August 2022 Newsletter: Big Growth in Alternatives Assets; Is The Tide Beginning to Turn?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 15th August 2022, 01:57 pm

It has quietly been an excellent month for alternative asset investors. Although, of course, you wouldn’t know from CNBC headlines or Jim Cramer soundbites.

Let’s take a quick lay of the land in the alternative assets market as of August 11, 2022. All percentages below are listed as 30-day changes:

- Gold: $1,795/oz. (+3.84%)

- Silver: $20.56/oz. (+8.61%)

- Platinum: $945.99/oz. (+11.75%)

- Palladium: $2,255.10/oz. (+10.93%)

- Bitcoin: $24,345 (+18.3%)

- Ethereum: $1,902.85 (+4.1%)

- Dow Jones U.S. Real Estate Index: $394.40 (+1.33%)

We’re seeing green across the board for all precious metals, the top cryptocurrencies, and real estate. If you have a well-diversified portfolio, chances are you had a good month.

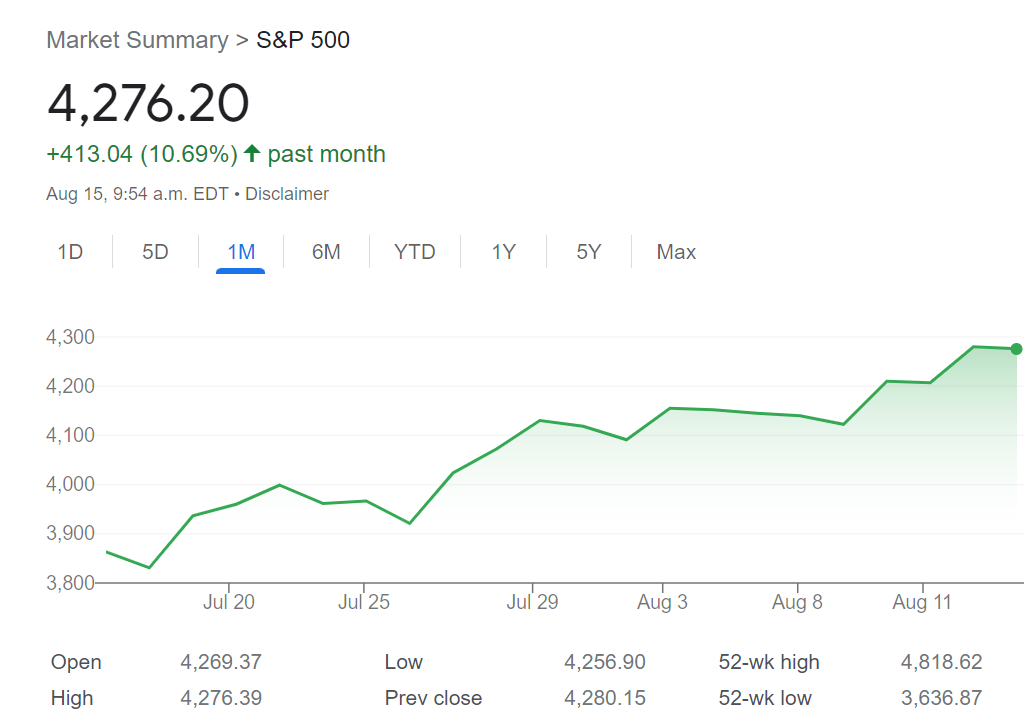

Source: Google Market Summary

However, there are underlying fundamentals that give cause for concern.

The housing market in North America is still precarious at best as foreign capital continues to influence the market and render the greatest source of intergenerational wealth inaccessible to millions of young Americans. In fact, a July report found that Chinese investors bought $6.1 billion worth of American residential real estate in the past 12 months alone.

The cryptosphere took yet another tumble in recent weeks as exchange platform Celsius Network LLC, with $12 billion in assets under management, filed for Chapter 11 bankruptcy on July 13.

On the equities front, the Dow Jones and S&P 500 have been largely propped up by the largest mega-cap technology companies. However, the economy is finally starting to do away with this unsustainable trajectory. Some of the largest private tech companies in America are now coming to terms with valuations 50% less than what they were pre-pandemic.

On the bright side, conventional markets are up on the news that gas prices are dipping and wholesale inflation is down 0.5% month-over-month in July. All signs point to prices finally falling, and the CPI coming back under control.

Small wonder, then, why the S&P 500 hit a 3-month high on August 10.

All this to say, there’s still a lot of room for volatility in the months ahead. Whether July was an outlier or the start of a trend toward greater price stability, only the future will tell.

To be on the safe side, consider diversifying with precious metals. Throughout the pandemic and the subsequent global recovery, metals such as gold and silver have been bulwarks against broad volatility and sell-offs. While stocks and Treasury yields have volleyed month to month, the yellow metal has held strong as a store of value. Consider investing today.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $4,413.94

Gold: $4,413.94

Silver: $68.93

Silver: $68.93

Platinum: $2,087.64

Platinum: $2,087.64

Palladium: $1,819.94

Palladium: $1,819.94

Bitcoin: $88,929.17

Bitcoin: $88,929.17

Ethereum: $3,033.39

Ethereum: $3,033.39