March 2022 Alternative Investing Newsletter: Amid War in Europe, Alternative Assets Provide Much-Needed Stability

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Global markets have been deeply affected by recent events.

Amid senseless turmoil and violence, our primary concern is usually not our pocketbooks or account balances. However, it's only natural to not make a bad situation worse by having your wealth eviscerated due to market instability.

The good news is that history has proven that gold can provide the stability your portfolio needs during times of war and unrest.

As of March 2nd, the gold spot price is $1,944 per troy ounce. This marks the first time that gold has surpassed the 1,900 mark since January 4th of last year, nearly 14 months ago.

Historically, the Iraq-Kuwait war saw the price of gold rise +11.1% (August 1-14, 1990), and there was a similar surge seen in the immediate aftermath of the September 11 attacks. The subsequent Invasion of Iraq saw gold prices rise from $10,800 on the eve of the ground operation on March 19, 2003, to $13,100 at year-end.

More recently, fears of war following U.S. airstrikes on Iran shot the price of gold to a seven-year high in January 2020.

The relationship between gold prices and instability isn't limited to wartime, either. The Black Monday stock market crash of 1987 resulted in a +4.2% spike in gold prices, whereas the dot com crash of 2001 and the global financial crisis of 2008 saw gold surge +18% and +79.9%, respectively. The same was true during the early days of the COVID-19 pandemic, causing a +20.5% gold rally from $1,670 to over $2,000 between March and August 2020.

As you can see, whenever the state of the world is uncertain, gold tends to appreciate in value. Today is no exception. If you want to improve your chances of keeping your wealth (or increasing it) during these turbulent times, adding gold to your IRA may be your best course of action.

While past market performance is no promise of future results, it still bears mentioning that the yellow metal has repeatedly served as a bulwark of stability during episodes of conflict.

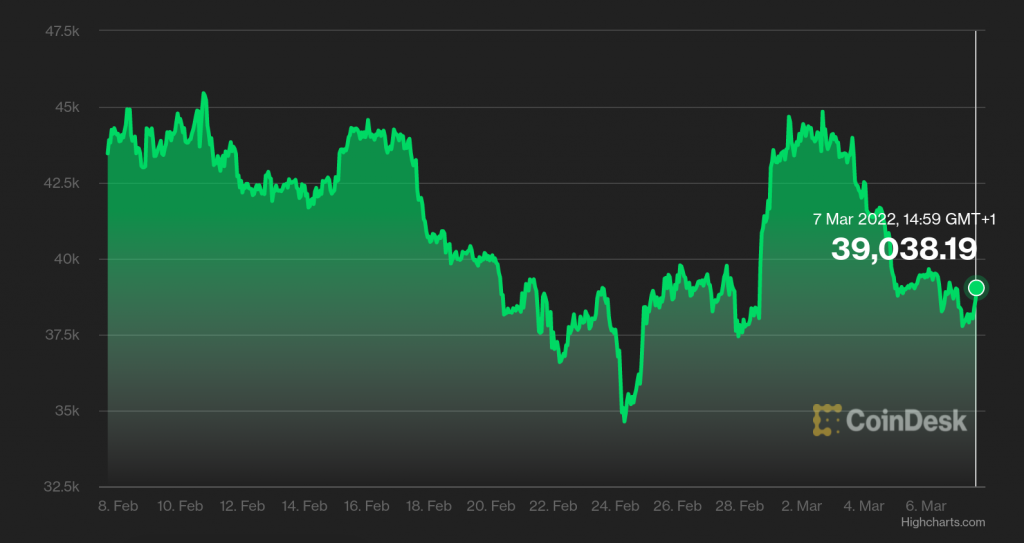

Bitcoin has also been resolute throughout the past week. On the eve of the Russian invasion, BTC was priced at $37,300. The cryptocurrency has since skyrocketed +18% to over $44,000. It's not just Bitcoin, either. Ethereum, the world's second-largest cryptocurrency by market cap rose from $2,590 to $3,000 per token between February 23 and today.

BTC to USD price chart as of March 7, 2022 (Source: CoinDesk).

To summarize, let's zoom out and look at how the alternative asset market is doing across the board since February 23, the day before the invasion:

- Gold: +1.17%

- Silver: +3.9%

- Platinum: -2.1%

- Palladium: +8.5%

- Bitcoin: +18%

- Ethereum: +16.2%

With the sole exception of platinum, which has seen a small dip, it's clear that alternatives as a whole are on the rise. While the stock market remains highly volatile, and with interest rate hikes looming, now may be the time to load up on alternative assets.

To get started, I recommend checking out our guides to IRA-approved gold or IRA-approved silver metals. From there, you can open a self-directed IRA with one of our top-ranked alternative IRA providers through which you can invest in a whole array of alternative assets—including both cryptocurrencies and precious metals.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,448.13

Gold: $3,448.13

Silver: $39.73

Silver: $39.73

Platinum: $1,370.20

Platinum: $1,370.20

Palladium: $1,119.46

Palladium: $1,119.46

Bitcoin: $108,459.67

Bitcoin: $108,459.67

Ethereum: $4,480.21

Ethereum: $4,480.21