As Coronavirus Rages On, JP Morgan Projects Drop in Q1 2021 GDP

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 25th November 2020, 11:27 pm

The economic fallout from coronavirus continued to worsen this past week as governors ignored court orders and imposed lockdowns. Resulting statistics from these and other protective measures have taken their collective toll on the U.S. economy in 2020. Despite record corporate, consumer, and government debt and over 11 million people unemployed, the pandemic continues to rage on in the United States (and around the world) even with restrictions in place for many locales.

Impasse Over Economic Stimulus Package Could Lead to Another Recession

In the midst of the ongoing economic fallout from the coronavirus over 100 individual economists have written to the congress and the Senate imploring them to send out another round of stimulus checks to stave off a looming economic recession according to the New York Times. The problems center around an unemployment benefits cliff that looms large just as the holidays conclude. Millions of individuals stand to lose their unemployment benefits unless another package of aid gets passed fast. These rising unemployment claims are renewing concerns.

Unfortunately, this just happens to coincide with a renewed surge in virus cases that have led to yet another raft of restrictions as well as closures of businesses in over 40 states throughout the U.S. Economic experts continue to sound the alarm that these factors could derail the economic recovery. U.S. coronavirus cases have hit a new high in the past weeks.

In light of the fragile and deteriorating economic situation in the country, the President-elect Joseph Biden's new team of economic advisors are busily pushing Democrats in congress to rapidly come to terms with Republican members on a stimulus deal. Both sides have expressed concern that the nation is headed for a recession with a surging virus count as the hoped for second aid package has still not been passed in Washington, D.C. The new Biden team has expressed rising concern that millions of residents will not only lose their critical unemployment benefits in January, but that the protections keeping them from being evicted from their homes will expire at the same time as the extended deferrals of student loans do according to the Sunday report in The New York Times.

A looming potential double dip recession is increasingly becoming more likely in the wake of the continuing economic challenges that have not yet been offset by an agreement for one of the two proposed economic relief packages. While House Speaker Nancy Pelosi and Senate Minority Leader Chuck Schumer are proposing a larger and more expansive package in excess of two trillion, Republicans are seeking a smaller package that totals around half a trillion in total. As the debate rages on, the people caught on the edge of the looming benefits cliff are the tens of millions in Americans who will see their unemployment benefits lost in December, per Business Insider.

Jobless Claims Spike Higher

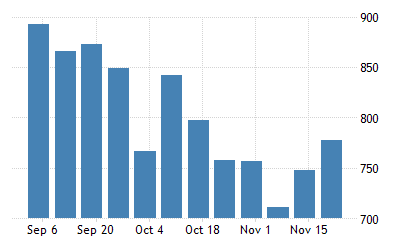

Unfortunately a side effect of the rising virus count has been a greater number of business forced to close down in substantial sections of the nation. This has led to higher jobless claims that jumped last week in their first such incidence dating back to October, while new hiring trends have slowed down. The chart below reveals the recent statistics in unemployment:

Economist Arindrajit Dube of the University of Massachusetts Amherst warned that:

“In the current environment, Mitch McConnell is unlikely to agree to a $2 trillion package. It's much better to make difficult compromises than to enter the new year without any relief. At some point we have to cut our losses. Otherwise the pain will be greater.”

JP Morgan Chase Projects Drop in U.S. Q1 2021 GDP

As the economic releases continue to waver and deteriorate, the investment banks and analysts are starting to adjust their projections for the near-future U.S. economy. Leading U.S. investment bank JP Morgan Chase with its 2021 outlook took the opportunity to adjust down the growth for the first quarter to negative as a result of the moving virus and restrictions being imposed. The economists at JP Morgan today anticipate an initial quarter of 2021 economic contraction thanks to these trends that a growing number of cities and states are being forced to follow and enforce.

This latest forecast update breaks with the consensus of Wall Street investment banks that the first quarter will still be positive and lead to an economy that improves in year 2021. Specifically, the economists at JP Morgan Chase stated that their expectation is for the economy itself to grow rapidly in the second and third quarters of 2020 thanks in no small part to the encouraging results from vaccines that are soon to start production. The over 100 nationally respected economists penned their comments in the open letter to the Senate and congress. It warned that:

“The winter will be grim, and we believe the economy will contract again in Q1.”

JP Morgan Chase anticipates that the economic growth of the first quarter will be negative one percent. They also concluded that the 2021 Q1 will see its economic results decline by anywhere from one percent (base case scenario).Yet the press conference also concluded some important messages. After a fairly mild decline, economists foresee an economy that rallies so that stocks increase in value. For the second quarter, economists economic foresee a rally with stock market and top line growth of 4.5 percent with a later 6.5 percent growth for the third quarter.

Meanwhile the numbers improve if a trillion dollar fiscal stimulus gets approved for all people. This massive stimulus of likely a trillion dollars total is anticipated to aid the economic growth by the middle of the year. The economists shared in their letter that:

“One thing that is unlikely to change between 2022 and 2024 is that the virus will continue to dominate the economic outlook… Case counts in the largest wave are easily surpassing prior records not set since the peak of the virus fully six months earlier.”

These economists similarly signed off on results showing that the headwinds are growing. They noted that it had been improved back in July by the economy being allowed to reopen, with:

“The economy no longer has that tailwind; instead it now faces the headwind of increasing restrictions on activity. The holiday season — from Thanksgiving through New Year's— threatens a further increase in cases.”

The national economists similarly anticipate that we will witness a drop in employment at various times and places in the coming months with rising numbers of monthly gains in jobs to return (to the tunes of millions) in the middle of 2021 and then level off later in the year. They explained that:

“We think the trends in the labor market should roughly follow what we expect for consumer spending — job growth should weaken noticeably around the turn of the year as the virus weighs on the economy, and then pick up again early next year once vaccine distribution eases virus concerns and fiscal support boosts growth.”

The JP Morgan Chase analysts forecast Monday that the country's gross domestic product would decline for the first quarter in 2021 by a one percent amount on a yearly basis. Goldman Sachs also reduced its Q1 economic forecast, yet it anticipates a growth amount of one percent for 2021.

CNBC Host Jim Cramer Calls Markets the Most Speculative He Has Ever Seen

Even CNBC money channel host Jim Cramer has taken issue with the level of the stock market based on where the underlying economy is now. He called the present day Wall Street environment “the most speculative market I've ever seen.” Cramer warned that such buying can not continue indefinitely as the lessons from history show that this type of speculation is typically hit by a reactionary sell off.

This reminds you that gold makes sense in an IRA. You can not stop a potential pullback in the stock market. You can look to diversify your investment and retirement accounts with IRA-approved gold. This starts with reading more about Top Gold IRA companies and the process of a Gold IRA rollover.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,289.49

Gold: $3,289.49

Silver: $32.98

Silver: $32.98

Platinum: $1,054.81

Platinum: $1,054.81

Palladium: $972.40

Palladium: $972.40

Bitcoin: $104,552.10

Bitcoin: $104,552.10

Ethereum: $2,518.87

Ethereum: $2,518.87