Gold Price

Gold Price | 24 hours

Gold Price | 15 Days

Summarized Gold Price Table

| # | Date/Time | Price |

|---|---|---|

| 1 | 06/25/2025 | $3,328.71 USD |

| 2 | 06/29/2025 | $3,274.04 USD |

| 3 | 07/03/2025 | $3,341.54 USD |

| 4 | 07/07/2025 | $3,318.08 USD |

Detailed Gold Price Table

| # | Date/Time | Price |

|---|---|---|

| 1 | 06/25 | $3,328.70 USD |

| 2 | 06/26 | $3,330.58 USD |

| 3 | 06/27 | $3,284.37 USD |

| 4 | 06/28 | $3,274.12 USD |

| 5 | 06/29 | $3,274.03 USD |

| 6 | 06/30 | $3,289.12 USD |

| 7 | 07/01 | $3,334.80 USD |

| 8 | 07/02 | $3,339.94 USD |

| 9 | 07/03 | $3,341.54 USD |

| 10 | 07/04 | $3,335.51 USD |

| 11 | 07/05 | $3,336.23 USD |

| 12 | 07/06 | $3,336.27 USD |

| 13 | 07/07 | $3,318.08 USD |

| 14 | 07/08 | $3,323.87 USD |

| 15 | 07/09 | $3,301.22 USD |

Gold Price | 3 Months

Summarized Gold Price Table

| # | Date/Time | Price |

|---|---|---|

| 1 | 05/01/2025 | $3,239.99 USD |

| 2 | 05/18/2025 | $3,284.88 USD |

| 3 | 06/08/2025 | $3,362.58 USD |

| 4 | 06/29/2025 | $3,281.58 USD |

Detailed Gold Price Table

| # | Date/Time | Price |

|---|---|---|

| 1 | 05/01 | $3,239.99 USD |

| 2 | 05/04 | $3,329.15 USD |

| 3 | 05/11 | $3,230.75 USD |

| 4 | 05/18 | $3,284.88 USD |

| 5 | 05/25 | $3,313.34 USD |

| 6 | 06/01 | $3,341.79 USD |

| 7 | 06/08 | $3,362.57 USD |

| 8 | 06/15 | $3,388.70 USD |

| 9 | 06/22 | $3,325.49 USD |

| 10 | 06/29 | $3,281.58 USD |

| 11 | 07/01 | $3,337.60 USD |

| 12 | 07/06 | $3,319.86 USD |

Gold Price | 12 Months

Summarized Gold Price Table

| # | Date/Time | Price |

|---|---|---|

| 1 | 08/24 | $2,472.38 USD |

| 2 | 09/24 | $2,571.35 USD |

| 3 | 10/24 | $2,689.75 USD |

| 4 | 11/24 | $2,658.97 USD |

| 5 | 12/24 | $2,639.18 USD |

| 6 | 01/25 | $2,702.77 USD |

| 7 | 02/25 | $2,887.77 USD |

| 8 | 03/25 | $2,977.94 USD |

| 9 | 04/25 | $3,227.50 USD |

| 10 | 05/25 | $3,284.74 USD |

| 11 | 06/25 | $3,349.77 USD |

| 12 | 07/25 | $3,329.72 USD |

Detailed Gold Price Table

| # | Date/Time | Price |

|---|---|---|

| 1 | 06/30 | $2,326.48 USD |

| 2 | 07/15 | $2,412.47 USD |

| 3 | 07/30 | $2,390.75 USD |

| 4 | 08/15 | $2,455.06 USD |

| 5 | 08/30 | $2,515.39 USD |

| 6 | 09/15 | $2,579.18 USD |

| 7 | 09/30 | $2,645.75 USD |

| 8 | 10/15 | $2,653.95 USD |

| 9 | 10/30 | $2,778.60 USD |

| 10 | 11/15 | $2,565.46 USD |

| 11 | 11/30 | $2,650.29 USD |

| 12 | 12/15 | $2,648.67 USD |

| 13 | 12/30 | $2,616.49 USD |

| 14 | 01/15 | $2,684.56 USD |

| 15 | 01/30 | $2,775.43 USD |

| 16 | 02/15 | $2,882.43 USD |

| 17 | 03/15 | $2,985.04 USD |

| 18 | 03/30 | $3,085.35 USD |

| 19 | 04/15 | $3,221.56 USD |

| 20 | 04/30 | $3,310.97 USD |

| 21 | 05/15 | $3,186.50 USD |

| 22 | 05/30 | $3,299.50 USD |

| 23 | 06/15 | $3,433.17 USD |

| 24 | 06/30 | $3,289.12 USD |

Gold Price | 5 Years

Summarized Gold Price Table

| # | Date/Time | Price |

|---|---|---|

| 1 | 2021 | $1,807.31 USD |

| 2 | 2022 | $1,834.09 USD |

| 3 | 2023 | $1,943.74 USD |

| 4 | 2024 | $2,388.22 USD |

| 5 | 2025 | $3,084.59 USD |

Detailed Gold Price Table

| # | Date/Time | Price |

|---|---|---|

| 1 | 12/20 | $1,863.58 USD |

| 2 | 06/21 | $1,827.58 USD |

| 3 | 12/21 | $1,792.86 USD |

| 4 | 06/22 | $1,841.05 USD |

| 5 | 12/22 | $1,797.75 USD |

| 6 | 06/23 | $1,943.89 USD |

| 7 | 12/23 | $2,038.16 USD |

| 8 | 06/24 | $2,325.23 USD |

| 9 | 12/24 | $2,639.17 USD |

| 10 | 06/25 | $3,349.77 USD |

Custom Gold Price Dates

Please select a from and to date to see a custom gold pricing chart:

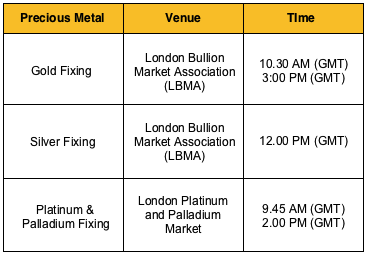

Who sets the price of gold and how often is it updated?

The spot price of gold is determined by the London bullion market. They announce the gold price twice a day – at 10:30am and at 3pm – London time. The task of determining the daily price of gold was performed by The London Gold Market Fixing Ltd. at the facilities of Nathan Mayer Rothschild & Sons. This has changed since 2004, when Rothschild left the business and it went to Barclays.

The spot price of gold is determined by the London bullion market. They announce the gold price twice a day – at 10:30am and at 3pm – London time. The task of determining the daily price of gold was performed by The London Gold Market Fixing Ltd. at the facilities of Nathan Mayer Rothschild & Sons. This has changed since 2004, when Rothschild left the business and it went to Barclays.

When the bankers meet by phone to set the price of gold, they review the amount of orders in each region at the current price. If the banks can meet that demand, the price remains the same. If there is a greater demand than what the banks were prepared to sell, the price is raised; and if the demand is lower than anticipated, the price is lowered.

What affects the price of the gold?

Many factors affect the gold price: supply and demand, asset allocations, currency fluctuations, inflation risk, and geopolitical risks are just some of the elements that influence the price of the shiny metal. Gold is traditionally considered as a “safe money” asset. During times of uncertainty, people and governments buy gold. It is the oldest type of investment and wealth preservation on earth as its use has been tracked all the way down to the earliest civilizations of mankind.

Many factors affect the gold price: supply and demand, asset allocations, currency fluctuations, inflation risk, and geopolitical risks are just some of the elements that influence the price of the shiny metal. Gold is traditionally considered as a “safe money” asset. During times of uncertainty, people and governments buy gold. It is the oldest type of investment and wealth preservation on earth as its use has been tracked all the way down to the earliest civilizations of mankind.

Some political factors are known to cause the price of gold to rise quickly. Stock market collapse or rapid dollar devaluation are two examples that create a quick demand for physical gold by investors. Worldwide crisis, such as declaration of war or terror attack, can also cause the price of gold to rise.

What industries are affected by the price of gold?

Aside from Jewelry, the industries that use gold include:

• Financial coinage: Mints around the world cast gold coins and bars. Many of these are purchased and protected by investors. Most of these coins are never circulated. In contrast, gold bullion is a convenient way to measure gold weight by investors who purchase and store gold precious metal.

• Electronics: Most of today’s sophisticated electronic devices contain a tiny amount of gold. Prior to 1995, computer keyboards used more gold. (These old keyboards can be recycled to extract gold). Mobile phones, GPS units, and even television sets contain some gold.

• Computers: Desktops and laptops contain some gold. These edge connectors used to mount memory chips and microprocessors and plug-and-socket connectors for cable attachment contain gold. Alloys used in these components increase durability. Gold is too soft to use in its pure state.

• Dentistry: Gold is non-allergenic. It is chemically inert and easy for dentists to use in fillings, orthodontic appliances, crowns, and bridges.

• Medicine: Gold is used to treat some medical conditions, including rheumatoid arthritis. Gold isotopes are used to diagnose patients. Some surgical tools and equipment are made with tiny amounts of gold. As a non-reactive metal, gold is reliably used in life-support equipment and devices.

• Aerospace: Gold’s reliability as a conductor and connector are two of the most important reasons aerospace manufacturers and NASA use it. Gold is used as a coating to protect craft temperature. It is also used in circuitry and as a mechanical part lubricant.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,316.03

Gold: $3,316.03

Silver: $36.41

Silver: $36.41

Platinum: $1,367.82

Platinum: $1,367.82

Palladium: $1,142.11

Palladium: $1,142.11

Bitcoin: $111,339.83

Bitcoin: $111,339.83

Ethereum: $2,773.71

Ethereum: $2,773.71