Huge Percentage of Americans Struggling from One Paycheck to the Next

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 25th December 2020, 06:31 am

This past week the news emerged that despite what has been called the greatest economy in history a huge percentage of Americans are actually living from one paycheck to the next. Respected business news site MarketWatch cited a few surveys that show how desperate the financial scenario is for a great number of American consumers. This is discouraging news for an economy that relies on consumer spending to power it forward.

The Startling Numbers on Struggling Americans

Nielsen Data conducted a series of surveys on Americans who are living from paycheck to paycheck. The results were surprising. Their data showed that fully 50 percent of American wage earners who receive $50,000 a year or less are existing from check to check. Lower wage earners are not the only ones struggling either. Around 25 percent of all families that earn $150,000 a year or more claim that they can not save. One in three American households that bring in from $50,000 to $100,000 each year lives from one paycheck to the next also.

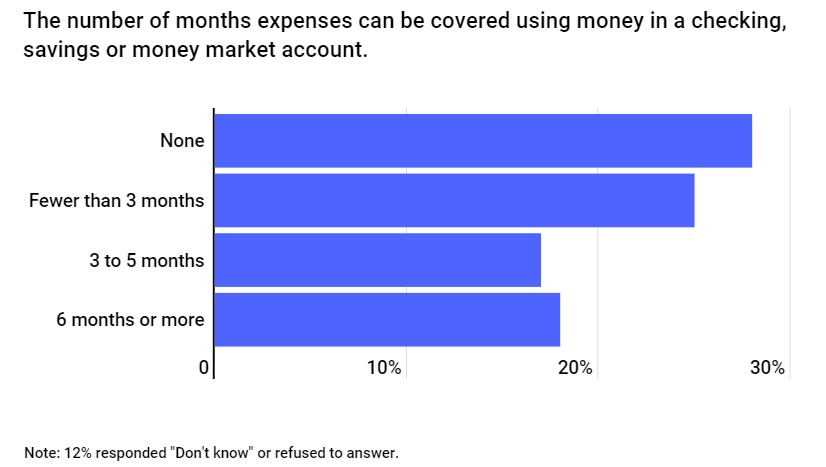

The numbers are actually worse than this according to the American Payroll Association and National Endowment for Financial Education. The two groups reported that a stunning 74 percent of all U.S. employees go from one paycheck to the next. This translates into no savings for many Americans. Bankrate reported in its most recent Financial Security Index that 30 percent of all Americans do not possess any emergency savings period. This chart below reveals the shocking state of American consumers:

The high numbers of Americans who can not survive beyond one paycheck are raising startling questions as to how this could happen in such a booming economy.

Why Can't Americans Save in the Greatest Economy Ever?

MarketWatch reported several reasons for why Americans are not able to save money in the greatest economy ever. Even though unemployment is low, the cost of living has been rising year in and out while wages remain stagnant. This is causing a squeeze on the finances of the American worker. Bankrate pointed out that half of all American employees did not receive any boost in pay for year 2019. They include receiving a raise or accepting a job with higher pay in this category.

Another reason was highlighted in a popular MarketWatch story from this past year. It revealed that obtaining a $350,000 salary in a costly city such as New York or San Francisco could barely be high enough to count as middle class. Beside this, the MarketWatch investigation pointed out that:

“Crippling debt from student loans, credit cards, and/or unexpected medical expenses is also taking a huge bit out of many workers' take-home pay.”

Data supports this argument. In one month after another in 2019, the levels of consumer debt reached all-time highs repeatedly. Per the end of the month of October, the outstanding aggregate consumer debt amounted to a new record high of $4.165 trillion. The American consumers owe a startling more than $1 trillion worth of credit card debt by itself.

Skyrocketing Consumer Debt is Actually Not Good News

According to many financial networks and pundits, skyrocketing consumer debt is good news for the economy. This argument makes the case that individuals will borrow a greater amount when they have confidence in their own personal financial situation. Bloomberg reported an increase in the consumer borrowing category for last summer as:

“The surge in borrowing indicates Americans, supported by higher wages, were feeling confident enough about their financial situation to continue borrowing and spending. The economy, beset by weakness in manufacturing, housing, and capital investment, remains highly dependent on the U.S. consumer to keep driving the expansion.”

The recent surveys show that such arguments crumble in the face of the hard data on the numbers of Americans struggling to get from one check to the next. A more likely explanation for the borrowing is that the American consumer has resorted to charging necessities and daily purchases on their credit cards. If this is the case, then the consumer is not simply living from one check to the next, but is actually borrowing some months to cover expenses.

This is bad news that Americans are overburdened with debt and existing from one paycheck to another. The U.S. economy and its growth are almost entirely reliant on consumer spending. It is not sustainable for Americans to fuel the national economy using money that they simply do not possess.

Consumer Spending Nearly All of Recent GDP Growth

In the last GDP report, consumer spending rose by 4.3 percent to contribute almost all of the growth in GDP. The resulting headlines congratulated American consumers with having saved the economy. Economist Peter Schiff of Euro Pacific Capital Management argues that this creates other problems, with:

“The problem is if the consumer rescued the economy, who is going to rescue the consumer? Because if you look at where the consumer is getting that money, it's from credit. Year over year, consumer debt has increased by five percent. So, what is driving consumer spending is debt.”

Job Cuts Resulting from Bankruptcy Reach Highest Levels Since 2005

There is another explanation for why Americans may not be getting by as well as economists would expect these days. For 2019, job cuts resulting from companies filing for bankruptcy rose to their highest point dating back to 2005. Challenger, Gray, & Christmas released data showing that 62,136 U.S. employer job cut announcements for the year 2019 occurred because of bankruptcy. The figure equates to a high 10.5 percent of last year's 592,556 announced job eliminations. Compare this to the announced numbers of job cuts for 2018 and you see that the 2019 figure was 10 percent higher.

The Challenger report revealed that the foremost reasons for 2019's job losses came down to:

“Trade concerns, emerging technologies, and shift in consumer behavior.”

More ominously, retailers mostly powered the rise in bankruptcy resulting job cuts. It was year 2005 since such a large number of bankruptcy-related jobs exceeded the totals for last year. In 2005, bankruptcies caused 74,238 job losses, but the percentage of the job losses resulting from bankruptcies was only 6.9 percent of the total. It is another indication of trouble in the U.S. economy.

Job Growth Has Been In Low Paying Sectors

Another problem contributing to American workers' struggle to make ends meet has to do with the specifics on jobs created during the last two administrations. The December job report may have been better than what economists had looked for, but the unemployment rate is not truly at a 50 year low. According to economist Peter Schiff, a half century ago the country utilized a vastly different method to calculate the unemployment figure:

“If we had to calculate unemployment using the same statistical measure that they were using 50 years ago, the unemployment rate would certainly be well north of 10 percent.”

Keep in mind too that the jobs created since the Global Financial Crisis and Great Recession a decade ago were primarily in sectors that are lower paying and include greater numbers of part-time jobs. The job growth has not been in manufacturing and high-tech sectors, but rather in retail, healthcare, and government services.

Unfortunately the news from this past week about Americans' savings and ability to make ends meet is not encouraging. You can diversify your retirement portfolio so that it is not only dependent on stocks and bonds. Gold makes sense in an IRA as a tool for such diversification. Today it is easy to buy gold in monthly installments. The IRS will even allow you to keep it in top offshore storage locations for your gold IRA these days. Before you make any decisions, it is a good idea to read more about the Top Gold IRA companies.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,355.30

Gold: $3,355.30

Silver: $37.89

Silver: $37.89

Platinum: $1,333.91

Platinum: $1,333.91

Palladium: $1,157.09

Palladium: $1,157.09

Bitcoin: $118,690.90

Bitcoin: $118,690.90

Ethereum: $4,284.91

Ethereum: $4,284.91