Cryptocurrency IRA Investing Explained (2021 Updated Guide)

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 16th September 2021, 07:08 pm

Adding cryptocurrency to one’s IRA is a tempting proposition. After all, Bitcoin and other top cryptocurrencies have skyrocketed in value in recent years. Despite the temptation, many investors shy away from cryptocurrency IRA investing because they don’t understand what they are, and how to open one.

Nonetheless, a growing number of Americans with retirement on their mind are getting involved in crypto investing. A recent report found that 31% of near-retirees in the U.S. are now invested in cryptocurrencies. This, despite the fact that many Americans are still unsure about what cryptocurrencies are, and what role they can play in their portfolio.

To put your questions to rest, I’ve put together a short guide to the fundamentals of cryptocurrency IRAs and their respective benefits and drawbacks. This way, you can make an informed investment decision before you get involved with this kind of cryptocurrency investment account.

Table of Contents

What is a Cryptocurrency IRA?

A cryptocurrency IRA is an individual retirement account (IRA) that holds cryptocurrencies, including, but not limited to, Bitcoin, Litecoin, or Ethereum. These accounts provide tax benefits that allow the assets held within them to appreciate on a tax-deferred or tax-free basis, depending on the account type chosen.

Cryptocurrency IRAs do not have to be solely invested in cryptocurrency. In fact, many are only partially invested in digital assets, and instead hold a majority of their value in stocks, bonds, mutual funds, and other conventional assets. Technically, a portfolio that consists of 90% stocks and 10% Bitcoin is still considered a cryptocurrency IRA.

Benefits and Advantages of a Cryptocurrency IRA

If you’re on the fence about whether a crypto IRA is right for you, first consider their respective advantages and disadvantages. Let’s start with the upside. Below, we’ve listed the main benefits of a cryptocurrency IRA.

- Tax-Deferred/Tax-Free Growth: Roth and traditional IRAs allow for tax-free or tax-deferred growth, respectively, for your cryptocurrency assets. This way, your Bitcoin and other tokens can appreciate within accruing 20% capital gains taxes.

- Decentralization: Unlike virtually all other asset classes, digital currencies are not centrally owned or controlled and therefore immune from security attacks or seizures from any one point of failure (unlike, say, a security breach at a bank).

- Diversification: Bitcoin and other cryptocurrencies are uncorrelated to the stock market and share only a weak correlation with the broader performance of the economy. Therefore, its addition in one’s portfolio can help protect one’s wealth during downturns in the economic cycle, such as during recessions.

- Enhanced Security: Cryptocurrencies operate on blockchains, which are immutable peer-to-peer networks that cannot be tampered with. Every node on the blockchain network is permanently recorded and traceable, making every transaction less susceptible to loss or failure than centralized networks.

- FDIC Insurance: The most reputable cryptocurrency IRA providers fully insure their customers’ deposits, providing peace of mind that cannot be attained when investing in cryptocurrencies outside of an IRA.

In sum, the benefits of a crypto IRA are many. Above all, however, they provide peace of mind and key tax savings since each deposit is FDIC insured and gains can be realized without having to pay long-term capital gains taxes. Given the high growth potential of cryptocurrencies, this can amount to thousands of dollars in tax savings over time.

Disadvantages of a Cryptocurrency IRA

No investment vehicle is perfect, and this is as true of crypto IRAs as it is of any other investment. Nonetheless, an independent observer might agree that the myriad advantages of cryptocurrency IRAs outweigh the nominal disadvantages associated with these account types.

To make an informed and unbiased investment decision, you need to know the costs and benefits associated with IRA investing. That’s why, in the interest of objectivity, we’ve provided a list of the various drawbacks to crypto IRAs below:

- Variable Fee Structures: Cryptocurrency IRA providers charge annual fees for their services, and some run significantly higher than others. Most companies charge in the $175 to $400 range per annum. We recommend shopping around to find a competitively priced provider before making a final decision.

- Processing Fees: Certain service providers also tack on processing fees and transaction fees; however, these are not unique to IRA companies since every cryptocurrency wallet or exchange also incorporates fees. For IRA companies, these often range in the 0.25-1% range per transaction.

- Volatility: As a nascent asset class, Bitcoin and altcoins are prone to extreme volatility and their prices can change dramatically in the span of a day. Buyers should beware that they can lose significant value on their investment when investing in cryptocurrencies.

- Hype and Speculation: Much of Bitcoin’s ascendency (and the cryptocurrency market more broadly) is based on speculation and public exuberance regarding whether Bitcoin will one day supplant fiat currency in the world’s monetary system. Buyers should beware that these speculative assertions are exactly that, and should not be treated as a matter of fact.

How Do You Invest in Cryptocurrency?

When our readers ask us how to invest in crypto, our first piece of advice is to choose the type of account in which they’d like to invest. For those who want to build long-term wealth, or prepare for their retirement, either a Roth or traditional IRA is likely the right choice.

Those who’ve already maxed out their IRA contributions (e.g., contributed the maximum allowed $6,000 per year for those age 49 or younger) cannot contribute to a crypto IRA. These investors are better suited to investing with a private crypto wallet or exchange outside of an IRA environment. To get started, investors simply need to create an account with a reputable Bitcoin exchange service such as Coinbase, Binance, or Robinhood.

Traditional vs. Roth Cryptocurrency IRA

Most investors are better off opting for an IRA through a cryptocurrency IRA service provider. As a rule, younger investors in lower tax brackets should opt for Roth IRAs, whereas older investors in higher tax brackets should consider a traditional IRA.

Roth IRAs allow for tax-free gains because they consist of assets purchased with after-tax dollars. Therefore, later in life, when the account holder will presumably have a higher marginal tax rate, they will be exempt from paying taxes on the assets they withdraw.

By contrast, those who have already maximized their earning potential have more to gain from a traditional cryptocurrency IRA account.

Once you’ve decided on an account type, your next step is to contact cryptocurrency IRA companies and inquire about opening an account. In most cases, accounts can be opened, funded, and prepared for trading within 3-5 business days.

Funding a Cryptocurrency IRA

The process of funding a cryptocurrency IRA is a relatively straightforward process. Once you’ve opened an account with a cryptocurrency IRA company, you can fund your account via three different processes:

- Cash Deposit: A simple bank transfer or credit card charge that transfers to your crypto IRA wallet. Standard bank transfer rates apply.

- IRA/401(k) Rollover: A process in which funds are withdrawn from your existing IRA or 401(k), deposited into your personal bank account, and then redeposited into your new IRA.

- IRA/401(k) Transfer: Existing funds from an IRA or 401(k) are withdrawn and directly deposited into the new IRA account, without entering your personal bank account.

There are costs and benefits associated with each type of funding option. While cash deposits are the fastest, they can trigger fees from your bank. Rollovers, on the other hand, are subject to strict IRS regulations and can only be initiated once per calendar year.

Generally, we recommend direct IRA transfers since they’re a simple, hands-off procedure that minimizes risk and triggers no fees or charges.

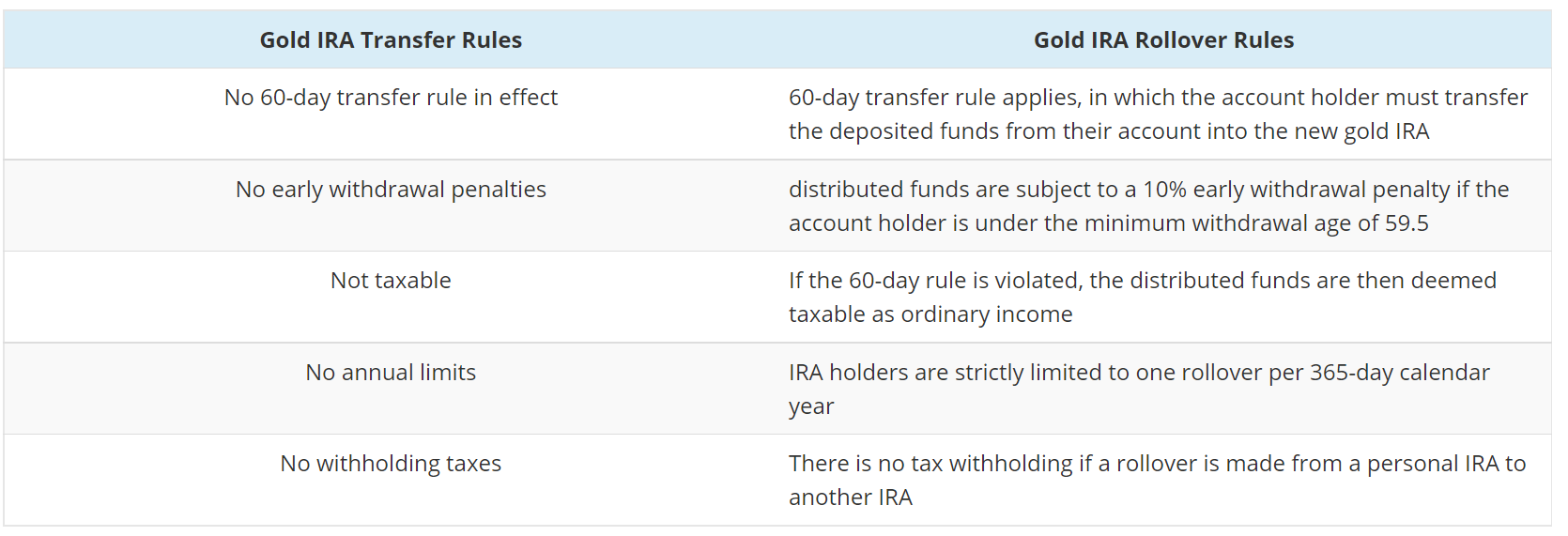

To get better acquainted with the regulatory differences between an IRA transfer and an IRA rollover, check out the table below.

For more information about the key differences between transfers and rollovers, read our complete guide to gold IRA rollovers. All of the regulations that apply to gold and precious metals rollovers and transfers apply equally to crypto IRAs.

Start a Tax-Free Cryptocurrency Investment Account Today

There are many reasons why you should invest in cryptocurrency—from massive upside price potential to unprecedented security and freedom—but the reasons for investing in crypto IRAs are less well known.

In short, a cryptocurrency IRA lets you build wealth through cryptocurrencies without triggering a tax event upon withdrawal. Since the potential for significant portfolio growth is high within this asset class, tax advantages such as these can amount to many thousands of dollars in savings.

Want to get started? To open a cryptocurrency IRA, contact a trusted cryptocurrency IRA provider and inquire about opening an account and initiating a rollover or transfer. This way, you can have your account funded and ready for trading within a matter of days.

The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,336.55

Gold: $3,336.55

Silver: $37.80

Silver: $37.80

Platinum: $1,337.40

Platinum: $1,337.40

Palladium: $1,124.21

Palladium: $1,124.21

Bitcoin: $117,645.06

Bitcoin: $117,645.06

Ethereum: $4,436.18

Ethereum: $4,436.18