Physical Gold vs. Paper Gold: A Critical Analysis for Investors

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 18th May 2023, 07:13 pm

For retail investors, the key differences between physical and “paper gold” couldn't be more important. While they both share obvious similarities due to their exposure to the spot price of gold, each asset category holds benefits and disadvantages that retirement investors need to know about before taking a position in either asset.

Whereas historically gold assets were once held exclusively by the moneyed upper classes and the aristocracy, the rise of the middle class, public stock exchanges, and the internet has seen gold become an accessible investment option for ordinary investors. But before getting started, savvy investors must understand the difference between paper gold (i.e., a stock or ETF certificate) and physical gold (tangible coins and bullion bars.)

Gold's Value is Well-Recognized

The earliest gold coin was minted in the Kingdom of Lydia nearly 2,700 years ago as a medium of exchange for merchants looking to exchange goods. Since then, gold coins have been used to facilitate international trade. Central banks and commercial banks the world over store gold bullion in reserve in order to manage risk and stabilize the value of their deposits.

Today, investors of all stripes can purchase gold numismatic coins, bullion, or gold bars, as well as paper-based gold products like mining stocks or exchange-traded funds that track the daily price of gold. At one time, numismatics were once legal tender for buying goods and services, but are today used primarily as a non-yielding investment. Gold bullion coins usually have a higher fineness, usually .999 or .9999, compared to other precious metals such as silver or platinum. The IRS allows individuals to purchase bullion coins and bars as part of an IRA (either Roth or Traditional).

At a Glance: Paper Gold vs. Physical Gold

Below, I've detailed the respective advantages and disadvantages of paper gold and physical gold investing.

| Physical Gold | Paper Gold | |

|

Benefits 👍 |

Tangible asset that retains value over time | Provides exposure to gold without storage and security concerns |

| Hedge against inflation and currency devaluation | Can be easily bought and sold through brokers or exchanges | |

| Potential for capital appreciation | Offers diversification from traditional stocks and bonds | |

| Not subject to counterparty risk or default risk | Offers liquidity for short-term trading strategies | |

| Disadvantages 👎 | Requires storage and security measures | May not provide the same level of transparency as physical gold |

| Not as liquid as “paper gold” assets | May be subject to counterparty risk or default risk | |

| May require additional transaction costs for buying/selling and storage fees | May not provide the same level of protection during economic downturns | |

| May have higher bid-ask spreads and premiums for physical coins and bars | ||

| Can be difficult to verify authenticity and purity |

Advantages of Physical Gold

Gold has historically always held value due to its rare chemical properties that make it useful for industrial purposes, jewelry manufacturing, and coin minting. Physical gold can always be remelted, sold back to its retailer, or sold to a local jeweler or pawn shop. Physical gold provides security against inflation and other economy-wide systemic risks. For this reason, many notable investors—including Kevin O'Leary, Ray Dalio, and George Soros—are all known to have positions in gold as a portfolio diversified and risk management tool.

Disadvantages of Physical Gold

The primary disadvantages of physical gold are its illiquidity (i.e., the time cost of converting the asset to cash) and the storage fees required to secure the assets in a vault. Retirement investors looking to add gold to their IRA or 401(k) must store their gold in off-site vaults. Home storage is not permitted for inclusion in tax-advantaged retirement accounts.

What is Paper Gold?

Paper gold refers to either the ownership of a certificate providing the “option” to buy physical gold, ownership in a company that mines gold, or the “option” to benefit from a price movement of gold in the exchange-traded fund (ETF). Before they are non-physical assets, investments in paper gold do not need to be stored in vaults.

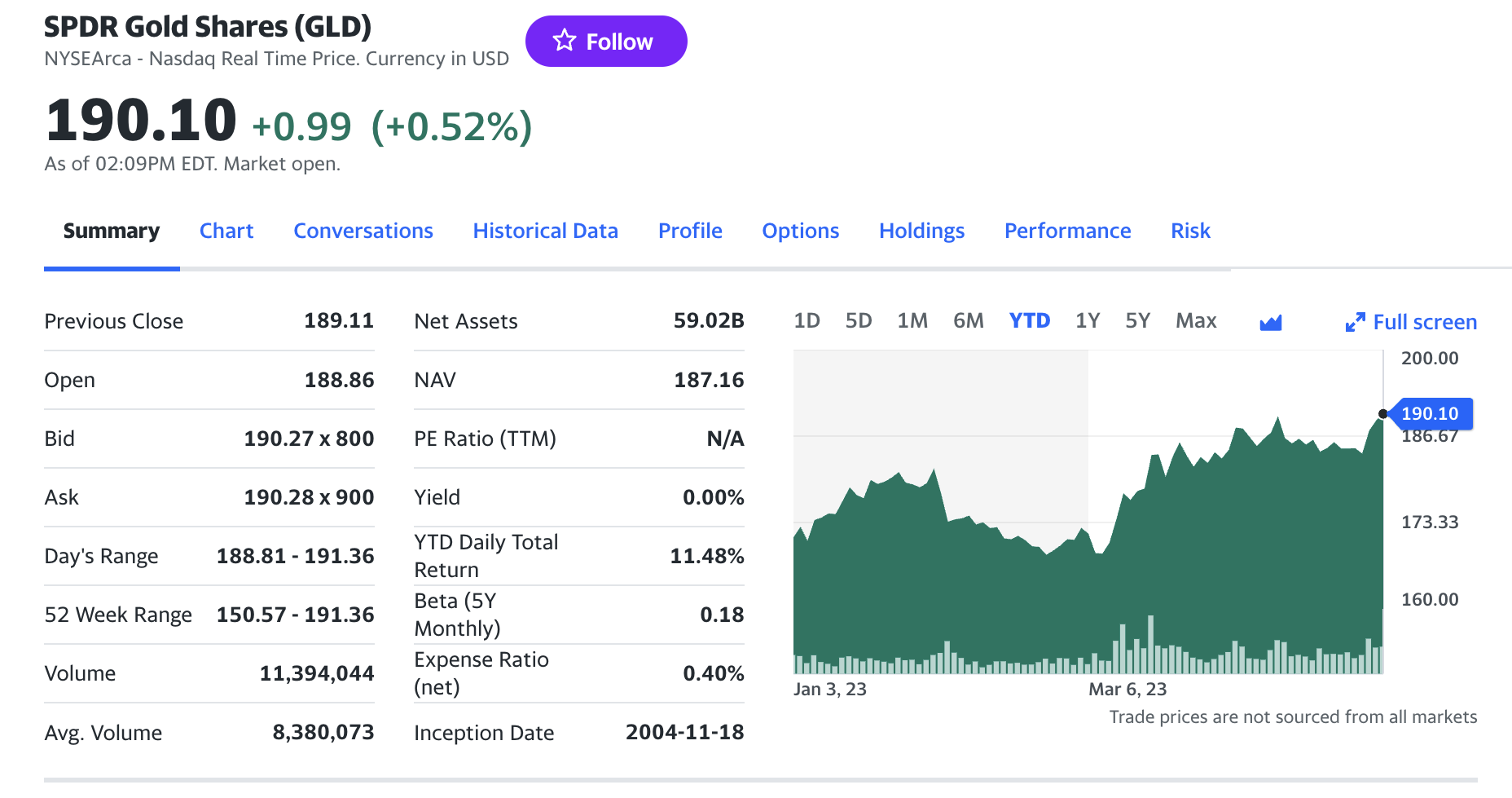

When you purchase a gold mining stock, for example, you will receive the right to the dividends of that company, provided that they are a dividend-issuing company. Therefore, gold mining stocks are rare examples of productive gold-exposed assets that generate income for the asset holder. The Gold SPDR (GLD), for example, is an ETF consisting of a bundle of gold-involved companies that closely track the price of gold. Investors can buy shares of GLD on public stock exchanges, making them highly liquid investment options.

Advantages of Paper Gold

Paper gold assets can generate higher returns than physical gold because investors can purchase “call” and “put” options to profit on the short-term price movements of gold. Beware, however, that these price movements can (and often do) result in financial losses for the asset holder.

As previously mentioned, paper gold assets are generally bought and sold on public stock exchanges such as the NASDAQ or TSX. Therefore, they are accessible to ordinary investors and benefit from a level of liquidity that physical assets do not have. Lastly, gold stocks have far lower barriers to entry than physical gold. As of Q2 2023, SPDR Gold Shares are trading on the New York Stock Exchange for US$190 per share—a much lower entry point for retail investors than the roughly US$2,000 per ounce that physical bullion costs.

SPDR GLD Stock Price in 2023

Disadvantages of Paper Gold

The most distinctive drawback to paper gold is that you don't own the physical gold. Paper gold assets are confiscable, and cannot be touched and felt the same way that physical bullion or coinage can. For many, physical gold's tangibility provides a sense of security and comfort that paper assets cannot provide. Likewise, paper assets cannot protect against inflation as physical assets can. Whereas more paper assets can always be printed into existence, the scarcity of physical gold ensure that the asset cannot devalue due to overproduction.

Plus, for a gold mine to become active, it might take a decade. The gold mining stocks forecast profits based on a rising gold price, which may not come to fruition. Should price forecasts fall short, the company may fail and your investment could go to zero. This is one of several examples of counterparty risk that paper gold assets are uniquely exposed to.

What is Counterparty Risk?

Counterparty risk is the risk of the other party in a transaction not making good on their contractual obligations. For example, financial institutions that default on their debt, or third-party custodians who declare bankruptcy, can present costly counterparty risks to gold investors.

In the context of paper gold assets, counterparty risk can arise when investors purchase gold through derivatives, futures contracts, or ETFs. In these cases, investors do not actually own physical gold, but instead own a financial contract that tracks the price of gold. If the counterparty fails to fulfill its obligations, investors may not receive a return on their investment.

Learn More About Gold IRA Investing Today

Whether you're interested in physical precious metals or paper-based assets, both products can be added to tax-advantaged retirement accounts such as a Roth or Traditional IRA. These assets can be used to manage risk in your investment accounts, and to add stability and upside potential to volatile stock-heavy portfolios.

To learn more about investing in gold in an IRA, read our exclusive guide to gold IRA investing today.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,371.96

Gold: $3,371.96

Silver: $38.89

Silver: $38.89

Platinum: $1,360.36

Platinum: $1,360.36

Palladium: $1,132.14

Palladium: $1,132.14

Bitcoin: $115,925.76

Bitcoin: $115,925.76

Ethereum: $4,752.97

Ethereum: $4,752.97