Federal Reserve Banking Sensitivity Test Shows Big Banks Could Experience Financial Trouble

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 27th June 2020, 08:16 am

This week the news emerged that the Federal Reserve's hand has been forced for the first time since the Great Recession. The Feds felt compelled to place new restrictions on the largest banks and the ways in which they spend their precious capital. This came in response to new and unique “sensitivity tests” that the Federal Reserve performed in which they took the coronavirus pandemic effects on the national economy into consideration.

Federal Reserve Goes After Top 33 Banks in the U.S. and Their Spending

This past week, the Federal Reserve took its first decisive action regarding the group of the 33 largest banks in the United States since the end of the Great Recession. It ordered them to suspend all stock buyback proceedings and to restrict their dividend payments to their shareholders for the third quarter. More importantly perhaps, the banks also have to turn in new plans on how they will raise and maintain sufficient banking capital in order to outlast a severe future downturn in the economy. The list of banks that were targeted included the national financial behemoths Bank of America, Wells Fargo, and JP Morgan Chase.

The Fed's analysis of the bank finances revealed that they might be in decent shape for the moment, but that some of them would struggle dangerously if the worst case scenario unfolds in the hoped-for economic recovery. Federal Reserve Vice Chairman Randal Quarles attempted to lessen the blow of the decision with his accompanying statement that:

“The banking system remains well-capitalized under even the harshest of these downside scenarios – which are very harsh indeed.”

Fed Governors Divided on Being Harder on the Big Banks After the Coronavirus Event Sensitivity Tests Show Weaknesses

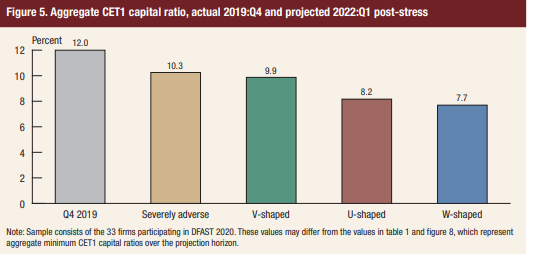

Members of the Fed argued bitterly over more stringent finance requirements for the big banks after considering how serious the coronavirus-induced lockdown economic crash might become. In the event that the slower U-shaped or even W-shaped ecoomic recoveries ensue (where potentially a short recovery gives way to a severe second economic crash later in the same year), a few of the mega banks “would approach minimum capital levels,” per the Fed statement.

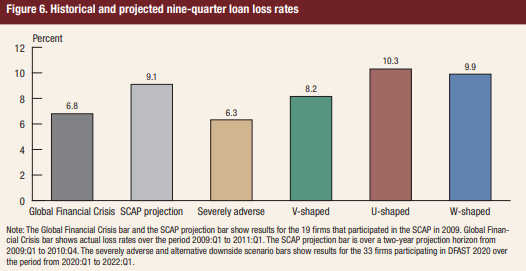

In fact, the banks they reviewed could potentially suffer loan losses that total over $560 billion and as much as $700 billion in the most severely tested scenarios the Fed uncovered, according to its own special Sensitivity Test report. These two charts below show the capital ratio and potential loan losses under the various projected economic recovery scenarios:

The facts emerged that not all Federal Reserve board members were satisifed with the lengths to which the regulators went in their efforts to reign in the mega American banks. One Board Governor Lael Brainard insisted on the central bank stopping all dividend payments to shareholders in this upcoming quarter and not simply limiting them. Brainard expressed his opinion as:

“I do not support giving the green light for large banks to deplete capital, which raises the risk they will need to tighten credit or rebuild capital during the recovery. This policy fails to learn a key lesson from the financial crisis, and I cannot support it.”

The Fed suffered significant deserved criticism for not releasing these results on a bank by bank level. On Capital Hill the critiques poured in. Democratic Senators Sherrod Brown (Ohio), Brian Schatz (Hawaii), and Elizabeth Warren (Massachusetts) jointly issued a letter on Tuesday addressed to Fed Chair Jerome H. Powell and Vice Chair Quarles. It stated that their decision was:

“Highly disconcerting,” the “transparency surrounding the results of the tests is a bedrock principle of the stress testing framework.”

The decision of the Fed only added to the grim reality that has seized control of the American economy in this the worst recession ever dating back to the Great Depression of 90 years ago. Earlier in June, over 30 million Americans had been forced to file for unemployment benefits, with major firms declaring bankruptcy every week.

Coronavirus Pandemic Forces Fed to Rework Stress Tests To More Accurately Show Worst Case Scenarios for Banking Losses

A critical banking metric has been the occasional stress tests that the Feds made the biggest banks undergo in order to show that they would be able to realistically outlast a hypothetical financial and economic crisis without having to require a bailout from the taxpayers. This year's stress test scenario was just published back in February even as the economy spiraled into freefall from the unfolding coronavirus crisis that no Fed stress tests took into account.

The Federal Reserve governors quickly accepted that their most extreme scenarios were nothing compared to the rapidly evolving economic crisis. Their worst case scenario had showed unemployment rising to a mere 10 percent level. Today's unemployment rate is at least 13.3 percent, while the actual rate is likely at least another three percentage points higher still.

Because the Fed's own much -touted stress tests were immediately both outdated and hopelessly irrelevant, they crafted a unique sensitivity analysis in honor of the present crisis to see how the various banks would do if the economy suffered a delayed or protracted recovery period after the shutdowns brought on by the coronavirus pandemic. Almost a quarter of the mega American banks were sitting close to the minimum threshold allowed in the most serious W-shaped recovery, per their analysis. They were to use this to establish their resulting across the board bank restrictions on the ways in which the financial institutions could deploy their capital, such as by stopping stock buybacks.

The Fed was a bit late to the party though. Fully eight of the largest banks in the U.S. had already suspended all of their buyback programs for the year with the economy slowing down, thanks to the coronavirus. Yet they all fought hard against having their dividend distributions restricted by the Feds. As Chief Executive Michael Corbat of Citigroup stated flatly to CNBC this week:

“From our perspective, our dividend is sound, and we plan on continuing to pay it.”

Fed Taking Measures to Shore up Big Banks' Finances and Balance Sheets Now

There are two primary means by which the Federal Reserve actually limited the banks' dividend payouts. The banks are not able to give away more than what they had paid for the second quarter. They also had to restrict their dividend payouts according to a formula that was connected to their recent quarterly earnings.

The Fed most seriously insisted that all of the country's mega banks will resubmit and bring up to date their plans for maintaining their necessary capital cushion. America's Feds are demanding that these all be turned in later on in the year so that they can appropriately account for the present day crisis. The hope is that this will enable the banks to know their own capital funding requirements so that over some time they can work through the coming period of dangerous uncertainty. Quarles explained further that:

“This approach builds on our existing standard on capital distributions. If the circumstances warrant, we will not hesitate to take additional policy actions to support the U.S. economy and banking system.”

Yet other observers were still disappointed in the Fed's limited response. They wanted stricter measures from the central bank. Better Markets' Chief Executive Dennis Kelleher declared that the Fed ought not to be permitting any capital distributions from the banks for minimally a year, with:

“These aren't just stress tests for Wall Street banks. These are credibility tests for the Fed.”

Others criticized the Fed for its lack of transparency in the sensitivity tests. The Fed has always revealed the individual banking detailed test results for how each bank fared in the test and the areas in which the banks individually had room for improvement. Yet with sensitivity analysis, only the aggregated data from the sector of mega banks was released on how the industry and system would perform as a group.

Senior Policy Analyst Gregg Gelzinis of the liberal think tank the Center for American Progress warned that not disclosing the individual banking results would hide the weaker financial institutions from needed additional scrutiny and reforms. He labeled this decision of the Fed's a “critical weakness.”

Unfortunately the economic and financial news coming out practically every week continues to range from bad to worse. This week is no exception with the new Federal Reserve sensitivity test results from the mega banks in America. It all goes to show you that gold makes sense in an IRA now more than ever. The good news is that it is not too late to consider acquiring some IRA-approved gold. Before you buy anything though, you should carefully read and consider more about the Top Gold IRA companies and the best Gold IRA Allocation Strategies.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,623.09

Gold: $2,623.09

Silver: $29.51

Silver: $29.51

Platinum: $929.27

Platinum: $929.27

Palladium: $917.22

Palladium: $917.22

Bitcoin: $98,210.06

Bitcoin: $98,210.06

Ethereum: $3,442.95

Ethereum: $3,442.95