Grim Real-Time Data Reveals Coronavirus Creating Widespread Economic Havoc in U.S.

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th December 2020, 06:36 am

In just the last two weeks, the International Monetary Fund has warned the financial world that stocks may suffer from another devastating meltdown if the unfolding global resurgence of coronavirus infections causes lockdown measures to be reintroduced or tensions in trade to increase. Yet just this past week, high-frequency economic data released is revealing exactly such disturbing patterns in travel, vacation, and dining out activity slowdowns in the U.S. and around the world. On top of this, UBS just released a survey of wealthy investors in the U.S. and globally showing that they overwhelmingly believe that life will never return to the lost pre-coronavirus pandemic normal.

Massive Resurgence of Coronavirus in Forty States Smashing Economy Again

In 40 states of the United States' 50 total, coronavirus cases are once again surging ahead. The U.S. has long been a primary epicenter of the global pandemic, but it is quickly becoming by far and away the most severe and troubling center in July. This has caused the occurrence of a dreaded economic activity slowdown and encouraged people to put spending, socializing, and travel on hold for what is left of the critical summer tourist season. The results came in from Barclays Bank's real-time data that tracks important measures of economic activity such as vacation bookings, dining out reservations, and job listings.

As one worrying example, restaurant traffic has quickly leveled back off after initially jumping as states starting their reopening procedures. Employers are also reducing their efforts to fill open positions. Perhaps most troubling, a growing quantity of individuals in the U.S. and overseas have declared that they will go nowhere this summer. The ones still determined to travel say that they will go by car rather than airlines. Barclays Bank's Director of Credit Strategy Ryan Preclaw warned that:

“The state of the outbreak clearly still has the ability to influence economic outcomes. Economic damage appears to be spreading widely, regardless of where cases are concentrated.”

Return of Lockdowns Becoming Imminent As Economy Falters Amid Coronavirus Resurgence

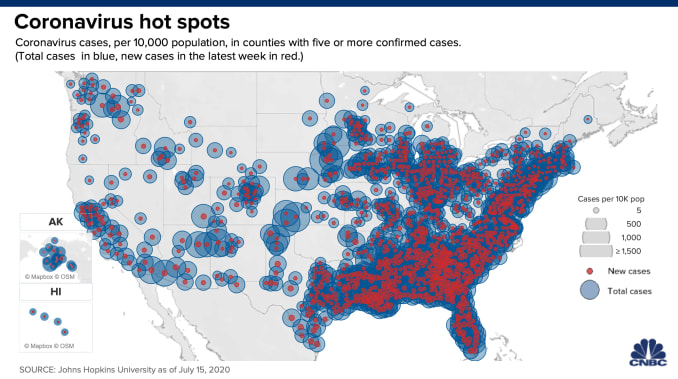

This last point is critical as the overwhelming majority of surging cases have transpired in four states mainly, including Florida, Texas, California, and Arizona. This group amounts to more than half of the new caseloads reported this past week per the COVID Tracking Project. This worrying map shows where the majority of coronavirus cases in the U.S. are now centered:

As states around the U.S. watch nervously the spiking cases across the so-called Sun Belt, they are re-thinking their re-opening plans aimed at re-firing up their own economies. The hospitality business in particular is suffering from rollbacks while many large get-togethers remain restricted until further notice. While Nevada is only backtracking on its reopening procedures, California has re-instituted lockdowns for bars, restaurants, pubs, cafes, and most places and activities that revolve around social gatherings.

High Frequency Data from Barclays Bank Shows Economic Recovery Faltering Badly

Barclays Bank's high-frequency data reveals that the amount of traffic on the roads nationwide “has been slower to recover” versus other places around the globe. It shows that Americans are afraid to return to their normal pre-coronavirus styled lives. And while payrolls were growing for several months in a row, increasing by as much as 7.5 million, now job listing have dropped to be around 20 percent below February levels again. Preclaw observed that:

This flattening of activity plus the rising number of virus cases “raises the possibility that a further acceleration in the national outbreak (and future restrictions in economic activity) may be on the horizon.”

In other words, it is far too soon to throw away your masks and other face coverings now.

Terrified Americans Staying Home this Summer and Not Spending Money on Travel

It is more than just anecdotal evidence showing Americans to be pulling back on their typical summer vacation plans. A recent Jefferies survey showed that 60 percent of the 1,800 respondents surveyed have decided to stay home for the summer versus a 52 percent reading back in May. For those who are still determined to travel, 75 percent now will drive versus 60 percent who planned to back in May. The numbers who will go safe with camping adventures has risen to three percent.

Jefferies research team wrote in their note that:

“This survey in general reflects an increasing fear of heading out to shop or enjoy entertainment, a sharp drop in expected travel, and less optimism around a 2020 return to work.”

Those who responded to the survey stated that 60 percent of working establishments were reopened, versus the 33 percent seen in May. A high 17 percent believe that they will still be working out of their homes through 2021 while a staggering 24 percent do not plan to go back to their former work spaces “for the foreseeable future.”

Unprecedented Fear Gripping Wealthy Americans According to New UBS Survey

The survey revelations only get worse and more surprising still. UBS, among the biggest of wealth managers globally, recently surveyed wealthy investors in the U.S. and internationally to determine what the post-coronavirus fears are and how they vary with the location of those surveyed residence along with their age. Shockingly, the rich are equally as worried about the future after the coronavirus as average Americans.

An incredible 82 percent of the rich in the U.S. now believe that the public life in the States is now permanently changed. Astonishingly, 86 percent of rich Americans believe that their feelings of fear will remain indefinitely, even after the pandemic ends. Of the 3,750 wealthy investors surveyed in the U.S. and around the globe, 81 percent of those who responded stated that they are worried about a second stock market decline ahead of any containment of the pandemic. Fully seven out of 10 investors surveyed said they planned to sharply reduce office visits and travel, and half will move to be nearer family. Almost half of the rich surveyed stated that they will likely abandon the heavily populated cities, with a stunning 88 percent saying that their own health is now their leading priority in life.

In fact, the coronavirus global pandemic has caused many of the rich to seriously rethink their lifestyles for the future. Those surveyed felt by a margin of 75 percent that “life will never be the same again.” This unparalleled level of permanent psychological scarring is bound to take a dramatic toll on future economic activity levels.

The survey conducted over 15 different markets revealed that many wealthy are already in the process of “adjusting their lifestyle” with the reshaping of public life. The UBS survey team wrote that:

“With the pandemic not yet in the rearview mirror, investors are navigating a changed world. Most will find their way with clear priorities, trusted guidance, and continued appreciation for the most important things in life.”

Incredibly, UBS' survey uncovered that of the wealthy in the world (who are usually insulated from such mundane problems as finance according to Newsweek magazine), almost half are worried about having sufficient savings against another pandemic in the future or about needing to work more years in order to address damage that has affected their retirement portfolios and plans. Most tellingly, a high 60 percent worry about becoming a “financial burden” on their families should they become ill with the virus, while 54 percent are now fearful of having sufficient wealth to leave to their children after they die.

The news is not contained to the rich either. The survey determined that fully 70 percent of all Americans claim that this pandemic has negatively impacted their own personal finances at least somewhat, while 77 percent declared that the outbreak has negatively affected their own retirement plans for the future.

Unfortunately the economic news coupled with the rising fear among both wealthy and ordinary Americans continues to show you why gold makes sense in an IRA. You can not stop the pandemic, but you can protect your own investment and retirement portfolios with the ultimate historical safe haven in the form of IRA-approved precious metals like gold. Now is the time to learn more about Gold IRA allocation strategies and the Top Gold IRA companies to help you with any potential future purchases.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,623.44

Gold: $2,623.44

Silver: $29.51

Silver: $29.51

Platinum: $929.27

Platinum: $929.27

Palladium: $917.22

Palladium: $917.22

Bitcoin: $97,120.60

Bitcoin: $97,120.60

Ethereum: $3,335.82

Ethereum: $3,335.82