Is It a Good Time to Buy Gold in 2022? Here’s What the Data Says

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 15th August 2022, 03:05 pm

Before making a decision to purchase any kind of investment, the obvious question is about its future price. Will it go up, remain steady, or go down?

The variation in price after your purchase determines your profitability. We pat ourselves on the back if the price shoots up while we curse our decision if it faces a severe decline. The “purchase timing” is therefore of utmost importance.

To take the bull by its horns, comprehensive knowledge of each investment type is needed. Otherwise, you may lack the confidence needed to invest strategically. You can do this by studying the historical performance of an investment to determine its behavior, and then applying these models to the current economic environment.

Table of Contents

Making Sense of Gold Investments

Alternatively, a simpler approach to understanding gold investments (or any type of asset for that matter) would be to work on the two W’s (i.e., What and When):

- What investments to purchase?

- When to purchase the investment?

To answer what investments to purchase, the decision is based on the level of income generated from the investment and its capital appreciation. Another important aspect is the amount of money available for investment. If you have a large sum available for investment then real estate might be the better option if you prefer to gain alternative asset exposure outside of paper assets or precious metals.

Paper assets include:

- Stocks and ETFs

- Debentures

- Mutual funds

- Bonds and T-bills

- Any other investment whose ownership is evidenced by a certificate

Precious metals mainly include gold and silver which can be in the form of coins or bricks of different sizes. Physical gold and silver are not paper assets, as they are physical and tangible items, comparable to real estate.

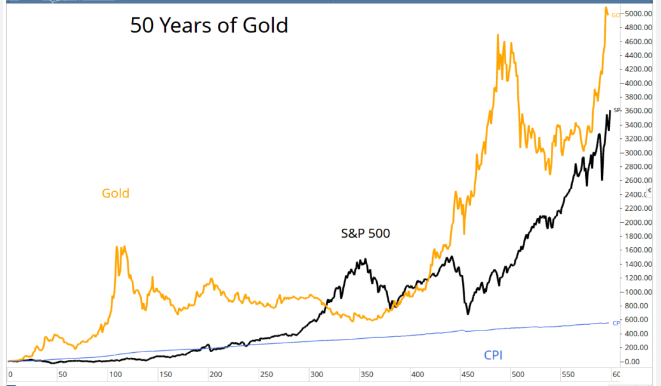

Although metals like gold do not provide a monthly return, their capital appreciation is much larger compared to stocks. Gold had an upper hand and outperformed the stock market most of the time during the last 50 years. This is evident from the graph below:

Source: MoneyandMarkets.com

So, if “gold” answers your question about what investment to purchase, the next question to ask will be: Is it a good time to buy gold?

To answer when to invest in gold, quick research into the following two questions will be helpful:

- The historical price of gold

- The current economic environment

Historical Price of Gold

Throughout this article, keep the following in mind:

- We are quoting price as per ounce of gold

- The quoted prices are in USD

- The prices are in real terms (i.e., inflation-adjusted)

- The year-end closing price is used for any given year

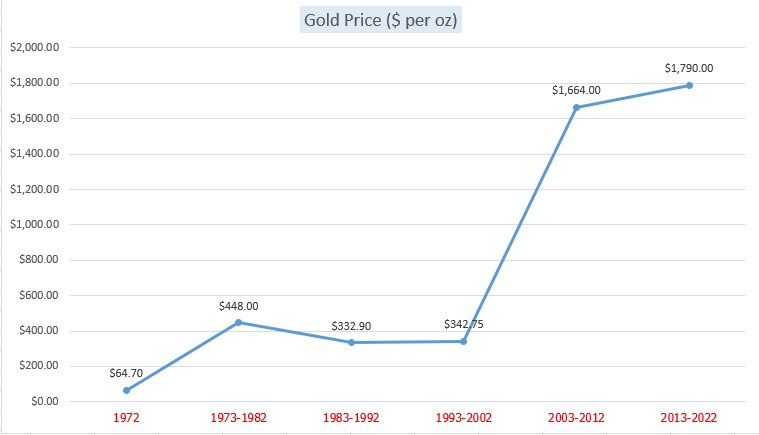

The gold price started at around $65/oz in 1972 after the end of the Bretton Woods system. Gold currently trades at $1,790/oz as of August 2022. This journey of gold prices has seen both ups and downs throughout the last five decades. This can be graphically shown below:

A glance over the graph shows that out of the last 50 years, gold prices were affected the most during the years from 2003-2012. The gold price increased from $342/oz to $1,664/oz during this decade. This represents a surge in dollar value by $1,321/oz which is a gigantic gain of 385%.

You might be curious as to what happened during the years 2003-2012 that caused massive growth in the gold price. Let’s analyze the major economic events during these 10 years that might have contributed to the sudden rise in the prices of gold. These are as below:

- The effects of the bursting of the 2000s dot-com bubble and the 2007-2009 global recession.

- Emerging economies created a lot of wealth, with China and India as examples, where we saw sudden tremendous economic growth in developing states. As a result, people became richer and an increase in demand for gold stretched its price.

- The war on terror intensified with more troops deployed by different nations of the world. Uncertainty about the future shifted the public’s preference back to precious metals, avoiding speculative trade. We cannot ignore the effects of regional and global conflicts.

Global events and macroeconomic indicators such as conflict, recessions, and instability can help you decide whether to invest in gold. During times of instability and uncertainty, gold has historically performed well. Take this into consideration before investing in gold.

Gold Price Prediction 2025

So, where is the gold price headed over the next few years, and is it a good time to buy gold if the price is to increase?

The answers to the above questions can only be estimated based on educated guesswork. We will base our estimation on applying the facts learned so far in this article to the current economic scenario. We will perform three tests here: (i) global recession (ii) emerging economies (iii) regional and global conflicts.

Test # 1: Global Recessions

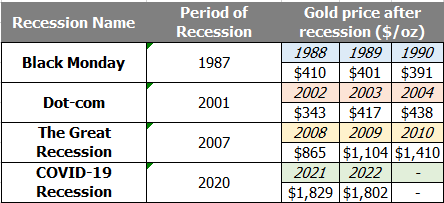

Our global economy is going through higher interest rates, unstable unemployment levels, lower customer spending, and low consumer confidence. These all hints that a recession is coming. How did the recession impact gold prices previously? Let’s analyze the last few recessions below:

In the above table, we have analyzed gold prices following three recession starts. For Black Monday and the COVID-19 recession, there was a slight decline but overall the gold prices remained quite stable. For the dot-com crash and the Great Recession of 2007 to 2010, the gold prices took a bullish trend and rose significantly.

The bottom line is that gold prices either increased significantly or remained stable during and after recessions. Given that our economy is either currently in a recession or on the precipice of entering one, this bodes well for future gold price forecasts.

Test # 2: Emerging Economies

The emerging economies worldwide include a longer list now than before with China, Russia, India, Brazil, Turkey, Mexico, and Indonesia gaining top positions. This hints that the demand for gold may increase in the future, with gold prices climbing as the global middle class expands.

Test # 3: Regional and Global Conflict

2022 has been witnessing conflicts with hopes that they are settled down, particularly among Russia, Ukraine, Taiwan, and the People’s Republic of China. In the event of open conflict, many thousands, if not millions, become displaced and traditional manufacturing and trade slows down. Therefore, investors avoid speculation and revert to low-risk precious metal investments.

Based on the above quantitative and qualitative tests, it is likely that gold prices will go up in the medium to long-term time horizon. This is based on historical trends regarding global conflict, and the current geopolitical situation.

Next Steps: Are You Ready to Buy Gold in 2022?

Now since you have adequate knowledge about gold’s pricing features and have hte tools for determining where the gold price is headed, the next step is to reinforce your learning. Although we are bullish on gold prices over the next few years, note that historical trends are not indicative of future performance.

We suggest finding a reliable source where gold prices can be tracked online. Our gold price page provides detailed and accurate pricing data to help you track the yellow metal. It is always up-to-date with real-time information about gold prices and their origination.

Once you get a hang of how the prices fluctuate in the market, it might be the time to make your investment. Finding the right company to deal with is the next hurdle. Our review of the top U.S. gold investment companies will help you make an informed decision and avoid dealing with sketchy

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,408.31

Gold: $3,408.31

Silver: $38.91

Silver: $38.91

Platinum: $1,356.66

Platinum: $1,356.66

Palladium: $1,114.94

Palladium: $1,114.94

Bitcoin: $112,480.93

Bitcoin: $112,480.93

Ethereum: $4,502.64

Ethereum: $4,502.64