A Look at Gold’s Insurance Qualities & Its Effectiveness in Protecting Wealth

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 13th August 2019, 01:13 pm

- Gold is commonly considered a safe haven

- Capacity to diversify portfolio returns

- Gold can act as a buffer in times of financial crisis or stress

Gold is well known as a storage of wealth

Gold has historically been considered a haven asset and a store and protector of wealth. Its capability to hedge against inflation is well established, greatly aided by the fact it is a rare and limited metal. Many financial advisors will discourage holding Gold or Silver in a portfolio as they are assets that do not carry dividends. This means they do not create periodic cash flows and have to rely on the re-evaluation of price for positive returns.

Diversification and Insurance factors of Gold

We are going to take a look at another characteristic of this shiny metal, which has great value and is often overlooked. That is Gold’s capability to act as a buffer to market turbulence in times of crisis.

It has little to no correlation with traditional assets such as stocks and bonds. This factor means that while socks may be in free fall, we may see an entirely different reaction in Gold.

Usually, portfolios are constructed using 60% stocks and 40% bonds; this is done to create some sort of diversification and holding bonds is considered less risky. As the saying goes, never put all your eggs in one basket. Therefore, Bonds act to reduce the risk of losing everything in the case of a sharp fall in stocks, and they are also less likely to show large losses of capital.

Adding Gold or Silver to a traditional portfolio mix can further add to the diversification benefit. It also acts very well in limiting losses in times of market stress. This does come at a price, as the overall return is lower than a standard 60/40 mix. If we consider precious metals in terms of insurance, then it would seem reasonable that protecting your capital will necessarily have a cost.

Portfolio performance

Portfolios are usually rebalanced every now and again, either at a set time interval, like every January, or after a specific percentage change in the price of assets. Rebalancing allows you to buy assets that have fallen in price and sell those that have risen in price to maintain the original 60/40 mix. The same process should be applied when Gold is added to the portfolio. This helps maintain the allocation of the assets at a more constant level.

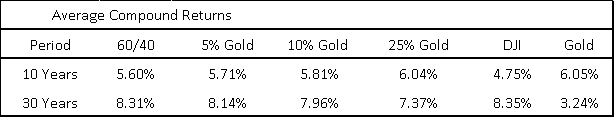

The table above shows how various types of portfolio combinations performed over the past 10 & 30 year periods, as well as the average return for the Dow Jones Industrial Average (DJI) and Gold. What we are going to look at next is the cost of adding Gold to a portfolio, before we look at its insurance benefit.

A traditional 60/40 portfolio of stocks and bonds had an average return of 8.31% over the 30 year period starting in December 1987 and ending December 2016. Adding 5% reduces that average return by 0.17% while adding 25% reduces it by 0.94%. We can see how this makes sense, as over the same period Gold averaged a return of 3.24% compared to the DJI of 8.35%.

However, the story changes greatly when looking at the last ten years, starting in December 2006. A 60/40 portfolio had an average return of 5.60% while adding 5%, 10% and 25% of Gold increased overall performance by 0.11%, 0.21%, and 0.44% respectively. Single asset performance shows that Gold outperformed the DJI by 1.30% on average for the same period.

It is likely that the explanation for Gold’s improvement in returns compared to stocks over the past 10 year period is due mainly to the crisis of 2008. Stocks and bonds, as well as other assets, performed particularly poorly as the crisis unraveled sending prices into a downward free-fall.

Adding Silver to the mix

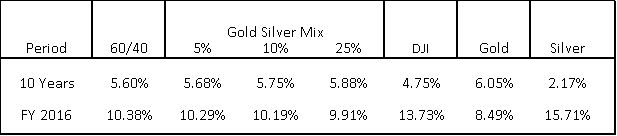

The table below shows the average return for a 60/40 portfolio with a 5%, 10% and 25% allocation to a 50/50 mix of Gold and Silver. Silver has had an average return over the previous 10 years of 2.17%, which is not as high as Gold at 6.05%. However, Silver has been on a very strong bull trend this year having posted a Yield To Date of 15.71%, beating Gold by 7.22%.

A combination of Gold and Silver has also outperformed a straight 60/40 stock/bond portfolio during the previous 10 year period. Adding these two precious metals by 5%, 10% and 25% increased the overall portfolio performance by 0.08%, 0.15% and 0.28% respectively.

How Gold performed in times of market stress

Looking at the capacity of Gold to buffer the negative effects of market routs we will have a look at the two most recent crises of 2001 and 2008. We have already seen that over a long period, such as 30 years, adding Gold had a relatively low cost in terms of lost returns. Whereas, over the shorter term, past 10 years, adding Gold & Silver has actually given performance a boost.

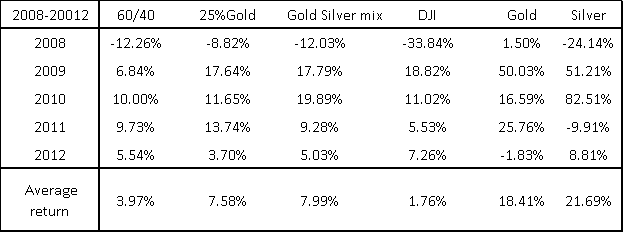

The table below shows the return over the five-year period starting in 2008 through 2012, which also included the Euro crisis of 2011. Having a 25% allocation of Gold to a 60/40 portfolio would have improved average return for the period by 3.61%. Adding a 25% allocation of Gold and Silver to a 60/40 portfolio would have improved the average return by 4.02%.

The Dow Jones had a negative return in 2008 of 33.84% while Gold had a positive return of 1.50%. Silver also had a negative return that year, but somewhat better than stocks at -24.14%.

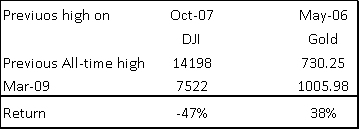

More importantly, when stocks were at their lowest point in March 2009 from their previous all-time high, the DJI reached a negative 47%, while Gold was up from its previous all-time high by 38%.

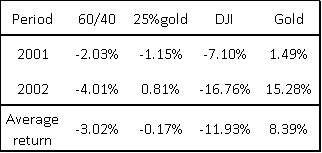

Looking at the crisis of 2001 we see a similar pattern, stocks performed poorly while Gold had positive returns. The table below shows Gold had a positive average return of 8.39% over the two-year period between 2001 – 2002. Gold outperformed stocks by 20.32% on average for the period. For a 60/40 portfolio with a 25% allocation to Gold average return was improved by 4.82%.

These two examples above show how gold can amortize the negative effects of market turmoil. If it were possible to interpret when and for how long a stock market sell-off will happen, then we wouldn’t have a need for portfolio insurance. As there is no crystal ball, it is necessary to diversify our asset allocation with assets that have as little correlation as possible.

Benefit of rebalancing uncorrelated assets

When following the rebalancing model for a portfolio, you would sell the assets that have risen to buy more of the assets that have fallen. However, if all assets in the portfolio fall, although by differing amounts, then you would be buying cheaper some assets but also selling at a loss others.

Because Gold has little to no correlation to stocks and bonds, hopefully, you would be able to sell Gold at higher prices while buying stocks at lower prices. This creates further income when put into practice with discipline.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $4,251.84

Gold: $4,251.84

Silver: $53.15

Silver: $53.15

Platinum: $1,725.42

Platinum: $1,725.42

Palladium: $1,654.82

Palladium: $1,654.82

Bitcoin: $108,356.77

Bitcoin: $108,356.77

Ethereum: $3,923.44

Ethereum: $3,923.44