Global Rate Cutting Proof the World Economy Is In Trouble

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Today you saw the U.S. Federal Reserve cut interest rates by another quarter percentage point. Wall Street was loudly demanding this in order to keep stock valuations at otherwise currently unsustainable levels. It was the third interest rate cut in as many meetings.

Fed Cuts Rates for Third Consecutive Month

As observers and economists were widely expecting, the U.S. central bank followed through with its latest interest rate cut for 25 basis points. This was their third interest rate cut in the past three meetings. They have now reduced interest rates by fully 75 basis points since only July of this year.

The Federal Reserve keeps labeling these ongoing easing actions as so-called “mid-cycle adjustments.” Economist Peter Schiff of Euro Pacific Capital Management forecasted that the cut back in July was the first interest rate cut on the path to zero percent interest rates. None of their actions so far have caused any doubt of their willpower to see it through.

Global Rate Cutting Frenzy Continues Unabated

The Federal Reserve is far from alone in these interest rate cuts though. It is in good company with the majority of the global central banks. They are engaged in a race to the bottom in their quest to slash interest rates and flush more printed money through the global economy. As of October 2019, fully 54 individual central banks throughout the emerging and developed countries have reduced their base interest rates.

Head of Market Intelligence Alistar Hewitt of the World Gold Council has stated a variety of arguments in this global interest rate cutting bonanza, with:

“Ongoing trade tensions between the U.S. China (and elsewhere too), the draining Brext saga, as well as a myriad of other geopolitical uncertainties, have taken their toll. Global growth is slowing, and investors are downbeat on world economic prospects. Recession in many major economies is now a real possibility.”

The Bank of International Settlements has been keeping an eye on the global interest rate policies as well. They follow the interest rate activities of 37 important central banks around the world. From these central banks, 60 percent have reduced their national interest rates in year 2019. This is now the greatest amount of cuts dating back to the Global Financial Crisis in 2008-2009. There are still another two months to go in 2019, so more central banks could cut rates too.

Extraordinary Global Monetary Policy Shows No Signs of Slowing

Even though there presently is no Global Financial Crisis underway, the world's extraordinary global monetary policy does not show any signs of slowing down. A number of countries (like Japan and several in Europe) have already gone down the bath of zero percent and negative interest rates in an effort to stimulate their economies out of stagnation. This was previously considered unthinkable and extraordinary. A serious question is: how will these central banks respond when the next significant crash occurs?

This global interest rate plunge has caused a substantial mountain of negative interest rate yielding debt to accumulate. It was only August when the total global debt carrying negative yields surpassed an astonishing $15 trillion for the very first time. In no time at all, the total exceeded $16 trillion. Over the past six weeks it has dipped back down to about $13 trillion. This amount is expected to increase again soon as other central bank rate cuts are in the works.

Negative Yielding Bonds Go From Economic Lunacy to Normalcy

Negative yielding bonds represent serious economic distortion. Whoever heard of paying a government for the privilege of loaning them your money? Only a few years ago, such negative yielding bonds were deemed to be “economic lunacy.” Today they are increasingly regarded as economic normalcy. When such unusual monetary policy shifts to normal, economics gets turned upside down.

This is a result of central banks (like the Federal Reserve) trying as desperately as they can to keep the bubbles in their economies inflated. Lately they are relying on more massive monetary injections to help consumers continue to borrow and spend. The problem is that this policy is unsustainable. It worked following the Global Financial Crisis and crash of 2008, but as economists have pointed out since then, it will not work again now.

Federal Deficits Are The Real Problem

The media pundits blame President Donald Trump and his tax cuts for surging deficits of the last few years. This is not honest though as government revenues increased for fiscal year 2019. Spending is the actual problem.

Consider that overall government revenues rose by four percent to reach $3.46 trillion. Of this amount, $230 billion came from corporate tax revenues, a 12 percent rise from the past year. Individual tax receipts increased by two percent to reach $1.72 trillion. Courtesy of the trade war with China, customs duties increased by 70 percent to touch a record amount of $71 billion.

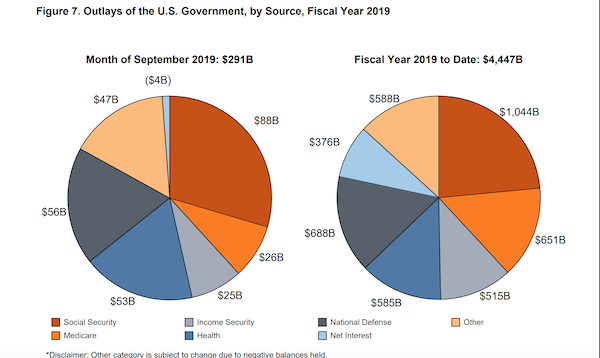

Yet as the chart below reveals, spending increased by more than eight percent to reach $4.45 trillion. Look at how much the government spent on only interest on the existing federal debt ($376 billion):

Negative Yields Necessary for Massive Deficits

It was only last Friday that the Treasury Department revealed its final FY 2019 budget figures. They touted as good news that the shortfall “only” amounted to $984 billion, exactly at the CBO's estimate. According to one CNBC report, this news would:

“come as a relief to the Trump administration, which had previously forecast that the deficit would hit $1 trillion during the 2019 fiscal year.”

Despite this apparent reprieve (of only $16 billion), the CBO still estimates that the federal government will exceed a trillion dollar deficit in fiscal year 2020. They anticipate that such trillion dollar plus deficits will be normal for the foreseeable future. Acting Office of Management and Budget Director Russ Vought released a statement with the Treasury Department numbers:

“Americans from all walks of life are flourishing again thanks to pro-growth policies enacted by this administration.”

There was no mention of the fact that we have de facto borrowed ourselves (and against the country's future) into current prosperity. Never mind the near miss of the trillion dollar deficit; this 2019 deficit is still the biggest budget shortfall dating back to 2012. The deficit still increased by 26 percent versus the past year's enormous budget hole.

The $984 billion figure equates to 4.7 percent of the country's entire GDP. This was the fourth year in a row when the deficit as a percentage of GDP rose. On only four occasions has the federal deficit surpassed the trillion dollar mark. Each of these was in the years after the 2008 financial crisis.

Artificially Low Interest Rates Boost Gold's Appeal

The unnaturally low interest rates (necessary for huge government deficits and debt servicing) are not great news for the U.S. economy. They do support gold though. As the World Gold Council's Hewitt explains, the negative yields reduce the opportunity cost to hold gold:

“As shown above, interest rates have been lowered and the stock of negative yielding bonds has grown rapidly, lowering the opportunity cost for holding gold. Falling rates and negative returns have made government debt less attractive and have increased the possibility of higher inflation and currencies' depreciation in the future.”

It helps to explain why ETF gold holdings touched a record high in September, and why gold makes sense in an IRA. As there is no viable end in sight to the interest rate race to the bottom (over the foreseeable future), it makes sense to consider diversifying your retirement accounts into IRA-approved gold using a Gold IRA rollover. You can read more to learn about the Top Gold IRA companies.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,355.30

Gold: $3,355.30

Silver: $37.89

Silver: $37.89

Platinum: $1,333.91

Platinum: $1,333.91

Palladium: $1,157.09

Palladium: $1,157.09

Bitcoin: $118,690.90

Bitcoin: $118,690.90

Ethereum: $4,284.91

Ethereum: $4,284.91