7 Reasons to Invest in Gold

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Gold has many characteristics that have made it a source of value throughout the centuries. Some of these characteristics are physical, such as its beauty, malleability, and non-corrosiveness.

Other features of this precious metal also make it a valuable asset. For centuries gold has been a store of value. In more modern times it is also a commodity in high demand for industrial reasons.

We are going to have a look at 7 reasons to invest in gold. You might be thinking of buying gold coins or investing in a gold IRA. Here are the motives that make gold a valuable addition to your investment portfolio.

Why Should We Invest in Gold

- Long-term investment

- Inflation hedge

- Portfolio diversification

- Independent of banks & corporations

- Real asset

- Bartering value

- High demand asset

All of the above aspects contribute to making gold one of the most precious metals out there. These features also create the high demand and turnover of the shiny metal that means you will always have a buyer when you need to sell.

Long-term Investment

Investing in gold has always been about buy and hold. An investment in gold has a long-term time horizon that retains and adds value. Over the past 50 years, gold has had a strong performance in terms of yearly returns.

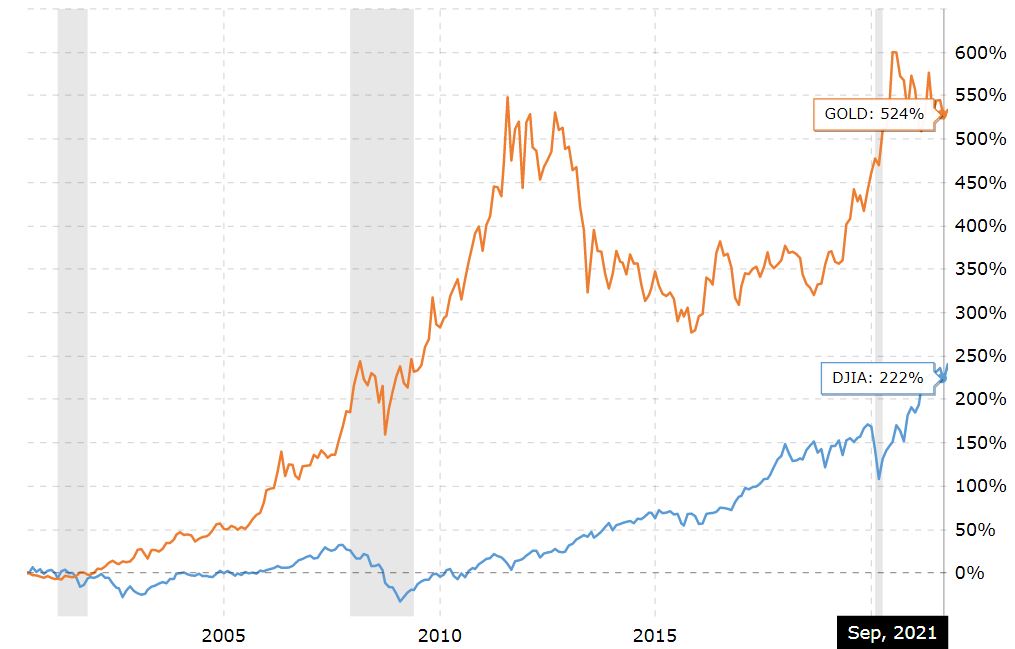

In 1971 Nixon ended the convertibility of gold. We can see from the chart below that gold had a relatively flat price performance in the decades preceding 1971. From the year gold’s price is free to float against the dollar the rise in value is spectacular.

Source MacroTrends

The trend in performance we have seen over the past 50 years looks set to continue. Gold is highly unlikely to ever be locked in at a set price again. Its value will continue to be set by the efficient forces of the financial market.

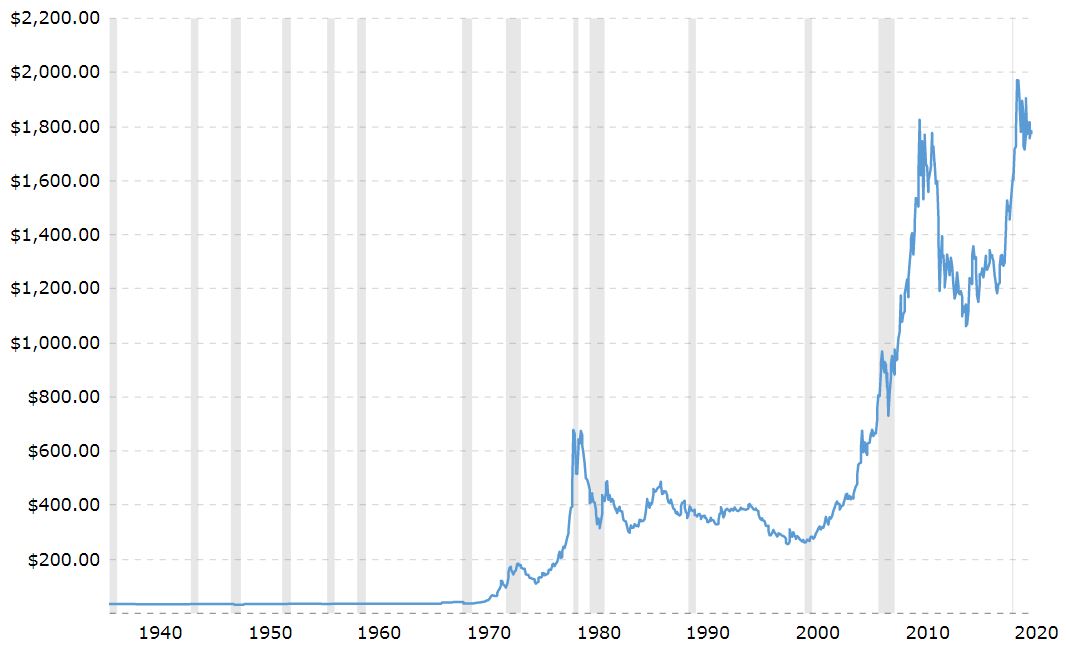

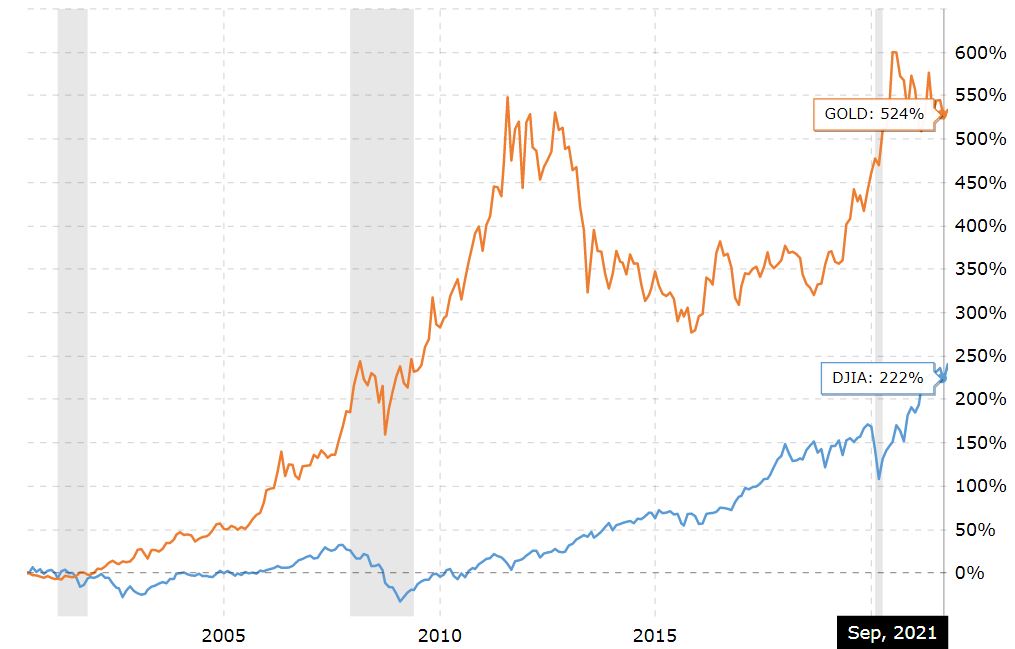

Looking at the past 20 years, it's important to compare the performance of gold to that of the general stock market. The chart below compares the price of gold to that of the Dow Jones Industrial Average index.

Source MacroTrends

We can see that since 2000 gold has outperformed the Dow Jones index, by just over 300%. Gold is not just a safe haven asset but also an outperforming asset, compared to the stock market, over the past 20 years.

Inflation Hedge

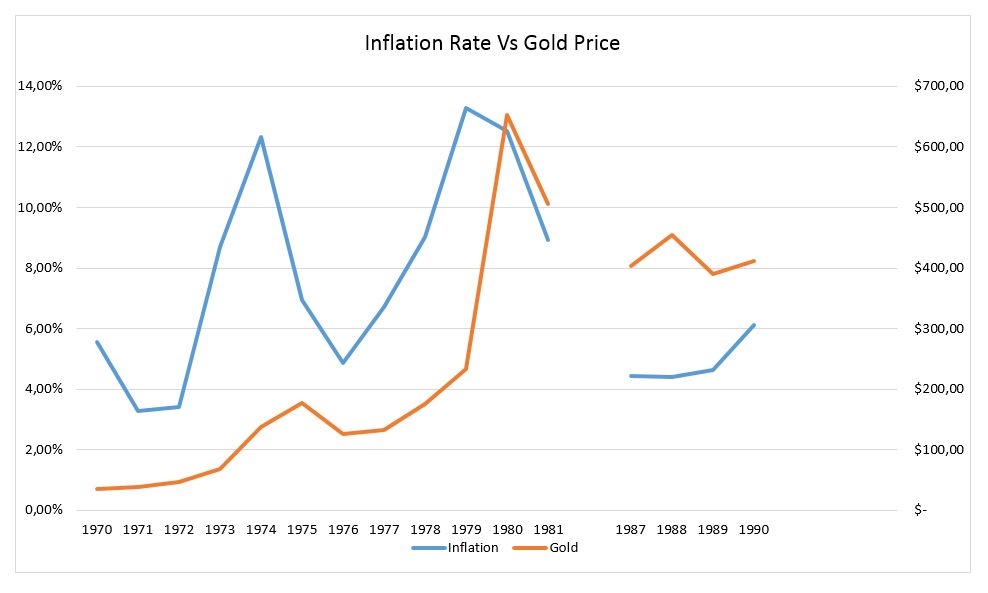

Gold is notoriously known for its capability to fight off inflation. Throughout the past inflationary periods, gold has managed to maintain or increase its value. Whereas stocks will generally perform badly in times of high inflation.

The reasoning behind this positive correlation to inflation is that gold should maintain its value to the US dollar. If the inflation rate is high, the US dollar is losing value more quickly. Gold holders will want more dollars to compensate for the loss of value of the dollar.

The chart below shows the performance of gold over periods of high inflation. We can see how, as inflation increases, the price of gold also tends to increase. During the 3 most recent periods of high inflation, over 4%, gold maintained or increased in value.

Source MacroTrends

Portfolio Diversification

The concept of diversification means you need to invest in a variety of assets so that you are not exposed to one single risk. For a stock portfolio, you probably have several stocks, so that you are not fully exposed to the risks of any one corporation in particular.

The same rule applies to asset classes. No savvy investor will have all of his portfolio in one single asset. The risk of severe losses is extremely high if you only hold one asset class and a crisis affects that asset class.

The traditional diversification model involves adding bonds to your stock investments and keeping some cash. However, adding a third, fourth, or fifth asset class will help in diversifying your portfolio even further.

Lack of Correlation

Gold diversifies your portfolio and reduces your exposure to traditional assets, allowing you to suffer less in times of crisis. The reason why gold has this feature is due to gold price being uncorrelated to those of stocks and bonds.

If you hold assets that have little or no correlation to the broader stock and bond market, in times of adverse conditions those assets will follow their own course.

The low correlation to stocks is also due to the fact that gold is considered a safe-haven asset. When there is a general sell-off in the stock market investors seek refuge in the precious metal, gold.

Independent of Banks & Corporations

There is an intrinsic risk when investing in stocks that exposes you to the possibility of a company failing, or underperforming through bad management. Of course, it’s that risk which also supplies a high enough reward to compensate shareholders for investing their money.

There is also a banking risk, which is offset somewhat by the FDIC insurance which covers money held at your bank up to $250,000 per account holder. That figure can increase if you have more than one account category.

However, you are still exposed to the banking system risk. Especially if you hold considerably higher amounts of cash than the FDIC affords protection to. The value of gold is out of the scope of either of these risks.

Banks and companies could fail with devastating losses for your wealth, but gold will continue to maintain its value regardless.

Real asset

Gold is a physical asset and not reliant on any institution whether they are financial, corporate, or government-backed. The precious metal has its own life independent of any type of securitization.

You have possession of a resource that withstands the test of time. Unlike real estate, another valuable real asset, it does not require maintenance, management of tenants, or appraisal to establish its value.

Gold cannot be hacked or easily stolen. They are stored in a very safe place with no easy access. Even if very rare, financial institutions and securities are prone to be hijacked due to the digitalization of assets. Cryptocurrencies in particular have suffered at the hands of some criminal experts in the past.

Bartering Value

Gold has historically been a method of payment, eras when monarchs of the past would raise an army thanks to the gold they possessed. Even today, I doubt very much anyone would refuse to exchange merchandise for gold.

What would happen if there was a catastrophic event? Something so large and unpredictable that everything fails. A scenario where money would be worthless would mean gold would again be the only valuable asset.

In a world-shattering occurrence owning gold would probably be one of the few things you would be able to buy things with. A universal measure of value and a means to create transactions. It is a very unlikely event that I am envisioning, however, gold still has this capability, to withstand even the greatest disaster.

High Demand Asset

The precious shiny metal has always had a high demand, and it wouldn't seem there are any reasons for that level to diminish. In fact, on the contrary, there would seem all the reasons for the demand for gold to increase.

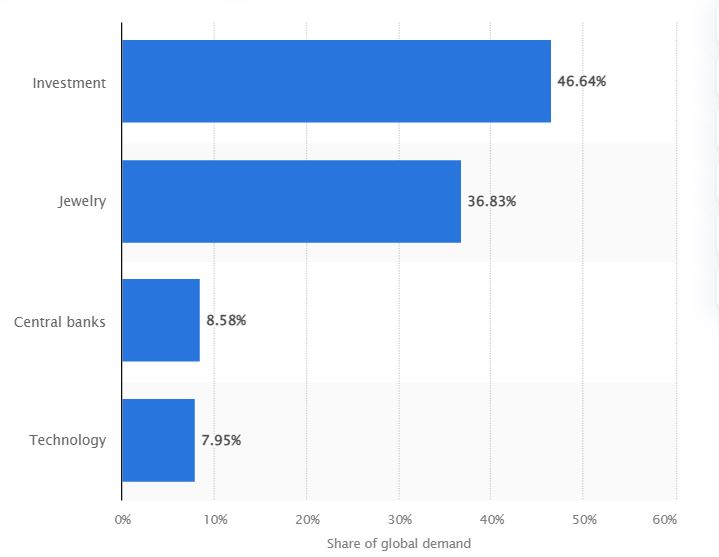

The largest component of the demand for gold is investment. Funds, companies, and individuals all contribute to taking the largest piece of the pie. The chart below shows the distribution of gold demand by sector.

Source Statista

Simply for its beauty gold has throughout the ages been a material of extremely high demand. Its ductility, malleability, and ever-shining color mean it is extremely appropriate for jewelry. Jewelry is still a strong component in the total demand for gold.

But why are jewelry and investment such important aspects in the demand for gold? As the world gets richer and we see global GDP grows and has been growing for decades, so too will the demand for gold for jewelry and investment continue to grow.

Wrapping Up

We have seen how several aspects make gold a special physical asset. Its capability to act as a portfolio diversifier while fighting off inflation is possibly the best known and most talked about.

But gold has these and a combination of other features as mentioned above that create the high desirability of this precious metal. These are also characteristics that have been around forever and will most likely continue to be there.

I cannot answer the question, what will gold be worth in 5 years? But I do know that the demand and desirability of this yellow metal are not going away anytime soon. All the qualities mentioned above have lasted thousands of years.

You may be thinking of adding gold to your investment portfolio and how you can go about it. You can buy gold by acquiring shares in a gold fund or you may want to hold the asset physically. A valid option if you want to own gold physically is to set up a gold IRA.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,688.06

Gold: $3,688.06

Silver: $42.69

Silver: $42.69

Platinum: $1,409.17

Platinum: $1,409.17

Palladium: $1,206.01

Palladium: $1,206.01

Bitcoin: $115,863.13

Bitcoin: $115,863.13

Ethereum: $4,528.42

Ethereum: $4,528.42

The above-given reasons are the most valid reason that one should consider while investing in gold. People have so many doubts while making any investment. this blog is going to be very helpful for those to come to decision.