Economic Recoveries of EU and Asia Lag Behind U.S.

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 24th February 2021, 09:54 pm

This past week news emerged that much of the rest of the world's economies are lagging behind that of United States' recovery. Economists at JPMorgan Chase and Company warned that the recovery within the U.S. is gathering pace at a rate that will have it surpass the V-shaped rebound emerging in China. This is good for the U.S. in the short term but may lead to negative feedback loop problems over the longer term.

All Economic Indicators Point to Higher than Trend Growth for the U.S.

Bruce Kasman the economic team leader at JPMorgan is seeing strong signs of positive economic trends for the United States. These include a ramping up in retail spending in America, global industry resilience, and concerted stimulus efforts in the U.S. and world. Kasman and his team shared in a note that:

“We now expect the U.S. to outpace China, moving on a path that raises GDP well above its pre-crisis trajectory. We expect a regional gap between the U.S. and China and the performance of the rest of EM to remain large for some time to come.”

The team added that a coinciding rebound from the European coronavirus alongside the increased American fiscal stimulus will encourage a 7.6 percent boost to the global GDP by middle of 2021. The picture within the United States appears to be especially encouraging. Slowing in China will remain, although high frequency data from the country shows that the slowdown is not as severe as had been anticipated earlier per the JPMorgan economics team.

Eurozone Not to Catch up Economically Until Next Year

It was only in January that the IMF International Monetary Fund praised the rebound in China even as it anticipated that both the American and Japanese economies would regain their economic levels (before the global COVID-19 pandemic) no later than the end of 2021. It also warned that the euro zone will take until 2022 to catch back up.

The EU has been slow to hammer out which specific projects will receive funding out of their joint recovery fund that totals 750 billion euros. Meanwhile the United States' latest stimulus package totals a larger, more impressive $1.9 trillion. Another thing holding back the European countries as they try to ease restrictions from the pandemic has been their delays in bringing out vaccines at the same time as there are worries about newly emerging varieties of the coronavirus. Chief Economist Sylvain Broyer of S&P Global Ratings EMEA explained it with:

“It remains a race between mutations of the virus and the vaccination, and euro zone countries are lagging on the vaccination process, that's for sure.”

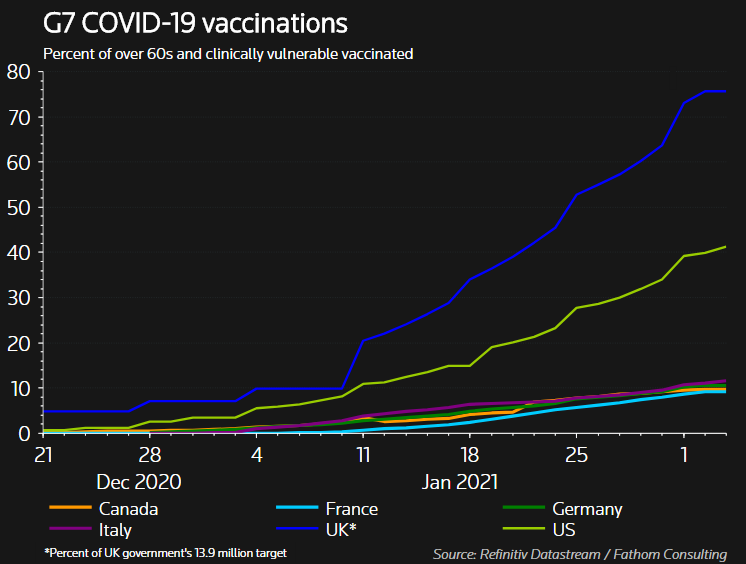

The graph below reveals the progress that various G7 countries have made so far in their vulnerable population national vaccination campaigns. It shows that Great Britain is far ahead of its nearest rival the U.S.:

Ongoing Existing Lockdowns in EU Continue to Hammer the Region's Economy

This week the data from the euro zone painted a grimmer picture. It revealed that the area's ongoing pullback worsened in the month of January with the extended restrictions on the primary service industry. Ongoing lockdowns in a number of the EU countries will continue through March and beyond. Germany released a survey on Thursday revealing that the firms in the largest economy in the euro zone expect some form of restrictions to exist through the middle of September. The ongoing increased travel restrictions signal more economic pain to come in the future.

The problem stems from the lagging European Union's vaccination drive. The block unveiled it grandly on December 27th but has grappled with ongoing vaccine shortages and continuously slower rollouts. The average daily vaccination rates in the larger EU economies (from Euler Hermes trade insurance group) shows a mere .12 percent of the population. This is one-quarter of the daily rate of Great Britain and the U.S. This has amounted to only three percent of the EU nations' populations having received their first dose, while nine percent in the United States have obtained theirs and 14 percent in the United Kingdom have, per Our World in Data.

This equates to a five week long lag in vaccinations, per estimates at Euler Hermes. Unaddressed, the EU is looking at nearly 90 billion euros in lost output for year 2021, roughly two percentage points of lost GDP growth for the quarter. Euler Hermes explained in a note that:

“Economies that finish the race first will be rewarded with strong positive multiplier effects supercharging consumption and investment activity in H2 2021, whereas vaccination laggards will remain stuck in crisis mode and face substantial costs – economic as well as political.”

The real risk for the European Union lies in long-term damage to the block's economy. Youth and long-term unemployment are serious potential problems associated with this scarring. These areas have only recently begun to improve in the last years since the financial crisis of 2008-2009. Guntram Wolff of the Brussels economic think tank Bruegel estimated that unemployment levels for workers within EU nations in the age group of from 15-24 have risen for Q2 2020 from 14.9 percent to 16.4 percent verses a year prior. He explained that:

“COVID-19 threatens to undo the last decade of progress: policymakers must act to avoid Europe's youth suffering the scarring effect.”

European Central Bank Unable to Match Stimulus Efforts of Federal Reserve

Such a delay in the economic recovery might cause conditions to be more difficult for the European Central Bank which is attempting to hold on to its ultra-loose monetary policy at the same time as the improving American economy is forcing up worldwide borrowing costs. This disconnect is appearing most noticeably in sovereign debt markets. While the 10 Year Treasuries are yielding 20 more basis points in 2021, borrowing costs for Germany are stuck at -.46 percent. Economist Marchel Alexandrovich of Jefferies European expounded with:

“If you get this outperformance of the U.S., you get more chatter about Fed tapering, pushing rates higher in the market, and making the ECB's role harder. Right now they (central banks) are all doing the same thing, but in 2022 there will be many more questions about policy divergence with the ECB still being more accommodative.”

The European decisions mean that there should not be as severe a lag coming from the virus-led recession as was evident emerging from the 2008-2009 financial crisis. The governments in Europe do not have the ability to equal the American stimulus packages that have already amounted to an enormous 19 percent of the national GDP. Yet they are being aggressive with their monetary and fiscal stimulus in the euro zone.

Analysts at Berenberg forecast that the euro zone area will require about nine quarters in order to achieve is pre-pandemic economic levels while the U.S. only needs six quarters. After the 2008-2009 crisis, the economy of the euro zone needed seven years to make up its losses while the United States recovered in half as much time. Should the EU countries deploy stimulus from the 750 billion euro EU joint recovery fund, the divergences for the future should be lower.

Christian Odendahl from the Centre for European Reform expounded with:

“If we manage to use this big pot of money to get some countries to do the necessary adjustments and reforms and investment they need to tap long-term potential, then this recovery fund would have served a very good purpose. But if the implementation of that recovery fund is weak — and there is a risk that is might be, because spending that much money quickly and well is difficult — then we may have squandered that opportunity.”

The continuing divergence in economic recovery between the United States, China, and Europe helps to explain why gold makes sense in an IRA. Today there are a wide variety of Gold IRA Storage Options available for IRA-approved gold.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,336.86

Gold: $3,336.86

Silver: $38.17

Silver: $38.17

Platinum: $1,421.87

Platinum: $1,421.87

Palladium: $1,258.16

Palladium: $1,258.16

Bitcoin: $117,578.27

Bitcoin: $117,578.27

Ethereum: $3,726.42

Ethereum: $3,726.42