Vantage IRA Review: Your Next IRA Service Provider?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

- Phone : (480) 306-8404

- URL :

- Global Rating

- Good

User Rating

- 2 Reviews

Vantage IRA is the company formerly known as Entrust Arizona. They are among the foremost self-directed IRA administrators of the southwest United States. With 6,500 clients in house since their beginnings in June of 2004, they are a third party administrator that works with First Trust Company of Onaga. Among their alternative asset choices they offer clients are private lending, real estate IRAs, private companies, and precious metals IRAs. Their annual fees are reasonable but do not include precious metals storage and administration fees.

Pros:

- They are among the leading IRA administrators with 6,500 clients

- Annual account administration fees start at only $100

- The company provides a significant range of alternative investment choices such as private lending, real estate IRAs, private companies, and precious metals IRAs

Cons:

- Their fees for precious metals IRA administration and storage start at $225

- There are other miscellaneous fees involved, some of them sliding scale based

Vantage IRA, formerly Entrust Arizona (www.vantageiras.com) is one of the leading self-directed IRA custodians in the southwest. The Phoenix, Arizona-based company has managed to amass a client base of more than 6,500 since its inception in June 2004. Vantage IRA is a third-party administrator (TPA) that is partnered with First Trust Company of Onaga (FTCO). Vantage IRA specializes in guiding investors through the process of opening and completing transactions within self-directed individual retirement accounts (IRAs).

Table of Contents

Vantage IRA Management

The Founder and CEO of Vantage IRA is J.P. DahDah, a graduate of the University of Arizona with multiple degrees in Finance and Marketing. His professional career began in 1997 when he started as a financial advisor working for American Express Financial Advisors, a consistent Fortune 100 company.

To learn more about the management and history of Vantage IRA, see their Meet Our CEO page.

Vantage IRA Prices and Products

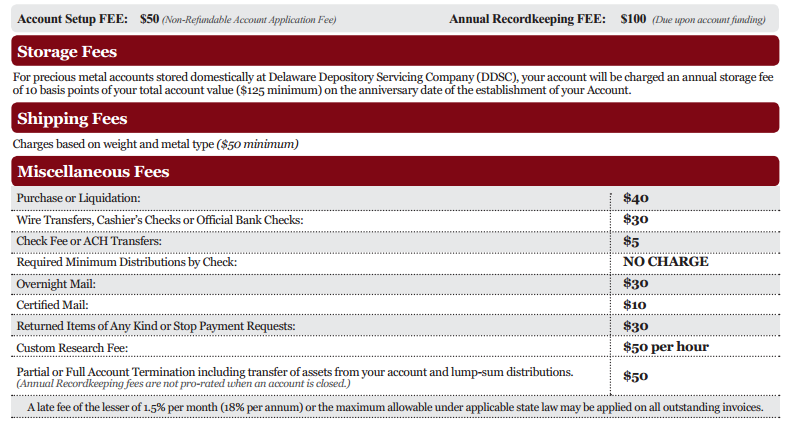

Vantage IRA specializes in providing custodial and administrative account services that let retirement investors invest in a broad range of alternative assets and account types, including real estate IRAs, private lending, private companies, and Gold IRAs. The following is a screenshot of Vantage IRA's precious metals fee schedule:

Note that the above annual fee of $100 does not include the cost of storage, which is charged at 10 basis points of the total fair market account value, with a $125 annual minimum. Thus, the minimum annual cost of having a precious metals IRA with Vantage is $225, in addition to the setup and other miscellaneous fees. Click here to see Vantage IRA's full fee schedule for precious metals with storage.

Vantage IRA Ratings & Complaints

- Better Business Bureau: ⭐⭐, A+ (Details)

- BBB: 1 complaint closed in last 3 years (Details)

- Business Consumer Alliance: No Profile

- Yelp: ⭐️ out of 5 based on 3 reviews (Details)

- Trustpilot: No Profile

- Facebook: 1,249 Likes

Vantage IRA Contact Details

- Address: 20860 N Tatum Blvd. Suite 240 Phoenix, AZ 85050

- Toll-Free Phone: (866) 459-4580

- Local Phone: (480) 306-8404

- Fax: (480) 306-8408

- Email: Investments@VantageIRAs.com

- Website: www.vantageiras.com

Always Review the Competition Before You Buy

Investing in precious metals within a self-directed IRA is a process that should be carefully researched and well understood by the investor. There are literally dozens of IRA custodians and hundreds of bullion dealers to choose from, and while most of them are reputable enough to fulfill orders and honor their guarantees, not all companies operate under the same terms and fee policies. Fortunately, we've made it easy for anyone to conduct their own research using comparison lists of the top 10 gold IRA companies and top 10 IRA custodians.

The main aspects you'll want to compare when choosing an IRA custodian are:

- Fee Schedules – The only way to really know exactly what you're going to pay to open and maintain a precious metals IRA is to examine your custodian's fee schedule. Some custodians charge a sliding scale storage fee, which increases along with the value of your account, while others charge a flat-rate fee that includes the cost of storage.

- Partnered Bullion Dealers – Some of the leading bullion dealers and gold IRA companies have established partnerships with custodians and are therefore able to waive the custodian's fees in exchange for you buying your IRA-eligible bullion from them. By opening an account through a company like this you can streamline the process of setting up the account and stocking it with the appropriate gold products, while also saving money on custodian fees that you would've had to pay if you had signed up with the custodian directly.

With the above facts in mind, we strongly urge you to compare the competition and research your decision thoroughly before making any substantial investments.

Contact Us if You Own or Represent Vantage IRA

If you're an owner, representative or associate of Vantage IRA and you've noticed any information within this review that is inaccurate, outdated, or misleading, please do contact us with your concerns. We strive to provide the most useful and accurate reviews for our readers on an ongoing basis.

Why Broad Financial is our Ranked #1 IRA Custodian in 2024

While building this year's list of the top 10 IRA custodians, we considered numerous different companies before narrowing down the candidates presented in the finalized custodian comparison table. We've made it easy for anyone to conduct their own research regarding the history, features, reputations, and fees of the leading precious metals IRA custodians. Each company has been thoroughly researched and ranked based on the following factors:

- preferred/partnered depositories and storage options

- whether storage fees are included in the annual charge – some companies require you to pay storage fees in addition to annual administration/renewal fees

- setup charges and account startup cost

- fee structure – sliding scale annual feesvs. flat-rate annual fees

- company reputation and industry presence

Broad Financial partners with bullion dealers, brokers, and investment firms to bring retirement investors cost-effective, streamlined access to precious metals IRAs. While it is possible to setup an account with Broad Financial directly as an individual, there are numerous unique benefits associated with opening your account through Augusta Precious Metals, one of our leading precious metals providers.

If you'd like to learn more about the advantages of opening a Broad Financial precious metals IRA through Augusta, see our full review of Augusta Precious Metals. You can easily sign up for a free, no-obligation information kit to begin your gold IRA investing journey.

- Phone : (480) 306-8404

- URL :

- Global Rating

- Good

User Rating

- 2 Reviews

Vantage IRA is the company formerly known as Entrust Arizona. They are among the foremost self-directed IRA administrators of the southwest United States. With 6,500 clients in house since their beginnings in June of 2004, they are a third party administrator that works with First Trust Company of Onaga. Among their alternative asset choices they offer clients are private lending, real estate IRAs, private companies, and precious metals IRAs. Their annual fees are reasonable but do not include precious metals storage and administration fees.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $4,190.03

Gold: $4,190.03

Silver: $57.49

Silver: $57.49

Platinum: $1,655.37

Platinum: $1,655.37

Palladium: $1,473.01

Palladium: $1,473.01

Bitcoin: $92,884.57

Bitcoin: $92,884.57

Ethereum: $3,185.76

Ethereum: $3,185.76