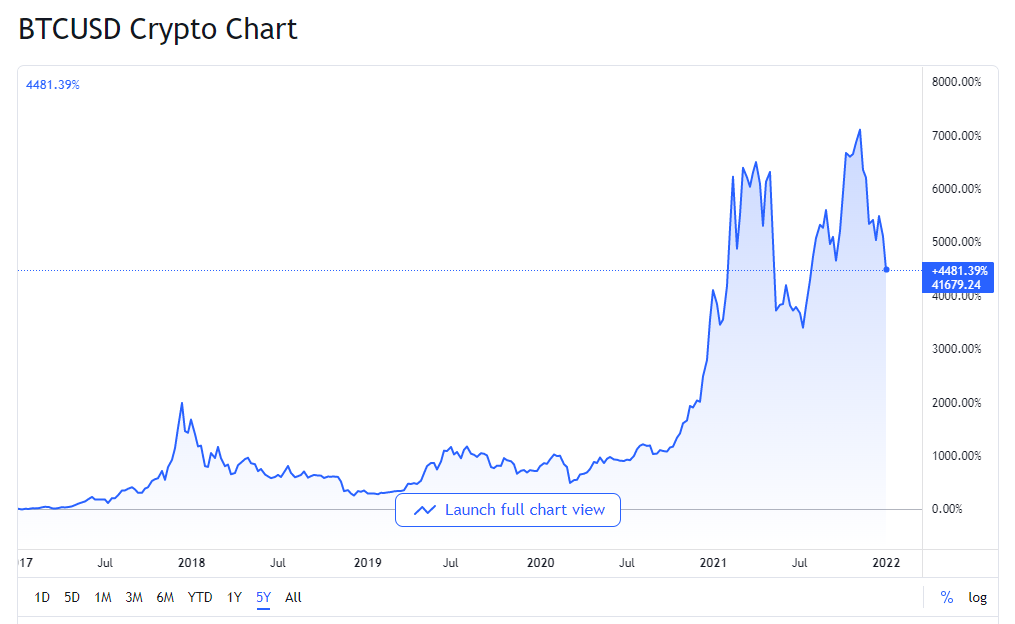

Bitcoin has seen a surge in popularity and with it an increase in demand. The price of this virtual asset increased by 4,481% between 2017 and 2022. The chart below shows the performance of the world’s largest cryptocurrency. As we can see it has been a ride with many sharp climbs and steep drops.

Source TradingView

Cryptocurrencies are becoming so mainstream that individual investors are increasing their asset allocations and even including them in IRAs. Several Bitcoin IRA companies can streamline the process of opening a Bitcoin IRA. Some specialize in Bitcoin IRA only, in either case, they will help you through the process.

Although these types of IRAs are referred to as Bitcoin IRA, they do allow you to invest in other cryptocurrencies such as Ethereum, Litecoin, or Ripple to mention a few. So, let’s have a look at the pros and cons of investing in a Bitcoin IRA.

Pros

- Portfolio Diversification

- Long-Term Investment Horizon

- Potential in Upside

- Tax Savings

Portfolio Diversification

Bitcoin is likely to act as a diversifier of risk. This quality may come from the uncorrelated nature of its value to that of stocks and bonds. It may be too early to tell. However, the returns of virtual currencies do not seem linked to those of traditional assets.

In search of diversification, it makes sense to add an asset that should not suffer in times of a crisis. Isolation from extreme events for stocks and bonds means your portfolio will have some protection from this type of episode.

Diversification also means you shouldn’t dedicate all your IRA to bitcoin. You should have other savings and assets. Your IRA is your pension pot and shouldn’t be put to extreme risk.

Long-Term Investment Horizon

IRAs are an investment vehicle with a long-term investment horizon. You may have your IRA for over 30 years in some cases. Bitcoin has had a volatile price performance since its inception. And the stunning results seen in the past may prove hard to match in the future. However, you may still see its value grow considerably with a long enough time horizon.

Digital currencies are not going to disappear anytime soon. The technology behind them, blockchain, is a secure way to store all types of information. Blockchain is already being applied by financial institutions and they offer an effective and incorruptible way of making a variety of transactions. The quality of the technology means that it is here to stay, and its use should only continue to expand.

Potential in Upside

Bitcoin has seen some spectacular price drops so far. But the fact that supply has a hard limit could be the main factor that keeps its price moving upwards. Given the mainstream attention the digital asset is gaining, it doesn’t seem like interest and demand will disappear anytime soon.

Unlike fiat money, there is no central bank that can continue printing money which devalues the currency. Supply is limited, but demand is potentially unlimited. Scarcity and Inflation are two factors that drive the price of gold. If the value of the dollar decreases, then holders of gold will demand more dollars for their gold. The same should be true with Bitcoin.

Tax Savings

When considering a Bitcoin IRA, you can choose between both a Traditional and Roth IRA. You can invest in Bitcoins with deferred taxation (in a Traditional IRA) or watch your investment grow tax-free (in a Roth IRA).

In either case, you will benefit from the preferred tax status of your investment while your bitcoins are held in an IRA. This includes any income gained through trading the digital currency. As long as the income remains inside the IRA you will not pay capital gains tax.

Cons

- High Volatility

- Higher Bitcoin IRA Fees

- High Minimum Investment

- Responsibilities

High Volatility

The spectacular increase in value of Bitcoin has not been without its scary moments. This digital asset is definitely not for those investors who cannot live with periods of extremely high volatility. The fact that it is so volatile means that the closer you are to retirement the riskier your investment. You may be needing the funds at the wrong moment if you are close to taking distributions.

The chart below shows the price action of the S&P 500 and Bitcoin over the past year. We can see how the digital currency oscillates drastically compared to the steady price pattern on the broad stock market index.

Examples of the volatility expressed by this cryptocurrency include a 59% drop in April 2021. When it slid down to $28,600 from $64,895 by June 2021. That drop is nowhere near its two largest drops of the past 5 years. From June 2019 to March 2020, it tanked from $13,885 to $3,850, a decrease of 72%. And from December 2017 to December 2018, it crashed from $19,666 to $3,122 a loss of 84%.

Higher Bitcoin IRA Fees

Fees for holding Bitcoin in an IRA are higher than holding traditional assets. There are various extra fees associated with holding digital assets in an IRA. The fees include an initial investment fee, annual custodial fees, buy order fees, and sell order fees.

Account setup fees average 10% of your initial investment. Buy order fees range between 3.5% and 5% for most IRA custodians. If you are trading in bitcoin through your IRA, you will get the tax protection, but you will also incur heftier fees.

Bitcoin’s high performance in the past has more than compensated for these fees. The risk is in the case the digital asset underperforms. Negative returns will only be amplified by these extra costs.

High Minimum Investment

Bitcoin IRAs also have a relatively high initial minimum investment. If you have an existing IRA that you have contributed to for many years that may not be a problem. However, if you are just starting or only have a few years of contributions under your belt, the story changes.

Some IRAs can have initial minimum investments that range in the 10s of thousands. BitcoinIRA has a minimum of $3,000. Comparatively low, but if you have just started investing in an IRA that sum would represent half of this year’s maximum contribution.

Thinking of investing 50% of your IRA in any one asset does not make for good diversification. Considering the extremely volatile nature of Bitcoin your exposure to the cryptocurrency should be much lower than 50%.

Responsibilities

Although IRA custodians are regulated by the IRS which implies a set of regulatory requirements. These obligations refer to the standards the IRA must hold regarding the IRS. Examples include the capability to act within the accepted rules of fiduciary conduct.

However, they are not ultimately responsible for any misdoings you may inadvertently cause. In a Self-Directed IRA, especially the LLC type, you're solely responsible for all actions within the IRA. This means that there is no backup, and any penalties incurred fall on you.

Takeaways

Self-Directed IRAs allow investors to acquire investments that go beyond traditional stocks and bonds. These investment vehicles have been used for decades to invest in gold, property, or commodities.

In the last few years, Bitcoin and other top-tier digital currencies have entered the mainstream with interest from various pundits, funds, and financial institutions. A strong increase in interest from individual investors has also evolved. The interest in Bitcoin by these investors has given rise to Bitcoin IRAs.

Various companies have sprouted over the past several years that will streamline the whole process of setting up a Bitcoin IRA. With many of these services, you won't even need to leave the comfort of your home, as it can all be done online.

Investors that are convinced of the future of Bitcoin can find a tax-advantaged investment vehicle with a Bitcoin IRA. If you are comfortable with riding the extreme volatility of digital assets you can benefit from the tax protection offered within an IRA.

Deciding whether the pros outweigh the cons is the conclusion you must come to. Having evaluated all the risks and compared them to the potential you think Bitcoin may have in the coming years. There are other options for investing in Bitcoin out there. Various online exchanges and platforms offer a cheaper alternative.

However, you may find a lower fee structure, but you will not benefit from the tax protection offered in an IRA. As you make money on your Bitcoin investments you will be subject to capital gains tax if you invest in Bitcoin outside of an IRA. You can find more information here on how to buy Bitcoin in an IRA.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $5,278.81

Gold: $5,278.81

Silver: $93.77

Silver: $93.77

Platinum: $2,364.52

Platinum: $2,364.52

Palladium: $1,784.65

Palladium: $1,784.65

Bitcoin: $65,910.47

Bitcoin: $65,910.47

Ethereum: $1,931.66

Ethereum: $1,931.66