Debt Limit Ceiling Threatens Government Shutdown

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 27th August 2021, 06:29 pm

This past week a largely ignored alarm sounded from Washington, D.C. out of the Treasury Department. Secretary of the Treasury Janet Yellen issued a warning to Congress last Friday that the department will have no choice but to launch “extraordinary measures” come August 2nd in order to keep the American government from a default. This will happen unless Washington lawmakers are able to reach a last minute deal to raise the debt ceiling in the next few days.

Extraordinary Measures to Run Government Are Imminent

If no agreement on raising the debt ceiling is reached before August 2nd, the Treasury Department will be forced to start employing thee so-called “extraordinary measures” in order to cover the financial and legal obligations of the U.S. government. This fix is only temporary, but it enables the secretary to utilize other government accounts for a matter of weeks.

Treasury Secretary Yellen made the dangerously approaching deadline clear in a letter she wrote to Speaker of the House Nancy Pelosi. One of the first measures to come into effect will be the suspension of U.S. government bonds at the conclusion of July. This is the means through which the federal government funds its debt. Yellen stated in her letter to Pelosi that:

“The period of time that extraordinary measures may last is subject to considerable uncertainty due to a variety of factors, including the challenges of forecasting the payments and receipts of the U.S. government months into the future, exacerbated by the heightened uncertainty in payments and receipts related to the economic impact of the pandemic.”

Not Clear How Long Emergency Capital Will Last

This communication from the Treasury secretary to the Speaker of the House is a mandatory requirement when the total U.S. debt spending approaches the pre-set legal limit. Such extraordinary measures have been utilized in past years to stave off default. The problem now is that no one is certain how much time this emergency capital will hold with all of the unprecedented Coronavirus stimulus programs that are ongoing.

The White House Press Secretary Jen Psaki tried to play down the serious language of the letter by reminding reporters that other administrations have occasionally had to send out these types of communications. She stated that:

Such a letter is “standard practice for Treasury secretaries when a debt limit is going to be re-imposed. During the previous two administrations, the Treasury secretary sent nearly 50 letters to the Hill on the debt limit, some of which were very similar, in wording and asks and updates, to this letter.”

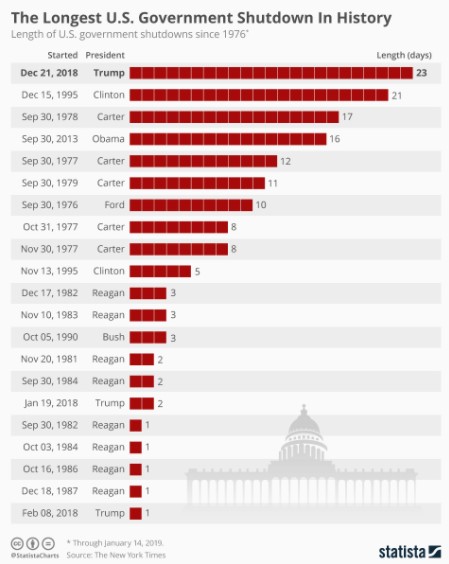

This chart shows past government shutdowns and how long they have lasted:

Past History of This Event Has Caused Market Chaos and Debt Downgrades

Her statement ignores the consequences of getting too close to the limit. The United States has not gone through in defaulting on the debt in these uncomfortable cases, yet it still can lead to financial chaos. Back in year 2011, the unwillingness of the House to put through an increase to the debt ceiling caused the U.S. sovereign credit rating to be downgraded. This action caused turmoil in financial markets.

Actual default is unlikely according to economists, but it would be catastrophic if it occurred inadvertently. A number of economic sectors would be severely threatened by such an event. The democrats have a few options to prevent this but no clear plan yet.

Administration Calm, but Breach of Deadline A Virtual Certainty

The administration has called for calm even as gridlock on key legislation has made it almost certain that the Congress will not make the August 2nd deadline. One of the stickiest points is the lack of compromise on a one trillion dollar infrastructure deal spearheaded by Chuck Schumer the Senate Majority Leader. Senate Minority Leader Mitch McConnell shared that he:

“Can't imagine a single Republican” voting in favor of raising the debt limit while the Democrats are pursuing a policy of “free for all for taxes spending.”

Meanwhile GDP Growth Is About to Hit a Wall

Meanwhile GDP gross domestic product data missed its Dow Jones estimate of 8.4 percent, coming in at 6.5 percent (annualized). While it still seemed like a high growth number, the economy is working its way back to a normal level as millions of American employees go back to work. It will lead to an eventual reversion to the mean for the U.S. economy that has averaged growth nearer two percent before the pandemic. Chief Economist Mark Zandi of Moody's Analytics shared that:

“Growth has peaked, the economy will slow a bit in the second half of the this year, then much more noticeably in the first half of 2022 as fiscal support fades. The contours of growth are going to be shaped largely by fiscal policy over the next 18 months. The tailwind just blows less strongly, and may stop altogether by this time next year.”

The economics firm Jefferies keeps a running gauge on economic activity and now shows that growth has returned to 100 percent of the pre-pandemic totals for its first time. The company shared that some sectors such as air travel and employment are still lagging even as housing and retail combined to lift economic activity to the 2019 level as of July 26th. Chief Financial Economist Aneta Markowska of Jefferies shared her opinion that:

“When I look holistically at household income dynamics and balance sheets, I see a very, very positive situation, very healthy fundamentals, and it's hard to be pessimistic on the outlook.”

Other data released was disappointing. The unemployment benefits initial claims for week ending July 24th came in with 400,000 people filing initially. This was higher than the 385,000 claims estimated by Dow Jones surveyed economists and at almost twice the normal level before the pandemic.

Chief Economist Joseph Brusuelas of consulting firm RSM explained that:

“What we see is an economy growing robustly above trend albeit at a slower pace through 2023. Absent any productivity-enhancing policy support, we eventually will move back to trend because there's not much we can do about the demographic headwinds, which will eventually drag growth back to the long-term trend.”

An Aggressive Bout of Inflation to Hit Economic Output

Even these relatively high growth numbers face near term headwinds. The aggressive bout of inflation caused by supply and demand imbalances stemming from the economy reopening will impact output. Federal Reserve economists are calling the inflation temporary because of skyrocketing car and truck prices. Yet Treasury Secretary Janet Yellen cautioned that the there will likely be a few months of price increases.

This inflation coupled with dwindling fiscal support will be a drag on growth. U.S. Economist Alexander Lin from Bank of America wrote that:

“Looking ahead, this is likely the peak, with growth cooling in the coming quarters.”

Chief North American Economist Paul Ashworth of Capital Economics similarly shared that:

“With surging prices squeezing real incomes we suspect the pace of monthly growth will remain lackluster, setting the stage for a sharp slowdown in consumption and GDP growth in the third quarter.

A reason that gold makes sense in an IRA is that inflation is a threat to markets and the value of the money in your investment and savings portfolios. One way to reduce the impacts is with IRA-approved precious metals. There are a variety of gold-IRA storage options these days.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,274.09

Gold: $3,274.09

Silver: $35.99

Silver: $35.99

Platinum: $1,338.78

Platinum: $1,338.78

Palladium: $1,138.53

Palladium: $1,138.53

Bitcoin: $107,376.61

Bitcoin: $107,376.61

Ethereum: $2,428.34

Ethereum: $2,428.34