Silver Price

Silver Price | 24 hours

Silver Price | 15 Days

Summarized Silver Price Table

| # | Date/Time | Price |

|---|---|---|

| 1 | 08/11/2025 | $37.90 USD |

| 2 | 08/15/2025 | $37.92 USD |

| 3 | 08/19/2025 | $37.82 USD |

| 4 | 08/23/2025 | $38.89 USD |

Detailed Silver Price Table

| # | Date/Time | Price |

|---|---|---|

| 1 | 08/11 | $37.89 USD |

| 2 | 08/12 | $37.81 USD |

| 3 | 08/13 | $38.34 USD |

| 4 | 08/14 | $38.32 USD |

| 5 | 08/15 | $37.92 USD |

| 6 | 08/16 | $38.00 USD |

| 7 | 08/17 | $38.00 USD |

| 8 | 08/18 | $38.08 USD |

| 9 | 08/19 | $37.81 USD |

| 10 | 08/20 | $37.52 USD |

| 11 | 08/21 | $37.98 USD |

| 12 | 08/22 | $38.27 USD |

| 13 | 08/23 | $38.88 USD |

| 14 | 08/24 | $38.88 USD |

| 15 | 08/25 | $38.82 USD |

Silver Price | 3 Months

Summarized Silver Price Table

| # | Date/Time | Price |

|---|---|---|

| 1 | 06/22/2025 | $36.09 USD |

| 2 | 07/06/2025 | $37.09 USD |

| 3 | 07/27/2025 | $37.79 USD |

| 4 | 08/10/2025 | $38.09 USD |

Detailed Silver Price Table

| # | Date/Time | Price |

|---|---|---|

| 1 | 06/22 | $36.09 USD |

| 2 | 06/29 | $36.03 USD |

| 3 | 07/01 | $36.59 USD |

| 4 | 07/06 | $37.09 USD |

| 5 | 07/13 | $38.18 USD |

| 6 | 07/20 | $38.73 USD |

| 7 | 07/27 | $37.78 USD |

| 8 | 08/01 | $36.88 USD |

| 9 | 08/03 | $37.76 USD |

| 10 | 08/10 | $38.09 USD |

| 11 | 08/17 | $38.08 USD |

| 12 | 08/24 | $38.85 USD |

Silver Price | 12 Months

Summarized Silver Price Table

| # | Date/Time | Price |

|---|---|---|

| 1 | 09/24 | $30.03 USD |

| 2 | 10/24 | $32.51 USD |

| 3 | 11/24 | $31.14 USD |

| 4 | 12/24 | $30.33 USD |

| 5 | 01/25 | $30.26 USD |

| 6 | 02/25 | $32.09 USD |

| 7 | 03/25 | $33.08 USD |

| 8 | 04/25 | $32.18 USD |

| 9 | 05/25 | $32.75 USD |

| 10 | 06/25 | $35.88 USD |

| 11 | 07/25 | $37.74 USD |

| 12 | 08/25 | $37.95 USD |

Detailed Silver Price Table

| # | Date/Time | Price |

|---|---|---|

| 1 | 08/15 | $28.04 USD |

| 2 | 08/30 | $29.31 USD |

| 3 | 09/15 | $30.72 USD |

| 4 | 09/30 | $31.35 USD |

| 5 | 10/15 | $31.26 USD |

| 6 | 10/30 | $33.99 USD |

| 7 | 11/15 | $30.40 USD |

| 8 | 11/30 | $30.62 USD |

| 9 | 12/15 | $30.55 USD |

| 10 | 12/30 | $29.27 USD |

| 11 | 01/15 | $30.13 USD |

| 12 | 01/30 | $31.14 USD |

| 13 | 02/15 | $32.14 USD |

| 14 | 03/15 | $33.79 USD |

| 15 | 03/30 | $34.11 USD |

| 16 | 04/15 | $32.30 USD |

| 17 | 04/30 | $32.80 USD |

| 18 | 05/15 | $32.15 USD |

| 19 | 05/30 | $33.12 USD |

| 20 | 06/15 | $36.31 USD |

| 21 | 06/30 | $36.07 USD |

| 22 | 07/15 | $38.08 USD |

| 23 | 07/30 | $37.64 USD |

| 24 | 08/15 | $37.92 USD |

Silver Price | 5 Years

Summarized Silver Price Table

| # | Date/Time | Price |

|---|---|---|

| 1 | 2021 | $24.17 USD |

| 2 | 2022 | $21.66 USD |

| 3 | 2023 | $23.38 USD |

| 4 | 2024 | $28.28 USD |

| 5 | 2025 | $33.91 USD |

Detailed Silver Price Table

| # | Date/Time | Price |

|---|---|---|

| 1 | 12/20 | $25.14 USD |

| 2 | 06/21 | $26.87 USD |

| 3 | 12/21 | $22.53 USD |

| 4 | 06/22 | $21.59 USD |

| 5 | 12/22 | $23.36 USD |

| 6 | 06/23 | $23.47 USD |

| 7 | 12/23 | $24.03 USD |

| 8 | 06/24 | $29.61 USD |

| 9 | 12/24 | $30.33 USD |

| 10 | 06/25 | $35.88 USD |

Custom Silver Price Dates

Please select a from and to date to see a custom silver pricing chart:

How Are Silver Prices Calculated?

Similar to gold, silver enjoys a distinction of having being used a fiat currency and as a monetary standard for centuries (and perhaps longer). Silver is an important investment commodity that can be traded in bars, coins, futures contracts, exchange-traded products, and others.

Similar to gold, silver enjoys a distinction of having being used a fiat currency and as a monetary standard for centuries (and perhaps longer). Silver is an important investment commodity that can be traded in bars, coins, futures contracts, exchange-traded products, and others.

As a bullion metal, silver tends to be more flexible than gold in the sense that purchasing, collecting and trading mint pieces such as coins and small bars is easier. There is also a direct correlation to gold in the form of a ratio; specifically, the silver market tracks the gold market, a factor known as the crustal ratio.

For the most part, silver prices are calculated by the supply and demand created by the COMEX, which is a futures contract market affiliated with the New York Mercantile Exchange (Nymex,) which is in turn operated by the CME Group. This calculation is based on analysis market activity.

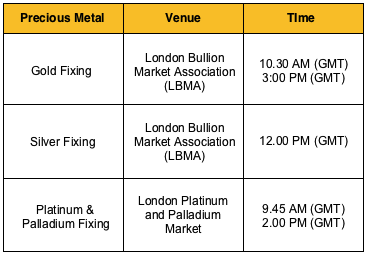

Who Sets the Price of Silver and When?

The spot price of silver is set by bullion dealers in the major markets such as New York, Chicago, London, Zurich, Hong Kong, etc. This price tends to be close to the minimum that major industrial players will pay to acquire silver for their needs. These days, spot silver prices are updated in real-time around the clock. Futures contract pricing, which is only slightly higher than spot pricing, is set by COMEX software during trading sessions, which these days continue after hours.

The spot price of silver is set by bullion dealers in the major markets such as New York, Chicago, London, Zurich, Hong Kong, etc. This price tends to be close to the minimum that major industrial players will pay to acquire silver for their needs. These days, spot silver prices are updated in real-time around the clock. Futures contract pricing, which is only slightly higher than spot pricing, is set by COMEX software during trading sessions, which these days continue after hours.

What Factors Affect the Price of Silver

Like other major commodities, silver is affected by supply, demand, speculation, investor sentiments, and geopolitical events. Just like gold, the value of silver goes up when the dollar is doing well, and goes down when the dollar (read: economy) is weak.

How is Silver Used in Today's World of Industry?

More than 40 percent of silver is used in industrial settings these days; the rest is used for minting, jewelry and investment purposes.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,367.63

Gold: $3,367.63

Silver: $38.68

Silver: $38.68

Platinum: $1,342.21

Platinum: $1,342.21

Palladium: $1,111.57

Palladium: $1,111.57

Bitcoin: $112,458.94

Bitcoin: $112,458.94

Ethereum: $4,591.05

Ethereum: $4,591.05