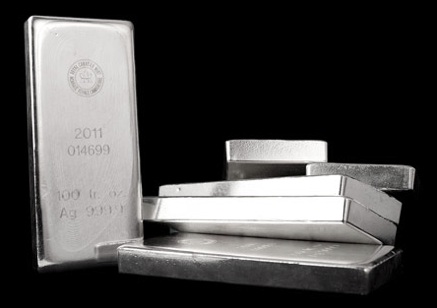

Royal Canadian Mint Silver Bars

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

The most pure silver bars available on the market today are the Royal Canadian Mint Silver Bars, each guaranteed to be 99.99% silver. Their wide availabilities, trusted name brand, low premiums and incredible quality make these one of the most preferred silver bars for investors around the world.

Development, Introduction and History

The Royal Canadian Mint was founded in 1908, and has produced all of the bullion coins and bars for Canada. Despite its name – and association with the Canadian government and national currency – the Mint is actually a corporation and not a public agency. Its two facilities, located in Winnipeg and Ottowa, produce as much as 2 billion coins each year.

Most famous for the production of its gold and silver Maple Leaf coins, the Royal Canadian Mint does offer a limited selection of silver bars.

The Mint has a well deserved and proudly maintained reputation for high quality; In 1982, the Royal Canadian Mint became the first refinery to produce .9999 fineness gold bullion coins. In 1999, the Mint made waves again by becoming the first producer of .99999 purity bullion products. The silver bullion bars are an extension of this tradition.

Royal Canadian Mint Silver Bar Characteristics

Bar Design

These Royal Canadian Mint Silver Bars are manufactured with a sleek, flat, easily stackable design. The actual look of the bar’s face is not standardized, but all are stamped with the seal of the Royal Canadian Mint as well as the weight denomination and metal purity (Ag 999.9).

These bars are also stamped with unique identifying serial numbers, typically located right under the year of production.

Specifications

Royal Canadian Mint Silver Bars come in a variety of weigh denominations, ranging from 1-100 troy oz. The Mint has recently offered 1000 troy oz. bars, however the listed purity on these bars is .999 silver, rather than the standard .9999.

The most common weight denomination for Royal Canadian Mint Silver Bars is the 100 troy oz. bar. The 100 oz. size is an excellent method of investing in large volumes of silver, and this bar is the only .9999 purity silver bar currently produced. In fact, most retailers only carry the 100 oz. bar.

The 2014 version of the 100 oz Royal Canadian Mint Silver Bar measures 185 mm x 85 mm x 18 mm, and has a gross weight of 3111.0g.

Royal Canadian Mint Silver Bar Pricing

Unlike many bullion coins, silver bars are not used as legal tender, and therefore carry no transactional value. Still, silver bars contain certain advantages over silver coins as an option for investing in physical silver.

The minting of bullion bars, such as the Royal Canadian Mint Silver Bar, can be much lower than the minting cost of bullion coins. This means that the market price (value of metal content plus production and shipping costs) tends to be very close to the spot price (metal content) of silver. Silver bars can be a very cost effective way to own silver.

The market price is used to determine value inside of an investment portfolio. Since silver prices fluctuate daily, the value of Royal Canadian Mint Silver Bars will also fluctuate daily. You can check out our home page for live metal pricing.

Even though these bars are widely demanded, a Royal Canadian Mint Silver Bar carries a very low premium over the spot price of silver.

Investing in Royal Canadian Mint Silver Bars Through an IRA

The IRS allows Individual Retirement Accounts (IRAs) that meet specific requirements to carry precious metal bullion as an investment in a portfolio. Often referred to as a “precious metals IRA”, these accounts are self-directed and may only include metals in the form of IRS-approved bars and coins.

Royal Canadian Mint Silver Bars are authorized to be included in a precious metals IRA. Since the spot price of silver tends to be much lower than gold, silver can be a more affordable alternative hedge for those interested in precious metals.

These bars meet the minimum purity requirements established in Internal Revenue Code section 408(b) for IRA investing. To establish an account, the owner must make an initial purchase of at least $5,000 worth of qualifying bullion, and each subsequent purchase must be at least $1,000.

When you make a purchase of Royal Canadian Mint Silver Bars (or any precious metals designated for an IRA), the IRS further requires that all coins and/or bars must be held in qualifying “depositories.” Your depository is responsible for the security and maintenance of your coins or bars.

Those with an existing IRA have the option of transferring or rolling over funds into a precious metals IRA. All other forms of investments (stocks, bonds, mutual funds, etc) found in traditional IRA accounts can also be held in a precious metals IRA.

Royal Canadian Mint Silver Bars are available for purchase directly from the Royal Canadian Mint through their official website. International shipping may result in extra fees as your coins pass through customs.

Additionally, collectors and investors can buy from dealers around the world, such as the American Precious Metals Exchange (APMEX). Regardless of whether you purchase from the source or from a high quality dealer/manufacturer, the quality of your bars will remain the highest quality.

Sign up to learn more. It's free!

If you're worried about the economy and want to learn tips on how to protect your retirement savings in case of another systemic collapse, sign up to our monthly newsletter now for free! We cover topics such as: precious metals investing, inflation, currency devaluation, national debt, the Fed's financial policies, world politics, and much more. Join now and we'll send you a free PDF report entitled “5 scams to avoid when investing in bullion gold & silver”

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $5,371.71

Gold: $5,371.71

Silver: $91.03

Silver: $91.03

Platinum: $2,303.46

Platinum: $2,303.46

Palladium: $1,762.16

Palladium: $1,762.16

Bitcoin: $67,868.52

Bitcoin: $67,868.52

Ethereum: $1,988.88

Ethereum: $1,988.88