Best Lithium Stocks: Which Stocks Will Rock This Sector in 2022?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 15th August 2022, 09:56 am

In our search for the best lithium stocks, we decided to look at companies that mine the raw material and companies that operate with lithium. By operate, we mean companies that make batteries with lithium.

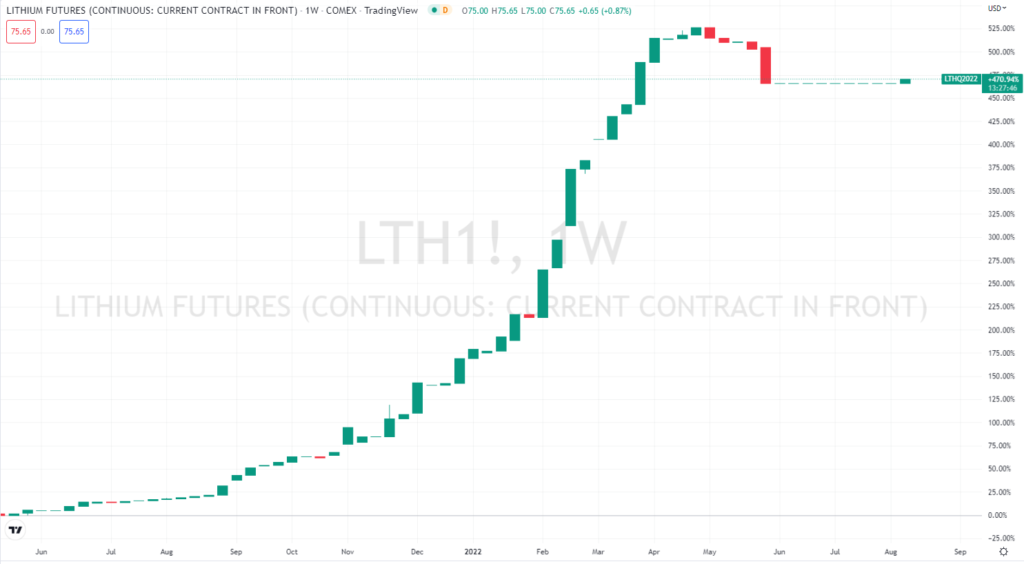

At the end of the day, the sharp rise in the price of lithium over the past 5 years is due mainly to the high demand for battery production. The largest batteries made are for electric vehicles, Sure cell phones and other electric devices are fueling demand. But EVs beat them all because of the size and number of units being produced.

Source: TradingView

Source: TradingView

The demand for lithium does not look like it will dwindle any time soon. So, let’s jump into the 5 best lithium stocks.

5 Best Lithium Stocks

Adding lithium stocks to your portfolio can be a way to diversify your returns across multiple sectors. These are some of the best-performing stocks we found that we feel have the potential to see outperforming growth compared to the broad stock market.

To diversify your portfolio even further you could add gold stocks and silver stocks. This would create more diversification within the raw materials, mining, and extraction sectors.

Albemarle (NYSE: ALB)

- Market Capitalization: $31.1 billion

- Average Volume: 1.3 million shares

- Forward Annual Dividend Yield: 0.61%

- Profit Trend: 2 years of increasing gross profit

Albemarle is an American company based in North Carolina with mining interests in Chile and Australia as well as the USA. They produce 55 % of their revenue through lithium mining, and also produce bromine and other refining products.

This American lithium mining company is one of the largest in the sector to supply lithium for electric vehicle batteries. They are also investing to double their domestic production of lithium as US carmakers want to avoid supply chain concerns.

We are confident that Albemarle will reach its goal of doubling domestic production. We say this as research shows that there are currently 20 sites with deposits or prospects that have 15,000 metric tons of past production or resources.

Research into advanced materials for lithium batteries is also on their agenda. They seem well positioned to meet the demands of higher electric vehicle battery demand.

The chart below shows the performance of the stock price of Albemarle over the past 5 years. ALB has managed a healthy 182.66% increase during this period, and YTD alone has increased by 13.66% while the S&P 500 is down 11.7% YTD.

Source: YahooFinance

Source: YahooFinance

This miner has only had the last two of the past four years with increasing gross profits. However, for 2002 it looks set to double that number from 2021. Gross profit TTM shows a revenue of $1.5 billion, compared to $997 for the 12 months of 2021.

The forward annual dividend rate may seem low, and it is. But this stock is more about growth potential and less about income streams. Think of companies like Google and you can see what I’m saying.

This company has a great setup, with research into new technologies and materials, plus its concentration on mining in the US. We feel these factors will allow it to continue its growth in the sector.

Lithium Americas Corp. (NYSE: LAC)

- Market Capitalization: $3.4 billion

- Average Volume: 2.7 million shares

- Forward Annual Dividend Yield: N/A%

- Profit Trend: None

Lithium Americas Corp is a Canadian company founded in 2007, and a relative newcomer to the scene. They are concentrating their efforts at the moment on two projects. One is Thacker Pass in Nevada, the other is in Argentina.

Neither of these two sites currently produces any lithium, and LAC is not earning any revenues yet. However, Thacker Pass is the largest known lithium resource in the United States. And the mine in Argentina would be the largest brine operation for producing lithium in 20 years.

Once their projects are actively extracting and producing lithium, we feel the stock price of this miner could be well positioned for explosive growth. One of LAC’s largest shareholders is Ganfeng, another lithium stock on this list. The Chinese miner currently owns 11% of LAC.

The chart below shows the performance of Lithium Americas Corp. over the past 5 years, we can see how it has experienced some spectacular growth. Albeit with a very high level of volatility. This stock looks like it’s going to be a bumpy ride for its investors.

Source: YahooFinance

The stock is up 566.59% over the past 5 years. However, in March 2022 it traded at an all-time high of $40.14 and just 5 months later was down at $29.33. We see this as more of an opportunity rather than a demise. Young corporations’ stock prices often suffer large bouts of volatility. But if their mining projects finally start producing, we feel they have an extremely large potential.

Their financial reports for the past 4 years going back to 2018, show that they have only reported earning gross revenue in 2018, which was a negative 1.9 million. This is a young company and typical metrics used for mature companies are not possible.

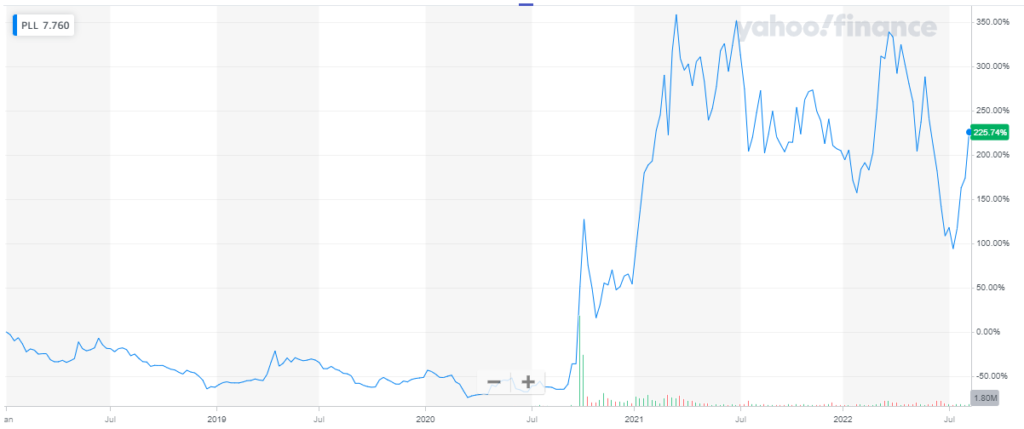

Piedmont Lithium Inc. (NASDAQ: PLL)

- Market Capitalization: $1.0 billion

- Average Volume: 473 thousand shares

- Forward Annual Dividend Yield: N/A%

- Profit Trend: None

This is another relative newcomer to the lithium mining sector and is another early-stage lithium miner like LAC. This company caught our attention because has large resource exploration projects in Quebec, Cape Coast, Ghana, and North Carolina where it is based.

Only in North Carolina, the company is exploring 3.1 thousand acres of land within the Carolina Tin-Spodumene Belt. As well as a 61-acre project in Kings Mountain. The company is based in Belmont North Carolina.

In 2021, PLL was awarded a contract to supply lithium to Tesla. Unfortunately for the shareholders, this deal has seen a delay. PLL is still waiting for licensing from North Carolina state to start extraction.

State officials are concerned about the environmental impact of the lithium mines. This has meant that PLL has had to put a hold on scheduled deliveries to Tesla. Gaston county officials are to vote again on PLL’s project.

So, this is a risky bet but if PLL gets their licenses sorted out, shareholders should be well compensated for their risk with the company’s Tesla contract.

From the chart below we can see the stock price of PLL has gained 225.74 5 over the past 5 years. And that the past two years saw a massive bull market, mostly on the back of the Tesla deal. Like most young companies the stock price of PLL is also volatile.

Source: YahooFinance

Source: YahooFinance

In March 2021, PLL’s stock price reached an all-time high of $88.97 and after various deep troughs and high peaks is now down at $56.06 at the time of writing. YTD the company is showing a growth in the stock price of 16.68%. The recent rally may show a change in investor sentiment about the probabilities of PLL starting production.

Sociedad Química y Minera de Chile S.A. (NYSE: SQM)

- Market Capitalization: $29.4 billion

- Average Volume: 1.8 million shares

- Forward Annual Dividend Yield: 11.03%

- Profit Trend: 2021 increased gross profit after a 3-year decline

Sociedad Quimica y Minera de Chile, known as SQM, is based in Santiago Chile. Their location gives them easy access to some of the best lithium deposits in South America. Such as the salt flats in the Atacama Desert. They can also keep their production costs lower. And currently produce iodine, potassium, industrial chemicals, and nitrate fertilizers apart from lithium.

In late 2021 the stock price took a tumble as Chileans voted for an extreme left-wing government. Investors feared that the new government’s policies would limit the company’s capacity to mine and produce revenue.

These fears of eco-friendly left-wing regulations were soon eliminated as the Chilean government awarded SQM a lithium development contract in January 2022. This gave investors the cue that the government was supporting this type of company and adding demand for their services.

This company is a well capitalized miner, with an extremely attractive annual dividend yield of 11.03%. If we add this type of dividend to the stellar stock price performance, we have a very appealing high-growth prospect.

Source: YahooFinance

Source: YahooFinance

The company came out in 2021 with positive gross profit for the first time in 3 years. Gross profit in 2021 reached $1 billion, up from 483 million in 2020. We feel that the contract awarded by the Chilean may have turned their revenue trend around. In fact, their TTM gross profit is $2.1 billion.

In the chart below we can see the price performance of SQM stock over the past 5 years. We can see how the stock price has been in a bull trend since March 2020. We can also see how the largest rise has come from the beginning of the year. YTD this stock has rallied 105.15%, while overall growth for 5 years has been 150.35%.

Gangfeng Lithium (OTC: GNENF)

- Market Capitalization: $25.7 billion

- Average Volume: 11 thousand shares

- Forward Annual Dividend Yield: 0.5%

- Profit Trend: 2021 increased gross profit after a 3-year decline

This company based in China has numerous mining projects throughout the world. The main site is in Australia, other locations include Argentina, Mexico, China, and Mali. The company supplies Chinese electric vehicle makers as well as Tesla in the US.

In November 2021, Ganfeng Lithium signed a deal with Tesla to continue supplying lithium and lithium-based products from 2022 for 3 more years. That gave the share price some relief. However, YTD the stock has not been performing well and is well off its previous all-time high at $22.68.

At the time of writing Gangfeng was quoting $9.35, a substantial decline from its all-time high on May 22. However, we believe this company is well positioned to take care of the increasing demand for lithium.

The miner is also involved in all processes of the lithium industry. It has lithium mining operations and also produces lithium fluoride, lithium chloride, and other lithium compounds. This miner also produces lithium metals in the form of ingots, foils, rods, particles, and alloy powder.

And it doesn’t stop there, GENF also produces polymer lithium batteries, and battery storage, as well as copper-lithium or aluminum-lithium. The company also provides battery recycling solutions across the industry.

Gangfeng managed to increase gross profit for the first time in 2021, taking the number to $4.4 billion from $1.2 billion in 2020. The TTM for gross profit is putting the miner to improve that number for 2021 and is at $7.5 billion.

Source: YahooFinance

Source: YahooFinance

From the chart above we can see how the stock price of GNENF has rocketed from late 2020 to an all-time high of $22.68 in august 2021. From there it has had a hard time reaching new highs and has drifted lower to the current level of $9.35. However, this could be a good entry point given the prospects for lithium demand and the involvement of the company in the whole production cycle.

Bottom Line

Adding mining stocks of companies that mine raw materials that are in constantly increasing demand seems like it could play out well. Lithium stocks can help diversify your portfolio, but they are still stocks. And therefore, carry corporate risk and are more likely to perform similarly to the broad stock market.

However, if the economy falters, or worse fails completely there is only one asset that can protect your wealth and that is gold. There are many reasons to invest a portion of your portfolio in gold. And those reasons have been constant throughout time. Although now may be a better time than ever before according to some experts.

To take advantage of a tax-enhanced environment you can invest in gold and other precious metals through a self-directed IRA. Investing in gold requires specialized knowledge of the sector. Several companies offer their services to help in your aim. You can read our reviews of the top gold IRA companies here.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,325.10

Gold: $3,325.10

Silver: $37.18

Silver: $37.18

Platinum: $1,317.42

Platinum: $1,317.42

Palladium: $1,112.66

Palladium: $1,112.66

Bitcoin: $113,534.77

Bitcoin: $113,534.77

Ethereum: $4,182.36

Ethereum: $4,182.36