May 2022 National Survey: Nearly 4-in-5 Americans Haven’t Taken Action to Hedge Against Inflation; 14.6% Have Added Real Assets

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 28th June 2022, 04:21 pm

Table of Contents

- Key Takeaways:

- May 2022 Survey: Nearly 1 in 5 Americans Have Done Nothing to Their Investment Portfolio to Combat Inflation

- Inflation Hedging by Age Group

- Inflation Hedging by Gender

- Survey Methodology

- Study Details and RMSE Score

- Discussion and Conclusions

- Had Enough of Inflation? Hedge Your Bets With an SDIRA

- Full Survey Report

Key Takeaways:

- 79.1% of Americans haven't taken any action to combat 40-year-high inflation levels

- 9.4% of Americans have diversified with precious metals (gold or silver)

- 4.9% of Americans have diversified with cryptocurrencies such as Bitcoin or Ethereum

- 5.3% of Americans have diversified with real estate

- Only 1.4% of Americans have diversified with Treasuries (i.e., TIPS), an asset created to hedge against inflation-incurred losses

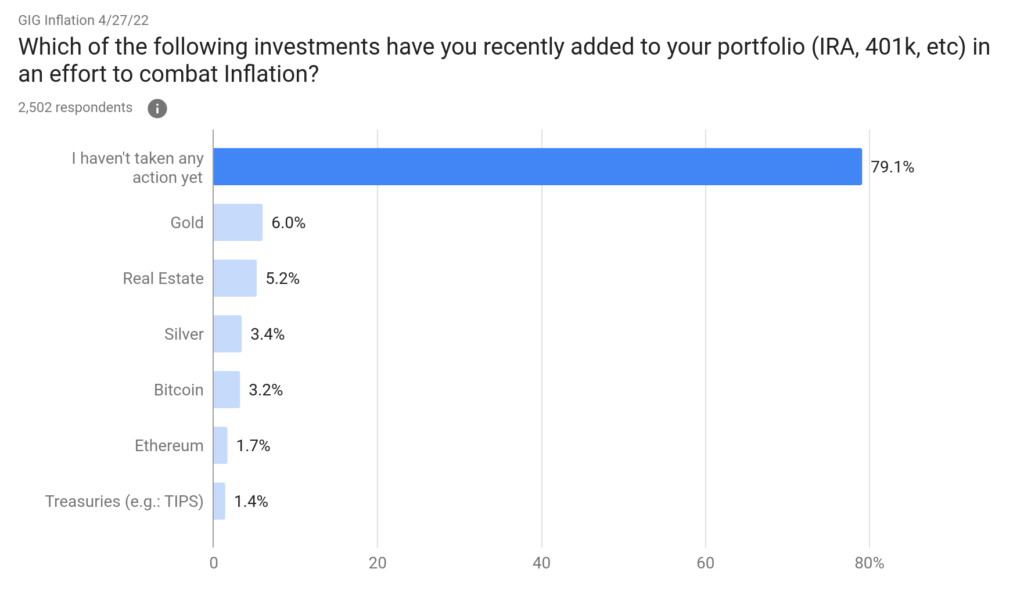

Figure 1. Source: Google Surveys

Most American investors have decided to stay the course in light of generationally-high inflation. According to a nationwide survey published by Gold IRA Guide on May 4th, 2022, over 79% of Americans aged 35 and over have refrained from adjusting their investment portfolio to offset the declining purchasing power of the dollar.

The indifference of US investors defies recent polling data. A poll published in April by Washington Post-ABC News found that an incredible 94% of Americans are “concerned or upset” about inflation. Despite this, few Americans have adjusted their investment strategy to address these concerns.

Since the onset of generational CPI levels in mid-2021, the investing habits of average Americans haven't been methodically questioned until now. In this article, we’ll discuss the data from this landmark survey and discuss how American investors are reacting to inflation.

May 2022 Survey: Nearly 1 in 5 Americans Have Done Nothing to Their Investment Portfolio to Combat Inflation

Gold IRA Guide recently published the results of a nationwide survey that found that 79.1% of US individual investors “haven't taken any action yet” to reduce the effects of inflation in their investment portfolio or retirement accounts. The question was put as follows:

“Which of the following investments have you recently added to your portfolio (i.e., IRA, 401k, etc.) in an effort to combat inflation?”

The survey recruited 2,502 respondents weighted by age and gender, each of whom were residing in the United States and aged 35 or older.

American adults between the ages of 18 and 34 were excluded intentionally to target more mature investors with more capital invested. Younger adults, who are significantly less likely to invest their money, may have otherwise skewed the survey results.

The results displayed above (Fig. 1) demonstrate that the vast majority of Americans have yet to take any financial investment action to deal with rising inflation. However, among those who have, the most popular asset for inflation protection is gold (6%) and precious metals more broadly (9.4%). The next most popular is real estate (5.2%).

In short, most Americans, while being concerned about inflation, seem more willing to “ride it out” than to take action to curb its effects. Yet a sizeable minority (14.6%) have added real assets to their investment portfolios in order to safeguard their wealth from inflation.

While the survey results did not meaningfully differ by gender, older respondents were, interestingly, much more likely to have not “taken any action” than their younger counterparts.

Inflation Hedging by Age Group

Figure 2. Source: Google Surveys

The chart above (Fig. 2) depicts the differences in how the various age groups responded to the survey. This survey included four age brackets represented in the data:

- 35-44

- 45-54

- 55-64

- 65+

As a rule, older respondents were much more likely to report having taken no action to manage inflation in their portfolios. In fact, there were about 70% more respondents in the oldest group (65+) than in the youngest (35-44) who did nothing to their portfolio.

Furthermore, those aged 35 to 44 were generally much more likely to have hedged against inflation than other age groups. For example, over twice as many respondents in the youngest age category diversified with gold (2.56%) compared to any older age bracket.

It's also worth noting that age discrepancies were particularly pronounced in the “Bitcoin” response group. Nearly three times as many respondents aged 35 to 54 diversified with Bitcoin (2.36%) than those aged 55 and over (0.84%).

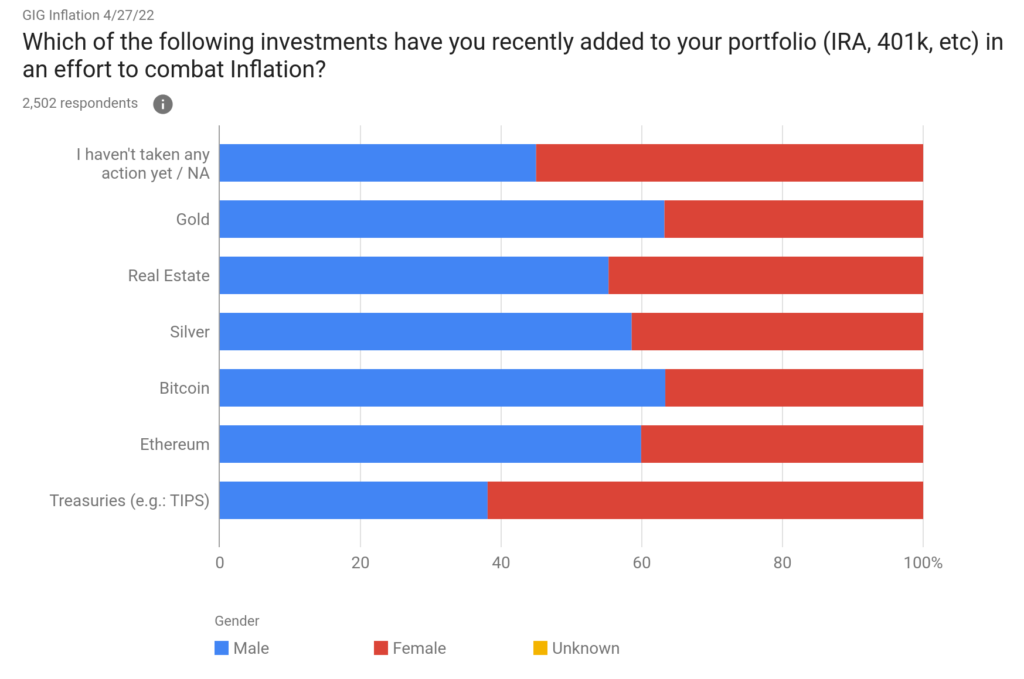

Inflation Hedging by Gender

A gender-based analysis of the survey results yields largely uninteresting insights as the discrepancies between men and women were mostly insignificant. Nonetheless, women (83.4%) were more likely than men (74.4%) to have not taken any action. Thus, men were more likely to have diversified with alternative assets.

Some interesting findings across genders include the following:

- Among women, the most popular inflation hedge asset was real estate (4.5%)

- Among women, the least popular inflation hedge was Ethereum (1.3%)

- Among men, the most popular inflation hedge was gold (7.9%)

- Among men, the least population inflation hedge was TIPS (1.1%)

Figure 3. Source: Google Surveys

Survey Methodology

The survey was conducted over a three-day period between April 29 and May 1, 2022, with a sample size of 2,502 adults. Respondents were geographically limited to the United States, were at least 35 years of age, and were users of the AdMob Network by Google Surveys.

The methodology made use of convenience sampling and included a nationally representative sample of men and women.

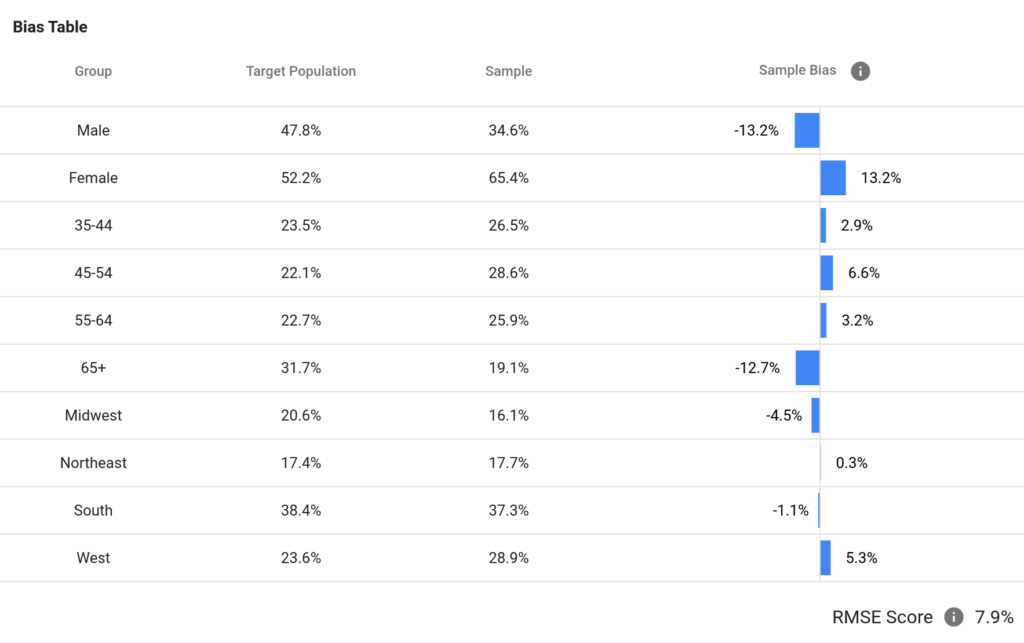

Study Details and RMSE Score

- Audience: Users of the AdMob Network and Google Surveys

- Method: Convenience

- Age: 35+

- Gender: All genders

- Location: United States

- Language: English

- Frequency: Once

Root mean square error (RMSE) is a weighted average of the difference between the predicted population sample (CPS) and the actual sample (Google). The lower the RMSE score, the smaller the total sample bias.

Root mean square error (RMSE) is a weighted average of the difference between the predicted population sample (CPS) and the actual sample (Google). The lower the RMSE score, the smaller the total sample bias.

Discussion and Conclusions

These survey findings shed light on an interesting facet of US investing behavior and psychology. Although roughly 90% of Americans are worried about how inflation will affect their investments, purchasing power, and day-to-day life, only 1-in-5 are investing accordingly.

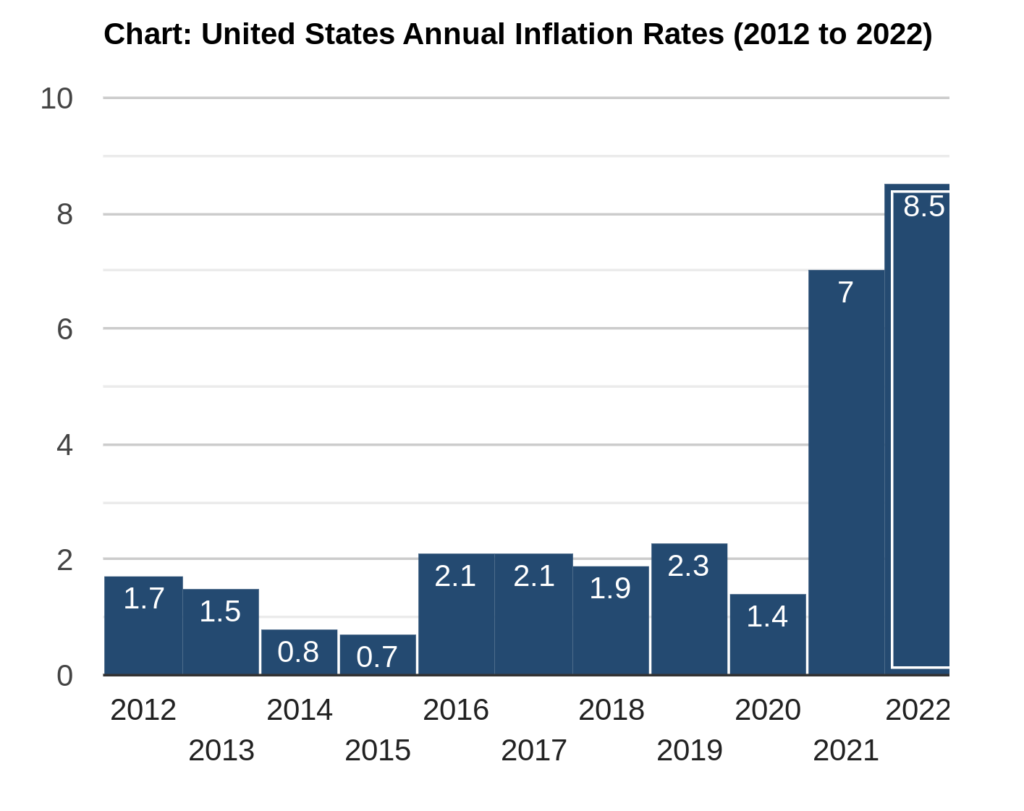

At the time of writing, the annual inflation rate in the United States is 8.5% for the 12-month period that ended in March 2022. This is the highest inflation rate, represented by the Consumer Price Index (CPI), reported by the US Department of Labor since December 1981.

Figure 5. Source: US Inflation Calculator

The graph above (Fig. 5) depicts the relatively stark levels of inflation currently experienced in the United States compared to other years in the past decade. Today's high inflation levels make the findings of this study, which indicate a degree of complacency by the US investing public, particularly of note.

Indeed, there are only ways in which Americans may be combating inflation. For instance, they could be cutting back on discretionary spending and generally consuming more wisely. However, when it comes to financial investing, many are content with the status quo.

Had Enough of Inflation? Hedge Your Bets With an SDIRA

If left unchecked, runaway inflation can delay your retirement, erode your purchasing power, and threaten your financial stability. Savvy investors may want to consider all their options in light of consistently increasing inflation levels.

Those fully invested in the stock market, whose historic return is around 10% (S&P 500), are likely to have their gains completed erased by the diminishing value of the US dollar. By investing in hard assets, such as precious metals or real estate, you can diversify your holdings and safeguard your wealth in assets uncorrelated to the stock market or inflation index.

To get started, open a self-directed IRA. Known as an SDIRA, these tax-advantaged retirement savings accounts put the power back in your hands—and out of the control of brokerages—to invest in a wide variety of alternative assets, including gold and silver.

Check out our list of the best self-directed IRA companies to take back control of your investments today.

Full Survey Report

For a more in-depth look at the data, view the full survey report on Google Data Studio.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $4,378.12

Gold: $4,378.12

Silver: $73.94

Silver: $73.94

Platinum: $2,111.80

Platinum: $2,111.80

Palladium: $1,672.70

Palladium: $1,672.70

Bitcoin: $88,670.98

Bitcoin: $88,670.98

Ethereum: $3,013.07

Ethereum: $3,013.07