Fed Presidents Kashkari and Evans Calling for Stricter National Lockdown

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 13th August 2020, 05:07 pm

This past week Federal Reserve President (for Minneapolis) Neel Kashkari released a New York Times op-ed that he and Professor Michael Osterholm from the University of Minnesota co-wrote. In this article and a series of interviews Kashkari gave, he called for a complete economic shutdown in the United States for as long as six weeks in an attempt to stop the continuing spread of Coronavirus throughout the country. Despite the fact that the past efforts at lockdown have caused devastating results for the American economy, the Fed president and his colleague argue that in the long run, this action will help to improve the economic picture for the nation.

First Lockdown Was Not Strict Enough Per Minneapolis Fed President Kashkari

Last Friday's op-ed in the New York Times from the Fed President Neel Kashkari and Professor Osterholm the Center for Infectious Disease Research and Policy Center director argued that the United States' economy will need a more severe national shutdown than before if it is to overcome the coronavirus. Kashkari strongly called for the government to mandate a so-called shelter in place directive lasting as long as six weeks for “everyone but the truly essential workers.”

The two men stated that the lockdown of March did not strongly enough defeat the virus. As a result, the United States has fallen behind the recovery efforts of nations that were stricter in containing the coronavirus. According to their op-ed:

The result “could make what we have experienced so far seem like just a warm up to a greater catastrophe. To be effective, the lockdown has to be as comprehensive and strict as possible. If we aren't willing to take this action, millions more cases with many more deaths are likely before a vaccine might be available. In addition, the economic recovery will be much slower, with far more business failures and high unemployment for the next year or two.”

The pair are not alone in this assessment as the White House Coronavirus Advisor Dr. Anthony Fauci the nation's head infectious disease specialist has made similar claims per CNBC. Fed President Kashkari declared that the national efforts so far are not stringent enough. The United States has the most numbers of Covid-19 cases at over 5.1 million. The nation officially recorded a daily average of 52,875 new cases during the past seven days. Tuesday's daily death total was more than 1,000 once again. Director Dr. Ashish Jha of the Harvard Global Health Institute told CNBC that:

“I really have come to believe we have entered a real, new, emerging crisis with testing and it is making it hard to know where the pandemic is slowing down and where it's not.”

This testing decline has been especially severe in some of the states that have been hit most desperately by the outbreak in recent months like Texas. Cases in the Lone Star State have dropped by 10 percent to a daily average of 7,381 per day from the average two weeks ago of 8,203 per the seven day moving average. Yet at the same time, the testing has plunged by 53 percent. In this timeframe the percentage of tests coming back positive has doubled to around 24 percent during the past two weeks per Johns Hopkins University. Kashkari's op-ed warned that:

“Simply, we gave up on our lockdown efforts to control virus transmission well before the virus was under control.”

Another lockdown could be coming sooner than you think. Chicago Fed President Charles Evans has also gone on record this week backing a four week hard national lockdown as The Street reported.

The Consequences of the First Lockdown Were Economically Devastating

In the first round of American lockdowns, the country closed enough businesses to cause minimally 20 million jobs to be lost. Since that time that ended a few months ago, only around half of those jobs have returned in the economic restart. Congress has intervened through various packages of rescue funding in the meantime. These have impacted the nation's debt level by increasing it $3 trillion to reach $26.5 trillion.

At the Federal Reserve (of which Kashkari is a member) they have boosted their central bank balance sheet to the tune of almost $3 trillion through offering liquidity and lending programs in a range of vehicles. Efforts to contain the virus also devastated wider economic output in the nation. The GDP plunged by 32.9 percent during the second quarter (figured on a full year period).

Fed Member and Economist Argue That Despite Pain of A Serious Second Lockdown, Long Term Benefits Will Be Realized

Even though there was a massive amount of economic and financial harm caused in the first shutdown (such as massive layoffs, many thousands of failed businesses, and widespread educational and mental health problems) Kashkari and colleague maintain that a second lockdown would lead to a more powerful post-coronavirus recovery. Kashkari stated that:

“If we do this aggressively, the testing and tracing capacity we've built will support reopening the economy as other countries have done, allow children to go back to school, and citizens to vote in person in November. All of this will lead to a stronger, faster economic recovery, moving people from unemployment to work. There is no trade off between health and the economy. Both require aggressively getting control of the virus. History will judge us harshly if we miss this life- and economy-saving opportunity to get it right this time.”

U.S. President Trump's Efforts To Boost Consumer Spending through More Unemployment Benefits Will Be Delayed

U.S. President Donald Trump has signed a series of executive orders in an attempt to extend a financial lifeline that has carried millions of Americans through the economic lockdown and aftermath. This has the added benefit of giving otherwise cash-strapped American consumers the ability to spend to help support an economic recovery. The $300 per week increase in unemployment benefits that President Trump just authorized may take more than a month to reach workers in need of help.

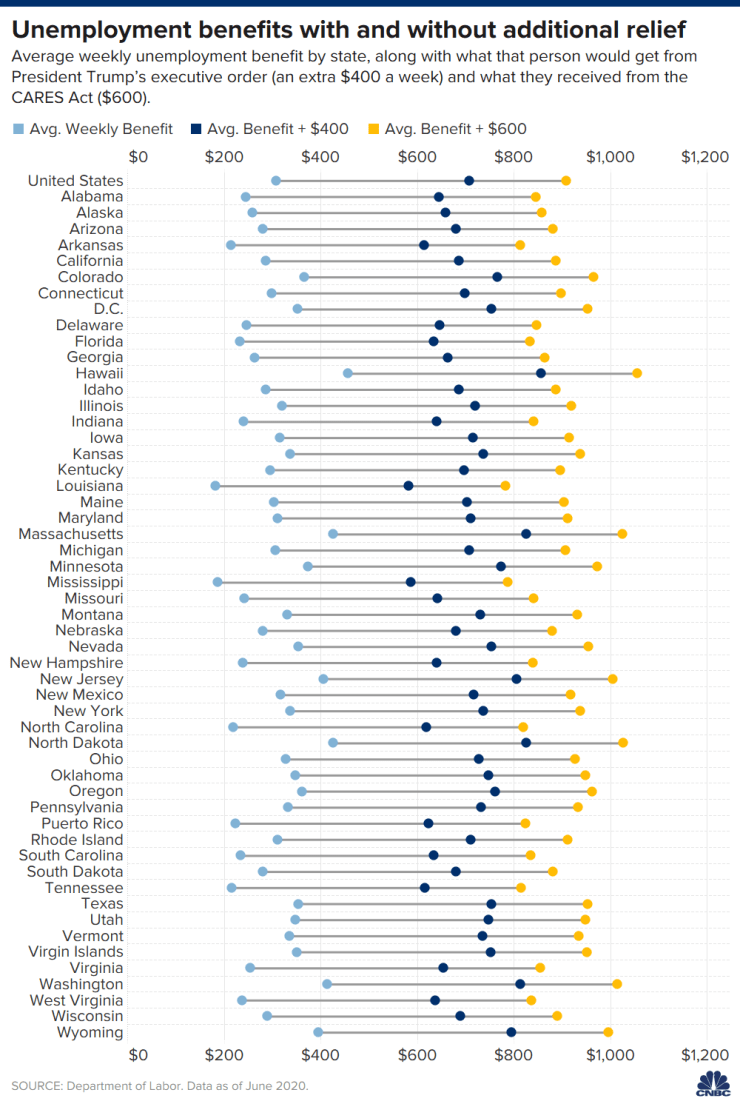

This chart below demonstrates the current unemployment benefits that the different states currently offer as well as the amount that they will be able to provide if and when this additional relief arrives:

Unfortunately for consumers in need of financial assistance at the moment, there are states where these benefits might not be offered period.

Trump's executive order from Saturday would take as much as $44 billion of funding from federal disaster relief programs and send it to those Americans who are unemployed. This $300 was supposed to be boosted by another $100 from the states' contributions, but a loophole allows for them to ignore the order. Labor experts have warned that the governors of many states including New York, New Jersey, Mississippi, Kentucky, Florida, Delaware, and California have already indicated concern about providing the unemployment benefit extension. There is a chance that they will avoid the effort required because of the expense of putting the program into place.

Unfortunately you can not change the ideas of policymakers regarding potential additional draconian lockdown measures across the United States anymore than you can stop the unprecedented rise in government national debt or the incredible increase in the ballooning balance sheet of the Federal Reserve today. It is hard to argue with the assessment that gold makes sense in an IRA these days. You can research IRA-approved precious metals as well as a Gold IRA rollover. There is more information available on precious metals from the Top Gold IRA Companies.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,631.42

Gold: $2,631.42

Silver: $29.86

Silver: $29.86

Platinum: $938.75

Platinum: $938.75

Palladium: $921.81

Palladium: $921.81

Bitcoin: $95,667.01

Bitcoin: $95,667.01

Ethereum: $3,322.64

Ethereum: $3,322.64